The episode ‘Nosedive’ was the opener of the third season of the popular dystopian series Black Mirror. In it, every member of society had a ‘score’ which was calculated from their behaviour towards other humans. The number fluctuated whenever someone interacted with the world. Those with a good score had better opportunities whilst a bad score constrained them. The episode followed the main character’s fall from grace due to her deteriorating rating.

How comfortable would you feel in that society? Well, I have some unsettling news: it is happening in real life today.

Welcome to the Financial Mirror

Trustworthiness. A pillar of society, whether that be a job application or an informal meeting, our credibility is always evaluated.

For hundreds of years, credit was determined solely by humans. Banking and insurance representatives were hired to go around and decide how trustworthy a person was. When they came back, they could say: “they pay on time, usually. But possess a fondness for the likes of whiskey and cigars.” But this character-based decision-making meant that a visit to a bank, even with a satisfactory credit history could still result in being turned down because the banker did not like the customer’s demeanour.

Find out more about how to repair your credit with Money.com:

As time passed, some organizations tried to acquire data geographically to decide where it is better to lend. The Federal Home Owners’ Loan Corporation created a map of Atlanta in 1938, and the ‘best’ regions were coloured in green, opposed to the red, ‘hazardous’ areas. Here lenders sought to develop a scoring system, but it still relied on human emotion and judgment, with all the entrenched bias it brought. Something (data driven) had to be done.

can we do it now without finding ourselves in a surreal black mirror universe?

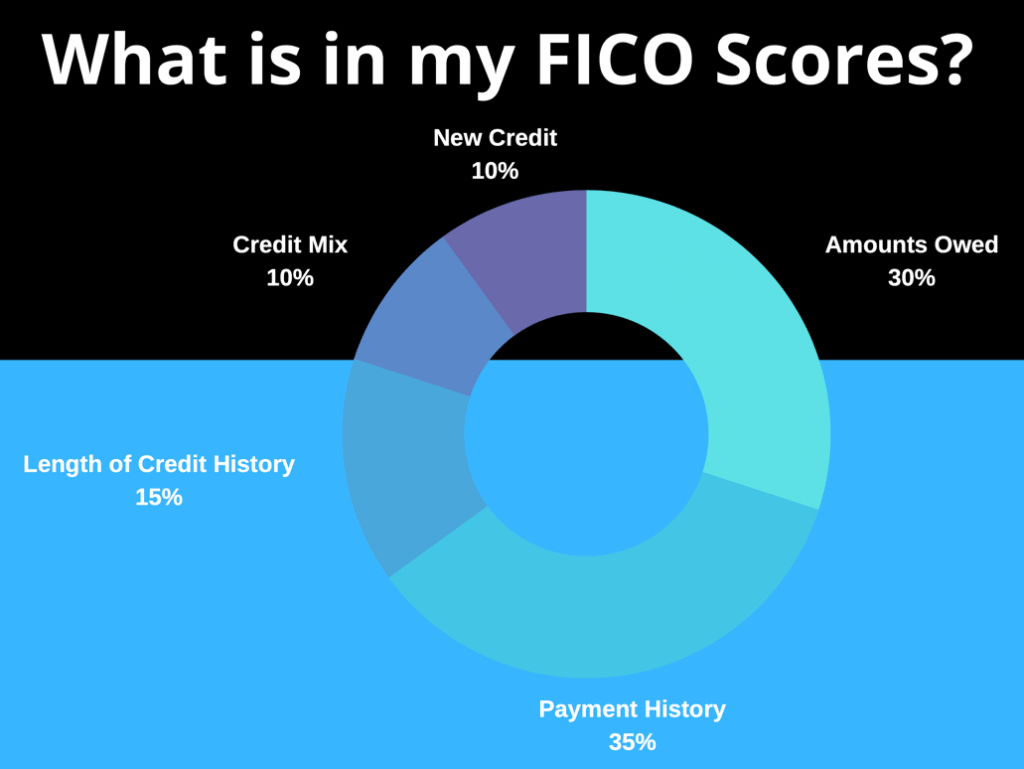

In the 1950s Bill Fair and Earl Isaac designed an electronic scoring system which was further developed and became the ‘FICO score’ that is now widely in place in the U.S., used in 90% of lending decisions across the country. The system measures the likelihood of paying credit back by giving a score for future debtors automatically. This rating is available any time on many websites. On-time payments make up the largest segment of the FICO score calculation, at 35%. The chart below represents how the FICO Score is split.

Although there are international differences, the UK has a similar system in which the scoring usually starts at 0 and ends at 999, but varies among the financial institutions. Typically, a credit score of 881 or higher is considered good. Customers have four credit scores – one from each of the UK’s Credit Reference Agencies (CRA)- Experian, Equifax, TransUnion and Crediva. These agencies gather information about past credit history in a very similar way to FICO providers. Lenders will ask one or more of these agencies for information before accepting credit applications.

