Tesla’s stock price has rallied by more than 30% since Donald Trump secured his landslide victory in the recent US elections, pushing the electric vehicle (EV) maker’s market cap to $1.05 trillion. Currently the world’s most valuable automaker and the eighth most valuable publicly listed company, Tesla has appealed to investors who believe the company will fare well under a Trump presidency due to Elon Musk’s strong ties to the Trump administration.

Besides the boost from the elections, Tesla’s underlying business performance has also been on a solid upward trajectory, providing further impetus to the rally that has seen Musk’s net worth exceed $300 billion.

Wall Street analysts project the company will rake in revenues of $99.94 billion this year and $116.28 billion in 2025 – a remarkable surge from $53.82 billion in Dec 2021. Importantly, Tesla’s impressive topline growth in the past three to four years has translated into substantial growth in net income, which soared from $5.51 billion in 2021 to $14.99 billion in 2023, according to the company’s financial statements.

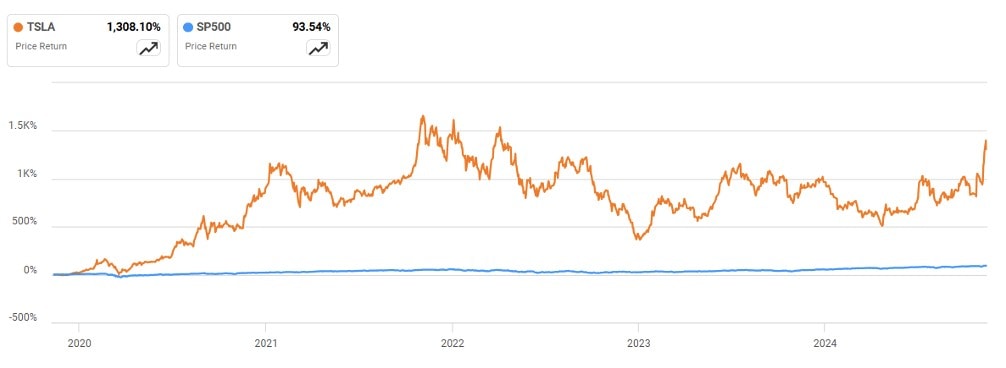

Unsurprisingly, Tesla’s stock has risen substantially over the past five years (1308%) on the back of this strong commercial performance. It has outperformed the S&P 500’s 93.54% return by more than 13 times.

Tesla has outperformed the S&P 500 over the past five years by more than 13 times; source:Seeking Alpha

Investors feel confident that Tesla’s robust business performance can carry on given the company’s dominant market share in the EV market. In the third quarter of 2024, Tesla commanded approximately 48% of the US EV market. Globally, its market share stood at around 19% in the first quarter of 2024. By comparison, China’s BYD Group held about 14.8% of the global EV market, while Volkswagen captured 6.7%.

AI and Autonomous Cars Could Drive Stock Higher

Morgan Stanley analysts, led by Adam Jonas, argue that Tesla’s aggressive investment in autonomous vehicles and its own robotaxi platform could drive a sustained rally in the stock. They believe Tesla’s autonomous technology could be the “great unlock” that transforms it into an AI powerhouse, especially if CEO Elon Musk leverages his political influence during Trump’s second term.

Despite 80% of Tesla’s year-to-date revenues coming from vehicle sales, the company is often overlooked in the excitement surrounding artificial intelligence, data centers, renewable energy, robotics, and on-shoring. However, as Tesla increasingly focuses on these sectors, the stock stands to benefit from increased investor interest, the analysts noted.

Tesla’s ambitious transition to autonomous driving is underpinned by cutting-edge AI technologies, with its Full Self-Driving (FSD) software at the forefront. Utilizing deep neural networks, Tesla processes vast amounts of data collected from its extensive fleet of vehicles. This continuous data stream enables the AI to learn and enhance its driving capabilities, effectively navigating a myriad of real-world scenarios. The company plans to introduce FSD capabilities in Europe and China by early 2025, pending regulatory approval.

FSD Supervised sees more than you

— Tesla (@Tesla) November 13, 2024

And never gets tired or distracted pic.twitter.com/eMp6LwhoIw

“In our opinion, the winners in autonomy (whether in cars or other form factors) will be those firms who can combine capabilities in data, robotics, energy, AI, manufacturing and downstream infrastructure,” the Morgan Stanley analysts said. “We believe Tesla has the capability to benefit from this theme over time.”

