French banking giant BNP Paribas reported record second-quarter profits, driven by a surge in equities trading. The eurozone’s largest bank by market value saw net income jump 21% to 3.4 billion euros, surpassing the 2.9 billion euros consensus estimate by analysts covering the bank. Similarly, Group revenues rose 8% to 12.3 billion euros, trouncing analysts’ expectations of 11.9 billion.

The bank’s corporate and investment banking division was the star performer of the quarter, with revenues from equities and prime brokerage soaring by 58% to 1.15 billion euros. These services involve facilitating stock purchases and sales, providing loans to clients, and offering a range of support services, particularly to hedge funds.

The lender’s equities trading business benefited from increased market volatility triggered by European elections and the European Central Bank’s (ECB) decision to ease monetary policy and cut interest rates as inflation continues to fall. As investors adjusted their portfolios in response to these events, trading activity picked up, boosting BNP Paribas’ income from the equities business unit.

Jean-Laurent Bonnafe, BNP Paribas CEO, has strategically prioritized equities trading as a key business growth driver in recent years. He bolstered the unit by acquiring businesses and client relationships that competitors like Deutsche Bank AG and Credit Suisse were divesting.

BNP Paribas details some of the growth in its stock-trading division after reporting a 57% yoy revenue uptick in Q2

— Chris Whittall (@Chris_Whittall) July 24, 2024

Shows growth in equity derivatives and prime brokerage in particular

Big 5 US banks reported gains of ~20% on average in Q2, albeit from a higher base pic.twitter.com/181cT0ldjW

Preparing For Rate Cuts

BNP Paribas’ strong corporate and investment banking performance offset a decline in the French retail business, which suffered an 11% drop in net interest income. (NII). This metric simply refers to the difference between what banks earn on loans and what they pay on deposits.

NII has remained elevated across the European banking sector in recent years due to an increase in rates, but as the ECB reduces rates, analysts expect banks to face pressure on this key earnings driver. While higher rates have boosted bank profits, the shift to a lower interest rate environment could impact revenue streams and compel them to rely more on fees to boost income.

BNP Paribas’ finance chief, Lars Machenil, believes that while there are challenges ahead, signs of easing inflation and the ECB;s pivot on rates suggest a potential economic upturn.

“I see this optimism that there are green shoots on the horizon, with inflation tapering off, and the ECB is moving on rates.” he told Bloomberg, adding “Our stance is that there will be two rate cuts this year.”

Despite the uncertain outlook, BNP Paribas has maintained its full-year profit growth target for 2024. “With the very solid result in the second quarter, we’re able to confirm our 2024 trajectory assisted by an overall environment that we expect to become more favorable in the second half in particular for BNP Paribas…our trajectory in 2024 will be supported by the growth in our revenues which we anticipate being above 2% versus last year,” CEO Bonnafe stated on the earnings call with analysts.

He reiterated that the Bank’s “business model is well adapted to the expected gradual decrease in interest rates and we do confirm our strong ability to step up our free business.”

The lender is also slashing €1 billion in costs this year as it navigates a complex economic environment. Additionally, the bank is undergoing a restructuring of its personal finance unit, with expectations of improved performance by year-end.

“We will also continue the implementation of operating efficiency measures as well as our disciplined management of cost of risk. The intent is to continue leveraging on the key strengths of the group which are particularly relevant in the current environment,” Bonnafe remarked.

“The second half of 2024 should see the continued implementation of the previously announced additional operational efficiency measures of EUR400 million. We expect to achieve efficiency savings of EUR650 million, adding up to the EUR1 billion over the full year.”

“With the unemployment rate rising above the 4.0% level that the Fed penciled in for the year-end another increase in the jobless rate could challenge our base case of one rate cut this year in Dec, raising the possibility of two cuts starting in Sep.”https://t.co/G6An92nx1y

— #DisruptionBanking (@DisruptionBank) July 26, 2024

Stock Attractive For Income Investors

Despite the record quarterly performance, BNP Paribas shares’ have not moved much since the earnings and are flat YTD, with investors weighing the risks that interest rate cuts pose on net interest income.

