Ethereum has long been celebrated as the “world computer” of blockchains, allowing users to build a wide range of decentralized applications (dApps). However, as Ethereum grew more popular, it hit some big problems. The network became crowded, which made transactions slow and expensive — sometimes reaching $50 to $100 per transaction during peak times, such as during the DeFi boom and NFT craze. For everyday users and developers, this made Ethereum hard to use.

Vitalik Buterin, Ethereum’s co-founder, now has a new plan to fix this problem called The Surge. His big idea is to scale Ethereum using something called Layer 2 solutions.

Possible futures for the Ethereum protocol, part 2: The Surgehttps://t.co/DdEUpV4zQN

— vitalik.eth (@VitalikButerin) October 17, 2024

What Is “The Surge”?

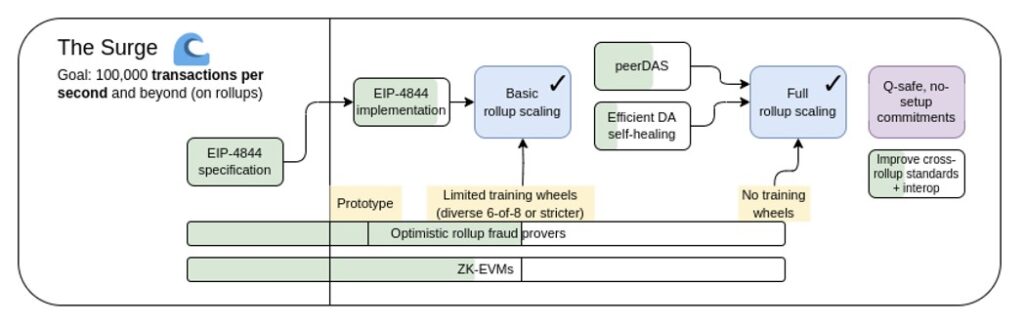

In simple terms, The Surge is all about making Ethereum faster, cheaper, and easier to use. Currently, Ethereum can only handle about 15 transactions per second (TPS). That’s nothing compared to what’s needed to serve millions of users globally. Buterin’s new plan is to scale this up to more than 100,000 TPS — a massive leap. How? By using Layer 2 technology, which helps handle transactions outside Ethereum’s main network (called Layer 1). This reduces congestion and keeps fees low without sacrificing the network’s security.

Buterin wrote, “Ethereum should feel like one ecosystem, not 34 different blockchains.”

To do this, The Surge focuses on “rollups.” These special methods group transactions together and process them off-chain before sending the final result to Ethereum’s main chain. There are two types of rollups Buterin wants to use: Optimistic Rollups and Zero-Knowledge (ZK) Rollups. Both are designed to boost transaction speed and reduce fees, making Ethereum more practical for everyone.

Scalability is a huge issue for Ethereum. Gas fees can skyrocket When many people want to use the network at once — like during the NFT craze in 2021. Right now, gas fees on Ethereum are around $0.50 to $2 on average, but during busy periods, they can go much higher.

This makes small transactions too expensive, especially for newcomers or people using dApps for fun or experimentation. Other blockchains, like Solana, charge pennies for transactions, so Ethereum needs to keep up.

“Our task is to complete the rollup-centric roadmap and solve these problems while preserving the robustness and decentralization that makes Ethereum special,” Buterin noted.

By increasing the TPS to over 100k, The Surge aims to make Ethereum affordable and user-friendly, even during peak times. This could open Ethereum to industries like gaming, finance, and social media, where fast, low-cost transactions are essential. If Ethereum can become easier and cheaper to use, it could attract millions of new users and developers, making it the top choice for Web3 projects.

#Arbitrum, an #Ethereum layer-2 network, unlocked 92.65 million #ARB tokens worth approximately $105.62 million on June 16. This unlock represented 3.2% of its circulating supply.https://t.co/uf3fHKlCVl

— #DisruptionBanking (@DisruptionBank) July 2, 2024

Where Rollups and Sharding Come In

Rollups and Sharding are key to The Surge, but Optimistic Rollups and ZK Rollups — two different types of Rollups — work in different ways.

