As the Federal Reserve shifts interest rates, investors worldwide are closely watching the bond market’s tweaking dynamics. The recent climb in 10-year U.S. Treasury yields reaching around 4.5% is shifting strategies across various bond types — from the U.S. Treasury bonds to international, green, and municipal bonds.

This high Treasury yield — a level not seen since the 2007/08 financial crisis — means U.S. Treasuries have become an appealing option for risk-averse investors. This higher yield offers a stable return, making Treasuries a compelling alternative to more volatile assets like stocks, especially as inflation moderates around 3.7%, allowing for a positive real yield.

According to Treasury reports and recent market data, U.S. government bond sales and issuance have grown reasonably in 2023 as the Treasury increased borrowing, with investors gravitating toward government-backed securities amid economic uncertainty and high yields on longer-term debt. This rising demand signals growing caution as economic uncertainties persist.

The pull toward Treasuries also affects equities. Kathryn Kaminski, Chief Research Strategist at AlphaSimplex, has noted that fluctuations in Treasury yields can influence market sentiment, often drawing capital away from equities as investors reassess risk amid economic uncertainty. This shift reflects broader economic anxieties, with many market participants viewing Treasuries as a “safe harbor” amidst market turbulence.

Bank of America Chief Executive Officer Brian Moynihan has urged Federal Reserve policymakers to be measured in the magnitude of interest-rate reductions.https://t.co/36uaCcfwIl

— #DisruptionBanking (@DisruptionBank) October 23, 2024

Last month, the U.S. inflation rate continued to ease, with the CPI rising 2.4% year-over-year, down from earlier peaks. This persistent inflation adds another layer of appeal to Treasury bonds, offering yields that outpace inflation — an attractive prospect for those seeking steady, real returns.

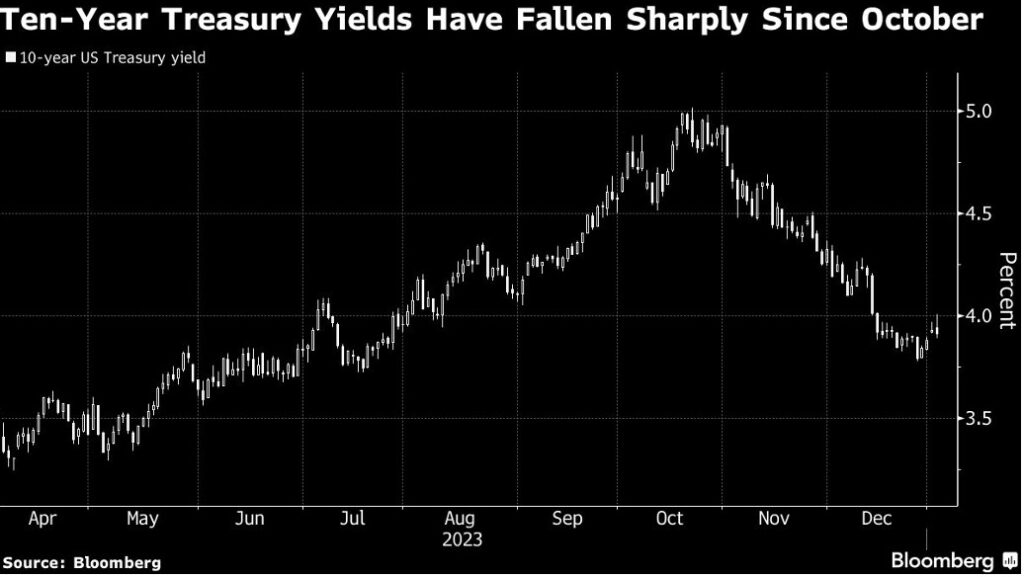

Recent gains have brought 10-year Treasury yields down to just under 4%, from a 16-year high of 5.02% in October. Yields on two-year Treasuries, which are closely linked to expectations for Fed policy, are now around 4.4%, down from their peak of 5.26% on October 19; source: Bloomberg

International Bonds: Global Diversification Gains Traction

International bonds, particularly those from stable, developed markets like Europe and Japan, offer U.S.-based investors a way to diversify amid shifting U.S. interest rates. In 2023, Bloomberg’s Global Aggregate Bond Index experienced a notable rebound, rising approximately 3.7% year-to-date, reflecting increased interest from U.S. investors in global bond diversification. This trend spells out a strategic shift toward spreading risk internationally, particularly as U.S. yields remain volatile.

