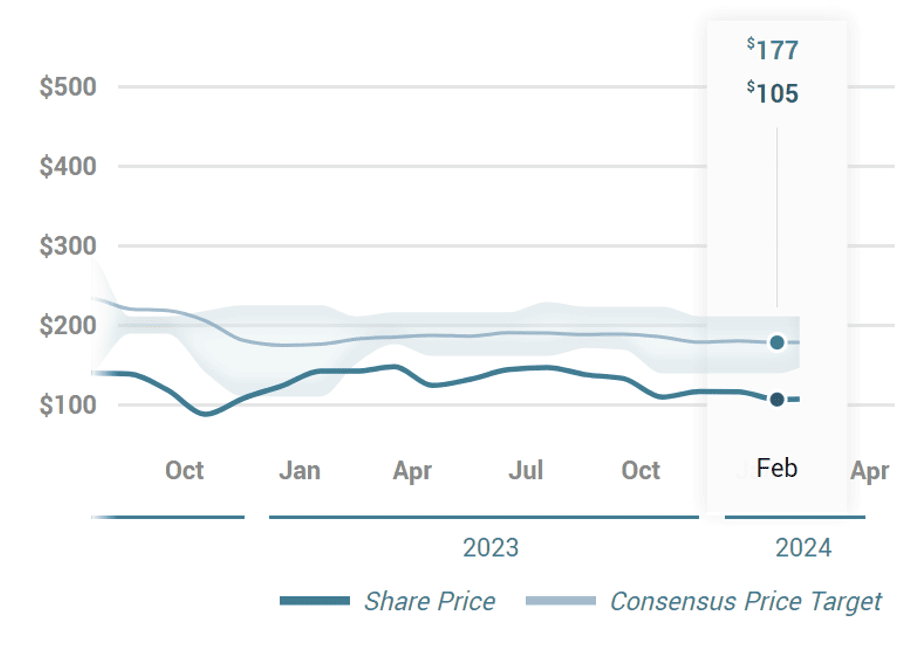

Baidu, the Chinese Internet giant, has disappointed Wall Street over the past year as its stock price has consistently undershot analysts’ expectations. Currently trading at around $105, it is nearly 40% lower than the $177 consensus price target.

Despite the stock being rated a buy by 16 Wall Street brokerages, including Goldman Sachs, Barclays, and JP Morgan, investors don’t appear sold on the idea that Baidu could outperform as analysts’ projections imply. Baidu’s shares, which are listed on both the Hong Kong Stock Exchange and the Nasdaq, have languished in the market in the past year despite lofty analyst price targets.

Baidu’s lackluster stock price performance suggests that investors are questioning whether the company can unlock new growth amidst the general weakness of the Chinese stock market and economy.

Baidu’s stock has lagged behind analysts’ price targets; source: MarketBeat

Additionally, there are wider geopolitical issues at play that have dampened investor sentiment towards Chinese stocks. There have, for example, been fears among some investors that Chinese firms listed in the US may be delisted due to ongoing trade and geopolitical tensions between the world’s two largest economies. These factors have weighed down on Baidu’s stock.

While US counterparts such as Meta and Alphabet have soared over the past five years, Baidu’s stock has lost more than a third of its value during this period. Its recent underperformance may make it unattractive to many investors. However, for risk tolerant investors who follow the wisdom of Warren Buffet, the legendary value investor, Baidu could be an opportunity to buy low and sell high. Buffet is famous for the line: “Be fearful when others are greedy, and greedy when others are fearful.” He looks for undervalued companies that have strong fundamentals and growth potential, but are overlooked or shunned by the market. Baidu seems to fit this description.

Dominant Position And Attractive Valuation

Baidu has a dominant position in online search, artificial intelligence, and cloud computing in China, and it has been growing its revenue and earnings steadily. It also has a diversified portfolio of investments in other sectors, such as online video, autonomous driving, and biotechnology. Its revenues for the trailing twelve months stood at $18.17 billion, with gross profits of $9.42billion and operating income of $2.97 billion. This is in contrast to revenues of $15.1 billion, gross profits of $6.45 billion, and operating income of $964 million in 2019. The business is fundamentally in better shape today than it was five years ago, yet the stock price has fallen by more than 30%.

