By the time Wall Street dubbed them the Magnificent Seven or Mag7, the market had already decided they were unique. Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN), Meta Platforms (META), Nvidia (NVDA), and Tesla (TSLA), seven companies whose combined gravitational pull has reshaped benchmarks, investment models, and the global economy. But in 2025, after years of blockbuster growth, the question facing investors is whether these market leaders can continue to deliver.

The name itself is borrowed from the 1960 Western classic, where a handful of gunmen banded together to defend a village. In today’s markets, these seven tech titans have defended portfolios from mediocrity for nearly a decade. The term was cemented in the market vernacular in 2023, popularized by Bank of America’s Michael Hartnett, who noticed that a handful of stocks were driving the lion’s share of S&P 500’s returns. It wasn’t just concentration — it was dominance. It replaced earlier classifications like the “FAANG” stocks popularized by CNBC’s Jim Cramer in 2013.

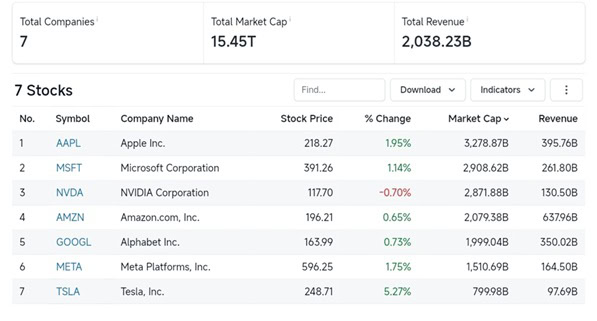

The Magnificent Seven in 2025

Fast forward to Q1 2025, and the tone has shifted. While Nvidia and Microsoft continue to ride the generative AI wave — both posting double-digit gains year-to-date — others are beginning to stall. Tesla, shaken by intensifying EV competition, alleged political attacks on Tesla trucks and facilities stemming from Elon Musk’s activities as head of the Department Of Government Efficiency (DOGE). Additionally, regulatory headwinds in Europe, has meant the EV giant has posted a sobering $780 billion decline in market value since January. Alphabet and Meta, meanwhile, are caught between growth pressures and increasing antitrust scrutiny on both sides of the Atlantic.

Tesla Inc.’s stock is in a freefall. Its sales are plunging around the world. Even its most avid Wall Street bulls are turning cautious. But one group is buying the electric-vehicle maker’s shares like never before: CEO Elon Musk’s fans#Tesla #Stock #Muskhttps://t.co/xOsey6reDN

— #DisruptionBanking (@DisruptionBank) March 21, 2025

Lately, the performance of the Mag7 has diverged significantly. Research from Charles Schwab indicates that while Meta (+4.84% YTD) is outperforming the broader market, Tesla (-30.26% YTD), is the weakest performer, reflecting a challenging market environment and broader economic risks. An earlier Disruption Banking story supports this claim as Jeff Bezos, Elon Musk, Brin of Google, and Mark Zuckerberg have all felt the pain of collapsing share prices this year.

But does this mean the Mag7 are no longer portfolio essentials? Hardly. Their balance sheets remain fortress-like. Their capacity to reinvent themselves is unmatched. And for long-term investors, leaving them out is still a bet against the future.

The Magnificent Seven’s Performance in 2025: the Good, the Bad, and the Tech-Fueled Reality

The Mag7’s performance in 2025 so far has been a mixed bag. On the one hand, these stocks are still the bedrock of any tech-focused portfolio. They still have the necessary resilience that only comes with entrenched market dominance. On the other hand, 2025 has not been the seamless ride that investors had grown accustomed to in previous years. While the broader S&P 500 has enjoyed a modest uptick, the growth of the Magnificent Seven has stalled. A correction — to the tune of $1.5 trillion — some might say, was long overdue.

Nvidia (-11% YTD) is perhaps the one standout exception. The leader in artificial intelligence computing has consistently outperformed expectations. Partially driven by its pioneering role in AI technology and the rapid adoption of its chips in everything from data centers to self-driving cars. As AI continues to permeate every sector, Nvidia’s market cap surged to new heights in early 2025, up nearly 40% from last year. Even though Liang Wenfeng DeepSeek’s R1 AI model launch caused a tech market selloff in the U.S., Nvidia’s share price has started to regain its earlier position.

