Most of the stories one hears about Australia focus on Sydney or Melbourne’s successes. Perth, in Western Australia, is often overlooked due to its location. However, Western Australia is well connected to major markets and shares a time zone with over half of the world’s population. Today we explore how Perth became a financial hub.

Western Australia is a global mining leader that produces over 50% of the world’s lithium and 30% of its iron ore. In 2010 researchers at The University of Western Australia presented research that confirmed how Perth is becoming the most globally connected city in Australasia.

Building on the wealth that Perth is creating, it is no surprise that many financial institutions are also looking at the city. The Commonwealth Bank of Australia (CBA) was one of these institutions, which successfully opened a tech hub in Perth in 2023. More about this later in today’s story.

We’ve launched the new @Bankwest and CBA Perth Tech Hub to support Australia’s expanding digital economy.

— CBA Newsroom (@CBAnewsroom) May 5, 2023

How Perth Became a Globally Connected City

Perth is home to 77 per cent of the population of Western Australia. It has 2.6 million inhabitants and is forecast to grow to 2.9 million by 2031 and 3.5 million by 2050. This makes it the third largest city in Australia after Sydney and Melbourne.

During the Diamond Jubilee celebrations for Queen Elizabeth II, the Perth waterfront was named Elizabeth Quay. The Queen visited the waterfront in 2012, one of seven visits she made to Western Australia. By 2016 the first buildings were in place, but work is still ongoing. This year the final piece of the jigsaw appears to be the opening of Brookfield’s Nine The Esplanade. This 19-storey office tower is set to house EY and one of the leading stockbroking firms in Perth – Argonaut – as well as other businesses.

#FLEXIBLEworkspace and building hospitality provider Hub Australia is expanding into the #WesternAustralian market, and will open its first #Perth location at Nine The Esplanade. #flexibleoffice #workplace #OfficeLeasing #CRE #commercialrealestate https://t.co/VtImqg6MGQ pic.twitter.com/CooXDC7six

— Australian Property Journal (@AusPropJournal) June 9, 2023

The development of Elizabeth Quay has certainly helped put Perth on the map. But it’s the mining and resources of Western Australia that has led to strong demand for financial services. Commodity trading, venture capital, and private equity firms are present in numbers. Indeed, Argonaut, whom we mentioned above, focuses on sectors such as Oil & Gas, Uranium, and Commodities associated with battery technology and energy sustainability.

Which Financial Institutions call Perth Home?

A review of some of the latest job vacancies in Perth helps to paint a picture of the most active employers in the city. PwC, EY, KPMG and Deloitte sit prominently on this list. But there are others who are worth noting.

The Commonwealth Bank of Australia

In March 2024 CBA or Commbank (the abbreviations of the Commonwealth Bank of Australia) announced its transition to a fully digital bank over the course of 2024. This move to digital meant that the CBA Group aimed to employ more than 5,000 people in Western Australia. Many of these employees will work at BankWest, which previously was called the Agricultural Bank of Western Australia. It is part of Commbank today.

Some of the other companies in the local ecosystem include the BNK Banking Corporation (based out of Perth and listed on the Australian Stock Exchange). Westpac, Australia’s famous leading private equity and investment firm Macquarie, Marketech, P&N Bank, Dorado, Ebury, AUSIEX (Australian Investment Exchange with a local office in Perth), DigitalX, Euroz Hartleys Group, Bamboo, and NAB (Australia’s largest business bank following on from a merger between the National Bank of Australasia and the Commercial Banking Company of Sydney). One small issue in gaining a substantive list was that there is a State General Election in Australia on the 8th March 2025. This means that all government agencies have been restricted from commenting on any data. The startup ecosystem was better furnished with data.

What is the Startup Ecosystem like in Perth?

There are several successful startups that call Western Australia home. DigitalX, a leader in providing insitutional-grade access to digital assets for wholesale investors, is more of an exception rather than the rule. Interestingly, fintech or blockchain are not areas that are highlighted in any reports about Western Australia. Space industries feature more prominently than fintech, for instance.