In a discussion, Henk Potts, Senior Investment Strategist at Barclays, mentioned that emerging market bonds often present an “attractive risk-reward,” particularly as global investors look for yield alternatives in an environment where developed market bond yields remain low. This perspective sits pretty well with the theme of bonds providing both stability and moderate excitement as part of a diversified portfolio, especially when selected carefully in response to ongoing economic trends.

The global bond rally has regained momentum due to econ concerns in the US and weak figures in the Eurozone. Value of global bonds rose 0.3% this week to $69.29tn, almost a fresh ATH. pic.twitter.com/uComZ4HR0t

— Holger Zschaepitz (@Schuldensuehner) September 8, 2024

However, the appeal of emerging market bonds remains tempered by the Fed’s rate increases, which strengthen the dollar and complicate debt repayment in dollar-denominated bonds. For instance, Brazil saw its 10-year government bond yield soar above 12% in 2024, highlighting both attractive yields and the economic risks tied to its fiscal landscape. Meanwhile, South Africa’s 10-year bond yield has remained close to 9.5%, reflecting a high, though slightly lower, yield level compared to Brazil.

Green Bonds: Investing with Purpose

The demand for green bonds continues to climb as environmental concerns gain traction in financial decisions. According to the Climate Bonds Initiative, the global green, social, and sustainability (GSS+) bond market is on track to exceed $5.1 trillion in cumulative issuance by mid-2024. Although the green bond market alone initially surpassed the $500 billion annual issuance milestone back in 2021, ongoing growth has positioned the market for an anticipated $1 trillion in yearly issuance by 2025. This steady expansion underlines the market’s commitment to sustainable finance and climate resilience.

A decarbonised world will require more investments – green investments.

— Ursula von der Leyen (@vonderleyen) September 23, 2024

Last year, I launched a €1 billion Green Bonds initiative to kickstart green bonds markets in developing countries, like Small Islands States.

This year, we go a step further ↓ https://t.co/Xxuugl5qVD

These bonds, which fund eco-friendly projects like renewable energy, offer investors a way to support sustainability while achieving stable returns. Marilyn Ceci, Global Head of ESG Debt Capital Markets at JPMorgan Chase, explains that green bonds are vital tools for connecting investor interest with corporate commitments to sustainability, driving positive environmental outcomes.

In addition to their environmental appeal, green bonds are often backed by government or large corporate guarantees, adding a layer of stability. In 2024, public-sector entities, including government agencies, sovereigns, and municipalities, contributed significantly to the sustainable bond market, making up around 42% of global issuance. This government involvement has made green bonds more attractive to risk-averse investors, particularly in emerging and developed markets.

The UK is at the forefront of sustainable finance, raising £10.5 billion through green bonds in 2022-23.

— zensar (@Zensar) October 23, 2024

Explore how the UK is setting the standard in green finance: https://t.co/3kjHMeyNwT#UKBanking #SustainableFinance #ESG #GreenBonds #UKFinance pic.twitter.com/x4dHJZzA3w

Governments in Europe have been leading the charge, with the European Commission’s NextGenerationEU recovery fund pledging to issue up to 30% in green bonds, amounting to around €250 billion (~$275 billion) by 2026.

