2024 was a milestone year for Hungary, with the country holding the presidency of the EU Council and Orban Viktor leading significant diplomatic meetings with global leaders. But what does this mean for Hungary in 2025? With increasing global disruptions and Hungary’s positioning on the international stage, is 2025 Hungary’s big chance?

The aim of Orban’s Hungary is to disrupt. This is what has set the stage for 2025. How will Trump’s presidency and his administration’s disruption impact Hungary’s opportunities in 2025?

Donald Trump is himself a disruptor. Many of the pictures from the recent inauguration show him surrounded by disruptors like Elon Musk, Vivek Ramaswamy, Robert F Kennedy, Howard Lutnick, Tulsi Gabbard, even Mark Zuckerberg, to name a few. At a recent conference attended by DisruptionBanking in Texas we asked attendees who, amongst national leaders, are the disruptors that Trump would align best with? Whilst Orban was mentioned, it was Argentina’s President Javier Milei who was a more popular choice.

Closer to home, the Hungarian leader has been quick to comment about how George Soros’s network was defeated following Trump’s inauguration. This war between Orban and Soros has formed much of the political debate in Hungary over the last decade. It started when Orban transformed Fidesz into a centre-right conservative party in the mid-1990s. The relationship reached new lows with the relocation of the Soros-funded Central European University from Budapest to Vienna in 2019. Something that aggravated EU lawmakers.

You can have your own opinion on whether you like Soros or not. Indeed, you may have an opinion about Orban too. As journalists our role is not to take sides or cultivate either narrative. It is simply to report the news. Orban is reported to have a problem with authority. Be that the EU or George Soros, if he doesn’t like it, he won’t support it.

Now. The threat of Soros’s ‘globalization’ is over. What does this mean for Hungary?

President Donald Trump wasted little time taking action on two culturally controversial issues he campaigned on, signing executive orders ending federal #diversity programs and restricting gender definition to two sexes — male and female.https://t.co/2mEpBKre6k

— #DisruptionBanking (@DisruptionBank) January 21, 2025

Trump has signed several DEI-related executive orders already. The anti-woke rhetoric aligns with Orban’s politics. But does Trump align with Orban elsewhere?

What is the Current State of the Hungarian Economy?

It was recently that we shared with our readers the success of OTP Bank in 2024. OTP Bank is Hungary’s and Central Eastern Europe’s largest bank. The financial health of this bank speaks volumes about the potential of Hungary. Couple this with the financial results of the largest Hungarian oil and gas company, MOL Group, and there is every reason for optimism.

BlackRock, Morgan Stanley, Citi, Wise and many other financial institutions and tech firms call Hungary home today. The allure of talented Hungarians ensures these companies have a vested interest in staying. Further afield the Hungarian Fintech startup SEON has a presence in London and Texas already.

We are excited to announce that we are opening our new office in Austin, Texas, to help break down the barriers to #fraudprevention in the US market! Find out more at: https://t.co/D5ueAUcbjd #fraud #fraudmanagement #payments pic.twitter.com/G2KRH32Tbh

— SEON (@seon_tech) April 27, 2021

Whilst there is some good news, recent stories about the value of the Hungarian forint have been less positive. In late November 2024, Moody’s Ratings lowered the outlook of Hungary’s debt to negative from stable. The agency affirmed Hungary’s rating at Baa2, on par with Mexico and Columbia. Fitch Ratings has given Hungary a BBB rating.

The European Court of Justice fined Hungary €200 million in June 2024 which is proving difficult to pay for the Hungarian government. This isn’t the only area where Hungary is facing problems in Europe. Hungary was supposed to benefit from the EU Recovery Fund (RRF) to the tune of €10.4 billion. The moneys have been held back so far. Then there is the matter of a €1 million daily penalty Hungary has been given by the ECJ for failure to comply with its asylum policy. Things are challenging at best.

The Hungarian Forint, Inflation and the Budget Deficit

The biggest problem here is the strength of the Hungarian forint against the Euro. In January 2023 the forint stood at approximately 384 HUF to 1 Euro. Today it is at 410 HUF to 1 Euro.

Why has the forint dropped so low against the Euro? There are many things to consider. Hungary’s dependence on the German automotive market where Volkswagen is struggling. Lack of EU funds. Geopolitical uncertainty. Budget deficit. There are many elements that have led to the forint’s demise.

