The global exchange-traded fund (ETF) market is poised for another banner year after cumulative assets reached a record $13.4 trillion at the end of the third quarter, according to a new report by Morningstar. The report indicates that global ETF flows totaled $947 billion in the first nine months of 2024 and are on track to surpass $1 trillion by the end of the year, barring any significant market disruptions.

The $13.4 trillion of global ETF assets as of September 30 represents a 38.14% jump from Q3 2023, when global ETF assets totaled $9.7 trillion. Since the debut of the pioneering SPY ETF in 1993, which tracks companies in the S&P 500, the global ETF industry has witnessed relentless growth fueled by consistent fund inflows, rising market indices, and the introduction of innovative products that appeal to both institutional and retail investors.

Notably, investors have maintained their confidence in ETFs even during periods of market turmoil, including the 2008 global financial crisis, the COVID-19 pandemic, and the subsequent inflationary surge and interest rate hiking campaign.

“Remarkably, there has never been a negative quarter for flows since the beginning of Morningstar’s flows database in 2008,” said Syl Flood, senior product manager at Morningstar. “Monthly outflows have occurred only 10 times over that 201-month stretch.”

Flood noted that a key factor driving the persistent growth in global ETF assets and flows was the continuing migration of money from traditional open-end mutual funds into ETFs. Another factor, he pointed out, is that market sentiment “is still risk on”.

Bullish Projections

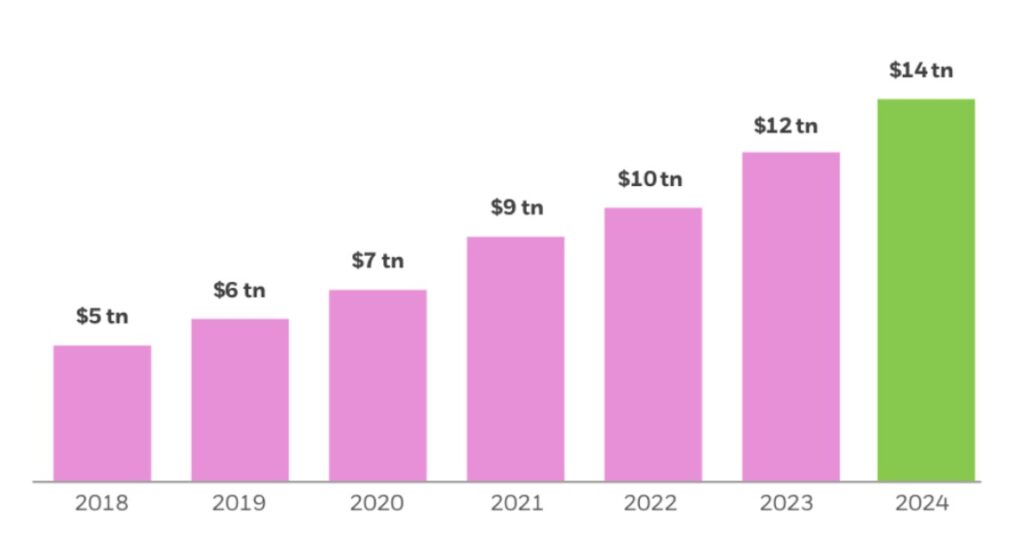

BlackRock, the largest provider of ETFs globally through iShares, expects ETF growth to accelerate in the years ahead as “investors increase their use of ETF strategies as tools to potentially beat the market.” It projects that global ETF assets will surpass $14 trillion this year.

Source: BlackRock

“As investors recognize that asset allocation tends to be more important than individual security selection, they are likely to step up their use of ETFs as building blocks in asset allocation and as vehicles to deliver factor-based investment strategies that seek to emphasize persistent drivers of returns,” stated BlackRock.

In a pointer to the growing momentum the global ETF industry has garnered, PwC analysis reveals that the number of asset managers offering ETFs has more than doubled since 2013. The figure has risen from 233 a decade ago to 582 by the end of 2023. Notably, 60% of the top 100 asset managers now offer ETFs.

