Polygon (MATIC) has been an important player in the crypto market, known for its advanced technology and solutions to scale Ethereum. However, its journey has been anything but smooth. Despite its potential, MATIC holders have faced challenges in maintaining price recovery. This piece explores the reasons behind this struggle, the broader market trends, and investor sentiments impacting MATIC and similar altcoins.

The Struggles of Polygon (MATIC)

Right now, MATIC is trading at $0.5413 on CoinMarketCap with a market cap of $5.42 billion. The price has seen big swings. Even when the price goes up for a bit, it often plummets, which is hard for Polygon holders. In July, the number of MATIC holders kept growing, showing a 76% increase year-on-year. The price has been fluctuating, with an expected average of $0.55 this month, despite a brief spike on July 16, 2024. This increase didn’t last long, showing that many holders are ready to sell as soon as they can break even. This constant selling pressure might push MATIC’s value down to $0.50, lower than the month’s average of about $0.55.

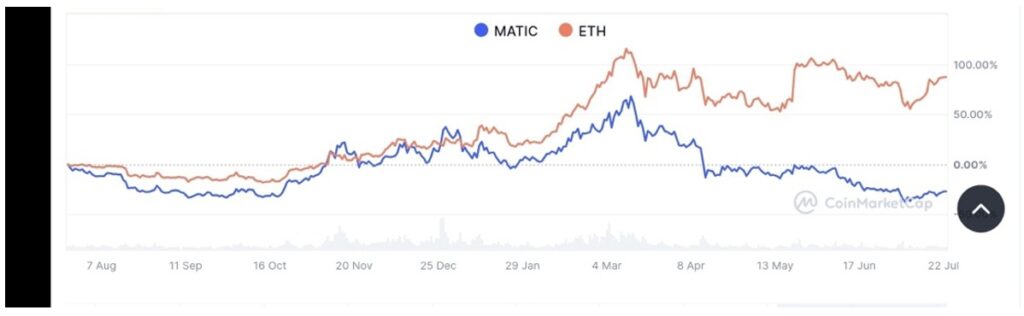

In January 2024, MATIC saw a price increase from $0.75 to $1.20 but fell back to $0.70 by February. This volatility discourages long-term holding. During the March 2024 year-high rally, many holders sold their assets when prices reached $1.24, reflecting a lack of confidence in sustained recovery. Data from CMC shows that MATIC’s performance has continuously declined since last year. The biggest drop happened on June 5, 2024. Compared to Ethereum, which saw a steadier increase in value, MATIC’s performance appears unstable, highlighting the challenges faced by smaller altcoins.

MATIC vs Ethereum Price Chart, Source: CoinMarketCap

Regulatory pressures, such as the SEC’s scrutiny of altcoins, have further exacerbated MATIC’s price instability. In May 2024, news of potential regulations contributed to a 15% drop in value.

MATIC’s liquidity has been lower compared to top-tier cryptocurrencies. In April 2024, MATIC’s daily trading volume averaged $266 million, significantly lower than Ethereum’s $20 billion. Delays in implementing Polygon’s latest scaling solutions, Polygon 2.0 — from MATIC to POL, a reportedly “next-generation token” that can host “a vast ecosystem of ZK-based L2 chains,” unveiled in June and announced on their official X handle in October last year — have also affected investor confidence. In March 2024, this delayed rollout of zk-rollups possibly led to a 10% price dip, besides other macroeconomics that may have played out.

The POL token upgrade is now live on Ethereum mainnet.

— Polygon | Aggregated (@0xPolygon) October 25, 2023

Polygon 2.0, released this summer, is a roadmap for scaling Ethereum to build the Value Layer of the Internet. POL unlocks that future.

POL is a next-generation token that can power a vast ecosystem of ZK-based L2 chains.… pic.twitter.com/gmrsu0ZqLz

However, according to Polygon’s latest news blog on July 18, “September 4th is the expected mainnet date for the MATIC → POL upgrade.”

Investors Remain Optimistic of a Better Tomorrow for MATIC

Coming on the heels of this upgrade, despite the financial setbacks, the sentiment among MATIC investors remains somewhat positive. This optimism indicates a strong belief in MATIC’s future. However, investor sentiment can be fickle, rapidly shifting with new developments or news.

A June 2024 survey by CoinMarketCap revealed that many MATIC investors were optimistic about its long-term potential despite short-term losses. Polygon’s active developer community continues to back the project, with over 1,500 new dApps launched in the first half of 2024. News of partnerships, such as Polygon’s collaboration with Starbucks for a loyalty program in December last year, temporarily boosted investor confidence and price.

Starbucks Korea is promoting the use of personal cups using NFTs. Just launched the program on @0xPolygon https://t.co/xnu3l3KiJO

— Sandeep | AggLayer 👿 (@sandeepnailwal) December 22, 2023

Broader Market Trends

The broader altcoin market has been underperforming. Since the start of 2024, altcoins, excluding Ethereum, have dropped 17% against Bitcoin. This trend is influenced by institutional movements and the impact of exchange-traded funds (ETFs). The current bullish sentiment is mainly focused on mainstream coins like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Toncoin (TON), and Binance Coin (BNB).