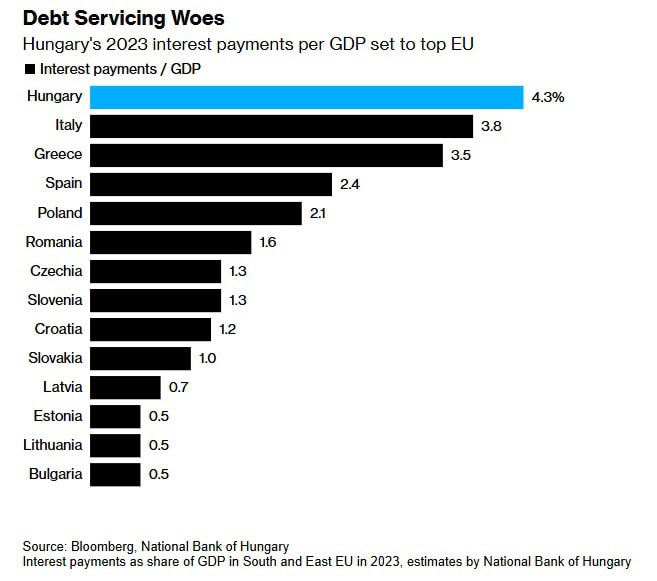

The biggest impact on the forint within Hungary is down to government debt and central bank interest rates. In September 2024 Hungary’s government debt accounted for almost 76% of GDP. Whilst this is high, it is not as high as countries like Belgium, Finland, France or Greece.

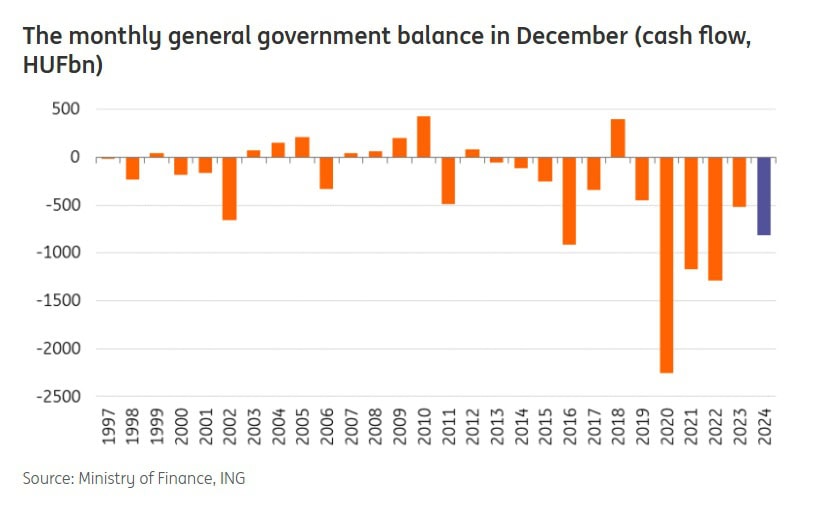

In December 2024 the Hungarian parliament approved the 2025 budget presented by Orban. One of his priorities is to lower the budget deficit in 2025 from a projected 4.6% by the European Commission to a more sensible 3.7%. Over the last five years though, the budget deficit has tended to be above 7%. In 2023 it was 6.7% for instance.

There are 8 EU member states subject to the EU’s excessive-deficit procedure today. In Hungary’s case though, it has missed its budget goals each year since the COVID-19 outbreak.

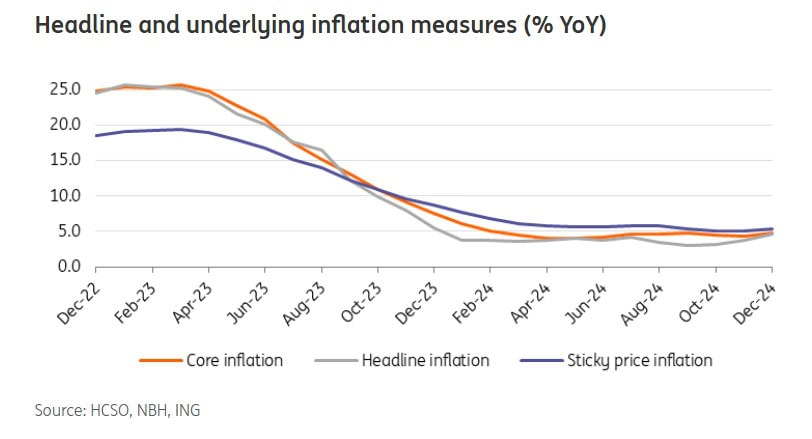

Inflation and a technical recession are other concerns that need to be highlighted. Inflation may have dropped substantially from 2023 to 2024, but that didn’t mean everything is fixed. It has dropped from historic highs of 17.6% two years ago. In December it was 4.7%. Higher than expected.

