In 2006 blockchain was still an almost unheard-of technology innovation. A much bigger movement was about to take off in software engineering. One that may not have had the international renown that blockchain has eventually achieved, but which has been instrumental in the process of digitalisation and the related innovation, nonetheless. DevOps as a cultural shift and as an approach to deploying technology has crept up on financial institutions. But what about blockchain?

Disappointingly, today’s story is not about blockchain or any of the various layers of it. Distributed ledger technology doesn’t need any more promoting. The metaverse and all the talk of Web3, FTX, and smart cities have accomplished plenty of notoriety. Our story instead focusses on DevOps, a combination of cultural philosophies, practices, and tools that increase an organization’s ability to deliver applications and services at higher velocity. An analysis of how DevOps might be the unsung hero of innovation, where blockchain may seem to get all the plaudits.

Let’s get on with it. In 2006 Werner Vogels, the CTO of Amazon was quoted as saying: “The traditional model is that you take your software to the wall that separates development and operations and throw it over and then forget about it. Not at Amazon. You build it, you run it. This brings developers into contact with the day-to-day contact with the customer. This customer feedback loop is essential for improving the quality of the service.”

The topic Werner was discussing sounds very similar to what is known today as DevOps. But unlike the CTO of Amazon, DevOps comes from Belgium, whilst Werner comes from the Netherlands. In fact, the first devopsdays was held in 2009 in Belgium with Partrick DeBois headlining the event. Not a Dutchman from Seattle.

How DevOpsDays instigated the deployment of DevOps

Why do people say that Patrick DeBois invented DevOps? The answer is in an interview with Oracle’s Java Magazine. In it, Patrick clarified why DevOps as a term has been attributed to him.

Initially what he did, in 2008, was to set up an Agile System Administrator Google Group together with Andrew Clay Shafer. But it didn’t sound like the right name until Patrick spoke to Jean-Paul Sergent. Who, in turn, had spoken about developer and operations teams at an event Patrick had attended. After the discussions between Patrick and Jean-Paul, the gentlemen came up with a name for a conference: “DevOpsDays” and the rest, as they say, is history. There appear to be a few versions for this story, however all the versions agree that the hashtag for that first conference just happened to be #DevOps.

Famously, Patrick explained how “before the DevOps movement, once your app was running, you didn’t have any insight into what else was going on. You couldn’t see the logins, you didn’t have access to the file system if something failed, and you couldn’t do debugging. You couldn’t see how things ran in production in order to avoid making the same mistakes. Those were the main drivers that led me to believe that all this needs to be more flexible.”

Andrew Clay Shafer’s significance in the move to DevOps shouldn’t be underestimated either. He may not have his own Wikipedia entry like Vitalik Buterin does, but he continues to be a vocal advocate for all things DevOps. Andrew believes that DevOps didn’t change an awful lot for developers, developers were already the centre of feature discussions and product decisions. Being agile was often enough. Or was it?

Today, Andrew suggests that less than 40% of IT infrastructure that is supposedly DevOps, is actually anything to do with DevOps. He thinks some companies go too far by creating SRE (Site Reliability Engineering) teams, DevOps teams, DevSecOps teams and then they add a Continuous Delivery team too. All of which he considers ‘buzzwords’ rather than actual DevOps. And what Andrew thinks is that the focus should be on the platform. And on the concept of “platform engineering”. Andrew is a straight talker. He doesn’t own DevOps. He isn’t the Founder of DevOps. But he has the same passion and drive to share his knowledge as many of the founders of various Layer 1 and Layer 2 blockchains do.

Most important #DevOps stuff according to @littleidea:

— Digital Startup (@digitalstartup5) November 22, 2022

– Learn to Read

– Learn to Write

– Learn to Speak

– Tweet this talk

Here is the link to the full video: https://t.co/7dlq1PiDcF pic.twitter.com/dmAgXDUBSN

Web1 to Web3: How DevOps Changed Digital Transformation

“There is always pushback when you try to change culture,” Patrick Debois once said. More recently, Cameron Haight, a VP at Gartner, went a step further. He explained the 6 things that he believes that DevOps needs within an organization in order to thrive. These are: “C(ollaborative), U(nited), L(earning), T(rustful), U(ndisguised), R(esults), and E(mpowered)”. Cameron, significantly, predicted the course for DevOps to take in the future. He predicted this in 2011. And by 2012 Cameron had a captive audience of hundreds of IT operations managers who wanted to learn more about new technologies. And Cameron talked DevOps talk to them.

Some of those IT operations managers worked for financial services companies. Many of them took note of what Cameron said. They started to push both digital transformation and the need for a change in culture within their respective financial institutions.

