Cathie Wood, the CEO and chief investment officer of Ark Invest, rose to prominence during the Covid-19 pandemic when her aggressive bets on high-growth tech stocks fueled astronomical returns for her funds. Her flagship fund, the actively managed ETF ARKK, returned 149% in 2020 thanks to the stellar performance of holdings like Tesla, Roku, Zoom, just to name a few. However, ARKK has since plummeted by more than two-thirds from its pandemic-era peak and is up just 10.7% year-to-date, compared to the tech-heavy Nasdaq’s 26.49% return.

Many now question whether Wood can regain her momentum and outperform broader benchmarks in light of her strategy, which involves placing outsized bets on companies she views as well positioned to benefit from “disruptive” technologies.

The problem with this strategy is that many of the companies she backs are highly volatile, most lack profitability, and their returns are closely correlated. The fact that her funds’ portfolios are highly concentrated also presents a major risk – like a double-edged sword, concentration can amplify both gains and losses.

For Wood and ARK Investment Management LLC, lower costs and lower prices for consumers are part of what defines an innovative company.

— #DisruptionBanking (@DisruptionBank) April 14, 2021

Find out more in our Special Feature today:#ActivelyManagedETF #DisruptiveInnovation https://t.co/kpU419ZPC3 pic.twitter.com/wr2jM8vdLE

Who is Cathie Wood?

Cathie Wood, a California native, attended the University of Southern California (USC), where she was mentored by renowned economist Arthur Laffer, famous for the Laffer curve illustrating the relationship between tax rates and government revenue.

Wood’s financial career began as an assistant economist at Capital Group and continued at Jennison Associates, where she served as chief economist. Her expertise further developed during her tenure at AllianceBernstein, where she transitioned from economics to portfolio management, gaining experience in high-growth, high-risk, smaller-cap stocks.

In 2014, Wood founded Ark Invest, focusing on disruptive technology. Ark Invest manages six active ETFs, all connected to the tech sector, including its largest fund, the Ark Innovation ETF (ARKK).

Changing Macro Backdrop Triggers Sell-Off

Critics argue that Wood’s pandemic-era success was not due to her stock-picking genius, but rather the favorable macro-environment that supported her strategy. Following the pandemic, near zero interest rates and a flood of liquidity from government stimulus drove investors to seek growth wherever they could find it, with speculative tech stocks emerging as the primary beneficiaries. As long as cheap money was available, investors were willing to overlook the lack of earnings and invest heavily in these high-risk, high-reward bets.

But when inflation surged in the aftermath of Russia’s invasion of Ukraine in 2022, central banks around the world led by the US Federal Reserve responded with tighter monetary policy. This drove investors away from speculative stocks to companies with proven cash flows, profitable business models and consistent dividends. This triggered wide scale sell offs in stocks that ARK Invest held, leading to a massive decline in the value of its funds.

According to Morningstar, the ARKK ETF destroyed $7.1 billion in wealth over the past decade, while its healthcare-focused ARK Genomic ETF destroyed $4.2 billion in wealth. What’s striking is that Ark’s significant wealth destruction occurred during a period when the stock market was generally bullish.

“These funds managed to lose value for shareholders even during a generally bullish market,” Morningstar analyst Amy Arnott said.

“The biggest value destroyers in the fund industry illustrate that there’s no guarantee of success, even during a generally favorable market environment. They also provide a valuable case study in how not to invest,” said Arnott.

"Tech stocks are very sensitive to interest rate moves, but particularly so when P/E ratios are higher."https://t.co/Y749PgXPjU

— #DisruptionBanking (@DisruptionBank) November 25, 2024

Rate Cuts Fail To Help

Despite recent rate cuts, analysts remain skeptical about ARK’s potential recovery. The pace and scale of these cuts are deemed insufficient. While inflation may be under control, central banks have signaled that a return to near-zero interest rates is unlikely in the near future. Consequently, interest rates remain elevated, prompting investors to favor companies with positive cash flows and proven commercial success over speculative investments.

With her funds’ underperforming, Woods has come out to clarify that “we have a volatile fund.” Speaking to CNBC’s Squawk Box, she said: “We should not be a huge slice of any portfolio. We are more of a satellite strategy now.”

Indeed, for many retail investors who saw Cathie Wood as their ticket to quick riches, the experience has been nothing short of nightmarish. Those who went “all in” on her funds have nothing to show but heavy losses.

“The technologies which we have centered our research on are so much more advanced, so we think we’re a very good complement to the broad based benchmarks out there because we do not look anything like them,” she remarked.

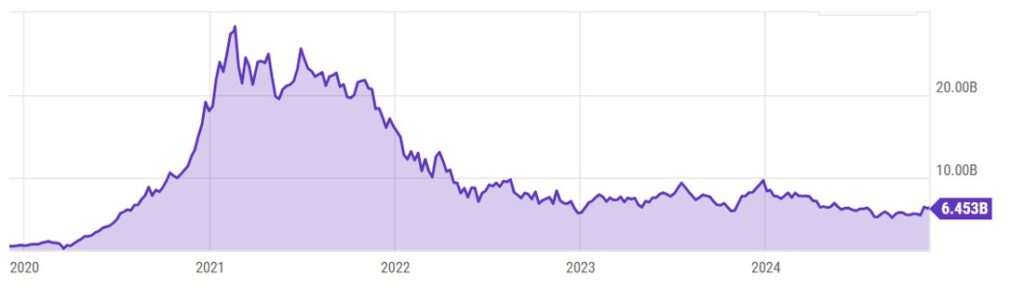

ARKK assets under management have fallen this year; Ycharts

Despite Cathie Wood’s optimism, investors remain generally bearish, as evidenced by the decline in ARKK’s assets under management this year. The flagship fund currently manages $6.45 billion in assets, down from $8.4 billion at the start of the year. At its peak in 2021, ARKK’s assets under management soared to $28.2 billion, highlighting the sharp reversal in fortunes the fund has experienced over the past three years.

A Few Bright Spots

Some of ARKK’s current top holdings include Tesla, Coinbase, Roku, Roblox, Palantir Technologies, Robinhood Markets, Crispr Therapeutics, Block and Shopify. Plays like Tesla, Coinbase and Palantir have done exceptionally well, highlighting a few bright spots in Wood’s portfolio.

Woods has been right on some calls, including Bitcoin. She believes that we’re are still in the early phases of the Bitcoin bull cycle and has an optimistic price target of between $1 million and $1.5 million.

She is now betting that the biggest gains in coming years will come from healthcare. “We’ve been great on Tesla, Bitcoin, Nvidia and now we want to go after healthcare, Crisper gene editing. If you look at JD Vance, Elon Musk, they are all talking about this new wave of cures ahead, so stay tuned,” Woods told CNBC.

Whether or not her bets in healthcare will help revive investor confidence in her funds is anyone’s guess. What’s clear for now is that Woods has some convincing to do given that her strategy of making outsized bets on disruptive companies has underperformed markets for the past three years.

Author: Acutel

We are global investors who invest in good companies at fair valuation and speculate on all else subject to the risk exposure we can afford.

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.