It sounds like a token that investment bankers and portfolio managers might be interested in. But Quant as a token, or QNT, has more to do with central banking digital currencies than it does with the world of asset management. Or does it? Today we look at how strong the Quant Token or QNT might be in 2025.

Some of you might think of QNT and think of Britcoin. Others might think of CBDCs. But from the perspective of our editorial, it’s great to see a token created in the United Kingdom. A token whose vision was formed through the ingenuity of a technologist called Gilbert Verdian.

When the Quant whitepaper was released almost exactly 7 years ago it mentioned a concept called ‘Overledger’. The description is key to understanding what QNT is used for:

“Overledger is a new blockchain operating system intending to solve the problems of single-ledger dependency by increasing communicability among DLTs, allowing general purpose applications to run on top of different blockchains.

“Overledger enables users to build decentralized multi-chain applications which aren’t single-blockchain dependant.”

Today, all links to Quant’s whitepaper and much of the information about QNT has been removed from the Quant Network website. We looked at why the team at Quant don’t really promote QNT. It is unusual.

What does the Quant Token do?

According to the team at Quant, QNT is a utility token. “It is used as a form to gain access to Quant services…. Quant has no interest in our token as a cryptocurrency… The QNT token is an integral part of our platform but it’s not the focus of our efforts.”

Some exchanges do list the token, even though the team at Quant are not pushing QNT. TradingView writes about it widely.

Importantly, there is a limited supply of QNT out there today. Even more limited than the supply of bitcoin. This is of particular significance to retail and institutional investors.

As opposed to bitcoin where there will only ever be 21 million. So with QNT there will only be 14.6 million. This becomes particularly significant when you consider the current market cap of QNT. This stands at over $1 billion today. It makes QNT in the lower 70s for size by market cap. But as the price of the token is currently above $100 its not quite that simple. The highest price for QNT in September 2021 was $428. If market cap grows, then QNT could grow astronomically in a short period of time. Much like it has in the past.

The token is clearly valuable. The scarcity of tokens in the future could drive the price of the token to new highs. Today, though, QNT suffers from severe volatility. Although, amazingly, the price today is almost identical to the price one year ago to the day.

What Affects the Price of the Quant Token?

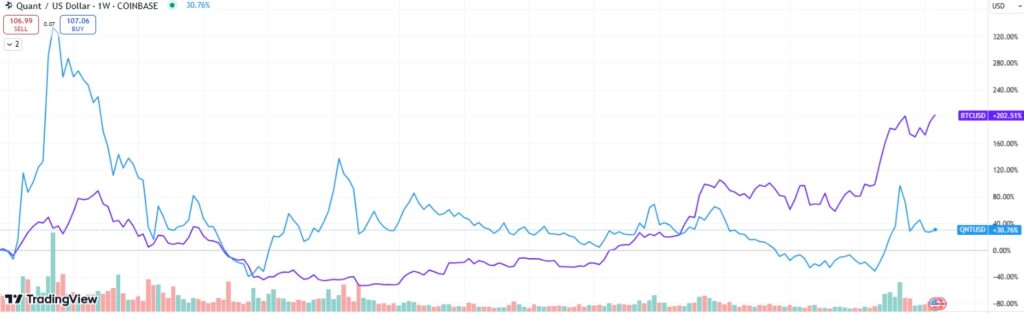

As befits an editorial team we had a look at some of the peaks and troughs in performance by QNT over the years. The biggest peaks took place in September 2021, October 2022, January and December 2023, March and December 2024.

When QNT was first issued it was more volatile than it was in 2024. In fact, during 2024 the token started to follow bitcoin to a limited extent. December was the moment that this is the most visible.

Some of the news that affects the price of QNT is available through the press releases that appear on Quant’s website. Others you need to dig into more. For instance, Project Rosalind.

Quant collaborated with the Bank for International Settlements Innovation Hub in London and the Bank of England on Project Rosalind. The project was completed in June 2023. It’s a huge achievement for the team behind Quant. And a great use case for QNT.

We’re proud to announce our role as part of the vendor team for #ProjectRosalind. The project, led by the @BIS_org and the @BankOfEngland, explored how application programming interfaces could be used for central bank digital currency systems.#CBDChttps://t.co/y44Jxasws4

— Quant (@quant_network) June 16, 2023

Project Rosalind

According to Quant’s team, the company helped the Bank for International Settlements and the Bank of England with Project Rosalind during 2022 and 2023. The firm helped these organizations to conduct practical explorations on how application programming interfaces can deliver new benefits in terms of payment and functionality to banks and customers in the event of a retail central bank digital currency. Or CBDC.

