Investors are reportedly making fortunes from their sofa using online trading apps to pursue highly speculative assets and trading strategies. Many experts don’t think these are sustainable investment strategies, but they point to trends that could have long-term consequences for markets.

In recent weeks, several highly speculative investment strategies and assets have been making the headlines.

If the news stories are to be believed, a small number of armchair investors are making big profits betting against hedge funds, while the spectacular increase in the value of Bitcoin has made millionaires of forward-thinking techies.

Coutts Head of Asset Management, Mohammad Kamal Syed, points out that, as is always the case with these stories, the devil is in the detail.

“There’s no doubt that some individuals have done well from these strategies,” he says. “But recent market moves demonstrate that both approaches are brittle, and liable to sudden reversals.”

Over the last few days, GameStop has started to fall again as the trade unwinds.

Essentially, the fundamentals that a long-term investment strategy relies on don’t stack up for GameStop. The company hasn’t posted a profit in a long time, and retail trends are against it.

“Someone will be left holding these shares as they start to fall,” says Mohammad. “That’s what makes this a dangerous strategy – you need to make sure it’s not you.“

Investing under the influence

The sudden rise in GameStop’s share price has seen some hedge funds take big losses. But why did the share price rise so suddenly?

There are the technical matters around shorting strategies (see box) that made this possible, but for Mohammad, it is the rapid digitisation of investment that’s most significant.

“A key factor in the story is the role of online ‘influencers’. Popular posters in investment groups on the website Reddit spotted the weakness of the short position and encouraged their followers to buy the stock.

“Many took small positions that would, in themselves, have had little impact on the price. But as thousands of investors piled in, the price began to creep up.”

This triggered buy signals for holders in the short positions, whose purchases accelerated the rise. Pretty soon, prices were headed “to the moon” as the Reddit posters say.

Mohammad adds, “As well as the impact of social media networks that made the attack easy to organise, it wouldn’t have been possible without commission-free online trading platforms – notably, in this case, Robinhood. These made it quick and easy for investors to buy the stock, greasing the wheels of the whole process.”

Bitcoin: fools’ gold?

The digitisation of markets is also – in part – behind the spectacular rise of Bitcoin. Coutts wrote about Bitcoin in 2018 – even then it was becoming easier to buy and spend. More recently, PayPal has started to accept transactions in Bitcoin and more and more retailers are accepting it.

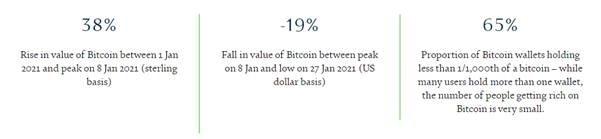

But that gradual expansion of Bitcoin’s presence as a medium of exchange doesn’t explain its rise in value. At the time of our last article, Bitcoin had been on a high of around £15,000. At the start of 2020, Bitcoin peaked at around £30,000, a rise of around 100%.

Should you have invested then? Maybe, but you would have to be prepared for eye-watering levels of volatility. Mohammad warns, “Within 12 months of the £15,000 high, the value of Bitcoin fell to around £3,000, a loss of 80%.”

All assets experience ups and downs, albeit not that extreme, but how can you tell which direction Bitcoin will go from £30,000?

The problem is you can’t.

“Bitcoin is an entirely speculative asset,” says Mohammad. “It has no intrinsic value in itself and no real connection to the general economy. Other ‘stores of value’, like gold, have a well understood relationship to economic conditions and, particularly, inflation, based on a track record going back thousands of years.

“How Bitcoin is influenced by underlying economic conditions – if at all – is not well understood.”

A further factor behind both the GameStop phenomenon and the surge in value of Bitcoin is market liquidity.

“A decade of low rates has meant there is a great deal of money available for investors and, arguably, the availability of investments hasn’t kept pace,” says Mohammad. “This makes alternative assets like Bitcoin attractive, especially when bond returns are so low.”

Trading not investing

All of this can be fun for those with an interest in markets or a gamer’s instinct for trading, but they’re not the same as investing. Investing is the business of earning money through the long-term strength of companies and the economy.

“It can look a little dull compared to the thrill of taking on the hedge funds or being at the cutting edge of a bold experiment like Bitcoin,” admits Mohammad. “But traditional investing – based on an understanding and analysis of corporate and economic data – remains one of the best ways to access sustainable returns in the long term.”

The story was prepared and submitted to #DisruptionBanking by Coutts

#Influencers #GameStop #Bitcoin #Coutts #Reddit #HedgeFunds #Liquidity #RiseoftheRetailInvestor

One Response