Luxembourg, 19 March 2025: Despite ongoing geopolitical tensions and shifting market dynamics, Luxembourg’s financial sector demonstrated adaptability and resilience in a complex economic and operational environment. In 2024, the financial services industry saw steady growth – exceptional in some segments – and continued to attract international investment.

Key Figures:

- 61 new entities licensed or authorised by Luxembourg’s financial regulators

- Employment growth in the financial sector of 3.9%, rising to over 70,000 people

- Assets under management rose to over €7.3 trillion, an 11.5% increase in a year

- Over 2,300 GSSS bonds were listed on the Luxembourg Green Exchange at year end, a 23% increase, amounting to over €1.2 trillion

- Luxembourg life insurance saw a record breaking year, with premiums increasing by over 41% to reach over €26 billion

Luxembourg’s financial industry continued its steady expansion in 2024, deepening and diversifying the financial centre. The country’s two financial regulators licensed or authorised 61 new entities during the year.

This included the arrival of two new banking institutions, Banco Inversis and Banco Votorantim; two electronic money institutions, including LianLian Europe; five Virtual Asset Service Providers (VASPs) including Standard Chartered and B2C2; seven authorised Alternative Investment Fund Managers (AIFMs); and 41 registered AIFMs. The establishment of China Taiping in Luxembourg saw the first Chinese insurer licensed in the country.

Employment within financial services also showed momentum, rising by 3.9% to over 70,000 people, reflecting confidence in Luxembourg’s economic stability and its attractiveness to global talent, whether for career or personal reasons.

“Luxembourg’s continued growth in a complex global market is testament to our financial ecosystem’s resilience, its focus on innovation, and commitment to sustainability,” noted Tom Théobald, CEO of Luxembourg for Finance. “We remain dedicated to fostering a deep and diverse financial centre that supports long-term international investment and helps connect global markets.”

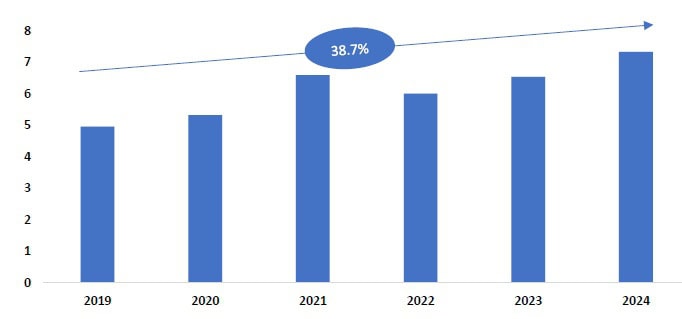

Assets under management experienced strong growth last year, increasing by 11.5% to exceed €7.3 trillion in mutual funds and AIFs (see Figure 1). Growth was strongest in alternative funds, 13.2%, and AIFs now represent one-third of Luxembourg’s fund industry. Over the course of 2024, Luxembourg further entrenched its foothold as Europe’s leading alternative fund domicile. In mutual funds, AuM increased by 10.7% y-o-y. Luxembourg also saw continued growth in ESG funds, with AuM in ESG UCITS funds rising by 5.6% between end-H1 2023 and end H1-2024, to reach €3.2 trillion.

Figure 1: Luxembourg-domiciled AuM Growth (Mutual Funds and AIFs)

Source: CSSF and BCL

The country continued to solidify its role at the forefront of sustainable finance. The Luxembourg Green Exchange listed more than 2,300 Green, Social, Sustainable, and Sustainability-Linked (GSSS) bonds totalling approximately €1.2 trillion by the end of the year. Luxembourg thus continues to consolidate its position as the world’s leading centre for GSSS securities.

The insurance sector experienced exceptional growth in 2024, highlighted by record-breaking performance in life insurance. Life insurance premiums surged by 41%, reaching approximately €26.8 billion, driven primarily by a remarkable 72.4% increase in classical life insurance premiums and a substantial 28.9% rise in unit-linked life insurance premiums. Non-life insurance continued to perform well, with overall premiums increasing by 4.3%. Reinsurance premiums also grew steadily by 4.1%, further underlining the sector’s diverse and balanced nature.

“Growing investor demand for diversification, including in private assets, has provided significant tailwinds for Luxembourg. Building on its existing strengths and continuing to expand its expertise in areas such as alternative funds, corporate banking and digital assets, the country is effectively positioned to meet evolving investor preferences, demonstrating adaptability that goes beyond mere resilience,” highlighted Théobald.

He added: “Looking ahead, the government’s comprehensive tax package, which entered into force in the beginning of 2025, will help sustain the current momentum, attracting more high-quality talent, and strengthening the financial centre’s overall competitiveness.”

About LFF

Luxembourg for Finance (LFF) is a public-private partnership between the Luxembourg State and PROFIL, the financial industry federation. Chaired by the Minister of Finance, LFF serves as the voice of Luxembourg’s financial centre, acting as a facilitator and connector to Luxembourg’s financial services ecosystem for those seeking to develop new and existing financial activities in the country.

Through targeted outreach, strategic partnerships, and thought leadership, LFF strengthens Luxembourg’s position as a reliable, international, and forward-thinking financial centre.