In December the Government of Western Australia awarded $45 million (AUD) in funding in local early-stage startup investment. This move was also intended to give local startups opportunities to raise funding in Western Australia. Preventing them looking to the East for help from Sydney or Melbourne.

One of the organizations active in Western Australia is Innovation Central Perth (ICP). The industry and science collaboration centre is located at Curtin University (Perth’s technology university). The centre has collaborated with local startups like Assuro (a digital platform simplifying bank guarantees). Curtin University has also been named the operator of Western Australia’s new GreenTech Hub. Showcasing how Western Australia aspires to be at the forefront of the net zero initiative.

There are more innovation hubs that the Western Australian Government supports. These include CyberWest or the WA Cyber Security Innovation Hub, the WA Life Science Innovation Hub, the WA Data Science Innovation Hub, and the WA Creative Tech Innovation Hub.

What about AI?

If you are more interested in artificial intelligence trends instead, then there is a busy AI Innovators community you can join on Meetup. The Western Australian Government is taking AI seriously too. Just last week an AI Advisory Board was established to provide advice to government agencies on using AI.

There are several prominent figures who standout in the artificial intelligence and wider tech community in Perth. One of them is Associate Professor Sonny Pham of Curtin University. Pham recently shared on social media how recent investments “not only aim to position Western Australia as the next Silicon Valley of Australia but also contribute to building a sustainable future for all.”

What about Blockchain?

There is a thriving digital assets ecosystem in Perth. There are several organizations that have played a key role in this. One of those is Blocksquare’s Regional Hub Program, led in Perth by Karoline Kolman. Although the hub promotes Real World Assets tokenization, there are other startups involved in the community too.

Delving into the space one can find Orange Brick Road, a Perth-based cryptocurrency education and consulting firm. Other companies include Spektrumlab Pty Ltd which offers educational services related to AI, ChatGPT, and Blockchain-based digital technologies. There is also TecStack who strive to provide education, research and advisory services to organisations and industries on the impacts and opportunities that arise from these changes.

Another organization that holds events in Perth is the Australian DeFi Association. The Aus DeFi Association’s vision is to establish Australia as a global hub for innovation and leadership in the blockchain space.

Bamboo App is another company worth noting. The app makes tiny investments into crypto & precious metals every time you spend money. Grafa is a finance media technology company transforming raw financial data into engaging, actionable insights including cryptocurrencies.

There is more for crypto enthusiasts. But this initial list should show that Perth is fully connected to the decentralized digital assets space.

Perth’s Golden Heritage

HSBC has been prominent amongst rugby fans in Perth, in 2024 and 2025 Perth has hosted the Australian leg of the HSBC SVNS, as the tournament is known. Sports is a big thing in Western Australia. When the Perth Heat Baseball team made headlines by announcing itself as the first ever bitcoin baseball team it was big news. A sports team that operated on a bitcoin standard.

Self-custody is finally attainable with Passport hardware and Envoy mobile wallet. @FOUNDATIONdvcs – the official hardware wallet of the #Bitcoin Baseball Team. pic.twitter.com/YlLKjwgpq6

— Perth Heat Baseball (@PerthHeat) July 12, 2023

Perth’s baseball team may have its long-term future aligned with bitcoin. The city itself has a much longer history with gold. This is highlighted by the role that the Perth Mint has played in the city as well as in Australian coin history. The company has been selling gold since 1899. While demand for gold in 2024 has seen a drop from 2023, the price of gold has risen. The Perth Mint refines and produces about 10% of the world’s gold and silver. It is also a tourist hotspot.

Importantly, the Perth Mint started tokenizing very early on. In 2019 InfiniGold launched the first digital token backed by gold stores held by the Perth Mint. This was completed on the Ethereum blockchain and was commonly referred to as PMGT. The success of the token has been limited. The story underlines the pioneering nature of Western Australians.

