Two of Boston’s well-known regional banks, Berkshire Hills Bancorp and Brookline Bancorp, have officially announced their all-stock merger. Combined, they will hold $24 billion in assets and manage over 140 branches across five states. This merger creates a more robust regional player, but it raises big questions. How will it affect local economies, small businesses, and the communities that depend on these banks?

Commenting on the merger, Berkshire Chairperson David Brunelle said, “This highly compelling combination is a true merger of equals that will create a preeminent northeast financial institution. Scale and efficiency […] is a powerful driver of value for all of our stakeholders.”

Regional bank mergers like this one are becoming more common, but they are not without trade-offs. Let’s break it all down.

A Bigger Regional Bank in a Competitive Industry

The merger between Berkshire Hills and Brookline shows how smaller banks are adapting to survive. Regional banks are facing heavy competition from giants like JPMorgan Chase, Citigroup, and other national banks. Bigger players dominate because they offer better digital services, vast loan programs, and lower fees. Smaller banks, on the other hand, often struggle with rising operating costs and limited resources.

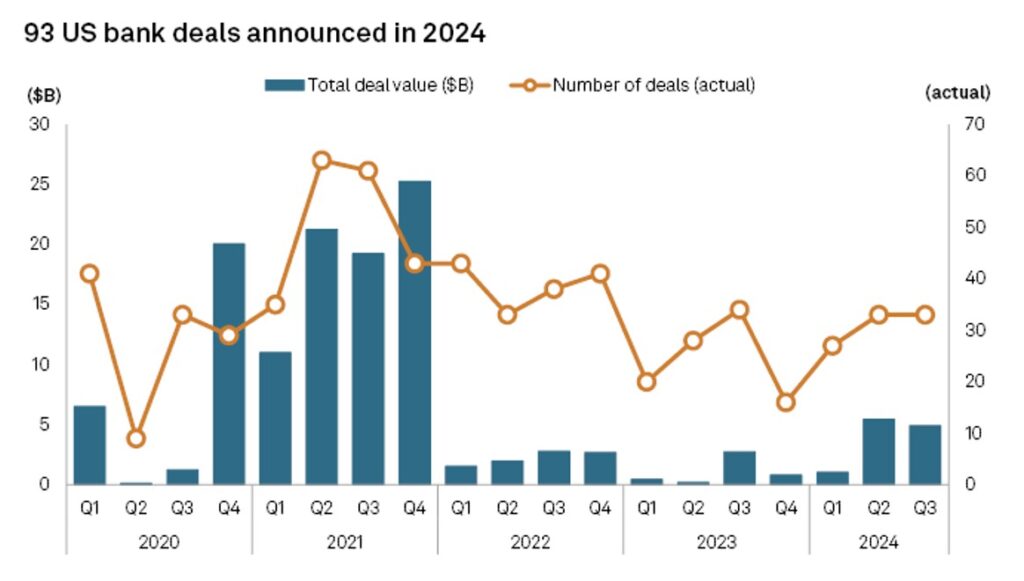

To remain relevant and enhance competitiveness, regional banks are merging. In 2023, U.S. bank mergers experienced a significant decline, with total deal value reaching approximately $4.21 billion — the lowest since 2009 — according to S&P Global Market Intelligence. However, there is an anticipated rebound in 2024, with 93 U.S. bank deals worth an aggregate of $11.42 billion announced through September 30, 2024.

Data compiled Oct. 3, 2024, shows analysis limited to US-based whole company, minority stake, and franchise bank and thrift deals that were announced between Jan. 1, 2020, and Sept. 30, 2024. Excludes branch, government-assisted and terminated deals, as well as bids and thrift merger conversions. Deal values are as of the announcement date. Source: S&P Global Market Intelligence.

The Huntington-FirstMerit merger and KeyBank’s acquisition of First Niagara are good examples of successful consolidations.

The new entity, formed by Berkshire Hills and Brookline, will have more firepower to compete. By combining their assets, they can offer improved digital banking, better loan packages, and expanded services. Brookline Bank and Berkshire Bank currently serve hundreds of small businesses and families in New England, New York, and Rhode Island.

Industry analysts, like Economist James Lowell, observe that banks are merging not solely for increased size but to adapt to a rapidly evolving financial landscape. They argue that, for some institutions, remaining small may pose challenges in sustaining operations amidst technological advancements and regulatory changes.

The Trump administration’s anticipated deregulatory agenda presents a unique moment of opportunity for investment banks to thrive, particularly in areas like mergers and acquisitions, cross-border deals, and the debt market. #investmentbankinghttps://t.co/CJ6Px2CTZp

— #DisruptionBanking (@DisruptionBank) December 12, 2024

Benefits, Concerns About Branch Closures and Community Impact

For small businesses, the merger could bring opportunities. The combined bank will have more funds available to lend, thanks to its $24 billion asset base. Small businesses in Massachusetts, Rhode Island, and New York rely heavily on regional banks for loans and lines of credit. This merger could expand that access.

With more resources, the merged bank will likely improve its technology services. Regional banks have lagged behind national players in digital tools. Upgrades could mean better online banking, faster loan approvals, and advanced tools for small businesses.

Take the example of First Citizens BancShares, which merged with CIT Group in 2022. The move allowed First Citizens to expand its tech capabilities, offering improved services for its growing customer base.