“This highlights the considerable opportunities that asset managers have seen in the ETF segment over the past decade which according to our survey results show no signs of abating,” PwC noted.

PwC’s Global ETFs survey 2023, which included responses from over 70 executives—more than 80% of whom are ETF managers or sponsors—revealed heightened optimism about the continued growth of the global ETF market.

The survey projects that global ETF assets under management (AuM) will exceed $19.2 trillion by June 2028. This growth represents a five-year compound annual growth rate (CAGR) of 13.5%, more than double the anticipated 5% CAGR for the asset and wealth management industry as a whole in the five years up to 2027.

📈 This month in our AM #MonthlyBriefing we discussed the highlights of our 2023 PwC Global ETF Survey. Ready to find out what they were? Give our video a watch then 👇 https://t.co/y4ReOQyxH2

— PwC_Luxembourg (@PwC_Luxembourg) April 11, 2024

Fixed Income Driving Growth

When it comes to the next big thing in ETFs, Vanguard Chairman and CEO Tim Buckley believes that fixed income is a key area of growth of the industry.

“Well, old is new, if you will. Fixed income, one of the oldest asset classes out there, will drive the growth of ETFs in the next decade. And we know that fixed income belongs in most long-term portfolios. We already talked about how the ETF is a good building block for portfolios, but yet the penetration of fixed income into the ETF structure has lagged way behind equities. It’s probably a decade behind,” he noted last year in a podcast hosted by State Street Chairman and CEO Ron O’Hanley to mark the 30th anniversary of the launch of the SPY ETF.

“In fact, equity penetration to ETFs is 50% more than that of fixed income. So we expect in the next decade for fixed income to start to close that gap and make it into ETF form and make it into client portfolios,” added Buckley.

According to the PwC Global ETF Survey, fixed income ETFs recorded a strong 24.4% year-on-year increase in 2023 and are expected to continue on this trajectory. “More than eight out of ten survey respondents expect significant demand for fixed income ETFs over the next two to three years, although long-term demand will be contingent on inflation and interest rate movements.”

Flows into fixed income ETFs continue at a robust pace, with net new assets of USD6.8 billion in September, according to Invesco.https://t.co/AJOwLbPcjQ

— #DisruptionBanking (@DisruptionBank) October 16, 2024

BlackRock attributes the rising popularity of bond ETFs to their ability to offer investors more efficient market access. “We believe there is tremendous growth potential in bond ETFs as institutions find it more difficult to access individual bonds. To facilitate large transactions, investors are increasingly likely to use bond ETFs alongside or instead of single securities,” it stated.

Bond ETFs enable the efficient trading of bundles of securities that would otherwise be difficult and costly to access individually. According to BlackRock, trading individual emerging market bonds from more than 50 countries can be up to 65 times more expensive than using an ETF that tracks an index, illustrating the appeal of these ETFs to investors, who are invariably sensitive to costs.

Education And Product Innovation Key

Despite their explosive growth over the decades, ETFs still have a long runway for greater adoption, State Street notes, citing Morningstar data which showed that passive and active ETFs accounted for less than 12% of investable assets globally at the end of 2023.

However, what will ensure sustained ETF adoption, particularly by self-directed retail investors, is a relentless focus on education and product innovation.

“I think the next big thing is just making sure more people know how to use ETFs, that they understand the different ways they can be used and that people are really doing that education. There’s clearly product opportunity, there’s opportunity in new markets,” said Deborah Fuhr, Founder and Manager Partner of ETFGI, in a podcast with Yie-Hsin Hung, President and CEO State Street Global Advisors.

“There’s also opportunities in how ETFs are being used as building blocks. I think retail is a huge opportunity around the world. We’re just seeing that really scratch the surface in many markets like Europe, Latin America and Asia,” Fuhr added.

Author: Acutel

We are global investors who invest in good companies at fair valuation and speculate on all else subject to the risk exposure we can afford.

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.