The well-off are coming increasingly under the spotlight. City and Wall Street Execs and professional football players are now next in line to the throne scrutiny after U.S. unemployment rose by more than 6.6 million today.

Footie Legend Harry Redknapp said “Football Clubs shouldn’t be taking government money to be frank”. At the heart of this debacle is the Professional Footballers’ Association for having “written to all of its members urging them not to agree any reduction or deferral in wages until they have spoken to the union.” as reported by the BBC.

London’s Mayor Sadiq Khan demands rich footballers share coronavirus burden – ‘Sacrifice your salaries!’ – per the Express.

The outlet went on to quote him as saying “highly paid football players should be those who sacrifice their salary rather than the person who does catering or the person that doesn’t get anywhere near the salary some of the Premier League footballers get.” and that “they probably have savings. Rather than those who are in catering or hospitality who got probably no savings and live week by week.”

Huge respect for you Gary (especially with what you’re doing for NHS staff at your hotels) but it won’t… and there’s way too much energy being expended on trying to ‘save the football season’ when all efforts should be diverted to saving lives. Football’s irrelevant. https://t.co/wH3qFEdTjc

— Piers Morgan (@piersmorgan) March 28, 2020

Who is behind this association that appears to the central bankers of Premier League football? Speaking of central banks…

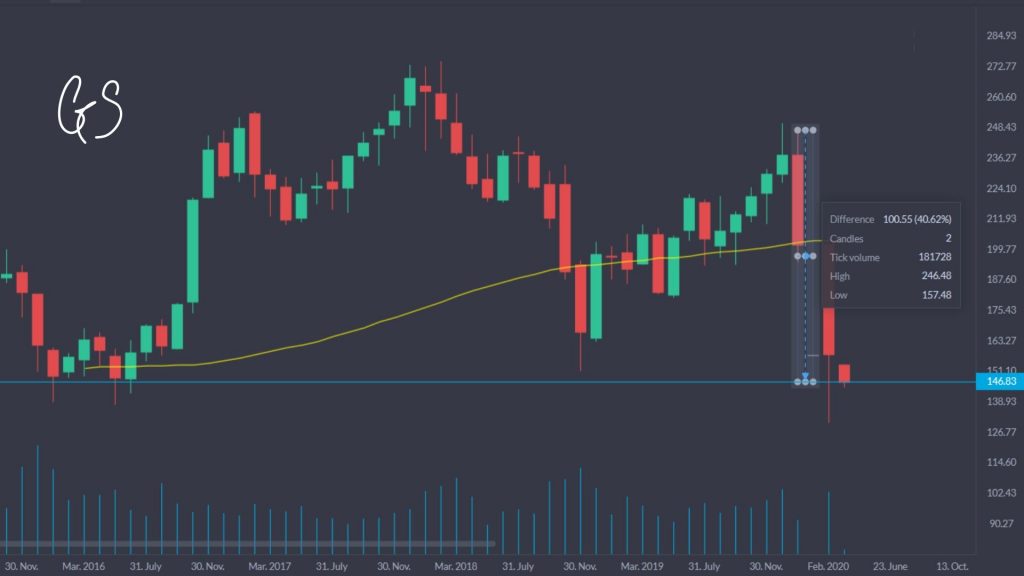

In a move that has been called “one of the most tone-deaf moves in corporate history” by Forbes (we wonder about how many lawyers are working on the lawsuits), Goldman Sachs CEO David Solomon’s pay rise of 20% to $27.5 million has been widely criticized as the economy and employment tanks and lives are lost. Ball-to-hand!

However, opinion of Solomon should also be weighed by his bold claim that Goldman Sachs will not IPO a company without one ‘diverse’ member of the board. The problem with that plan of course is if the global situation continues to descend into Pandæmonium owing to the pandemic, will there be anyone left to fill those board seats?

As ZeroHedge notes in a piece labelled “Broken Markets: A Visual Odyssey Through All The Market’s Dislocations In 56 Charts”, the strain in the roughly $1.3 quadrillion global derivatives market is on full display. Park the bus. Because the markets are truly only fearful of one thing: the barter system.

Nobody wants ‘squads’ to be more commonplace in relation to firing bullets than kicking footballs.

In answer to a question in a very different version of a soon-to-be Shrek sequel, where Donkey manically asks “are we there yet?” as the troop moves down The Valley of Death, we are not there yet. But we do need to band together, at a safe distance mind you, to help society function and breathe.

BABB listed amongst the likes of @Microsoft and @Dropbox; helping charities navigate choppy waters.

We don’t charge donor fees and are waiving cash-out fees for COVID-19 causes.

Download and donate: https://t.co/GDUvVGrK6J#Charity #Fintech

Info: https://t.co/1FagAeKODd

— BABB – Make a Difference 🙏🏻 (@getbabb) April 2, 2020

Perhaps we should all take a page out of BABB’s book and remember that its not business as usual and making money shouldn’t be the goal. We applaud in the highest terms, the more than 500,000 people that signed up to be NHS volunteers in the U.K. Back of the net. Endless gratitude.

👏 Thank you to the NHS staff and all key workers from everyone at #RangersFC.#ClapForCarers #ClapForNHS pic.twitter.com/txv6POZY0K

— Rangers Football Club (@RangersFC) March 26, 2020

Editor’s Note: DisruptionBanking neither agrees nor disagrees with the notion that GS alumni may own the Fed.

The peak efficiency of knowledge and strategy is to make conflict unnecessary. – Sun Tzu

Looking to learn how to code for free? Check out HTML.net to learn PHP, CSS, JavaScript and HTML.

Looking to make a difference in someone else’s life or ask for a donation? Check out Leveler.info for wealth redistribution.

Looking for tips to stay physically healthy? Check out this link.

Looking for tips to stay mentally healthy? Check out this link.

Looking to get in touch with government advice? See here for U.K., see here for U.S.

Looking to learn how to build machine algorithms? Check out the Machine Learning Institute for more.

Looking to learn how to manage macro risk in finance? Check out the Bank Treasury Risk Management Certificate for more.

Looking to relax with 40 perfectly looped ambient GIFs? Check out this link.

Looking to watch cryptocurrency trades being processed live? Check out this link.