The merger could also open new credit lines for industries like construction, healthcare, and manufacturing, which dominate the Northeast economy. Small business owners in these sectors often depend on relationships with local bankers to secure flexible loans.

“The absence of local community banks that became a target of a merger or acquisition by nonlocal acquirers has, on average, led to local small business lending credit gaps that were not filled by the rest of the banking sector,” observes Julapa Jagtiani, Senior Economic Advisor and Economist at the Federal Reserve Bank of Philadelphia.

As noted in a Disruption Banking report on M&A, mergers often come with a downside: branch closures. The two banks currently operate in overlapping regions, which means some branches could shut down to cut costs. This happened when PNC Financial acquired BBVA USA in 2021, leading to hundreds of closures.

Currently, Berkshire Hills operates over 80 branches across New England and New York, while Brookline manages several banks in the Northeast, including Brookline Bank in Boston, BankRI in Providence, R.I., and PCSB Bank in New York’s lower Hudson Valley. If branches in smaller towns or neighborhoods close, communities might lose critical access to banking services.

For smaller towns, losing a local branch can have a ripple effect. In rural and underserved areas, businesses depend on face-to-face relationships with their bankers. If branches close, businesses and individuals could struggle to access loans or personalized services.

This also reduces competition. When fewer banks operate in a community, small businesses may face higher fees and fewer options for financing. According to Federal Reserve data, branch closures have disproportionately affected lower-income and rural communities in recent years.

Speaking to a media outlet on bank consolidations, Phyllis Salowe-Kaye, former president of New Jersey Citizen Action, said, “The fewer banks there are, the fewer products there are, the less service, the less investment.”

To balance cost savings and community impact, the new bank will need to communicate clearly about its plans for branch networks. Maintaining services in smaller markets will be critical to avoiding backlash.

Commercial Real Estate: A Driving Factor Behind the Merger

One key reason for this merger is the banks’ heavy exposure to commercial real estate loans. The office sector has been under stress due to factors including the shift towards remote work and elevated interest rates. According to CBRE Research, U.S. office vacancy rates held steady at 19% in Q3 2024, following nine consecutive quarters of increases, indicating a stabilization at historically high levels. Notably, in Q2 2024, the U.S. office sector hit a record vacancy rate of 20.1%, breaking the 20% barrier for the first time in history (between 1986 and 1991), Moody Analytics shows.

Both Berkshire Hills and Brookline hold significant commercial real estate loans. For regional banks, this is risky. Falling property values could lead to loan defaults, weakening their financial stability. By merging, the two banks can pool resources to absorb risks.

However, the strategy isn’t foolproof. If the commercial real estate market continues to decline, the combined bank may still face challenges. Albeit, M&T Bank’s merger with People’s United in 2022 shows that even in tough market conditions, big banks can grow and succeed if they plan their mergers carefully.

Thus, to navigate any challenge, the merged entity must diversify its loan portfolio. That means expanding lending to small businesses, homeowners, and other less-risky sectors.

The trouble is the small banks are typically in worse position than the big banks. To give a very rough perspective on it:

— Bob Elliott (@BobEUnlimited) March 11, 2023

Small banks have 6.8tln in assets and 680bln in equity.

Large banks have 13tln in assets and 1500bln in equity. pic.twitter.com/D7e8Q9EfWF

A New Era for Community Banking in the Northeast

Berkshire Hills and Brookline have long been pillars of community banking in the Northeast. Both banks are known for supporting local nonprofits, sponsoring community programs, and financing small businesses. But will a bigger, more corporate entity continue that mission?

In recent mergers, banks have faced criticism for moving away from community-focused priorities. After SunTrust and BB&T merged to form Truist in 2019, customers voiced frustration over reduced personal service and increased fees. Berkshire Hills and Brookline will need to avoid that trap.

Community banking plays a crucial role in the U.S. economy. According to the Independent Community Bankers of America (ICBA), small banks provide nearly 60% of small business loans nationwide.

To all the people thinking of switching to a big 4 bank, community banks fund 60-70% of all small biz in this country. They make loans that large banks wouldn’t do. You are just a number to them and if you don’t fit in their box, you don’t get that loan. There are ways to protect…

— Community Banker Guy (@commbankerguy) March 12, 2023

The merged bank must ensure it stays true to its roots. That means:

- Maintaining close relationships with small business owners.

- Supporting local nonprofits and community programs.

- Offering flexible loan products that national banks often overlook.

Gates Little, president and CEO of The Southern Bank Company, emphasizes the importance of personalized service for small businesses: “Most community banks offer more personal service than large banks, meaning the customer has a dedicated officer or team of a few people who work with them daily or as often as needed […].”

If the new bank can blend efficiency with community focus, it will emerge as a stronger player. If not, it risks alienating the customers who built its success.

The merger of Berkshire Hills and Brookline Bancorp marks a big shift for regional banking in the Northeast. It brings opportunities for growth, stronger services, and better technology. Small businesses could benefit from expanded lending and improved banking tools.

But, there’s no denying the risks. Branch closures, reduced competition, and exposure to commercial real estate remain concerns. The new bank must balance its need for efficiency with its responsibility to local economies.

As the deal moves toward regulatory approval, all eyes will be on how this merger plays out. Will it deliver on its promises? Or will small towns and businesses bear the brunt of the changes? For regional banks like Berkshire Hills and Brookline, the road ahead is as much about people as it is about profits.

Author: Richardson Chinonyerem

#Banking #M&A #RealEstate