Importantly, quantitative factors influence this number but not personal, qualitative factors. Personal factors meant discrimination in the past but the current credit score depends on banking or legal data; credit history, registered to vote (UK), missed repayments, frequency of credit applications, a spouse’s rating, amount spent by credit vs. debit cards. This means one could have a terribly unhealthy consumption lifestyle; but does not particularly affect financial credibility.

Currently, our world is shifting towards a future where trustworthiness is measured consistently, and banks want to know one’s ‘real-self’ before lending money. The past becomes our future we could say, however, we need to reduce harmful discrimination from the results provided by new methods. It was not possible before, owing to human emotion, but can we do it now without finding ourselves in a surreal black mirror universe?

Nowadays, monitoring of what we spend our money on due to digital banking is far easier, and so too can the banks due to open banking. These data points provide a more accurate picture of us than we imagine, from the amount of tobacco smoked or the type of alcohol consumed, to how much we spend in the Christmas season.

“Don’t tell me what you value, show me your budget, and I’ll tell you what you value” — Joe Biden.

Additionally, further sharing of alternative information with financial institutions – Google Searches, internet cookies, Facebook, Instagram and gaming can help banks to understand clients better, connect the dots, and provide better and more relevant personalized deals. However, not everyone believes this will be to the benefit of all society. “Collecting increasing amounts of alternative credit data – especially data about short-term loans and utility payments – could lead to more adverse outcomes for some, especially in disadvantaged communities.” – states Christopher Peterson, a professor at the University of Utah’s College of Law and director of financial services at the Consumer Federation of America.

In the US, five federal financial regulators recently came together with a rare-joint statement on the benefits of alternative data. It shows how radically well-established organizations are changing their attitude towards this topic and more willing to engage collectively.

“The agencies recognize alternative data’s potential to expand access to credit and produce benefits for consumers. To the extent firms are using or contemplating using alternative data, the agencies encourage responsible use of such data. In addition, the agencies are aware that the use of certain alternative data may present no greater risks than data traditionally used in the credit evaluation process”. – The Board of Governors of the Federal Reserve System, the Consumer Financial Protection Bureau, the Federal Deposit Insurance Corporation, the National Credit Union Administration and the Office of the Comptroller of the Currency.

Fintech Takes the Lead

The World Bank estimates that 1.7 billion adults live unbanked globally. These people do not have the opportunity of obtaining a loan to buy a residence or start a business. In the United Kingdom and the United States younger people often do not have fair access to credit in current credit scoring systems, which has led to a boom in payday loan companies that disproportionately prey on them.

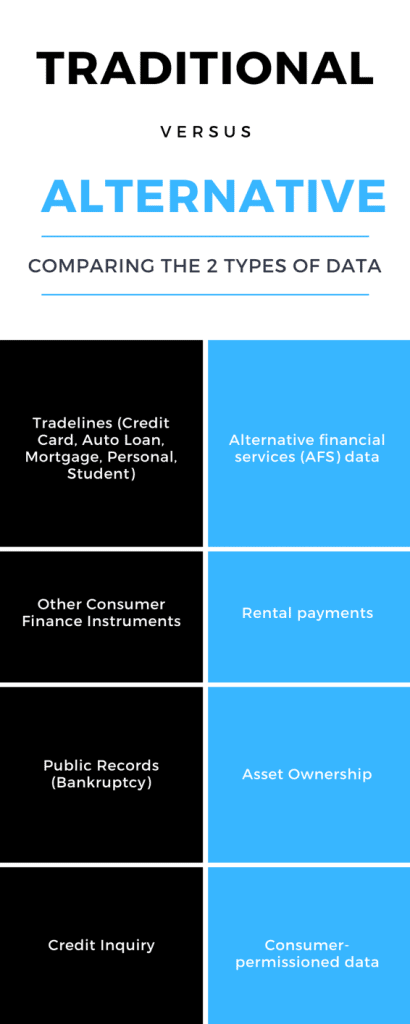

These people desperately need a better credit score to access lower interest rates and start their financial life more optimistically. In response to this mismatch, the credit scoring industry has undergone a recent eruption of fintech startups that take an ‘all data is credit data’ approach that “use non-financial payment streams, academic records, behavioural signals gleaned from online or social media footprints and results generated via digitized psychometric testing.”

Another problem with the current system is that people do not monitor their credit score regularly. According to Experian, the average rating among its customers is 759, a ’fair’ credit score. However, too many people do not monitor this result which can be disadvantageous because a bad record on credit scores can negatively affect the rating for several years. If there is a mistake in this then it can result in loss of opportunities down the road, so it is better to check the score monthly and correct the mistake as soon as possible.

“If a borrower’s application or pricing is based, in part, on the creditworthiness of her social circles, that data can lead to clear discrimination” – Lauren Saunders, National Consumer Law Center

In the age of globalized immigration, we lack international solutions for giving credit scores for new inhabitants. It is limited to the country where a person applied for credit before. Although it is possible to do foreign credit analysis in some cases e.g. if you want to buy a home in another country – most people have to start their credit history again in the country where they moved to.