Optimistic Rollups work by assuming transactions are correct unless proven otherwise. Transactions are bundled up and processed off-chain, and only if something looks suspicious do they go through a verification process. This keeps things quick and allows the system to handle a large number of transactions. Projects like Arbitrum and Optimism already use this method, showing promise in reducing costs and increasing speed.

On the other hand, Zero-Knowledge (ZK) Rollups use mathematical proofs to verify transactions without going through each one individually on-chain. This method is faster and more secure but more complex to set up. zkSync and StarkWare are projects currently using ZK Rollups. Buterin has mentioned that ZK Rollups could become the preferred solution as technology advances.

Both Rollup types offer benefits, and Buterin wants Ethereum to use both so the network can grow faster and stay secure. Optimistic Rollups help for now, but ZK Rollups may be the longer-term solution as they improve over time.

Danny Ryan, a lead researcher at the Ethereum Foundation, held in 2021 that “[…] Ethereum L1 today will not, alone, provide the throughput needed to support the global demand for decentralized applications. Although Ethereum’s current L1 coupled with L2 scalability techniques (rollups, channels, etc.) will help massively […], even then Ethereum will continue to see demand outstrip supply as global adoption continues.”

Then, there’s Sharding, another key feature of “The Surge.” Think of it as breaking up Ethereum into smaller parts, or shards, each holding a portion of the data. This allows Ethereum to handle more data without getting overwhelmed. In “The Surge,” there’s a unique type called EIP-4844 (Proto-Danksharding), which introduces smaller steps to fully prepare the network. Eventually, Danksharding will further divide data across Ethereum’s network. This “micro-sharding” process could allow Ethereum to handle 100,000 TPS, according to Buterin.

Ryan’s blog post emphasises the relevance of sharding: “To complement the exciting L2 rollup ecosystem that creates scalability through the use of L1 data, eth2 aims to come to consensus on a scalable, sharded data layer.”

What The Surge Could Mean for Adoption

The Surge builds on Ethereum’s recent progress, especially The Merge in September 2022, when Ethereum switched from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) system. This change reduced Ethereum’s energy use by over 99.95%, making it one of the greenest blockchains around and drawing interest from eco-conscious investors and institutions.

“The Merge was a monumental step forward for Ethereum, paving the way for a scalable future,” shared blockchain analyst Mati Greenspan

Now that PoS is in place, the focus has shifted to solving the scalability problem.