They forecasted a rise to $500 a share in their most bullish scenario, a gain of about 50% from the price of $328 at writing.

Similarly, Wedbush analysts are also decidedly bullish on Tesla. Led by Dan Ives, they project a continued surge from the current market cap of $1 trillion towards valuations of $1.5 trillion and $2 trillion within the next 12 to 18 months. Key drivers identified include the FSD technology and the launch of the Cybercab.

“We estimate the AI and autonomous opportunity is worth $1 trillion alone for Tesla, and we fully expect under a Trump White House these key initiatives will now get fast tracked as the federal regulatory spiderweb that Musk & Co. have encountered over the past few years around FSD/autonomous clears significantly under a new Trump era,” said Ives.

Bears Remain Skeptical

But not everyone is convinced that Tesla’s stock can continue powering ahead. Colin Langan, an analyst at Wells Fargo, expressed concerns that Tesla’s core auto business is slowing down due to price cuts and stagnating volumes.“My concern has been the price cuts and volume. Year to date volume is down 2% and pricing is down 3% . The core auto business is still in struggle,” he told CNBC after Tesla released Q3 earnings.

Tesla’s valuation is also seen by some as excessive, given its P/E ratio of 90x and EV/EBITDA ratio of 78x is significantly higher than most automakers’. Similarly, some investors believe Musk’s focus on FSD is misinformed and that his priorities have shifted following his increasingly prominent role in US politics.

Ross Gerber, chief executive of Gerber Kawasaki Wealth and Investment Management and a prominent Tesla investor, said robotaxis and AI were not the fundamental businesses he wanted Musk to focus on. “The days were good when Elon slept at the factory. He was there every day, working. Not going to Trump rallies of all things he could be doing.”

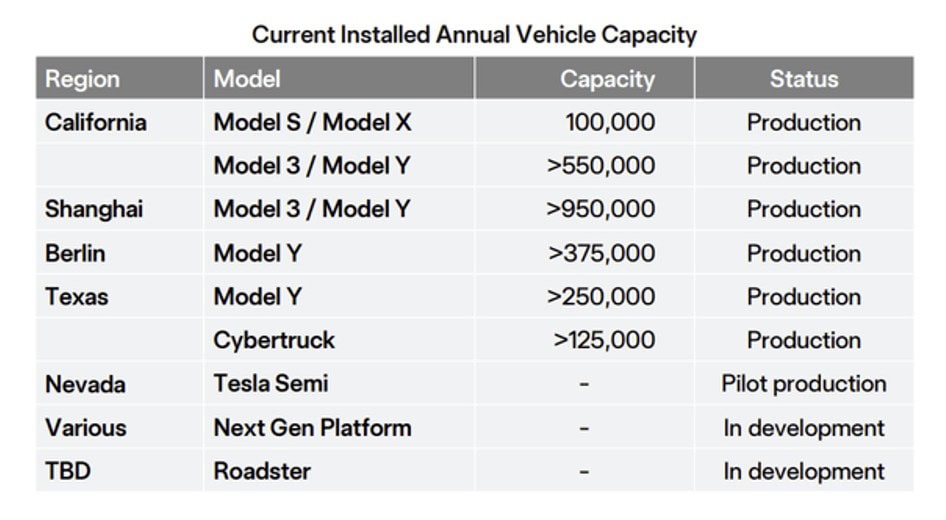

Tesla’s significant exposure to the Chinese market is also seen as a potential risk. The EV maker’s Shanghai factory has the largest annual vehicle capacity at the moment, ahead of California, Texas and Berlin. President Trump’s promise to impose tariffs of up to 60% on Chinese imports could lead to retaliatory measures by Beijing, potentially impacting Tesla’s competitiveness in China.

Source; Tesla press release

However, for all the risks that come with investing in Tesla’s stock, betting against the company has historically proven even riskier. Few investors have successfully shorted Tesla’s stock over time. Some notable figures who have burnt their fingers shorting the stock include Jim Chanos, David Einhorn and Bill Gates, highlighting Tesla’s consistent ability to defy skeptics. Whether the years ahead will see momentum shift in favor of bears is anyone’s guess, but the majority of investors are betting that Tesla’s stock will continue to outperform.

Author: Acutel

We are global investors who invest in good companies at fair valuation and speculate on all else subject to the risk exposure we can afford.

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.