Trade finance; the $10 trillion dollar buttresses which uphold the $18 trillion trade market. Historically speaking, banks have been the ideal facilitators for international trade, providing payment channels and financing both buyers and sellers, but recent developments are putting pressure on traditional systems and forcing even the most sophisticated of legacy players to look for new solutions.

Though traditional methods continue to function, events show them to be gradually diminishing in efficiency, creating a chasm of unmet demand which is reported to be around $1.5 trillion.

From quick, immediate updates to long-term applications which require sustained research, eliance on antiquated manual processes and digitizing key trade documents, like Letters of Credit (LOCs), to reduce cost and improve efficiency.

Others are looking to replace the process altogether with longer term applications of distributed ledger technologies (DLTs).

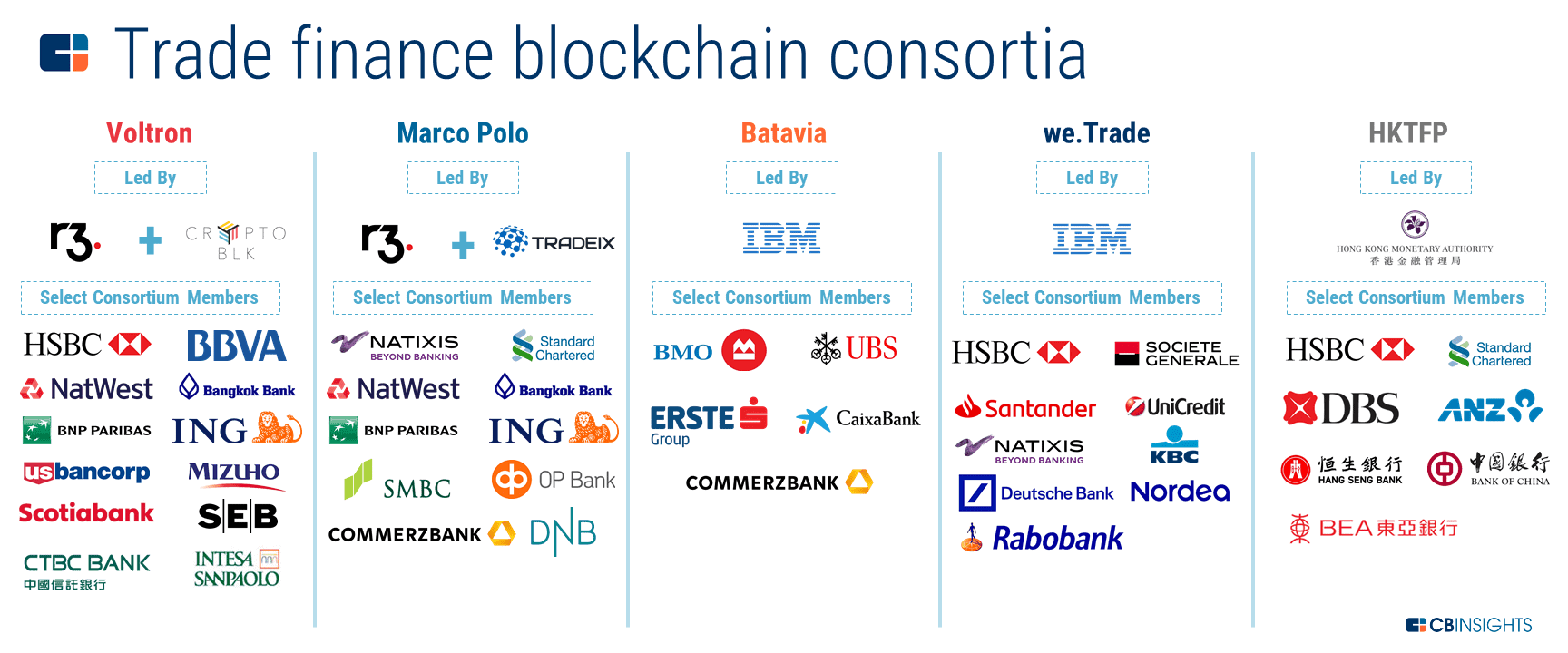

Here are the five largest consortiums focused on testing DLT in trade financing.

VOLTRON

What is it: Voltron is led by R3 and CryptoBLK with tech supported by Microsoft’s cloud platform Azure. Voltron has onboarded 12 partner banks.

Partners:.

Description: Voltron uses R3’s DLT platform to digitize paper-based letters of credit (LOCs), a highly manual process today that banks are anxious to digitize in order to reduce fraud and speed up document turnaround. The consortia has been making headway in trade finance with its DLT platform called Corda.

Milestones: Corda’s first blockchain plateform for businesses was unveiled in 2016. In May 2018, HSBC and ING used Corda, in partnership with CryptoBLK, to successfully complete a LOC for Cargill to ship soybeans from Argentina to Malaysia. In July 2018, R3 pivoted to B2B with Corda Enterprise, a business application of its commercial B2C blockchain.

MARCO POLO

What is it: A collaboration between TradeIX and R3

Partners: RBS’s NatWest, BNP Paribas, Commerzbank, ING, DNB, OP Financial, Bangkok Bank, SMBC, Standard Chartered, and Natixis.

Description: The collaboration combines R3’s Corda Enterprise solution and TradeIX’s TIX Core, an open infrastructure powered by DLT. The goal is to streamline accounting for businesses to track payment guarantees and expedite receivable discounting.

Milestone: In October 2017, TradeIX reported one of the earliest successful trade financing transaction pilots. Using TIX Core, Standard Chartered was able to digitally discount receivables and simultaneously secure credit risk through insurer AIG for an undisclosed logistics company.

BATAVIA

What is it: A consortium between built on the IBM Blockchain Platform.

Partners: 5 banks (UBS, Bank of Montreal, CaixaBank, Commerzbank, and Erste Group)

Description: Batavia has broader applications than the other projects, and uses smart contracts to help all participants in a cross-border trade to track and monitor their open transactions.

Milestone: In April 2018, the group ran 2 import pilots: it imported German cars and Austrian textiles to Spain. During the test runs, participants were able to monitor each stage of the trade as the goods traveled by road and sea. Next, they are looking to add air freight traceability before launch.

Hong Kong Trade Finance Platform

What is it: A venture led by the Hong Kong Monetary Authority (HKMA) with technology support from the Ping An Group.

Partners: 21 banks including HSBC, Standard Chartered, Hang Seng Bank, Bank of East Asia, Australia and New Zealand Banking Group, and Singapore’s DBS Group.

Description: Slated to launch later this year, HKTFP was established to digitize supply chain record-keeping and to eventually connect other trade platforms (like Marco Polo or we.trade) to further facilitate cross-border trades.

Upcoming Milestone: Go live with select consortia slated for the end of 2018.