Some people call it Andreessen Horowitz, others a16z, but if you’re a startup anywhere in the world you simply know of them. Founded in 2009 in California, a16z quickly grew into one of the most important venture capital firms in the world. It was an early investor in Facebook, Twitter, Coinbase and Stripe. Last month a16z decided it would close its office in London after less than 20 months. We ask why a16z decided to leave London in today’s story.

Andreessen Horowitz set to pull back from UK crypto investing https://t.co/H9Okdj6e03

— FT Technology News (@fttechnews) January 24, 2025

Two years ago the editorial team at DisruptionBanking attended the Financial Times’ Digital Assets Summit in London. Brian Quintenz, Head of Policy at a16z spoke at the event. He extolled the way the Conservative government was approaching regulation. Quintenz seemed impressed with the way policymakers in the UK understood decentralization.

He also added at the time how “the UK has an opportunity to be light years ahead of the U.S.”

Why Did a16z Choose London?

The opening of the a16z offices in London was a high-profile affair. The U.S. venture capital firm was hoping that the UK government would create a more hospitable climate for blockchain and crypto startups. Especially as Gary Gensler was making it tough for those same companies to succeed in the U.S.

At the time of opening the office it was reported that the UK had been actively courting digital assets companies. The UK prime minister, Rishi Sunak, was quoted as being “thrilled” at the arrival of Andreessen Horowitz in London.

Andreessen Horowitz chose London as a location over cities such as Dubai or Singapore. Leading figures at the venture capital firm believed they could help “‘nudge’ London into being a more active hub of technology.”

Why is a16z Leaving London?

On January 24th, Anthony Albanese, the COO of a16z, posted on X. In the post he shared how his company “has chosen to focus on the U.S. given the new administration’s strong policy momentum and will therefore be closing our UK office.”

He added that he remains confident in the UK’s role in crypto and blockchain.

We’re excited by the enthusiasm for crypto building and adoption in the UK and are encouraged by the recent positive policy announcements and actions. However, we have chosen to focus on the US given the new administration’s strong policy momentum and will therefore be closing…

— Anthony Albanese (@AAlbaneseNY) January 24, 2025

The day before the announcement, President Donald Trump issued an Executive Order titled: “Strengthening American Leadership in Digital Financial Technology.” Clearly this has had an impact on plans for companies like a16z.

Last July a story appeared in WIRED offering Sir Keir Starmer advice on fixing the UK’s Tech Industry. The story highlighted how many startup founders, investors and tech advocates felt at the time. Their advice to the newly elected Labour government was to “improve investment opportunities, unlock the potential of future technologies, and steal certain things from the playbooks of former Conservative governments – and other nations – to get ahead.”

Who are The Leading Fintech Unicorns in the UK?

