Shares of Germany’s largest lender, Deutsche Bank, have suffered a 16% drawdown since the bank signalled to investors in late July that it is suspending its share repurchase plan for the rest of the year. Deutsche Bank’s management attributed this decision to the potential legal damages stemming from a protracted legal battle over its botched 2010 takeover of Postbank.

Certain former Postbank shareholders allege in the lawsuit that Deutsche Bank exerted de facto control over Postbank prior to the 2010 public takeover bid, obligating the bank to launch a mandatory offer at a premium price. In April 2024, the Higher Regional Court of Cologne indicated that it might find merit in these claims.

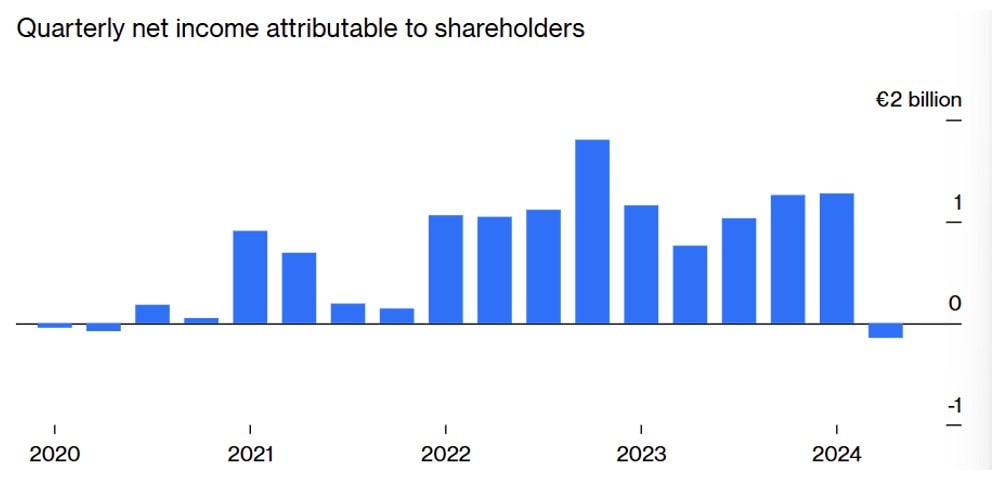

With estimated total claims, including interest, reaching approximately €1.3 billion, the legal dispute has forced Deutsche Bank to set aside a substantial provision to cater for the potential liability. This resulted in a net loss of €143 million in the second quarter of 2024 – the lender’s first quarterly loss in nearly four years.

Deutsche Bank slipped to a first quarterly loss since 2020; source: Bloomberg

Lender’s Promise To Shareholders Still Intact

Commenting on the impact of the provision on the lender’s capital allocation strategy, James von Moltke, the CFO, noted: “For this year, prudence would dictate that we step back from seeking a second repurchase authorisation,” Bloomberg reported.

Moltke expressed confidence that, despite the setback, the lender would still meet its promise to shareholders to return a total of €8bn through a mix of dividends and buybacks between 2021 and 2025. Deutsche Bank completed a € 675 million share repurchase program in the second quarter, bringing the cumulative capital distributions from 2022-2024 to € 3.3 billion.

The finance chief also highlighted the improvement in the bank’s common equity tier one ratio (CET1) – a key measure of a bank’s balance sheet health and financial stability. The bank’s CET1 ratio came in at 13.5% of risk weighted assets, an increase of 10 basis points from the first quarter.

“With a ratio (CET1) of 13.5% we more than offset the impact of the litigation provision. That sets us up well going into next year to continue delivering on the commitments we made to shareholders around the capital distribution trajectory,” he remarked.

In terms of the outlook, Moltke warned that while investors are anticipating interest rate cuts, the political climate is another critical factor to watch. With major elections scheduled in the US and Europe, among other countries, this year, political uncertainty could significantly impact global markets.

“Looking at the US specifically, and perhaps Germany’s reaction to it, [people naturally are looking at the possibility of aTrump victory and what that means from a policy perspective, how it will affect Europe, the economy, trade, the defence situation that we live within,” he noted.

Investment Banking Unit Shines

Deutsche Bank’s renewed investment banking push appears to be paying off after the lender reported that pre-tax profits from the unit surged 25% to €746 million on net revenues of €2.6 billion (up 10% year on year).

Growth was primarily driven by a doubling of origination and advisory revenues to € 585 million from €291 million a year earlier. This is revenue generated from advising companies on deals, as well as raising debt or equity capital. Over the past 18 months the bank has been on a hiring spree, adding over 100 investment bankers as it seeks to capitalise on a rebound in the global mergers and acquisitions market.

