Building a successful startup is challenging; building one in fintech is even tougher. Yet, some startups have defied the odds. Today, we spotlight a California-based fintech startup — Finfare, Inc. — that has done just that.

California is renowned for its vibrant startup ecosystem. Many of the world’s biggest tech companies, like Google and Apple, began in humble garages — garages that happened to be in California.

While many tech giants in California are rooted in the Bay Area, some have found their beginnings elsewhere. Near the iconic Balboa Bay Club in Southern California, and just miles from Irvine — one of America’s best places to live — Finfare’s founder drew inspiration. Here, the focus sharpened on assembling a team of top-tier fintech innovators. The Mavericks.

How Ambition and Entrepreneurialism Drive Fintech Innovation at Finfare in Irvine

Fintech isn’t just about payments and banking transactions. It’s more than Revolut or Chime. It is about communities and ecosystems and solutions.

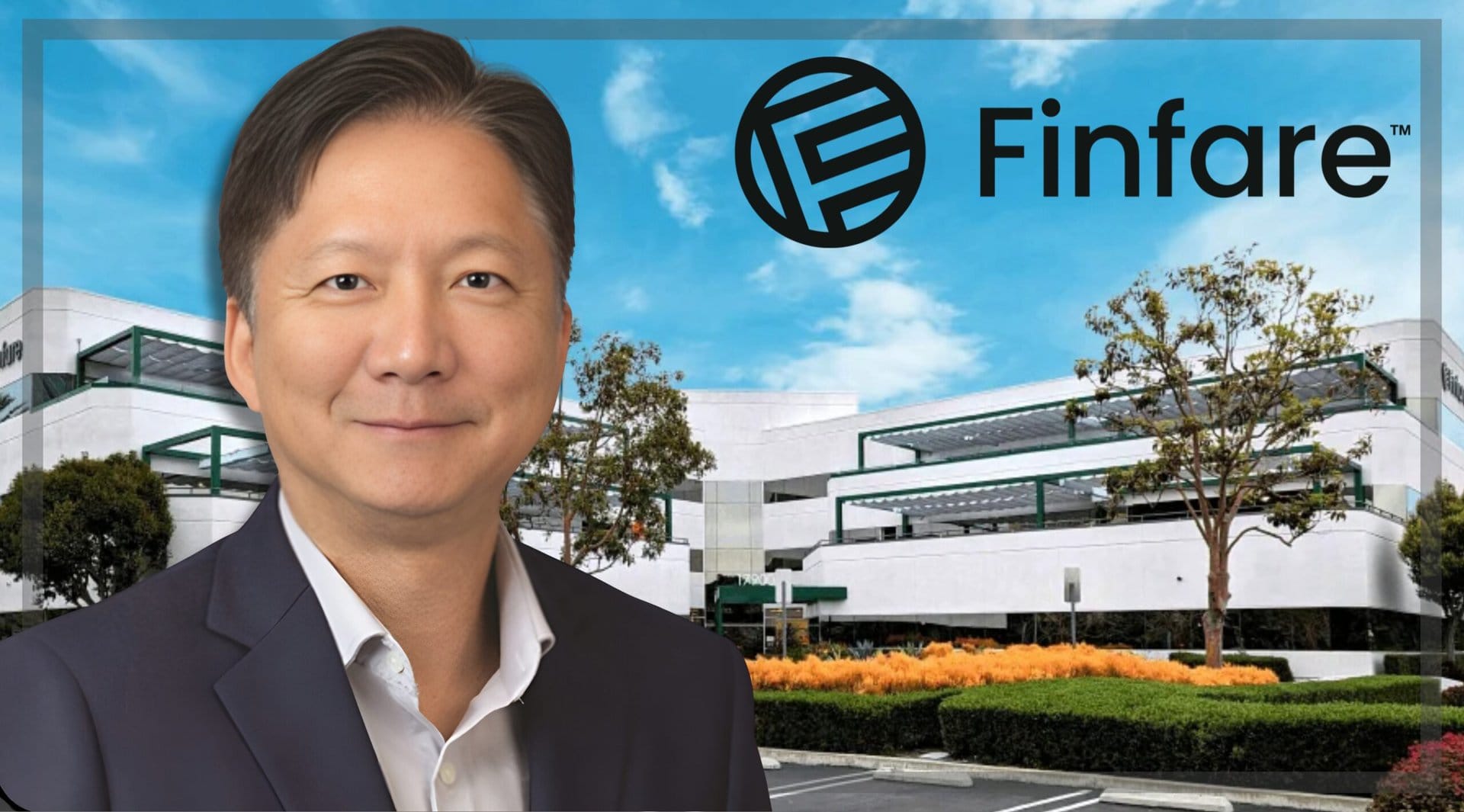

Wayne Lin, the visionary Founder and CEO of Finfare, embarked on his entrepreneurial journey with a mission to solve critical challenges for small businesses. As a Taiwanese immigrant, Wayne began his journey in the U.S. with little more than ambition and determination. Despite the challenges, he achieved remarkable success. In his 30s he sold his company which allowed him to refocus his efforts on Finfare when the time came.