Municipal Bonds: Low-Risk, Tax-Friendly Options

Municipal bonds in the U.S., valued at approximately $4.1 trillion, generally offer interest that is exempt from federal income tax, with some bonds also exempt from state and local taxes for in-state investors. However, certain bonds may be subject to the Alternative Minimum Tax (AMT). Investment-grade municipal bonds also have historically lower default rates than corporate bonds, making them appealing to conservative investors.

Local governments issue these bonds to finance infrastructure projects, from schools to hospitals, creating a “double benefit” for investors who seek steady returns while supporting community projects.

According to recent insights from BlackRock and data from Moody’s, investment-grade municipal bonds in the U.S. have a historically low default rate, averaging around 0.1%. This makes them one of the most stable options among fixed-income securities, appealing particularly, once and again, to conservative investors. However, default rates can vary slightly among lower-grade municipal bonds, though these remain relatively low compared to corporate bonds.

Peter Hayes, Head of the Municipal Bonds Group at BlackRock, drives home their appeal that high-yield municipal bonds have the potential to outperform the general market.

With interest rates higher, municipal bonds have seen renewed interest from investors in high-tax states like California and New York. Data from S&P Global shows that muni sustainability bond issuance could increase by 5% reaching $44 billion by the end of 2024, a strong indicator of their tax-saving appeal. For investors seeking both security and tax advantages, municipal bonds present a blend of benefits not easily matched elsewhere.

Emerging Market Bonds: High Yields with High Stakes

On the other hand, emerging market bonds from countries like Brazil, India, and South Africa attract investors with comparatively higher yields, typically ranging from 6-12%, far higher than developed markets. Yet, these bonds come with significant risk, particularly as the Fed’s rate hikes strengthen the dollar, making debt repayments more expensive for these countries. A 2023 IMF’s analysis warns that many emerging markets face heightened debt vulnerabilities due to high global interest rates and inflation, a reality that keeps some investors cautious.

The long end of the US bond market controls global financial assets today. Expected Fed policy shifts are the primary driver shifting bond curve. That means easier Fed policy is going to have to get priced in to keep the rally going.

— Bob Elliott (@BobEUnlimited) May 16, 2024

Assets have moved with yields in the last 2m pic.twitter.com/WB7NgoYrrv

Municipal bonds continue to draw investor interest in 2024, especially for their tax-saving benefits, with high demand in states like California and New York for sustainability-related issuances. Broad market indexes suggest positive returns by year-end, largely due to favorable tax-equivalent yields amid economic conditions.

Emerging market bonds can serve as portfolio diversifiers, though the risks, including currency instability and political unrest, are very real. In South Africa, for instance, bonds — particularly long-term ones like the 10-year — offer yields of nearly 9.50%, but investors remain wary due to the country’s economic and political volatility, as well as currency depreciation risks. This duality makes emerging market bonds suitable primarily for those with a high tolerance for risk.

Emerging markets #equities outpaced their developed market counterparts in the third quarter, gaining 8.7% compared to a 6.4% rise in developed markets.https://t.co/vZQI4crk0x

— #DisruptionBanking (@DisruptionBank) October 28, 2024

As the Federal Reserve’s rate adjustments ripple across global markets, each bond type offers distinct advantages and risks. With 10-year U.S. Treasury yields around 4.2% to 4.30% and longer-term yields, like the 30-year, nearing 4.5%, Treasuries offer a stable option for conservative investors amid stock market volatility. International bonds enable diversification, while green bonds let investors contribute to sustainability without sacrificing returns. Municipal bonds, a staple in the U.S., offer tax advantages, and emerging market bonds deliver high yields for those prepared to navigate economic and political risks.

The bond market in 2024 offers, on a platter, if you will, diverse paths to fit various investor goals — from stability-focused to high-yield seekers. For street-smart investors, the choices reflect a changing economic setting, where each bond type holds unique value amidst a rebooting global market.

Author: Richardson Chinonyerem

#Bonds #FederalReserve #InterestRates #Inflation