This discrepancy between Baidu’s business performance and stock price has resulted in attractive valuation multiples its stock. Baidu trades at about 12 times its forward earnings, 2 times its sales and 1.2 times its book value. These multiples are substantially below the industry averages – the average price to earnings ratio in the global internet services and social media, for example, was reported to be 35.66 in Q4 2023. Baidu’s strong balance sheet further enhances its appeal, with long-term debt of $8.03 billion compared to a substantial $26.19 billion in cash.

Baidu’s Q1 2022 results beat market consensus. Total revenues were RMB 28.4bn ($4.48bn). Non-GAAP net income attributable to Baidu was RMB 3.9bn. Revenue from Baidu Core was RMB21.4bn with non-ad revenues up 35% YoY, driven by #BaiduAICloud growing 45% YoY https://t.co/kLn4SMjouk

— Baidu Inc. (@Baidu_Inc) May 26, 2022

Venture Into AI Is Promising

Although company press releases can push self-promoting narratives, they can also offer important insights into the strategic direction a company is taking, especially when investors pay attention to the choice of words and phrases. From its earnings release for the third quarter ended September 30, 2023, it is clear that Baidu is reshaping itself into an AI company.

Baidu branded itself “a leading AI company with a strong Internet foundation” in the first paragraph. In his prepared remarks, Robin Li, the CEO and co-founder, Robin Li, stated early on that: “I am particularly pleased with our continuous technological enhancements and product improvements against the backdrop of emerging opportunities in generative AI and foundation models.”

Baidu’s emphasis on AI is informed by the fact that it developed its own Large Language Model called “ERNIE Bot,” which was launched last March and has gained more than 100 million users in less than a year. ERNIE Bot is comparable to OpenAI’s ChatGPT, the pioneering conversational AI system. “Our AI-centric business and product strategy should set the stage for sustained multi-year revenue and profit expansion within our ERNIE and ERNIE Bot ecosystem,” noted Li.

AI could be promising for Baidu, given its dominant market position in China. It’s noteworthy that the company’s research and development expenses have been steadily rising in the past five years, reaching $3.2 billion in the trailing twelve months versus $2.63 billion in 2019. This suggests it is investing heavily in new technologies and opportunities, including AI.

Baidu’s bet on AI could make or break China’s fallen tech group https://t.co/aWyIOPCJL0

— FT Technology News (@fttechnews) January 5, 2024

Chinese Recovery Looks Likely

In addition to having strong growth prospects, solid financials and an attractive valuation, Baidu could also benefit from the slew of measures that the Chinese government in Beijing is taking to boost confidence in the nation’s economy and revive the stock market. To mention a few interventions, Chinese policymakers are seeking to mobilise about 2 trillion Yuan (around $280 billion), mainly from the offshore accounts of Chinese state-owned enterprises, as part of a stabilization fund to buy shares onshore through the Hong Kong exchange link. The People’s Bank of China is also allowing banks to hold smaller cash reserves, a move expected to free up to 1 trillion yuan (around $140 billion) in long-term capital.

These measures appear to be one of the top priorities for Chinese policy makers, going by recent pronouncements by senior officials. Chinese Premier Li Qiang, for example, recently called for “pragmatic and forceful” action to boost confidence in the nation’s economy. This move underscores the government’s concern with a struggling economic recovery and a stock market rout. As Baidu continues to navigate this economic landscape, its strong fundamentals and strategic positioning make it an intriguing investment opportunity.

🇨🇳 #China Stocks Gain as Authorities Step Up Support: Markets Wrap – Bloomberghttps://t.co/dcqbmLdVc3 pic.twitter.com/j1YFzmwT0n

— Christophe Barraud🛢🐳 (@C_Barraud) February 21, 2024

Baidu’s stock is, however, not without its own unique set of risks. The company faces regulatory uncertainties in China and abroad, as well as competitive pressures from rivals such as Alibaba, Tencent, and ByteDance. The company also needs to invest heavily in research and development to maintain its technological edge and spur innovation, particularly now that every company in the tech industry is turning to AI as the new growth lever. Rising trade and geopolitical tensions between the US and China could also heighten the risk of it being delisted from the US, closing off a vital source of capital for the company.

These risk factors make Baidu’s stock particularly risky. But for investors who are willing to take a long-term view and embrace Buffet’s contrarian philosophy of buying good companies when others are fearful, Baidu could be a bargain worth considering.

Author: Acutel

We are global investors who invest in good companies at fair valuation and speculate on all else subject to the risk exposure we can afford.

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.