Daiwa Securities Group performed exceptionally well in its most recently reported quarter, cementing its position as one of Japan’s largest and most successful global investment banks. The Tokyo headquartered firm offers a full suite of investment banking products and services to individual and institutional investors, financial institutions, corporations, and government agencies worldwide.

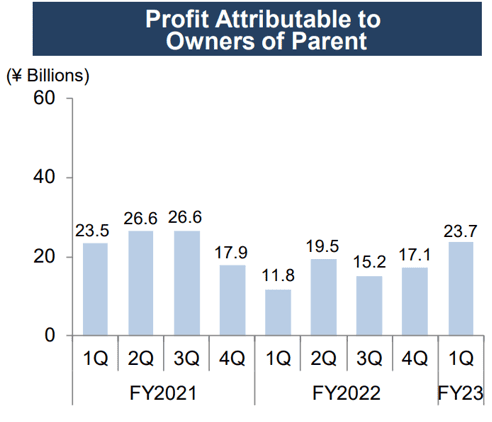

Daiwa had a record-breaking first quarter this year. The Group achieved significant performance milestones on several fronts. Assets under custody hit a record ¥80.3 trillion, according to the firm’s Q1 earnings presentation. Net operating revenues came in at ¥134.1 billion, a 26.4% increase from ¥106.1 billion a year earlier, while ordinary income came in at ¥36.0 billion, a 99.6% jump from ¥18.0 billion in Q1 FY2022. The Group’s profitability also improved significantly, with profit attributable to owners of the parent reaching ¥23.7 billion during the quarter. This is roughly double the ¥11.8 billion posted in 1Q FY2022.

Source: Daiwa Securities

Daiwa’s recent impressive performance was driven by several factors, including increased equities and bond trading, improved market conditions, and cost reduction. The Group enjoyed cost savings of up to ¥30 billion in FY2022 due to revenue restructuring. It is noteworthy that Daiwa had already achieved its FY2023 cost reduction target by May 31, according to its recently published FY2023 Management Strategy.

Expectations Are Rising

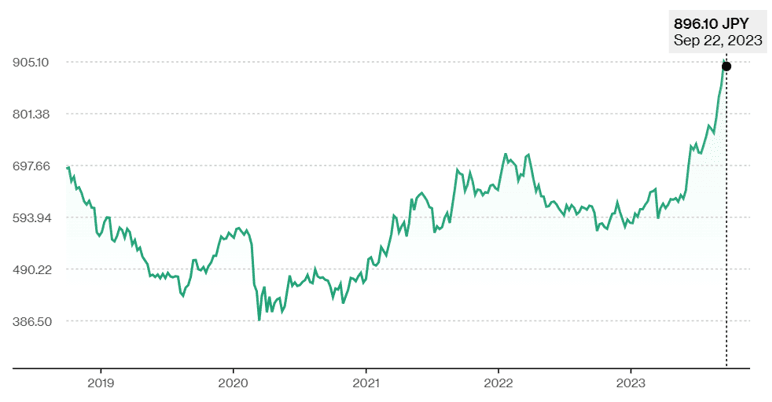

Thanks to Daiwa’s stellar financial performance, investors have bid up the stock aggressively in recent quarters. As a result, Daiwa’s stock has managed to achieve a year-to-date (YTD) return of 48.9% and 1 year return of 58.09%, making it a better performer than US equities as represented by the S&P 500, which is up 12.69% YTD.

Daiwa’s 5-year stock chart, Source: Bloomberg

With Daiwa’s stock currently trading at multi-year highs, the company’s management team will need to work assiduously to sustain earnings growth in coming quarters. This will help support the high share price.

Continued expansion of earnings is key for a rising stock to sustain its bullish momentum. This is particularly true if the stock’s valuation is not only historically high, but also higher or on par with the wider industry’s valuation. Daiwa is trading at a historically high P/E ratio of 16.83, according to Bloomberg. In comparison, the average P/E ratio for 30 firms in the US brokerage and investment banking industry tracked by NYU Stern Professor, Aswath Damodaran, is 16.44.

This tells us that Daiwa is no longer a bargain stock at current prices when compared with the publicly listed peers in the US brokerage and investment banking industry that are tracked by Prof Damodaran. This highlights the need for it to continue growing its earnings robustly to justify the current premium on its stock price.

M&A Transactions To Drive Growth

One of the main strategies that Daiwa’s management team is leveraging on to drive future earnings growth is the planned expansion of its global M&A (mergers and acquisitions) advisory business.

Daiwa Chief Executive Seiji Nakata disclosed in the firm’s recent FY2023 Management Strategy briefing that the Group is looking to boost annual revenue from the M&A advisory business by 50% in eight years. The firm is targeting global M&A revenue of at least ¥70 billion in the year ending March 2031 vs the ¥46.7 billion it raked in for the financial year just ended. Under this plan, Daiwa is expected to increase the number of M&A bankers it employs over the next eight years to 900 from 650.

“The M&A business is where we can expect big growth without using much of our assets,” said Nakata. He further added that a key area of focus would be mid-market transactions in the US, where Daiwa already has a presence in the M&A business following its 2017 acquisition of two boutique M&A advisory firms – Sagent Advisors and Signal Hill Holdings. Nakata noted that the firm would explore the potential buyout of additional boutique M&A firms to extend its reach. “We plan to allocate our resources vigorously to expand mainly in the United States, potentially buying boutique M&A firms,” he said.

Daiwa aims to become one of the top five global mid-market M&A advisors by focusing on deals of less than $500 million. Daiwa ranked eleventh in the league table for mid-cap M&A advisory last year, according to the company. If it cracks the top five list, it will join the ranks of Rothschild & Co and Houlihan Lokey Inc.

Japan's Daiwa targets 50% jump in M&A advisory with US focus https://t.co/ZWHBmGPuFh pic.twitter.com/E3gZZYlMXf

— Reuters Asia (@ReutersAsia) May 31, 2023

A Timely Strategy

According to PwC’s Global M&A Trends 2023 Report, the M&A market in 2023 is likely to be dominated by smaller, strategic transactions as opposed to larger mega deals. “We are seeing a divergence in the current M&A market between larger deals and smaller, mid-market ones. Larger deals, while often more transformational in nature, have become harder to complete in the current financing environment and are facing more regulatory scrutiny,” notes PwC.

PwC observes that the number of deals of $1 billion or more has declined globally by approximately 56% since the record M&A year in 2021. By contrast, deal volumes for those worth less than $1 billion declined by approximately 20% over the same period. This highlights the heightened appetite for smaller deals.

Dealmaking in the mid-cap space (transactions below $1 billion) is picking up as companies make strategic choices about their portfolios, capital structures, and funding. Factors such as sustainability and climate change, rising interest rates and macroeconomic headwinds, deglobalisation and geopolitical risks, among others, are leading to divestitures and tie-ups between different firms. This underlines the opportunity for Daiwa, particularly in the US which has the largest fee pool in the global M&A industry.

Daiwa’s Nakata indicated that some of the sectors the firm will be looking at as part of its M&A expansion plan are infrastructure, industrials, consumers and health care. It will also be actively looking for opportunities in sustainability and transition finance, both of which are potentially lucrative opportunities in view of the increasing number of firms looking to cut their carbon emissions and improve their overall sustainability rankings.

Author: Acutel

We are global investors who invest in good companies at fair valuation and speculate on all else subject to the risk exposure we can afford.

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.