Hungary’s economy shrunk in the third quarter of 2024 by 0.7%. Details about the fourth quarter haven’t been made available yet. But as it stands the Hungarian economy is going through a ‘technical’ recession. Did Orban’s budget in December do enough to address this extra challenge?

What about the Economic Outlook for 2025?

With a big election to take place in 2026 there is a lot of pressure on Orban in 2025. His hope to keep the budget deficit to 3.7% in 2025 is considered ambitious by the EU and miscalculated by market commentators like ING. 4% is the absolute minimum that is being reported by ratings agencies and others.

The EU’s stance is also a concern. Whilst the EU’s target inflation for EU member states is 3% in 2025, Hungary is off the mark by some distance. This is exacerbated by the cost of servicing the national debt which is the highest in Europe today.

However there are some reasons for optimism. The Head of the Hungarian Central Bank, György Matolcsy, is a fervent advocate of green finance. His team regularly attend events hosted by the most important institutions in the world like the Monetary Authority of Singapore or the Swiss Federal Department of Finance.

Matolcsy also presented ECB President Christine Lagarde with the coveted Lamfalussy Award just last week.

Regarding large investments by BMW, BYD and CATL (Battery Plant) the Hungarian Central Bank believes they can add up to 0.6% to the Hungarian economy in 2025. In 2025 these investments could provide up to 7,300 jobs. And by 2029 up to 24,000.

In the background, the EU has suggested that Hungary will grow 1.8% in 2025 with an inflation level of 3.6% and unemployment at 4.3%. This is forecasted to further grow in 2026.

Hungary’s Economic Strategy for 2025: A Focus on SMEs

As Hungary looks ahead to 2025, one of the government’s most significant objectives is to boost small and medium-sized enterprises (SMEs), a move recognized as vital for strengthening the national economy. This focus comes as part of a broader strategy to counteract the effects of inflation and foster long-term economic stability. Levente Ujhelyi, a senior banking professional in Hungary, explains that the success of this initiative will largely depend on global economic conditions, with an economic upswing offering the best chance for Hungary to build resilience through SMEs.

The government has taken bold steps to address this issue, including the creation of a national economy “super-ministry,” led by Márton Nagy. This centralization of economic powers is expected to streamline decision-making and foster greater alignment between government objectives.

However, the road ahead remains fraught with risks. Ujhelyi notes that, while the super-ministry has the potential to drive positive outcomes, it also carries the danger of over-centralization, where too much power in the hands of a single figure could lead to inefficiency or mismanagement. Furthermore, although the government is likely to benefit from higher VAT revenues, the impact of looser monetary policies aimed at stimulating consumption could drive inflation, presenting another challenge.

Ultimately, while Hungary’s strategy to strengthen SMEs is a step in the right direction, the success of this plan will be closely tied to global economic trends and the ability of the government to balance fiscal stimulus with inflation control.

Will Trump’s Familiarity with Orban Help the Hungarian Economy in 2025?

It was well noted during Trump’s election campaign that the U.S. President is fond of Orban. However, at the recent inauguration it appeared that Giorgia Meloni, Prime Minister of Italy was more prominent. Orban wasn’t invited, Meloni was.

It might take a while for Trump to work out what role Orban will play in his politics this year. The reliance by Hungary on China will complicate this situation. Hungary did take a €1 billion loan from China in the summer of 2024. Some argue this couldn’t be avoided. Trump might think differently.

Hungary enters 2025 at a pivotal moment, where opportunities and challenges intertwine. Its leadership role in the EU, coupled with major foreign investments from global players like BMW and BYD, signals the country’s potential to rise as a key player in Europe. Yet, the shadow of a weakening forint, growing debt obligations, and strained EU relations looms large.

While Orban’s disruptive style aligns well with Trump’s anti-globalization rhetoric, Hungary’s reliance on China and its economic vulnerabilities could complicate this partnership. Balancing these dynamics will require Hungary to tread carefully between ambition and realism.

For Hungary, 2025 is more than just a chance to redefine its global standing—it’s a test of resilience in the face of economic and political pressures. For Orban, it’s a year that could shape not only his country’s trajectory but also his own political legacy. The decisions made in the months ahead will determine whether Hungary rises to the occasion or finds itself further entangled in its challenges.

Author: Andy Samu

See Also:

The Five Largest Banks in Central Eastern Europe in 2025 | Disruption Banking

Is it Worth Investing in Poland in 2025? | Disruption Banking