Cryptocurrencies have always been a wild ride, but when politics get involved, things get even more interesting and unpredictable. As the 2024 United States presidential election approaches, the role of politics in shaping cryptocurrency markets and trading behaviors has become a hot topic, and the influence of political figures and events in this regard is equally undeniable.

As a reputable crypto media platform suggested, political leaders who support crypto innovation could attract younger, tech-savvy voters. On the flip side, those advocating for strict regulations might appeal to voters concerned about security and fraud. How these candidates approach crypto could influence voter opinions and, consequently, impact the market.

What Do the Numbers Say?

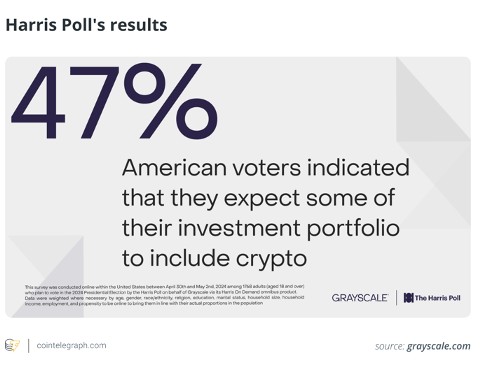

The growing significance of cryptocurrency in U.S. politics is evident as presidential candidates are now accepting cryptocurrency donations. A Harris Poll from November 2023 showed that 47% of American voters think crypto will be part of their investment portfolio in some fashion. This, along with the approval of Bitcoin and Ether exchange-traded funds (ETFs), shows that the future of cryptocurrency looks bright.

Source: Cointelegraph

Interestingly, another Grayscale-sponsored Harris Poll Insights in April found that “nearly half” of voters “do not trust political candidates that would interfere with crypto.” The report further indicated that 3 out of 10 people are more likely to support a pro-crypto politician.

Source: Harris Poll Insights 2024

Historical Context

Looking back to 2017, President Trump’s signing of the Tax Cuts and Jobs Act had significant ripple effects in the stock market and the crypto market. The act substantially increased Bitcoin’s value, with the crypto reaching nearly $20,000 in December 2017.

However, in 2018, Trump’s administration’s crackdown on crypto scams and fraudulent ICOs caused Bitcoin’s price to drop. This demonstrates how political events and statements can influence the market positively or negatively.

The impact of politics on crypto isn’t limited to the U.S. Political events and figures globally also impact the market. For example, regulatory decisions in China have historically caused significant market movements. In 2021, China’s crackdown on Bitcoin mining led to a massive drop in Bitcoin’s price.

Conversely, El Salvador’s announcement of Bitcoin as legal tender had an uptick impact on the market. According to data, the closing price for Bitcoin in June of that year was around $35,127.08, and by September, the price of BTC closed at $43,858.37, again reflecting the market’s sensitivity to political decisions.

The ‘Trump Trade’ and Crypto

Former President Donald Trump, who once famously called Bitcoin a “scam” and insisted that it “competes against the dollar,” which he wanted to remain “the currency of the world,” has recently voiced strong support for the industry.

TRUMP: Bitcoin, it just seems like a scam. I don't like it. I want the dollar to be the currency of the world. pic.twitter.com/CXjALsJmXx

— August Takala (@RudyTakala) June 7, 2021

His promises to support US crypto miners and reduce regulations have won him the industry’s support and funds — like the $1 million in Ethereum (ETH) from Kraken former CEO Jesse Powell, another $2 million in Bitcoin (BTC) from the Winklevoss Twins, and counting.

I just donated $1 million in bitcoin (15.47 BTC) to @realDonaldTrump and will be voting for him in November. Here’s why:

— Tyler Winklevoss (@tyler) June 20, 2024

Over the past few years, the Biden Administration has openly declared war against crypto. It has weaponized multiple government agencies to bully, harass, and… pic.twitter.com/qOQSpmanBR

This shift in stance, often referred to as the “Trump Trade” has made Bitcoin a key issue in the 2024 election.

The Trump Trade refers to the simultaneous surge in US stocks, Treasury yields, and the dollar that followed Donald Trump’s victory in the 2016 presidential election. Bernstein analysts suggest that crypto may emerge as the primary Trump Trade during the current election cycle, with Republican prospects improving and the party’s standard bearer increasingly embracing a pro-crypto viewpoint.

This shift in political stance towards cryptocurrencies is not just a strategy for campaign funding but also a reflection of the growing importance and acceptance of digital assets in the political arena.

Trump now sounds bullish on Bitcoin. Personally, I don’t believe him. He and his administration had a shot for supporting Bitcoin. It was hard if not a full stone wall to work with them.