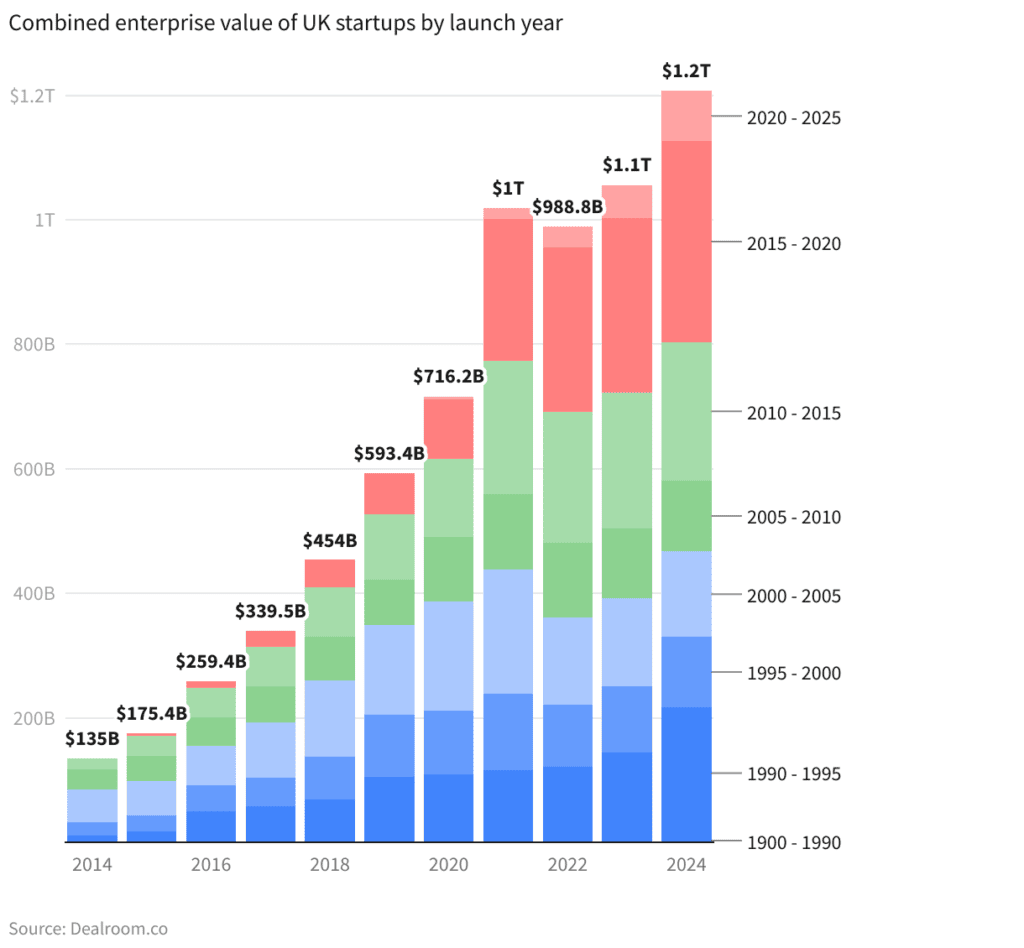

Dealroom provides excellent data on the UK tech scene. According to the data platform, the UK is the third most valuable startup ecosystem globally.

The report goes on to provide data on the UK venture capital scene. Traditionally London has dominated the European venture capital scene. But last year deal trade slumped from $18.2 billion in 2023 to $16.1 billion. By contrast, In 2021 this figure was $36.7 billion. However, this was still better than Germany who came in second in 2024 with $8.2 billion investment by VCs.

This is particularly important when one considers how VC firms have made up between 40 – 50% of total funding into the UK startup ecosystem over the last decade.

The UK has produced 168 $1 billion+ startups. 63 of them have not yet exited and are worth a combined $180 billion. Many of these represent the fintech sector. Wise, Starling Bank, Thought Machine, Revolut, TrueLayer, Blockchain.com, Copper and Funding Circle are just some of the uniorns you may have heard of.

How Have the UK’s Unicorns Fared Under the Labour Government?

Since the change of government, it has been a mixed bag for the UK’s unicorns. Whether this was the government’s fault or failings at the unicorns themselves is not the issue here. It is how the government is stimulating the economy. Or not.

Starling Bank was fined £29 million by the FCA for failings in their financial crime systems and controls. This was in October 2024.

Revolut’s CEO Nikolay Storonsky has spoken out. In a podcast with 20VC from December last year he shared how the U.S. was a better market for his firm to list.

This is the show we have all been waiting for.

— Harry Stebbings (@HarryStebbings) December 2, 2024

Revolut is one of the generational companies of our time.

Today we get answers to the questions we all want to know.

🏦 Where & when will Revolut IPO?

🚀 How does Revolut plan to reach $100BN valuation?

🇺🇲 How will Revolut win… pic.twitter.com/Ucuy8tERyZ

Storonsky shared some insights during the podcast – insights that Rachel Reeves and Sir Keir Starmer would do well to heed. Regarding a potential IPO in the UK, he explained how the cost of trading in the U.S. is free. In the UK there is stamp duty tax of 0.5%.

“I don’t understand how the product which is being provided by the UK can compete with the product being provided by the U.S.” Storonsky shared. “If I get a better product from the UK, then I will consider an IPO in the UK.”

Paul Taylor, founder and chief executive of Thought Machine was quoted by CityAM. “Companies like ours will be less incentivised to grow once the contribution we have to pay, per employee, increases – combined with forthcoming changes to employment legislation,” he said. Thought Machine are another UK fintech unicorn considering an IPO. However, following on from the UK budget there are no further stories about its desire to list that we could find. Only the above comment from Taylor about rising costs.

Is There Hope for UK Fintechs?

As the WIRED story highlighted, it would be useful if Rachel Reeves and Sir Keir Starmer considered copying more of the activities undertaken by previous UK governments. Or, indeed, foreign ones like Singapore or Dubai whom a16z prudently pointed to as competitors in the startup space.

In the past we have seen Prime Minsters like David Cameron get much more involved. Cameron opened the offices of Blockchain.com in London in 2017. Prime Minister Boris Johnson asked Wise about its IPO plans when he was in charge. There were also UK Fintech Missions to Western Europe that happened regularly during the previous government.

Janine Hirt, CEO of Innovate Finance, summarized the situation in a recent statement she shared:

“If the UK is to create leading technology companies to rival those from the US, these are most likely to come from the Fintech sector.

“It is fair to say that many Fintech leaders, entrepreneurs, and founders feel a sense of frustration right now about the opportunities that lie untaken in front of us. Our Fintech Plan for Government identified £328 billion which can be added to the UK economy if the sector is properly supported and continues to flourish.”

Hirt believes that in 2025 the UK needs to “rethink our regulatory framework; supercharge our capital markets, encourage investment, and ensure we have a business and tax environment that is attracting international entrepreneurs and enticing home-grown ones to stay here.”

Let’s hope that Rachel Reeves and Sir Keir Starmer read this story and take note. Or we will all be in big trouble.

Author: Andy Samu

See Also:

Has the Crypto Renaissance Really Begun? | Disruption Banking

a16z: UK Light Years Ahead Of The US For Crypto | Disruption Banking

Singapore Fintech Festival: Ben Horowitz on the potential of Web 3.0 | Disruption Banking