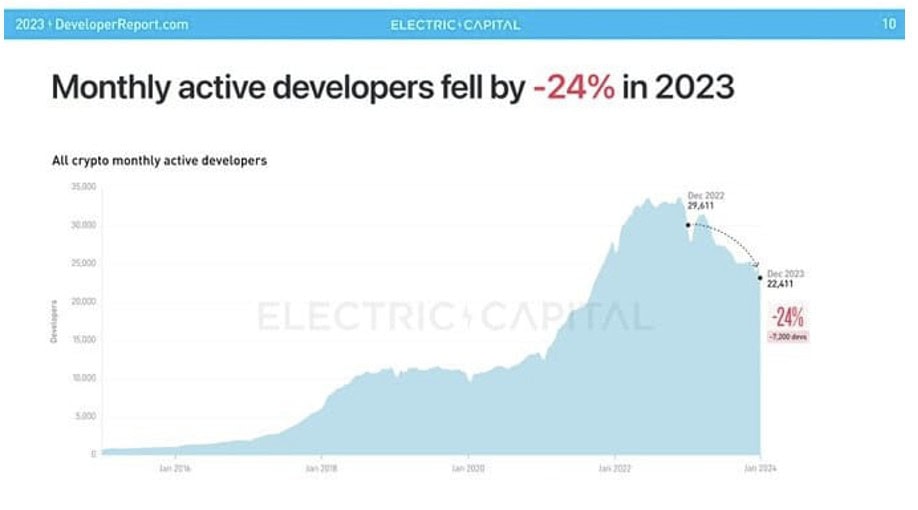

Since the launch of Ethereum 2.0, Ethereum’s developer community has continued to grow. A 2023 report by Electric Capital noted approximately 8,865 active Ethereum developers, which fell by 24% last year. They currently stand at 7,661 full-time developers as of July 2024, more than any other blockchain. However, for these developers, network congestion and high fees remain a challenge. By eliminating these issues, The Surge aims to make Ethereum a friendlier place to build dApps, encouraging even more developers to join.

Monthly active devs dropped by -24% in 2023, Source: Electric Capital

If The Surge works as planned, it could be a market disruptor for Ethereum’s adoption. Right now, Ethereum’s DeFi (Decentralized Finance) ecosystem holds approximately $47.996 billion in total value locked (TVL), accounting for a dominant 73.5% of the entire DeFi market, data from blockchain data tracker DefiLlama shows. However, with lower fees and faster transactions, that number could increase rapidly as more users and investors jump into the ecosystem. Predictions suggest that Ethereum could hit 100,000 TPS by 2026, putting it on par with traditional finance in terms of speed and transaction capacity.

Buterin has often said that Ethereum aims to become the “world computer.” With The Surge, Ethereum could finally live up to that vision. Faster, cheaper transactions would make it the go-to platform for everything from micropayments to high-frequency trading and even more casual applications like social media. If successful, Ethereum could become the blockchain of choice for a much broader audience. And from his post earlier in September, L2s are all he wants to talk about.

I take this seriously. Starting next year, I plan to only publicly mention (in blogs, talks, etc) L2s that are stage 1+, with *maybe a short grace period* for new genuinely interesting projects.

— vitalik.eth (@VitalikButerin) September 12, 2024

It doesn't matter if I invested, or if you're my friend; stage 1 or bust.

Multiple… pic.twitter.com/4cGxgsfmUc

The Scalability Trilemma

Despite its promise, The Surge has some obstacles. Rollup technology is still developing and requires extensive testing to work on a large scale. One major problem to solve is finding a balance between three important things:

- Scalability (can it grow and handle more users?)

- Decentralization (is it controlled by many people, not just one?)

- Security (is it safe from hacking and other threats?). Since rollups rely on external data sources, there’s a risk that these could be compromised, which would affect the security of the Ethereum network.

This is called the “scalability trilemma,” according to Buterin’s October blog post. It’s like trying to solve a puzzle with three pieces that need to fit together perfectly.

Another challenge is cost. Building and maintaining rollups isn’t cheap. According to The Block Research’s 2024 Digital Assets Outlook, Ethereum’s rollup-centric scaling strategy has considerably reduced costs, especially following the Dencun upgrade in March 2024, which introduced “blobs” for temporary data storage, thereby lowering data availability expenses for rollups. Despite this leap, the research estimated that scaling Ethereum with rollups could cost millions per year, depending on the adoption rate in sectors like DeFi and NFTs. Ethereum developers must find ways to balance these costs with the savings on transaction fees.

There’s also a debate over whether Layer 2 solutions might compromise Ethereum’s decentralization, as they rely on third-party validators for processing transactions.

The tokenomics of Ether the asset is inversely proportional to the usability of Ethereum the network

— Zach Rynes | CLG (@ChainLinkGod) May 6, 2023

Higher transaction fees and greater MEV extraction (sandwiches) results in more Ether getting burnt and fees paid to validators, but at the expense of higher costs for users… pic.twitter.com/PeggIcEy48

Ultimately, The Surge represents Ethereum’s leap toward mainstream adoption. It’s an exciting time for the Ethereum community as Buterin’s vision for a faster, more affordable, and widely accessible Ethereum takes shape. The journey is far from over, but if successful, The Surge could define a new era for Ethereum and the blockchain industry as a whole.

Author: Ayanfe Fakunle

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.