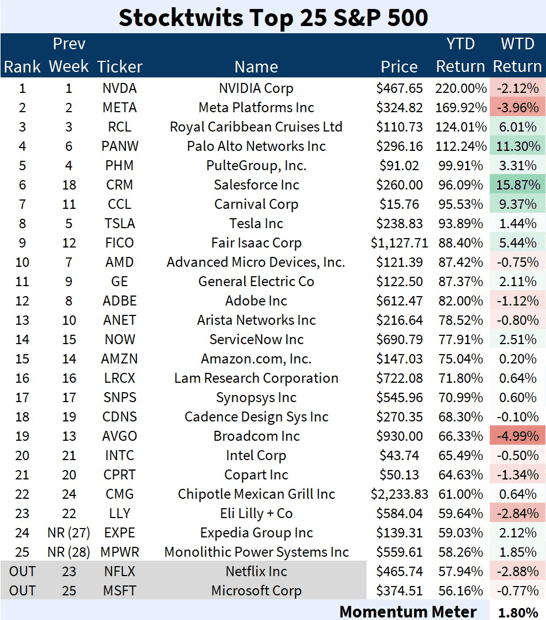

The S&P 500 index has delivered a stellar 19% return so far this year, beating its historical average of 10%. But that’s nothing compared to the performance of Nvidia, the index’s top performer and a global leader in chipmaking and artificial intelligence (AI). Nvidia’s stock has soared 220% year-to-date, making it one of only four companies on the index to double their investors’ money this year. The other three are Meta Platforms, Royal Caribbean and Palo Alto Networks, according to Stocktwits data at time of writing.

S&P 500 Top 25 Week 48; Source: Stocktwits

Nvidia’s impressive growth has attracted the attention and admiration of both institutional and individual investors. As of the end of September, more than 60% of all active long-only funds in the US had stakes in Nvidia, reports Richard Saintvilus on the Nasdaq. Nvidia is expected to remain one of the most popular and influential stocks in the US and worldwide in 2024, as it continues to drive the innovation and expansion of AI.

Rob Kapito, President, BlackRock Advisors, LLC, notes in a recent semi-annual report for the asset managers’ listed funds that: “We believe that stocks with an A.I. tilt should benefit from an investment cycle that is set to support revenues and margins.”

AI Fever

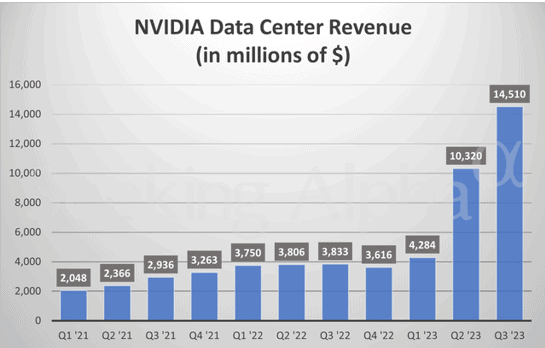

Nvidia has emerged as a leading provider of hardware and software for AI applications such as OpenAI’s ChatGPT and Microsoft’s Bing’s AI chatbot. These applications require Nvidia’s graphics processing units (GPUs) to train and run the machine learning models, which has boosted the demand for its data center platform for AI across various sectors and clients. As a result, Nvidia’s data center revenue soared in Q2 and Q3, helping fuel the stock’s mouthwatering YTD returns.

Nvidia has become the first chip maker to surpass a $1 trillion market cap, thanks to its dominant position in the AI infrastructure market. AI is expected to grow rapidly in the coming years, with some estimates suggesting that it will add 21% to the US GDP by 2030, and others forecasting a 37.3% annual growth rate for AI from 2023 to 2030.

Given these projections, Nvidia’s stock is likely to maintain its strong uptrend in 2024 and beyond, as the company has shown its ability to translate the increased demand for its AI solutions into improved financial performance. Its data center revenues have more than doubled in Q2 and Q3 of 2023 on higher AI-fueled demand for its chips.

Source: Seeking Alpha

Beware Of Risks

The future direction of Nvidia’s stock not only depends on company-specific factors – like the demand for its chips – but also on broader market conditions. In this regard, some analysts expect that global interest rates will be cut in 2024 due to lower inflation, which could boost the tech sector and Nvidia’s shares.

Bank of America’s global research economists forecast that inflation will ease globally, allowing central banks to reduce rates in the second half of 2024 and avert a global recession. Deutsche Bank, however, predicts that the U.S. will face a “mild recession” in the first half of 2024, forcing the Fed to cut rates more aggressively than the market anticipates. A lower interest rate environment could benefit the tech sector and Nvidia, making 2024 another profitable year for its investors.

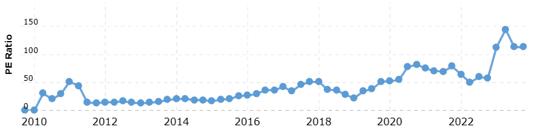

However, there are some risks that investors should be aware of before investing in Nvidia. The main risk is that Nvidia has a markedly high price-to-earnings ratio (P/E) of over 100. As of November 28, 2023, Nvidia’s P/E ratio was 115.351. This is a significant increase from the end of 2022 when the company had a P/E ratio of 61.42. The P/E ratio is a simple way to measure if a stock is over or under-valued and is the most common valuation metric. It is calculated by dividing the latest closing price by the most recent earnings per share (EPS) number.

Nvidia’s historical P/E ratio; Source: Macrotrends

The riskiest time to buy or hold a stock is when its P/E ratio is near historic highs, as any negative event or market volatility could trigger a sharp sell-off as investors try to reduce their exposure to risk. This is a risk that investors need to monitor closely, especially if Nvidia’s future earnings growth fails to impress.

Another significant challenge for Nvidia is that AI, which is shaping up to become its core business, could face regulatory and reputational hurdles, as there are many concerns among governments, businesses and individuals about the impact of the technology. In various countries, such as the US, Europe and China, there has been more discussion about mitigating the effects of AI on jobs, economic stability and even national security.

Tellingly, a large majority of people surveyed by Forbes Advisor – 77% of respondents – expressed their fear that AI could cause job losses in the near future. Likewise, a McKinsey report estimates that between 2016 and 2030, AI-related developments may affect around 15% of the global workforce.

These concerns could hamper the growth of AI, potentially affecting Nvidia’s earnings growth and interrupting its bullish trend. However, AI industry leaders, such as OpenAI, Microsoft, Meta and Alphabet, are collaborating with regulators and lawmakers to address the ethical and social issues surrounding AI. They are also exploring ways to mitigate the impact of AI on jobs and economic stability. This indicates that AI could continue growing—even with more regulatory oversight—allowing Nvidia to maintain its remarkable winning streak in 2024.

Wall Street analysts are notably bullish on Nvidia, data from TipRanks reveals. The average price target is $661.00 with a high forecast of $1,100.00 and a low forecast of $560.00, based on 34 Wall Street analysts offering 12-month price targets for the stock in the last 3 months. The average price target represents a 45.24% change from the last price of $455.10.

Author: Acutel

We are global investors who invest in good companies at fair valuation and speculate on all else subject to the risk exposure we can afford.

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.