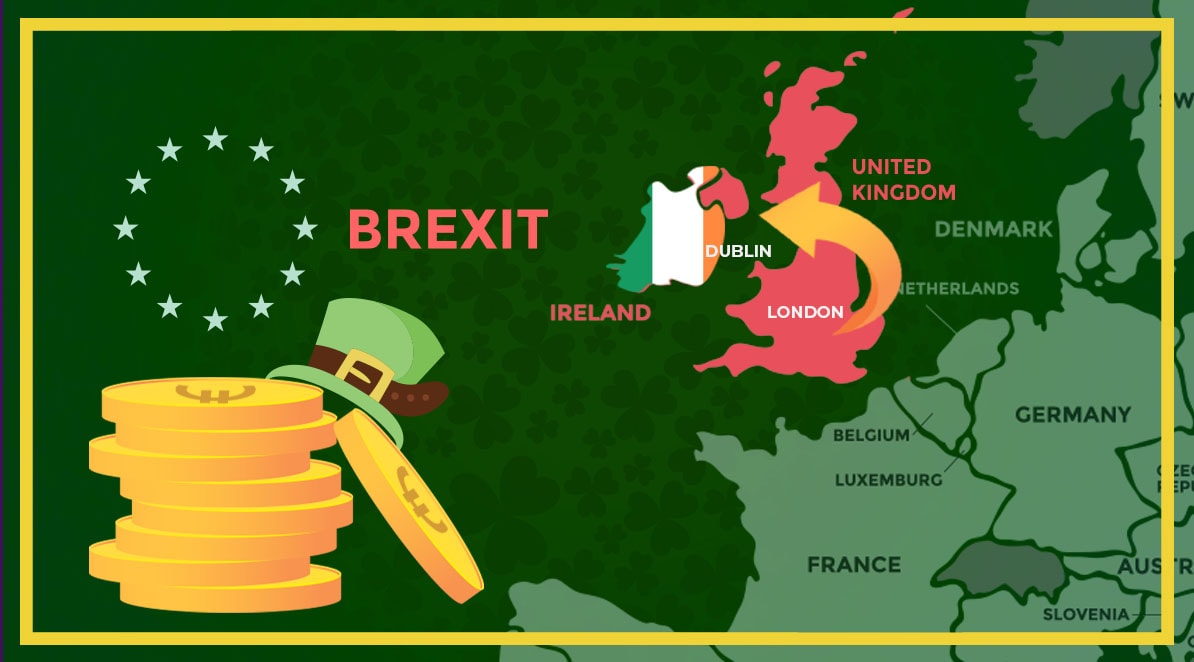

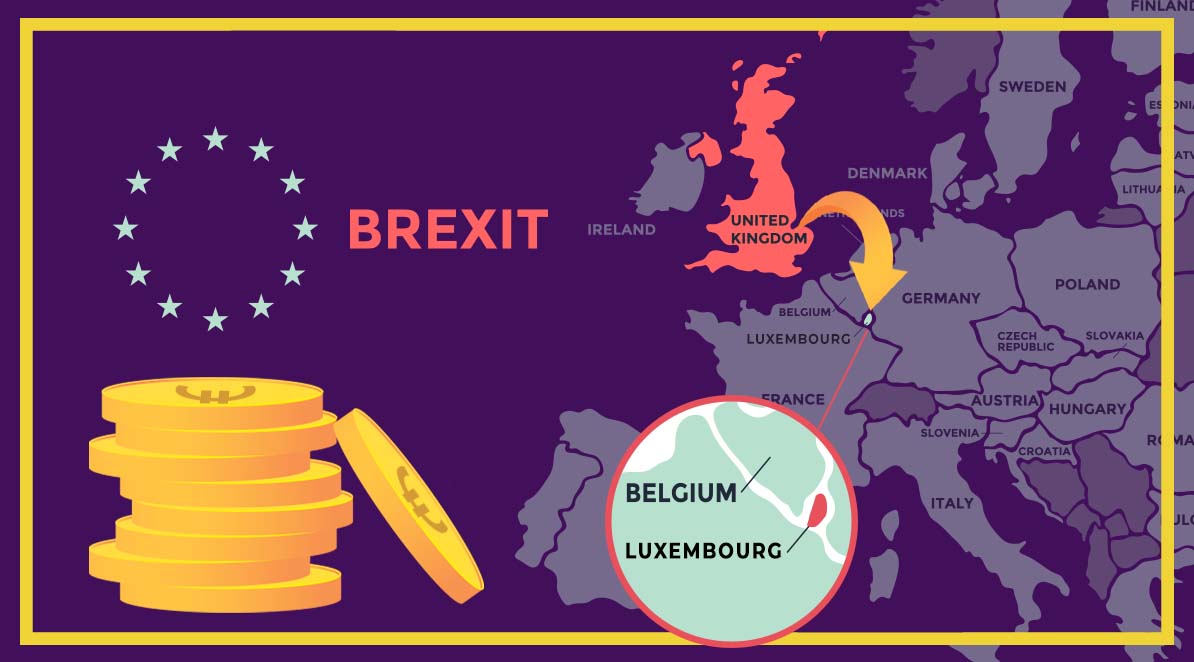

Emmanuel Macron famously worked for blue-blooded investment bank Rothschild so knows well how to craft overtures that the financial world’s chief executives want to hear as they relocate from the UK as a result of the country’s exit from the European Union (EU).