Only a few miles from the Hungarian border lies the idyllic city of Oradea. Geographically central to the region, the city today is hosting a different type of festival in the city’s medieval castle. A festival of blockchain, fintech, startups and all things digital.

The event is in its second year, and is the brainchild of Cosmin Cosma, Co-Founder & CEO at Finqware Romania. The first event held in June 2022 hosted almost 200 speakers and delegates. 2023 saw the event more than double in size. In fact, tickets were sold out.

Our Editorial team has arrived in Oradea. @DisruptionBank is a proud media partner of the biggest #Fintech festival in Central Eastern Europe. #UnchainFintechFestival pic.twitter.com/ZjVD8ZkMAp

— Digital Startup (@digitalstartup5) June 29, 2023

Consisting of three stages set out across two days the event appealed to all types of banks, investors and fintechs. Delegates and speakers represented Norway, Spain, Poland, Czech Republic, Bulgaria, Romania, Slovakia, Hungary, Japan, Belgium, Luxembourg, France, Austria, Moldova, Serbia, the UK, and many other countries. Highlighting the international nature of the event, Csaba Balint of the National Bank of Romania opened the event with a welcome speech.

Csaba is local from Oradea. His name is of Hungarian origin, but his welcome speech was in English. His opening comments were to highlight the words finance and technology in fintech. He used the analogy of a tree with several roots to better explain how he sees fintech. He shared how each root represents something integral to fintech – people, new ideas, technology. Csaba explained how when these roots meet something special happens. Furthermore, when these roots meet and radical ideas come out, then one can see the branches blossoming.

It was almost like he was describing the Unchain Fintech Festival itself. An event that has already blossomed since last year.

What VISA had to share with the audience at Unchain Fintech Festival

There are several sponsors of the Festival in Oradea, but the main partner is VISA this year. Other sponsors include Banca Transilvania, EvroTrust and Google Gloud. All of the companies have been well represented at the festival. On behalf of VISA, Adolfo Laurenti took the stage after Csaba. Adolfo is the Principal European Economist at VISA normally based out of London. And he had some key trends to share with the audience.

Unchain is in full swing with @AdolfoLaurenti on stage. Visa is a big partner to things in #CEE pic.twitter.com/oi6cDYpqsE

— Andy Samu (@Andysamu) June 29, 2023

One of the topics that Adolfo wasn’t afraid to touch on was the reality of inflation. He was complimentary about the labour market where we have seen wage rises in the recent past. Something that has also fuelled inflation, he added.

With inflation up to 8% in countries like Romania, Adolfo explained how central banks had to keep interest rates high. VISA monitors consumer sentiment all the time, and Adolfo shared how 40% of European consumers foresee that things will get worse in the economy. He added how only 42% thought things would stay the same.

“Over 80% of consumers believe things will stay the same or get worse,” Adolfo summarized. But it’s not all gloom and doom. Consumers are monitoring their spending more than ever. And this is a good thing for Fintechs.

“There is a large demand for more tools to control your finances,” Adolfo added. “This has led to consumers taking control of their finances and changes in the way that people are spending today.”

