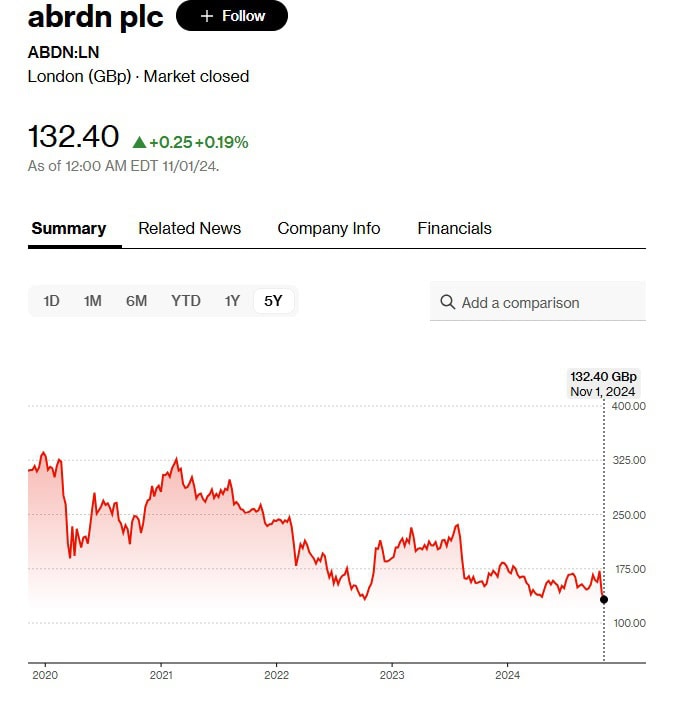

In the past five years, investor sentiment towards Abrdn has significantly soured. The stock price of the asset manager has fallen a whopping 55% on the London Stock Exchange from highs of £335 in Dec 2019 to its current levels of around £135.

The latest blow came with the recent release of the firm’s third quarter earnings report, which revealed persistent challenges with outflows, casting further doubt on the active fund manager’s ability to stem the tide of investor redemptions and win back the market’s confidence. The firm reported that investors across its funds withdrew a net £3.1 billion in Q3. The outflows were primarily driven by redemptions from its equities funds, with fixed-income funds also experiencing approximately £800 million in outflows, largely due to a single mandate redemption.

Abrdn’s share price has plummeted by more than half in five years; source: Bloomberg

Following the Q3 update on Oct 24, shares plunged 7.6% – the most in 14 months. Over the past five years the significant drop in abrdn’s share price, coupled with heightened trading volatility, has resulted in the company’s removal from the FTSE 100 index on two occasions.

Series of setbacks

The deterioration in Abrdn’s share price following its Q3 performance adds to a string of setbacks for the asset manager, which experienced outflows of £13.9 billion in 2023 and £10.3 billion in 2022. Notably, the performance of the firm’s investment funds has also come under increased scrutiny, with the percentage of assets under management outperforming benchmarks over a three-year period falling from 65% in 2022 to 42% last year. This was driven by its exposure to emerging markets.

The core appeal of an active management strategy is its potential to outperform broader markets. When this promise is not met, investor impatience can lead to substantial outflows. Abrdn’s investment business, which oversaw £367 billion in 2023, manages assets for insurers and pension funds.

Despite the headwinds that Abrdn is facing, its total assets under management and administration in Q3 rose by about £800 million to £506.7 billion, representing a 2% year on year improvement. This modest growth is largely attributable to a favorable market environment marked by strong price appreciation across most asset classes – this helped offset the impact of the outflows.

Turnaround Efforts Continue

Jason Windsor, CEO of Abrdn, acknowledged to reporters that, following the firm’s third quarter performance, there was a need to “move quickly” on turnaround efforts. “Our overall performance this quarter is not where it needs to be and underlines the need to move quickly to deliver the priorities I’ve set out,” he said, adding that the company’s previously announced cost-cutting plans were on track.

In a bid to achieve around £60 million in cost savings for FY 2024 and at least £150 million annually by the end of FY 2025, Abrdn laid off around 500 employees earlier this year. This represented about 10% of its workforce. Benefits were also slashed ahead of the redundancies announced in January, which were reported to have hit support functions such as HR, finance, tech, and marketing and communications the hardest. Moreover, over the past three years the firm has also merged or closed more than 250 investment funds and divested peripheral businesses and joint ventures.

Additionally, as part of its turnaround strategy, Abrdn acquired Interactive Investor for £1.5 billion in 2021. This business, it turns out, has emerged as one of the few remaining bright spots in its portfolio. The acquisition, which enabled it to sell more investments directly to consumers, was driven by the need to expand Abrdn’s funding sources. This has worked out well so far.

In the third quarter, assets under management and administration for Interactive Investor rose by 13% year-to-date to £74.5 billion, driven by robust net inflows and favourable market conditions. Abrdn reported that Interactive Investor achieved net inflows of £1.2 billion, up from £0.6 billion in Q3 2023, with year-to-date net inflows of £4.3 billion already 48% higher than the total for 2023.

Abrdn reports $4 billion of outflows in third quarter https://t.co/icbpYouC4Y pic.twitter.com/TWY0GlqHDU

— Reuters Business (@ReutersBiz) October 24, 2024

Winning Back Trust

Formerly the firm’s CFO, Windsor officially assumed the role of CEO in September after holding the fort on an interim basis following Stephen Bird’s departure in May. Bird’s tenure as CEO began in September 2020 when he was brought in to turn things around. However, investor confidence failed to rebound amid persistent outflows and narrowing margins.

He implemented significant cost-cutting measures, including job cuts and restructuring, but efficiency proved to be stubbornly elusive. For example, the cost-to-income ratio in Abrdn’s investment business, which constitutes the majority of its portfolio, was a staggering 94% in 2023.

abrdn launches ‘transformative’ £150m cost cutting programme with 2025 deadline https://t.co/glU68JrXJ6

— Investment Week (@InvestmentWeek) January 24, 2024

Commenting on the Abrdn’s cost cutting under Bird, Rae Maile, an analyst at Panmure Gordon said: “They’ve taken some costs out but there is still much which needs to be done. It’s all well and good saying you’ll take out 10% of the workforce but profit margins are still a million miles away from where they need to be.”

Earlier in the year, US investment firm Harris Associates, which has more than $100bn in assets under management, disclosed divesting its entire position in Abrdn’s stock. According to David Herro, the firm’s deputy chair, they “lacked confidence that management could repair the business”

According to Bloomberg, Harris Associates began reducing its stake in Abrdn in 2022, when it was among the top 30 shareholders, before completely divesting in mid-2023. Herro noted that the firm had held shares in Aberdeen Asset Management prior to its landmark merger with Standard Life in 2017, which resulted in the formation of Abrdn.

Windsor has the unenviable task of winning back investor confidence amid a wave of sell-offs in the company’s stock and public criticism from prominent investors. He is expected to persist with cost-cutting measures and maintain the momentum of the consumer investment platform, Interactive Investor. Additionally, Windsor must address the elephant in the room, which is the persistent outflows, and introduce innovative products to compete with the increasingly popular low-cost passive funds. Will he be able to reverse the firm’s troubled fortunes and restore investor confidence? Only time can tell, though Abrdn’s current share price seems to suggest that investors are sceptical and need more convincing.

Author: Acutel

We are global investors who invest in good companies at fair valuation and speculate on all else subject to the risk exposure we can afford.

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

One Response

Time to look for a buyer at present it’s going nowhere.