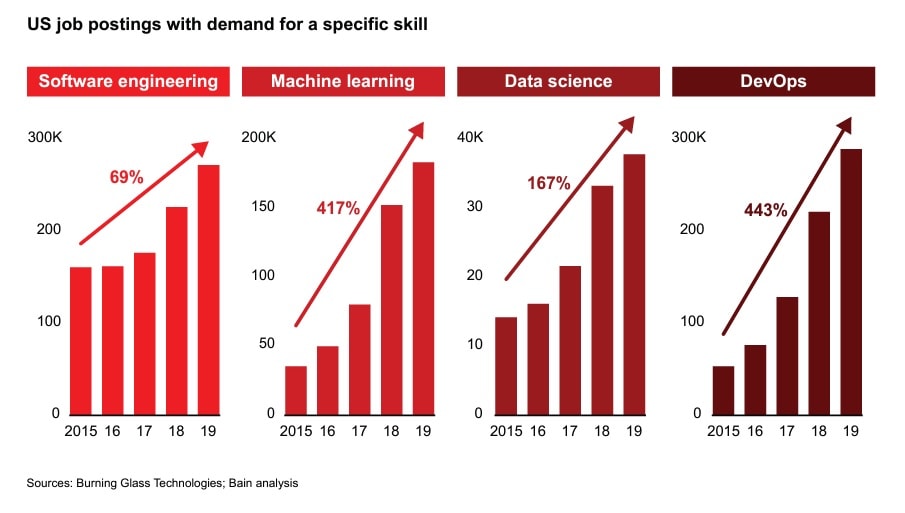

The outcome has been remarkable. Bain & Co. have reported a growth of 443% when it comes to the increase in DevOps job postings in the U.S. between 2015 and 2019:

How DevOps transformed the financial services industry

Many years ago, developers didn’t want to work for financial institutions. Instead, fintechs and tech startups were picking up some of the most talented programmers in the market. This was accentuated by the 2012 stock exchange debut of Splunk at $1.57 billion. A company that now delivers real-time DevOps monitoring and at the same time it is also “a tool that can help you achieve true DevOps.” A company that programmers wanted to work for. And not somewhere like Bank of America.

Today things have changed dramatically. Banks and financial institutions are no longer struggling to recruit and retain talent. In some cases, they have amazing partnerships with the leading cloud providers. They often use ‘best-in-class tools’ rather than ‘big enterprise suites.’ Banks are embracing technology. Some of them are even suggesting they are technology companies. Most of them, like Barclays, are encouraging some of the tech staff laid off by Silicon Valley to join them.

Banks and financial institutions have embraced change. A change in culture, and a change in the way they approach agile methodology. Below is a summary of the achievements of some of the leading banks in the world. Innovation, DevOps and blockchain are often linked.

ABN Amro decided to combine hybrid cloud and DevSecOps, since it was very clear to them from the beginning that to capture the full benefits of transformation, they needed to evolve both their way of working and their technology https://t.co/pLxFJXuRag

— Digital Startup (@digitalstartup5) January 9, 2023

Barclays embraces DevOps

One of the banks that embraced DevOps, as far back as 2016, was Barclays. It was when the bank announced they were moving to Amazon’s AWS. The banks’ CTO at the time highlighted how Barclays expertise was in “finance and finance technology – not in datacentres.” He also shared how the banking giant was running 18 on-premise datacentres. All of which created a process that was causing delays in new product development. In short, developers were not being given access to the resources available. Which led to a need for solutions like the cloud to increase latency. DevOps is best served in the cloud, where it can save time and allow developers the compute resources they require. Even 18 datacentres won’t cut it sometimes.

Barclays have been successful at creating a “foundational software, cloud service”. Also, in 2016, the bank moved onto blockchain. Barclays tested a way to trade derivatives using smart contracts. Additionally, by 2019 the bank announced it was investing in the creation of Utility Settlement Coin that would connect bank money to central bank money.

By late 2019 things became a lot more competitive. JP Morgan, CapitalOne, Morgan Stanley, Fidelity, Wells Fargo, HSBC, and Citi (to name a few) all joined Barclays in embracing DevOps. As well as blockchain.

Bank of America recognizes leaders in DevOps

Remaining in 2019, a little known company JFrog was offering an “end to end DevOps platform to power and secure the software supply chain.” The list of banks using JFrog’s DevOps products and solutions by 2019 was compelling. Subsequently Bank of America recognized how JFrog had helped the banks’ 30,000 developers perform. The company was recognized for industrial leadership and excellence in providing global business solutions at the 11th Bank of America Technology Innovation Summit.

Bank of America recently recognized JFrog for enterprise innovation. Here’s how we earned it, and why over 60 global financial companies rely on our #DevOps solutions.