On December 6, 2021, he met with some friends at the Balboa Bay Club in Newport Beach, California. It was then that one of his friends spoke with him about the investment opportunity he was seeing in the financial technology sector. This resonated with Wayne. In his time as an entrepreneur, he experienced the same challenges that other small businesses go through. Problems with gaining funding, money management, or business capitalization for instance.

Fast forward several years and today Finfare is a modern expense management platform that leverages cutting-edge AI technology for all types of businesses. We spoke to Wayne about the philosophy and mission behind Finfare.

At Finfare the Customer is for the Long Term

From the inception of Finfare, Wayne’s focus was on empowering small businesses. He made a commitment from day one to support his customers for the long haul. The team at Finfare worked tirelessly to get to know the customers. And they often went above and beyond to help customers gain access to finance and capital.

The Fintech StartUp, @FinfareHQ was driven by the need to tackle the obstacles that small and medium-sized enterprises (SMBs) encounter when it comes to financial management. https://t.co/BYaYWp2yaB pic.twitter.com/n7Rg7Fpe5W

— Digital Startup (@digitalstartup5) September 1, 2024

“When we strategize, we ask how close we can be to our customers,” Wayne explained. He added how the driving principle of Finfare is to partner with clients for life.

“I would prefer to have one customer who loves Finfare, rather than a thousand who are just transactional,” Wayne highlighted.

Initially, the customer base for Finfare was small businesses in general. There was no vertical that the teams focused on. Wayne shared how one of those customers when the company started to work with Finfare, was clearing about $400,000 a month. Over the years, and because of access to products like the Finfare expense management platform as well as capital that larger banks had been reluctant to offer them, today that company has grown substantially. Importantly, Wayne highlighted, that Finfare had been able to grow side-by-side with this customer.

While Finfare’s growth ambitions are global, the company initially focused on customers that were located nearby allowing Wayne and his team to get to know their customers, make personal connections, and get real-time feedback to ensure Finfare’s products and solutions were meeting their customer needs.

“We have in-person connections with many of our customers,” Wayne explained. “We talk to them; we invite them to our office.”

Wayne believes that Finfare is at a stage where it can set the standards about how to treat customers for the long term. He does not believe that there is a rush to show flashy growth numbers. When asked about any future exit strategies, Wayne is keen to highlight that he doesn’t have one.

“Why would I want to exit my team? My customers?” Wayne asked. “I want to be with them for life. For me it’s about how close I can be to our customer and not how much money we can make from that customer. That will come with time. The fundamental principle remains to try to be as close as possible to our customers.”

Working in Partnership

Today, Finfare doesn’t just have small businesses within its customer base. There are some bigger customers too. To help cater to these different types of customers Finfare has partnered with leading companies like Marqeta, Plaid, and Alloy. By adding these partners to the in-house expertise already available within Finfare the company caters to practically every need that a company could have from a fintech or traditional finance player.

If we hope to keep the American experiment in democracy going well into the 21st century, we must support the small businesses constituting our societal backbone

— Digital Startup (@digitalstartup5) September 1, 2024

This is not just central to @FinfareHQ's value proposition, but also its raison d’être https://t.co/xSYUKcQbr6 pic.twitter.com/8RIQdYuesf

Finfare works indirectly with over 5,000 merchants via affiliate network, gift card, and payment-linked offer partnerships — and millions of users have access to and can benefit from its products. However, at Finfare, Wayne highlighted, that there is more interest in the depth of engagement rather than the number of customers. But, unlike Chime or Chase, he doesn’t just want the numbers. He wants to be able to sit down with these customers. Not just have them as a statistic.

Wayne also pointed out how Finfare is an early-stage startup, unlike Chime or Chase. Wayne believes Finfare’s commitment to building close customer relationships sets it apart from other early-stage startups. Many other fintechs use numbers to impress investors or to look better than the competition. This is not the case with Finfare.

Creating a Top Gun Team

Wayne’s approach to recruiting talent is of particular importance. You need a strong team around you to support his long-term approach. And building that team in a hot market like fintech isn’t easy.

Wayne’s priority was assembling a top-tier product team. With his background as a fintech user, rather than a provider, he sought out the industry’s best to bridge the gap in expertise.

The initial team was brought together. These were the brave, the curious, and the ambitious. Wayne was looking for people who could bring value to customers for life, not just for a few months.