The approval of Bitcoin ETFs in early 2024 has shifted institutional investments away from altcoins, contributing to their underperformance. The proposed launch of five spot Ethereum ETFs on CBOE on the 23rd of July is drawing significant capital, reducing liquidity available for altcoins like MATIC.

Breaking News: Cboe confirms the launch of five Spot Ethereum ETFs on July 23.

— Burns (@Mr_Burns_Sol) July 20, 2024

• 21Shares

• Fidelity

• Franklin Templeton

• Invesco

• VanEck pic.twitter.com/gwCbPP6S4B

Based on a July 2024 report by CryptoCompare, investor sentiment has been heavily skewed towards Bitcoin and Ethereum, with altcoins experiencing reduced attention. The broader altcoin market (excluding Ethereum) has dropped 17% against Bitcoin since the start of 2024, influenced by institutional movements and ETF impact. Increased regulatory scrutiny, particularly in the U.S. and Europe, has made investors wary of smaller altcoins, contributing to broader market struggles.

Many new projects face challenges due to high, fully diluted valuations and limited liquidity, making it difficult to compete with established coins. However, according to Messari — a market intelligence company — Polkadot demonstrated resilience in Q1 2024, with its native token, DOT, soaring to a market capitalization of $12.7B, a substantial rise from the $8.4B recorded in the fourth quarter of 2023.

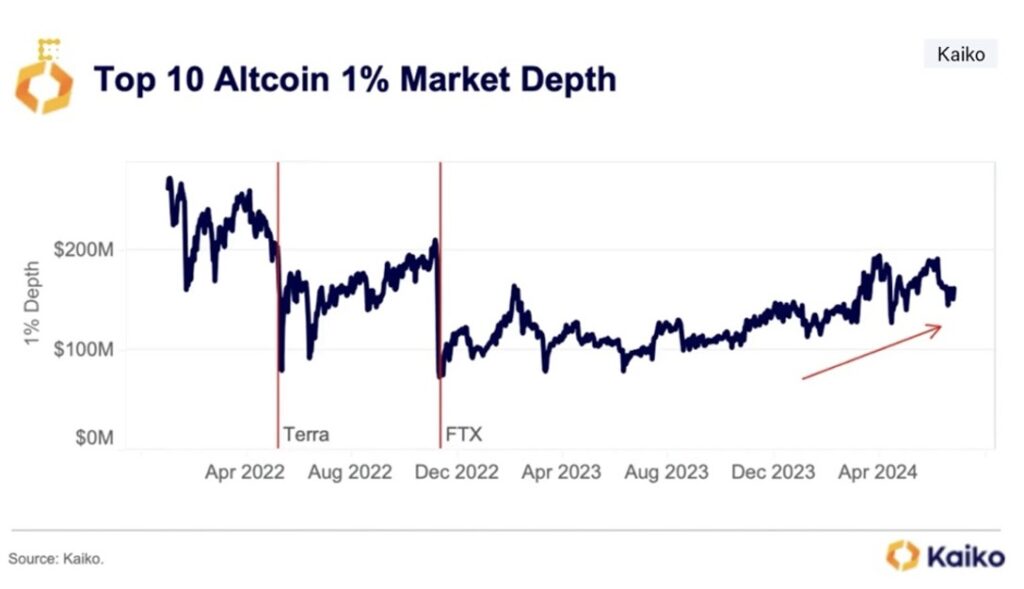

The liquidity situation in the altcoin market has shown mixed signals. While some altcoins have underperformed, overall liquidity in the market has seen significant improvement in 2024. According to data from Kaiko, the aggregated 1% depth for the top ten altcoins by market cap is about $162 million, which has gone up by 38% compared to last year’s average.

Source: Coindesk

What the Future Might Hold for Polygon (MATIC)?

Even though Polygon (MATIC) is facing some problems now, it still holds a lot of promise. Experts think the coin could go up to $0.7194 in 2024. If the market is good, Changelly’s analysts believe MATIC’s price could keep rising, possibly hitting $1.08 by 2025. This shows that investors still have faith in Polygon’s long-term success. Looking further ahead, the predictions are even better. Some say it could reach $18.90 by 2040 and $108.1 by 2050 if MATIC grows as Bitcoin did in the last five years, according to CoinCodex data. This makes it a strong choice for long-term investment.

The upcoming implementation of zk-rollups and other scaling solutions in late 2024 is expected to boost Polygon’s transaction speeds and reduce costs, potentially driving up adoption and price. As mentioned earlier, partnerships with major corporations, like the Starbucks collaboration, are set to enhance MATIC’s real-world use cases, driving future value. Polygon’s growing ecosystem positions it well for future growth and increased token utility.

Polygon (MATIC) exemplifies the volatile nature of the crypto market. Despite facing significant challenges, the long-term outlook for Polygon remains promising. With ongoing technological advancements, increasing adoption, and strategic partnerships, Polygon has the potential to see a substantial rise in value in the coming years. However, investors should be prepared for short-term fluctuations and make informed decisions based on thorough research and an understanding of market trends and investor sentiments.

Author: Ayanfe Fakunle

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.