But with alternative credit scores, this can be quickly solved as channels like Facebook, Instagram or Google are universal across all countries who use the same platform. Although Western societies are not at the ‘social media data’ point yet, FICO recently released FICO XD which includes payment data from TV or cable accounts, utilities, cell phones and land lines. FICO has also released UltraFICO, which focuses on how responsibly consumers manage their finances. But many startups propose social media posts, job history, educational history and even restaurant reviews or business check ins.

In reality, these systems that depend heavily on machine learning (a brand of artificial intelligence), are likely interpreting signals in ways that customers might not realize. Your zip code alone, could give a bank a rough idea of what someone’s ethnicity might be. “If a borrower’s application or pricing is based, in part, on the creditworthiness of her social circles, that data can lead to clear discrimination against minorities compared to white borrowers with the same credit scores” – wrote Lauren Saunders, the associate director of the National Consumer Law Center, in a 2015 letter to the U.S. Department of the Treasury expressing concerns about these tactics.

There are also some cases where the system could affect your credit score badly because of unintended behaviour. For example, if one moves frequently due to the nature of employment, then it might give a false impression of instability. New technologies have to be applied correctly to make a situation clear. “It is impossible to talk about alternative data without talking about different analytic technologies and machine learning, such as neural networks, random forests and stochastic gradient boosting. Data scientists play an important role to make sure that the patterns discovered are strong, relevant and explainable.” – writes Manish Gandhi from FICO.

On the other hand, it is not guaranteed that with alternative data a better record can be provided, leading some people to hesitate to share this information. “The lack of a credit file may be better than a credit file that incorporates some of this information, particularly if you get some of this information and it makes you more negative” – Explains Ed Mierzqinski, senior director of the Federal Consumer Program at the U.S. Public Interest Research Group.

“It is impossible to talk about alternative data without talking about different analytic technologies and machine learning” – Manish Ghandi, FICO expert

Whereas it is inspiring for many to think about the possibility that smartphones can dramatically reduce the cost of lending because we generate such a vast amount of data via them; texts, e-mails, GPS coordinates, social-media posts and receipts indicating patterns of behaviour that correlate with repayment etc- the dangers of narrow AI biases constrict the benefits. Arguably, we can say that using only alternative data is not enough to judge a borrower’s credibility objectively but can help banks to make more thoughtful decisions by adding it to traditional data.

Alternative Data Overkill

Since 2015 the so-called Zhima Credit, also known as Sesame Credit, has been making headlines. It is a credit scoring system of the Chinese Alibaba Group, which uses alternative data to provide easier access to loans from Ant Financial and decides whether or not a person is trustworthy enough. It reflects on this profile on e-commerce sites within Alibaba. Zhima Credit is collaborating with the Chinese government so they have access to all public documents, such as financial records and official identity. Nevertheless, as the government can access China’s most popular communication application and social media platform (WeChat), this is integrated for Zhima as well. This app has 1.15 billion monthly active users from a wide range of age groups, generating vast data sets.

China’s public sector uses the ‘Social Credit System’, and can have serious ramifications on the lives of citizens. It monitors individual, corporate and government behaviour across the country in real time. The main objective of the system is to evaluate trustworthiness in a similar way to how credit scores operate in Western nations. However, it tries to decide who can be trusted to repay a loan in a society where residents may not have credit history. Correspondingly, it uses alternative data and goes far beyond financial trustworthiness.

1000 individual data points are allocated to which the score can be improved by; donating blood or money, engaging in charity work, praising the government on social media and helping the poor. Staying within the law is expected. For this behaviour they fast-track work promotions, their children can go to better schools, they can access to bank loans and consumer credit.

Chinese citizens can lose points by; not visiting one’s ageing parents regularly, cheating in online games, insincere apologies for crimes committed and spreading rumours on the internet. Punishments are widespread; exclusion from booking flights or train tickets, restricted access to public services, even shamed on TV and via social media.

When Art Imitates Life

In the Black Mirror episode, the main character eventually found herself in a prison cell where she could do whatever she wants without consequences. It made her happier than being ‘out there’ where she was struggling to have a slightly nicer flat to be ’content’, but because of a bad score was not able to. She had the money for it, but her social rating was not deemed good enough.

It very accurately reflects how much struggle a person goes through when they have to fulfil the expectations of a society that measures every past and present behaviour, micro or macro transaction, to have a loan or rent the abode they are yearning for. As more data is collected on us, the financial institutions and data miners that provide them useful nudges are going to have to learn how to optimize opportunities without ending up with some scary dystopia.

The opinions expressed above are those of the author and do not necessarily represent those of DisruptionBanking or its partners.

By Balázs Zahorecz

One Response