“In the first two years, I was focused on finding exceptional talent,” Wayne shared. “It’s like Top Gun — only the best graduate. We’ve built a Top Gun team here at Finfare.”

One of the latest members of the Top Gun Academy at Finfare is Alan Zrado. Alan is the Executive Vice President of Finfare Connect – the rewards and loyalty business unit of Finfare. He has over 20 years of experience working at the intersection of loyalty & rewards, cards & payments, and data & infrastructure.

What about Finfare Connect?

Connect is Finfare’s rewards and loyalty platform, providing both the technology and the offers for a publisher to acquire, engage, and retain customers.

Wayne views Finfare Connect as a powerful value-creation tool for both B2B and B2C customers, emphasizing the importance of incremental growth. The underlying value is to embrace incremental growth. This is to engage a company’s existing audience, helping them to reach new customers and gain more value. Wayne highlights how Finfare Connect offers this access at an extremely low cost.

Wayne categorizes Finfare’s ecosystem into three categories of products. The first category is the acquisition product. Once the customer is acquired, then the next category is retention. This is undertaken through the existing suite of products such as expense management and capital. It brings the customer into the ecosystem.

Finally, the third category is where Finfare can provide the most value. This is where Finfare Connect can offer a lot. It can offer market exposure very quickly and at a very low cost, Wayne highlighted.

How Finfare Connect Adds Value

When extolling the business concept behind Finfare Connect, Alan joined the conversation. Alan sees Finfare Connect as having vertical and horizontal capabilities.

“In terms of Finfare Connect, I look at things from both vertical and horizontal angles,” Alan explained. Horizontal is focused more on retention and value. Partnering with Merchants and Publishers is acquisition, and building relationships is retention.”

When it comes to the vertical, Alan sees this as the acquisition category. The going to market, building direct relationships with publishers, with merchants, and in some cases with end users.

The acquisition strategy is supported by the rewards program that forms the core of Finfare Connect. Alan sees this as a chicken-and-egg scenario.

“You need a great set of offers to attract users,” Alan shared. “But you need a large audience to be able to get great offers.”

To help customers best utilize the offers, Finfare has created three types of partnerships.

“We partner with affiliate networks, with a gift card provider, and the third piece is what we call payment-linked offers,” Alan embellished. “The third piece is often referred to in the fintech space as card-linked offers.”

To explain this approach, Alan shared how the underlying differentiator is related to data. Finfare doesn’t use traditional card network data. Finfare taps into account-linking data via partnerships with Plaid in the US and GoCardless in the UK.

Critical to the development of Finfare Connect has been the acquisition of Network B in the UK.

The acquisition of Network B in the UK will enable @FinfareHQ to expand its product portfolio, supercharge its merchant network, and provide its business customers with a broader range of financial services to help grow revenues and increase loyalty.https://t.co/Iug0PXk6xe pic.twitter.com/vWTvdxkDc8

— Digital Startup (@digitalstartup5) September 1, 2024

Network B had been offering a rewards program to customers since 2020. Finfare’s acquisition of Network B in July 2023 has improved the ability for Finfare Connect to be rolled out in North America. This led to Alan joining the team in 2024.

“Ideally you want to get a mix of offers that touch on everyday spend,” Alan explained. “Categories like travel, which is an experiential engagement. Dining where we saw that people are going out to eat once or twice a week. The bigger our audience the more we’re going to be able to have the capability to go and engage directly with more merchants. That is our plan for the long term.”

Reiterating what Wayne was saying, though, Alan highlighted that the Finfare Connect product is being built out for the long term. There is no rush. The important thing is to make Finfare’s services and solutions work for the customers. We need to give them products that make them successful, he highlighted.

Wayne added how many big and recognizable brands are already working with Finfare. He also added how it’s not a numbers game. The companies with whom Finfare is building its rewards are relevant to Finfare’s customers.

The Vision Going Forward

“Our goal isn’t to offer just any product,” Wayne concluded. “It’s about becoming a trusted, long-term partner for our customers, far beyond a mere transaction. And that’s why it’s important that Finfare Connect is the next iteration of our service offering to our customers.”

Ultimately, Finfare aims to streamline and transform financial experiences, enabling people and businesses to save money, grow, and thrive.

And, while Finfare has launched its signature products, including Finfare Money and Finfare Connect, the company has plans for future launches in 2025 that will expand and enrich its product offerings for consumers and businesses.

This approach will allow Finfare to bring to life Wayne’s vision of products for acquisition, retention, and revenue.

Author: Andy Samu

See Also:

Finfare and Passion Punch Announce Strategic Alliance | Disruption Banking

The European Fintech Startup Offering Software and Financing to SMEs | Disruption Banking