For investors still holding Nvidia stock, it’s been a textbook case of the high-risk, high-reward play paying off. As noted by Visual Capitalist, Nvidia’s margins on its sophisticated chips are an impressive 90%, solidifying its position as a dominant force in the AI market. According to Disruption Banking, analysts at Saxo suggest that Nvidia’s market cap will run up to twice the value of Apple.

Microsoft (-7.86% YTD), too, remains a formidable force. It’s been making AI strides through its Azure cloud platform and continued dominance in enterprise software. The company’s shift to AI-driven services, combined with its traditional strength in cloud computing, has helped it maintain robust earnings, despite the headwinds facing some of its peers.

Year-to-date, Microsoft has posted an 8% dip in stock price, a far cry from the meteoric growth of 2024, but still a solid performer in today’s market. As reported by Motley Fool, its integration of AI into productivity tools and its focus on enterprise software make it a key player in the future of business technology.

Alphabet and Meta, while still major tech leaders, face new challenges that have tempered their once-unmatched growth trajectories. Alphabet (-11.42% YTD), with its sprawling business model from YouTube to Google Cloud, continues to face regulatory hurdles. The company has seen its stock price fall by 11% since January.

Meta’s journey through the metaverse is proving far more turbulent than initially expected, with the company’s stock down 4% this year. Both Alphabet and Meta remain formidable forces in their respective fields, but the cracks in their growth models are starting to show. Recent data from Charles Schwab highlights the growing pressures on these companies from antitrust scrutiny and evolving consumer preferences.

Then, there’s the flip side. Tesla, which has been the darling of growth investors for years, is facing mounting challenges. The firm is facing a host of new challenges in the EV space. Rivals are catching up, and regulatory scrutiny is on the rise. Tesla’s first-quarter performance in 2025 has been less than stellar compared to last year, with a decline of 12% since January.

Amazon (-8.66% YTD), meanwhile, is navigating a changing retail landscape and increased pressure from competitors like Walmart and emerging e-commerce platforms. The stock is down nearly 9% in 2025, trailing behind its fellow tech giants, as margins continue to tighten across its core business segments. Yet, Amazon’s dominance in cloud computing and its forays into new sectors, including health and logistics, provide hope for a return to growth.

Is the Magnificent Seven Relevant to your Portfolio?

Why should the Mag7 still form part of your investment strategy? The answer lies in the enduring growth prospects and the crucial role they play in shaping the future of tech and the economy.

First and foremost, these companies remain leaders in sectors that are essential to the modern economy. From cloud computing to artificial intelligence to social media to e-commerce, and autonomous driving. Even if some of them are experiencing a rough patch in 2025, their long-term potential is undeniable.

These companies are in a good place to benefit from massive secular trends that will continue to unfold over the next decade. Whether that’s the rise of AI, the expansion of the electric vehicle market, or the ongoing digital transformation of industries worldwide.

AI in 2025: Boom or Bust? 🚀

— #DisruptionBanking (@DisruptionBank) February 6, 2025

Nvidia, Atlassian & Arista Networks are driving AI forward, but ethics & scalability remain challenges. Who will lead the AI revolution?

🔍 Read more: https://t.co/u5qQn1BvIc#AI #ArtificialIntelligence #TechInnovation #Investing #Nvidia pic.twitter.com/zRjqMu8A6q

Analysts, such as those at Goldman Sachs, predict that the Magnificent Seven will continue to outperform the “Other 493” (S&P 500 excluding Mag7) by 7 percentage points in 2025.

For investors with a buy-and-hold plan, the Mag7 represents a strategic bet on the future of technology. Yes, there will be bumps along the way — regulatory hurdles, market corrections, and fierce competition. But these companies have proven time and again that they can adapt, innovate, and weather storms that might sink lesser firms.

In summary, the sheer scale of their operations and the financial strength of the Magnificent Seven provide a level of stability that’s hard to match. Even as growth slows, these companies are likely to remain key players in their fields, generating significant cash flow and maintaining healthy profit margins. In short, they’re unlikely to be unseated by disruptors anytime soon.

Author: Ayanfe Fakunle

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

Saxo Launches 2025 Outrageous Predictions | Disruption Banking

Is NVIDIA Leading a Market Rebound? | Disruption Banking

What Meta’s stock price has to do with the Metaverse | Disruption Banking

Are We Heading for a Stock Market Crash? | Disruption Banking