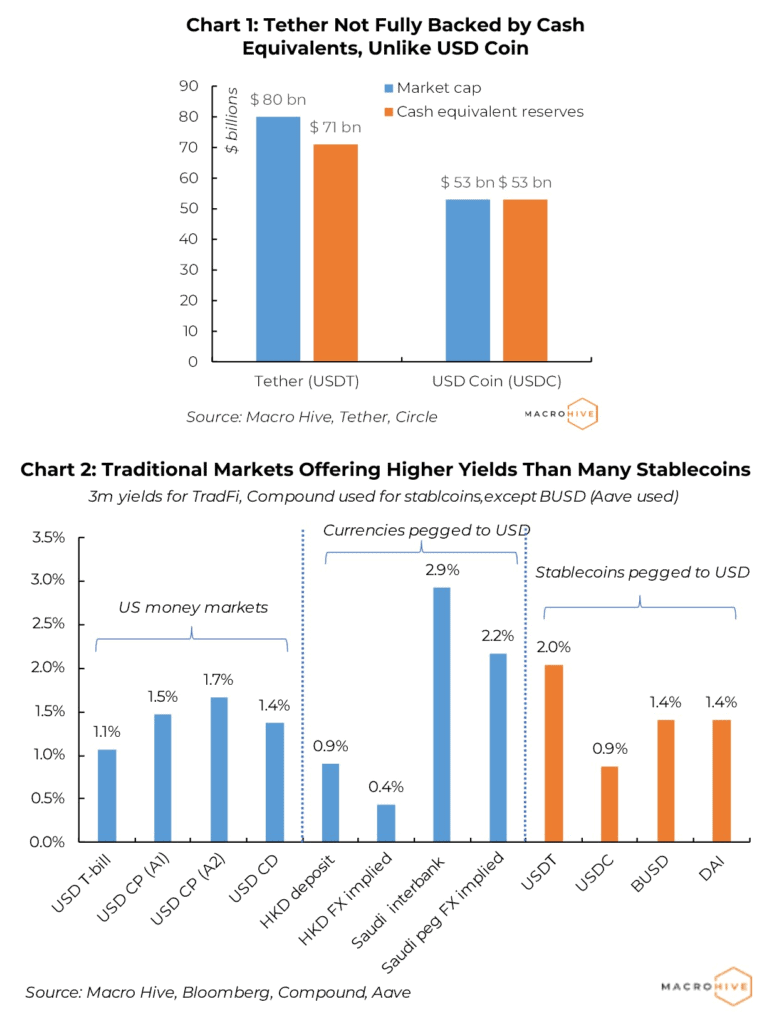

- We find the reserves of Tether (USDT) are not fully in cash equivalents. There is a sizeable allocation to crypto markets.

- Stablecoin yields are no longer high compared with yields in traditional markets such as dollar currency pegs and money markets.

- With the Fed raising rates, stablecoins could become less attractive.

After the TerraUSD/Luna collapse, all eyes have been on whether Tether (USDT) can maintain its peg. And at least over the past week, the answer has been a clear yes. This suggests speculators have moved away from attacking the coin. Nevertheless, the market cap of USDT has fallen by $1bn over the week, suggesting outflows are continuing. In contrast, the USD coin’s (USDC) market cap increased by $0.9bn over the same period. This suggests investors are rotating from USDT to USDC.

One reason for the rotation is ongoing concerns about the quality of the collateral used to back USDT. Tether recently released its quarterly assurance report for 2022Q1. It showed Tether had reduced its commercial paper holdings and increased its holding in safe Treasury bills. But not all the reserves are in cash equivalents. Around $12bn of the $82bn of reserves are held in loans, corporate bonds, precious metals and investments in other crypto markets. The latter category – investments in other crypto – has actually increased from $0.6bn to $5bn today. They now make up 6% of Tether’s reserves.

Therefore, the current market cap of Tether at $79bn is not fully backed by cash equivalents (only $71bn is). That introduces a vulnerability. Meanwhile, USD Coin (USDC) has a market cap of $53bn and holds the same amount in cash equivalents (Chart 1). This suggests there is more peg risk for USDT than USDC, meaning outflows from Tether could continue.

The other challenge for USDT (and stablecoins in general) is that short-term interest rates in traditional finance (TradFi) have been rising. Currently, three-month US T-bills are yielding 1.1%, and commercial paper (A2-rated) is yielding 1.7%. On the currency front, USD pegs like the Saudi riyal and Hong Kong dollar are offering yields of between 0.4% to 2.9%.

Meanwhile, USDT has a yield of 2.1% on Compound, USDC has a yield of 0.9%, and BinanceUSD (BUSD) has a yield of 1.3%. These yields are in the range of those offered in TradFi markets. Yet stablecoins have higher platform, market and regulatory risks. As the Fed and other central banks continue to raise rates, we could see more pressure on stablecoins.