— Gabor Gurbacs (@gaborgurbacs) March 11, 2024

CNBC video recording by: @thewallstbulloz pic.twitter.com/SFMPEIcaqC

The Crypto Voter Demographic

Furthermore, the crypto voter demographic is a diverse group, not only in terms of political allegiances but also in terms of their social and psychological characteristics. Experts are divided on how the 2024 election will impact the crypto market. Some believe that the market could go up if a pro-crypto candidate wins the election. Others worry that too much freedom could lead to scams and instability.

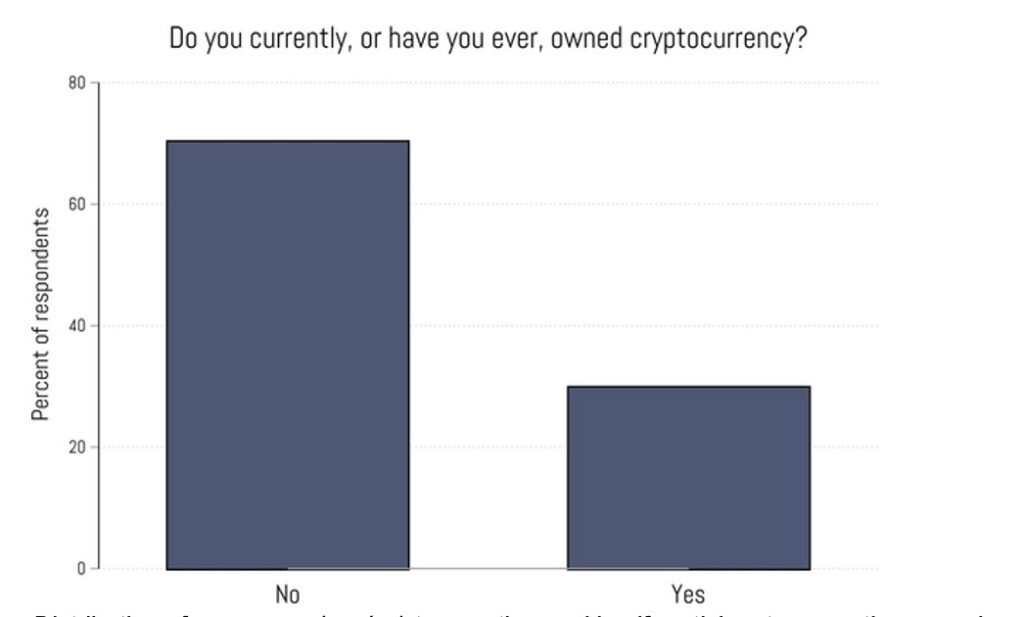

A study published in PLOS ONE journals in 2022 found that 30% of American adults have owned some form of cryptocurrency. These people have a range of political beliefs and identities. The study also found that the crypto market could change significantly around election time.

Source: PLOS ONE Report

How Crypto Policies Could Affect the Election

Cryptocurrency policies are playing a bigger role in the 2024 presidential election than ever. This is the first election where leading candidates are prominently discussing crypto. For instance, as earlier pointed out, Trump now accepts crypto donations for his campaign and has given cryptocurrency industry defenders such as Messari CEO Ryan Selkis a platform to speak about their beliefs. This is the start of his effort to attract the anti-central bank digital currency (CBDC) and pro-crypto vote.

On the other hand, Biden’s campaign claims to be speaking with cryptocurrency firms to seek guidance on good “crypto community and crypto policy moving forward” after Biden, in May, vetoed the Staff Accounting Bulletin 121 (SAB 121) introduced by the SEC — which would allow financial institutions to host cryptocurrencies — alleging that the act would “jeopardize the well-being of consumers and investors.”

Clearly, Trump’s pro-crypto stance has pressured President Joe Biden to soften his previously aggressive stance. However, many believe Biden stands staunchly against the crypto industry.

If Trump wins the election, we might see a rise in crypto investments. If the election leans more Republican, crypto could become the main Trump Trade and hopes of a better regulatory environment could change the narrative around blockchains.

Perhaps in a continued effort by the Trump camp to secure the crypto vote, Decrypt Media recently reported that Trump will still be speaking at the historical Bitcoin Conference in Nashville coming up in less than two weeks from now, despite escaping an assassination attempt over the Weeknd.

While unable to discuss details, BTC Inc. CEO @DavidFBailey told @decryptmedia that event organizers are now anticipating additional security measures at the conference where Trump will be featured as a key speaker. pic.twitter.com/DS2fYSLOBo

— Guillermo Jimenez (@guillermojimnz) July 14, 2024

The marriage of politics and cryptocurrency is a fascinating and complex subject. The influence of political figures and events on cryptocurrency markets and trading behaviors is undeniable. And like Coinbase CEO Brian Armstrong said last year, “Being anti-crypto is a really bad political strategy going into 2024.” And here we are.

Author: Ayanfe Fakunle

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.