According to PwC, the global M&A market is showing increasing signs of recovery following a 5% increase in the value of M&A deals compared to the first half of 2023. Brian Levy, Global Deals Industries Leader, Partner, PwC US, argues that the strategic need for M&As continues to grow stronger.

“The daunting combination of high interest rates, current valuations and political uncertainty has been a showstopper for many deals. Nevertheless, the strategic need for M&A continues to grow stronger, creating pent-up demand which will be unleashed as these uncertainties resolve,” he notes.

The resurgence in global M&A activity has not only benefited Deutsche Bank but many of its rivals as well, including Wall Street banks. According to the Financial Times, the five largest investment banks — Goldman Sachs, JPMorgan Chase, Morgan Stanley, Bank of America and Citigroup — together reported investment banking fees of $8.2bn in the second quarter, a 40% increase from a year earlier and the highest since the start of 2022.

Investors Bullish Despite Setback

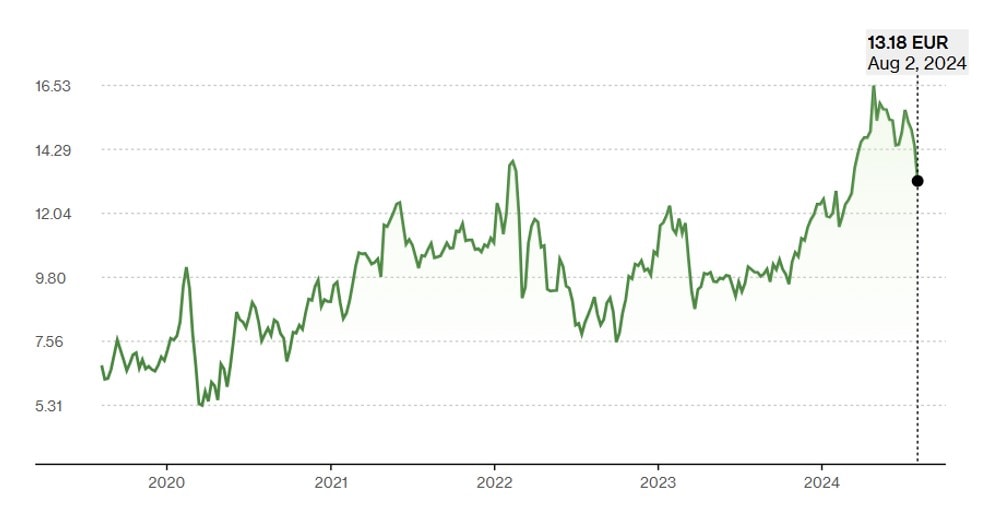

Deutsche Bank shares have plummeted by around 16% from recent multi-year highs of around €16 a share as the spectre of a multi-billion euro legal bill looms over the lender. Investors are now grappling with a crucial question: is this a golden opportunity to buy or a sign of waning confidence in the bank’s future? Despite the stock’s downturn, the bank has delivered solid operational performance in recent quarters. As a result its share price has doubled over the past five years, reflecting investor satisfaction with the lender’s turnaround efforts.

Deutsche Bank stock price has doubled in past five years; source: Bloomberg

However, the recent legal setback has overshadowed this positive trajectory. In fact, without the hefty provision for the Postbank litigation, Deutsche Bank would have reported another strong quarter, with pre-tax profits climbing to €1.7 billion compared to €1.4 billion in the same period last year.

The legal battle facing Deutsche Bank casts doubt on whether the lender has truly shed its troubled past. The bank has undergone a significant transformation in recent years, rebounding from a period marked by successive losses and a litany of embarrassing and costly scandals. Between 2014 and 2021 the lender racked up net annual losses due to litigation charges related to a series of scandals.

This includes a high-profile money laundering investigation connected to the Panama Papers that saw its Frankfurt offices raided by police in 2018. It has also come under fire for lending to former US President Donald Trump and his companies billions over the years, among other controversies.

Deutsche Bank is working hard to rid itself of this image of the “bad boy” of global banking after years of its reputation being tarnished by a series of controversies. The possibility of an adverse judgement in the Postbank case could undermine these efforts.

While the bank’s financial performance has improved – with a stronger capital position and plans to resume share buybacks in 2025 – the question remains whether investors will prioritise the bank’s improving fundamentals over the lingering concerns about the final ruling in the Postbank case. Has Deutsche Bank finally put its litigious past behind or will this case open the door to more legal woes and further strain future capital distribution to shareholders?

Author: Acutel

We are global investors who invest in good companies at fair valuation and speculate on all else subject to the risk exposure we can afford.

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.