The Rise of Wealth in Western Australia

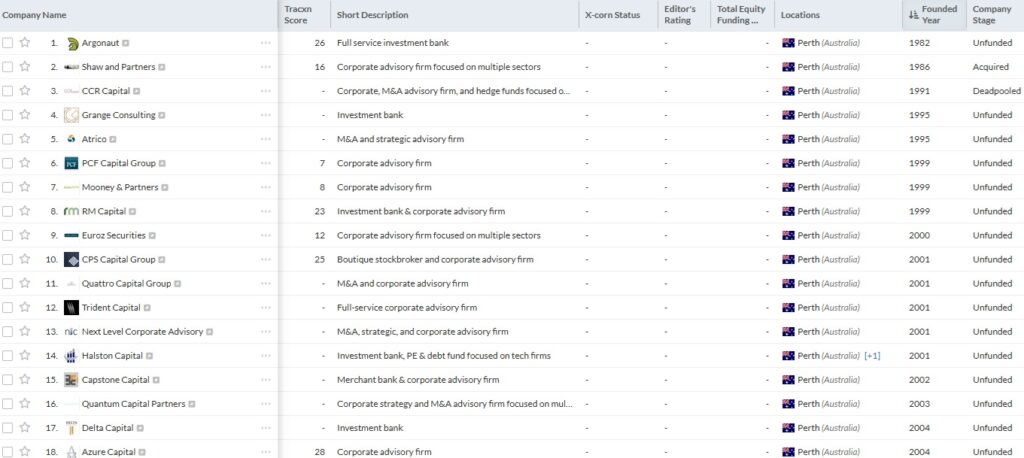

The larger part of business in Perth shapes itself around the natural resources sector. Many companies from this space are listed on the Australian Stock Exchange or ASX. Partially due to this there are a large amount of corporate advisory, M&A, private equity, and venture capital firms operating in the city. Sixty-eight of these entities are listed by Tracxn.

This continuous development of both natural resources and more recently climate technology has given rise to centi-millionaires. If centi-millionaires isn’t a term that you are familiar with. They have $100 million USD in investable wealth. They are the super-rich. And according to Henley & Partners, sixty-four of them are based out of Perth. More than Berlin, Dublin, Copenhagen, or Lisbon.

Even with all this heritage and background, there is still something missing in Western Australia. Could HSBC and others be more prominent? Is there more scope to work with Hong Kong and Singapore?

Carl Di Lorenzo, Partner, Tax, at RSM Australia shared in a recent report by the firm how “Perth should have bigger investment banks on the same time zone as Asia. It won’t be people saying, ‘I need to raise money, let’s go to Sydney or Melbourne’. They will come to Perth and once you’ve got the capital markets that will help drive commercial outcomes.”

To address this need for Perth to diversify and encourage banks to focus on Western Australia the upcoming Black Swan Summit is an ambitious entry to the annual events calendar.

The Biggest Capital Markets Event in Perth – The Black Swan Summit

The inaugural Black Swan Summit challenges conventional thinking by exploring the transformative power of technologies like Blockchain, AI, Quantum, and Climate Tech. The event takes place at the University of Western Australia from March the 24th to the 26th. The organizer of the event is the Global Finance & Technology Network (GFTN). The GFTN was established by the Monetary Authority of Singapore and also organizes the annual Singapore Fintech Festival.

The Black Swan Summit is a ‘By-Invite-Only’ event and interested attendees will be required to send in their registration through the Black Swan Summit website here

To encourage investors to invest and founders to secure capital Investor Hours will be taking place at the Summit. Some of the topics at the event include the future of money, tokenization, quantum disruption, cybersecurity and energy supply chain.

Author: Andy Samu

#BlackSwanSummit #BlackSwanSummit2025 #DisruptionBanking

See Also:

How Strong Will the Australian Dollar (AUD) Be In 2025? | Disruption Banking

Will improved relations with China boost the Australian economy? | Disruption Banking