To help explore the possibilities of a future CBDC platform, Quant contributed its expertise in ledger and infrastructure to Project Rosalind. The firm aimed to develop a core set of API functionalities that could support a retail CBDC platform, using two different blockchain technologies for comparison. One of them being Overledger Authorise, Quant’s own blockchain agnostic API gateway that interconnects blockchains and legacy networks to DLT.

Project Rosalind may serve as the foundation for a digital currency for the UK. And Quant appears to be directly involved.

Collaboration with Oracle

In 2018 a project called LACChain began. The project was designed to be a new digital Latin American dollar. Quant Network joined the project in 2021. The involvement with Quant led to 12 countries across Latin America benefitting from the collaboration which was completed in partnership with Oracle.

“Through our Overledger gateway, we enable participants to connect their private, public, and permissioned blockchains to LACChain. Networks and DLTs that were siloed can now connect,” Verdian explained.

This collaboration with Oracle continues. First the tech firm certified the Overledger Gateway as an interoperability solution for its Oracle Blockchain Platform in 2021. Now Oracle’s customers are also benefiting.

Chainlink may be helping JP Morgan with tokenization of funds. But it is Oracle’s ecosystem that the leading global bank is leaning on for streamlining payments across treasury, trade and commerce. Quant is well placed in the Oracle ecosystem. With its’ ‘secure bridges’ and expertise in APIs, Quant is in a better position than many to work with financial institutions in 2025 and beyond.

UK’s Regulated Liability Network

In May #DisruptionBanking spoke with the team at R3 about a joint project the company was undertaking together with Quant. The initiative, RLN for short, aimed to create a unified platform for various financial transactions using both tokenised and traditional commercial bank deposits to support a regulated liability network in the UK. It involved banks like HSBC, Standard Chartered, and Citi.

The future for central banking digital currencies and the streamlining of payments is a place where Quant is making its mark. And, as banks around the world learn of the benefits of working with Quant. So will the token increase in its value as demand picks up.

Who is Gilbert Verdian?

Gilbert Verdian is the CEO and Founder of Quant Network, which is what the original Quant company is now called. He is also a very professional technologist. Verdian doesn’t wear hoodies. He normally wears a suit. And he has a lot of experience in security in his previous roles. Including at HSBC.

Verdian is often on stage. Quant has sponsored many events and both him and Quant have a substantial following on X. Unlike a traditional tech bro, Verdian prefers to focus on regulation and the future of money in everything he does and most of his public appearances.

Verdian shared his thoughts about the RLN project last year. It’s worth a listen:

Watch the video below to hear @gverdian share some insights into what the Regulated Liability Network is, its key objectives and what it means for the future of payments. https://t.co/yfGvaRPVkt pic.twitter.com/JVkTXyOZVp

— Quant (@quant_network) May 20, 2024

How Far Can QNT Grow in 2025?

There are lots of influential figures surrounding QNT. For instance there is Zaven the Rapper, Zaven doesn’t want you to wake him up until QNT hits $220 and the man seems to be unreasonably certain that QNT might one day hit $87,000. The lower number might be more reasonable.

The token is almost certainly nearer the bottom of its cycle. It could go much further than $450 according to other commentators.

One of those commentators is the team at Forex Trading who are looking at $600 over the course of the next cycle. And finally there is Louie Crypto who suggests $225 is realistic not just in 2025, but probably before the summer.

TradingView’s Technicals suggest “Sell” is advisable for QNT as it stands today. We would suggest waiting for QNT to start a new run as all cryptos have been down over the last few days. Getting in at $100 is sensible with price predictions suggesting a return of at least 2.3:1 in 2025. Much of which will depend on what Verdian gets up to. Which is why you need to follow him as well as the token. We will be. And we can only imagine a lot of central bankers and retail bankers will be too.

Author: Andy Samu

#Overledger #Quant #QNT #DLT #CBDC #CentralBank #Oracle #SecureBridges #APIs

Disclaimer:

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

How R3 Is Championing DLT In Regulated Financial Markets | Disruption Banking

Full Fat, High Caffeine, Maximum Strength – Britcoin | Disruption Banking

Matt Hancock: Parliament’s Crypto Champion? | Disruption Banking