The Importance of Academia at Unchain Fintech Festival

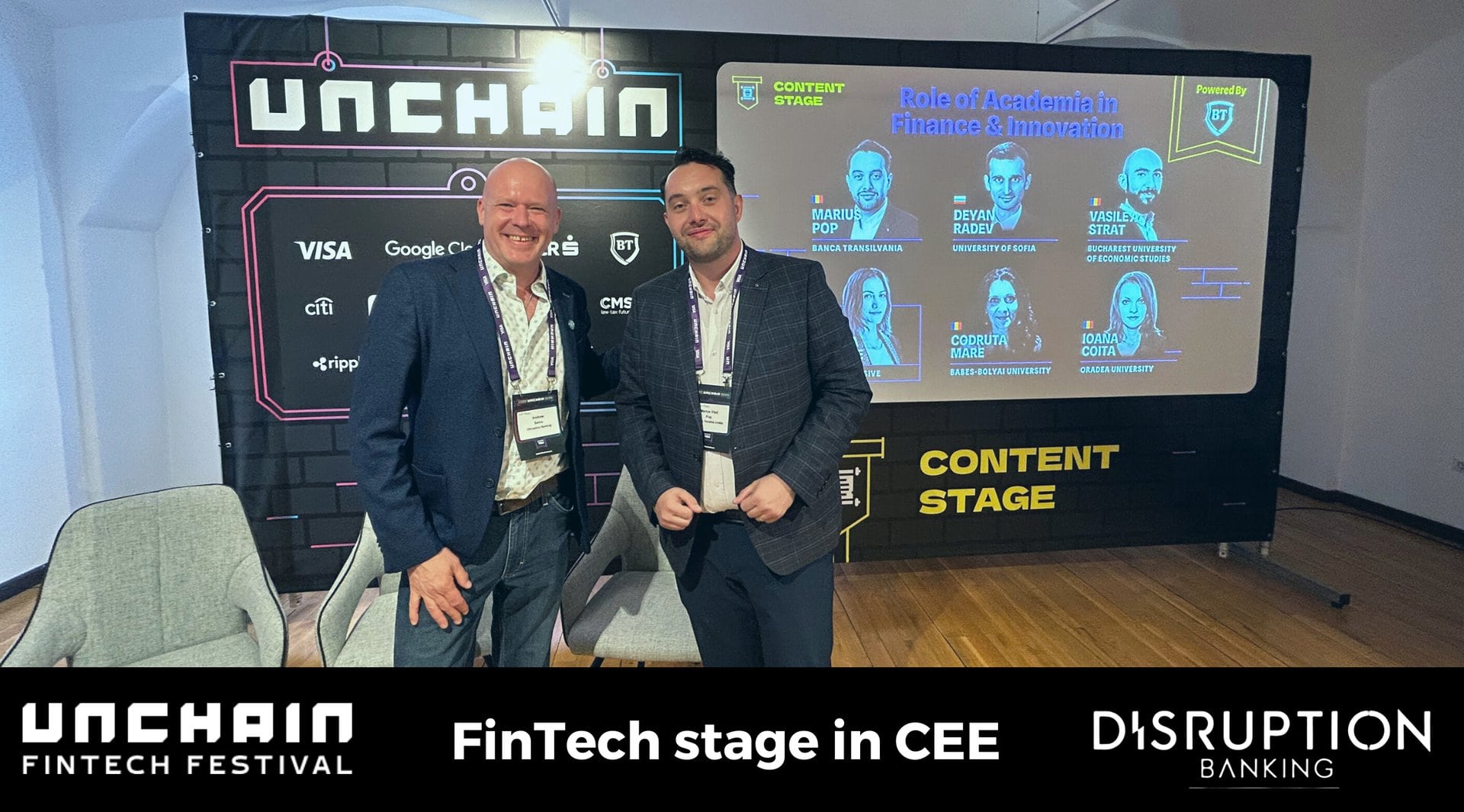

One of the big differences between Unchain and other Fintech events was the presence of academia during the two days. Representing Universities in Bucharest and Sofia, delegates were given a huge insight into some of the work being completed in the region. By some very forward-thinking thought leaders. Deyan Radev of Sofia University and Vasile Strat of Bucharest Business School joined a panel with Marius Vlad Pop of Banca Transilvania to share insights into a new Fintech report from the region. Ioana-Floria Coita Popovici and Codruta Mare joined the panel too.

Interestingly, the report was prepared by the academia without any financial support from business. Not only that, but Vasile and Deyan had come to the festival with the intention of spreading the news about their report. The organizers of the festival encourage engagement between business and the leaders from the local universities. Going forward one can see that this part of the festival can really become a valuable addition.

Celebrating Global Trends Locally

The final day of the festival saw a truly international line-up speak about trends from Belgium to Singapore, and from Japan to South America. One of the speakers actually travelled 17 hours on a plane to put in an appearance. All of this highlights both the quality and the demand for such a high profile event on the fintech calendar in Central Eastern Europe.

Most importantly, the winners of the Unchain StartUp Tournament were announced. And the winner was Synapze Gmb. An end to end automation platform for the financial services industry which makes decision-making efficient with the power of AI.

Today, there may only be a handful of unicorns from the region. But with people like Cosmin and others strengthening the market through initiatives like the Unchain Fintech Festival, the future is bright. The handful of venture capitalists at the festival were just some of the stakeholders who attested to this potential.

#DisruptionBanking are definitely going to be back again in 2024. Will you join our editorial team?

Author: Andy Samu

See also:

Oradea in Romania to host Unchain Fintech Festival in July | Disruption Banking

2 Responses

It would be nice if you edited the post to mention the startup that won this year’s festival.

updated 🙂