— JFrog (@jfrog) November 5, 2019

Learn more from JFrog CEO @ShlomiBenHaim https://t.co/P3egABeAcX

The approach to DevOps in the leading banks shows how being open to innovation is harder to achieve without DevOps. Which leads to the thought that a true DevOps, cloud-native bank will be in a far better position to implement blockchain. Whereas, in many cases, the two innovative concepts appear to scale at similar periods of the digital transformation process.

Bank of America had already filed for 15 blockchain-related patents and was drafting another 20 by early 2016. The CTO at the time stated how this was partially because the bank didn’t want “to be Neanderthal.”

DevOps and Blockchain at HSBC

Another conspicuous advocate of DevOps is HSBC. The same HSBC which has invested substantial resources into the metaverse and related blockchain ecosystem, especially in places like Asia.

HSBC processes first blockchain letter of credit using Chinese yuan https://t.co/Nqe38s2hjK pic.twitter.com/9GY2UwCavT

— Reuters (@Reuters) September 2, 2019

HSBC really started to throw their weight behind blockchain in late 2019. At the time HSBC had also announced plans to move $20 billion in assets to the blockchain. However, HSBC’s deployment of DevOps started arguably much earlier. At the latest by 2015 the financial institution was already working ‘DevOps’. With HSBC there may be a case that DevOps strengthened the banks ability to adopt blockchain.

Staying on the topic of DevOps. In 2021 HSBC invested $10 million into CloudBees, the enterprise DevOps leader powering the continuous economy from California. The financial institution wasn’t just investing into CloudBees. The bank was investing into a company that is the largest contributor to Jenkins. Which is, in turn, the leading open-source automation server, providing hundreds of plugins to support building, deploying, and automating any project. Jenkins is a popular tool that junior developers get exposed to early in their career. And HSBC also saw this.

Jenkins may not quite have the cult following that the likes of Vitalik Buterin of Ethereum or Sergei Nazarov of Chainlink have accumulated, but it has a plethora of collaborators, nonetheless. All this started before 2009. Long before the first large scale blockchain community was created.

And it’s not just HSBC who have worked out that DevOps is more than just a better way to deploy software. For banks implementing DevOps prior to the pandemic was a huge advantage. It almost seemed like blockchain went on hold for a moment as COVID raged across the globe. You could even argue that NFTs were the next big thing that raised the profile of distributed ledger technology. Apart from bitcoin, of course.

Importantly, HSBC acquired a plot in the metaverse-linked Sandbox earlier in 2022. In a famous story at the time, the bank claimed it made the world’s first commercially viable trade finance transaction using blockchain technology in 2018.

The Fidelity DevOps Council

Fidelity International, the leading U.S. investment firm, created a Fidelity DevOps Council. Within the DevOps Council the following areas were considered for further investment:

A unified developer experience, tools standardization, continuous compliance, and contextual metrics.

Fidelity deployed their 1st application on the public cloud in 2016

— Digital Startup (@digitalstartup5) January 23, 2023

It helped enable 50% of its applications to be on the cloud by 2022

With 18,000 developers across 1,600 squads, Fidelity wants to move 70% of their applications to the cloud by 2024https://t.co/9yJDzjCpEK

As a result of additional investment into inner sourcing through the Fidelity DevOps Council, an open-source framework was developed. The framework focused on “Incubate – Fund – Govern – Manage – Promote – Operate”. In 2021, the Council kicked off five new projects, among which one of them produced to date 174 features, and 3500 commits, supporting 12 business units, with 50 active contributors. Of course, Fidelity has been facilitating DevOps for much longer. Like all financial institutions the advent of cloud in the mid-2010s was a catalyst for digital transformation and DevOps.

Interestingly, Fidelity began researching bitcoin and developing blockchain solutions in 2014. Before nearly any of the other financial institutions made any public commitments on the topic of the technological innovation.

What, if any, correlation between deployment of DevOps and Blockchain?

First of all, it’s important to go back to what DevOps has meant for the financial services industry. How it can add up to 50% in performance.

“Banks that introduce DevOps and agile practices, such as sprint teams and continuous integration and continuous delivery (CI/CD) before the transformation are typically successful because these models work well within a flexible modern architecture. Our analysis reveals that even successful banks can miss out on performance improvements of up to 50 percent without these approaches,” McKinsey consultants shared in early 2022.

The other consideration is how tiny companies have popped up in all sorts of places across the world. Small and medium companies, offering blockchain or DevOps products and solutions. You don’t need DevOps to create a blockchain business. Or the other way around. But. When embracing innovation. It probably helps if DevOps is at the centre of what you do. Especially if you are a global systematically important bank.

Looking to the future, blockchain will undoubtedly be remembered for its part in innovation. Whereas DevOps may not. Even Ethereum is likely to last longer in people’s memories than how a Belgian chap decided to create a movement.

But if you ask one of the 30,000 developers propping up the desks at Bank of America today. They may have a different answer. At least for now.

Author: Andy Samu