\That said, the stock remains highly attractive for income investors in view of the high dividend yield of 7.23% and the fact that management expects earnings to continue growing. The company intends to sustain return of capital to shareholders over the next few years, according to Bonnafe.

“Regarding our dividend per share, we have the same continued growth with a CAGR of more than 10% over the period ’12 to 2023, reaching EUR4.6 per share in 2023. Over 2024, 2026 we will return to our shareholders an estimated amount of EUR20 billion.”

Betting On China And M&As

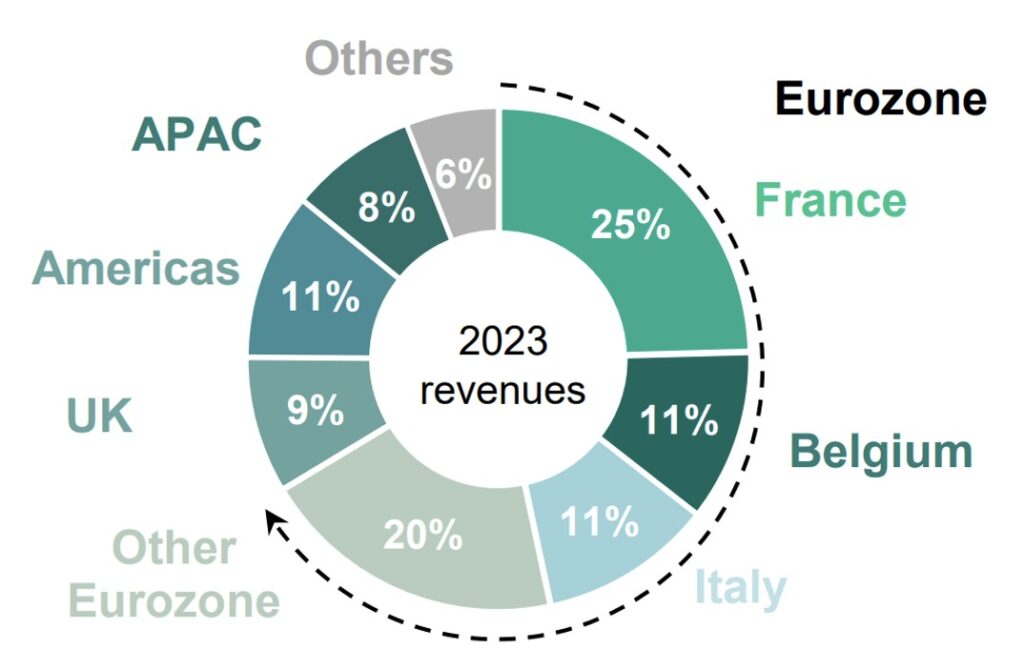

While BNP maintains a global footprint, 25% of its revenue in 2023 was attributable to its operations in France, and well over half from the Eurozone and the UK.

BNP Paribas revenue breakdown by region; source; investor presentation

It’s now making a bigger bet on China’s brokerage and asset management sector in a bid to diversify its geographic footprint. Earlier this year, it secured regulatory approval to establish a fully owned securities brokerage in China, marking a significant milestone in its expansion plans in the world’s second-largest economy.

The China Securities Regulatory Commission (CSRC) granted the green light for the new brokerage, which will offer a range of services including trading, investment consulting, and asset management. The bank will invest RMB1.1 billion (US$150 million) in the venture.

The approval comes as part of China’s ongoing financial market liberalization, which has allowed foreign banks to fully own securities businesses since 2021. While several Wall Street banks have already taken advantage of this opening, BNP Paribas’ approval is a win for European firms seeking a greater foothold in the Chinese market

Meanwhile, BNP Paribas is also looking at potential mergers and acquisitions to expand its asset management arm. Sources familiar with the matter say BNP Paribas is in preliminary discussions with French insurance giant AZA centered on creating a joint venture.

Such a deal, if actually inked, could create a behemoth in the European asset management industry Axa Investment Managers had €859 billion of assets under management at the end of March while BNP Paribas Asset Management had €562 billion.

Author: Acutel

We are global investors who invest in good companies at fair valuation and speculate on all else subject to the risk exposure we can afford.

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.