The last decade has seen a semiconductor race develop. There is heightened global competition between countries to develop and produce the best semiconductors. The race is especially important to companies in the U.S., China, Taiwan, South Korea, Japan, and the EU. One of China’s key players in this race is Will Semiconductor. It is listed in Shanghai, and its founder Yu Renrong, was reported as having a net worth of $4.4 billion. Renrong met with Xi Jinping and other Chinese business leaders last week, but did his posture at the meeting upset officials in Beijing?

Renrong’s Will Semiconductor is not the largest semiconductor company in China today. Semiconductor Manufacturing International Corporation (SMIC) is currently considered to be the largest Chinese semiconductor firm. The demand for semiconductors grew to record highs during the pandemic. However, in 2025, order volumes are expected to decline, which may trigger price competition amongst China’s leading semiconductor firms.

The sector remains a priority for Beijing nevertheless, as semiconductor microchips are at the centre of Beijing’s economic security strategies. China listed compound semiconductors as a development priority in its 14th Five-Year Plan in July 2021. This is partly because of the importance to the global electric-vehicle transition.

What Should You Know About Yu Renrong?

Yu Renrong founded Will Semiconductor in 2007. He has also been proficient at M&A activities including the purchase of several leading tech companies with operations in China. In March 2023, Will Semiconductor acquired Chinese competitor, Silicon Internet of Things Technology for $164 million.

This is overshadowed by the 2019 purchase of U.S.-based OmniVision Technologies. The acquisition was for over $1 billion. These activities have all led to Will Semiconductor becoming one of the largest Chinese semiconductor company based on market cap in 2024. And, it has led to a seat at the table for Yu Renrong during Xi Jinping’s recent meeting with leading tech entrepreneurs in China.

Chinese President Xi Jinping, centre, attends a symposium on private enterprises in Beijing on the 17th of February, 2025

— Digital Startup (@digitalstartup5) February 24, 2025

Attendees include founders and CEOs from Xiaomi, Huawei, Will Semiconductor, Tencent, BYD, CATL, Alibaba, and more. Has the #Tech #Crackdown in #China ended? pic.twitter.com/YHNs3RTXoC

It appears that rather than Alibaba’s Jack Ma taking centre stage at the meeting, it was in fact Yu Renrong who stood out. Reports about the details of what Yu Renrong said to Xi Jinping have emerged over the last week, and some commentators in Beijing raised their eyebrows.

What Did Yu Renrong do at the Meeting with Xi Jinping?

First, it’s important to mention that Yu Renrong was the only person representing China’s semiconductor industry at the meeting with Xi Jinping. This might be because Renrong is one of China’s main philanthropists.

绝对没想到,这次民企座谈会最火的人,不是马云,不是梁文峰,不是王兴兴,而是韦尔股份的老板虞仁荣,他的坐姿特别松弛,还是中国芯片首富。小米雷军偷瞄虞仁荣的发言稿,虞仁荣也偷瞄了雷军的发言稿。虞仁荣松弛的本钱:出资300亿,捐建宁波东方理工大学;2024年捐款53亿,超越雷军成为中国首善;传… pic.twitter.com/jxJYyfJ3Ar

— 总裁简报 CEO Briefing (@CEOBriefing) February 18, 2025

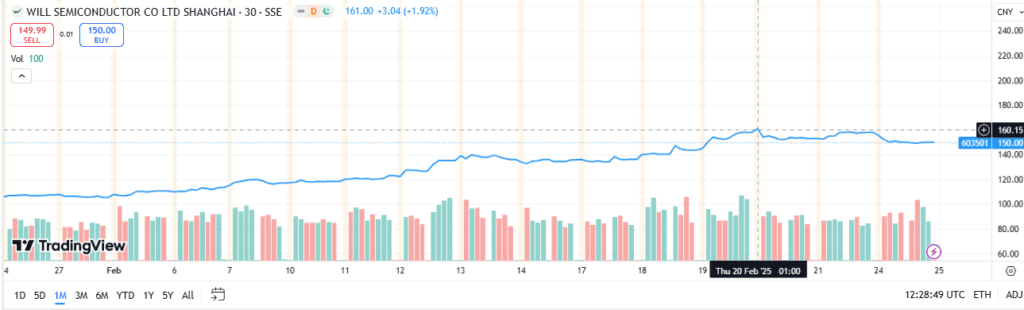

During the meeting some commentators criticized the ‘relaxed’ approach that Renrong had towards Xi Jinping. He is seen in the black jacket in the X post above. Some called out his ‘posture’ as being disrespectful. In China this is also called “Misconduct before the Throne.” This comment sparked controversy in China. It even led to a momentary dip in the value of Will Semiconductor stock.

It’s clear that the stock of Will Semiconductor has taken a slight knock on the back of the meeting with Xi Jinping. However, some Chinese netizens also admired the courage of Yu Renrong in behaving the way that he did.

It is a very difficult situation for the Chinese Communist Party to face. Years of tech crackdowns means that during the thawing of relations there may be some friction that will become apparent. The question is how Beijing addresses these moments of friction and whether or not the tech entrepreneurs in China can live with the repercussions.

Maybe Xi Jinping needs the tech entrepreneurs to forge a better future for China. But there may be some in the Chinese Communist Party that do not share his enthusiasm.

Author: Andy Samu

See Also:

Is Jack Ma the CCP’s Elon Musk? | Disruption Banking

How DeepSeek Sparked a Tech Selloff in the U.S. | Disruption Banking

TSMC Stock Could Soar Higher Despite Taiwan Risks | Disruption Banking