Point Zero Forum is one of the most prestigious events that the editorial team at DisruptionBanking attends. One of the reasons that the event stands out is because of the level of global innovation in banking that gets discussed at the event. As befits an event of this stature there are also plenty of new initiatives that are announced. One of those initiatives is related to a project called the ‘Canton Network’. It is the first privacy-enabled open blockchain network, and it is one of the big topics at this years Point Zero Forum.

Initially, one might think that the Canton Network is based out of somewhere in China. However, the name reflects more the cantons of Switzerland rather than the town of Guangzhou, where the annual ‘Canton Fair’ is held. This is because the company that has been instrumental in developing the Canton Network, namely Digital Asset, has a presence in Zurich too.

Leading market participants powering the Canton Network proudly announce the go-live of the Global Synchronizer, the Canton Network’s #decentralized interoperability infrastructure.https://t.co/XpDBWLrzqI pic.twitter.com/qqjstyKNMR

— #DisruptionBanking (@DisruptionBank) July 2, 2024

We sat down with Eric Saraniecki, Co-Founder and Head of Strategic Initiatives at Digital Asset in Zurich to find out more. Eric had just finished speaking as part of a panel at the Forum. Eric was joined on the panel by representatives of HSBC, Goldman Sachs, the DTCC, EY, and the Hong Kong FMI Services Ltd. The topic of the panel was ‘mobilising tokenised assets: transforming institutional capital flows’. The discussions centred around topics such as Hong Kong’s digital green bond issuance, CSDs or central securities depositories, and how a common blockchain can make a huge difference to global capital markets.

What is the Canton Network?

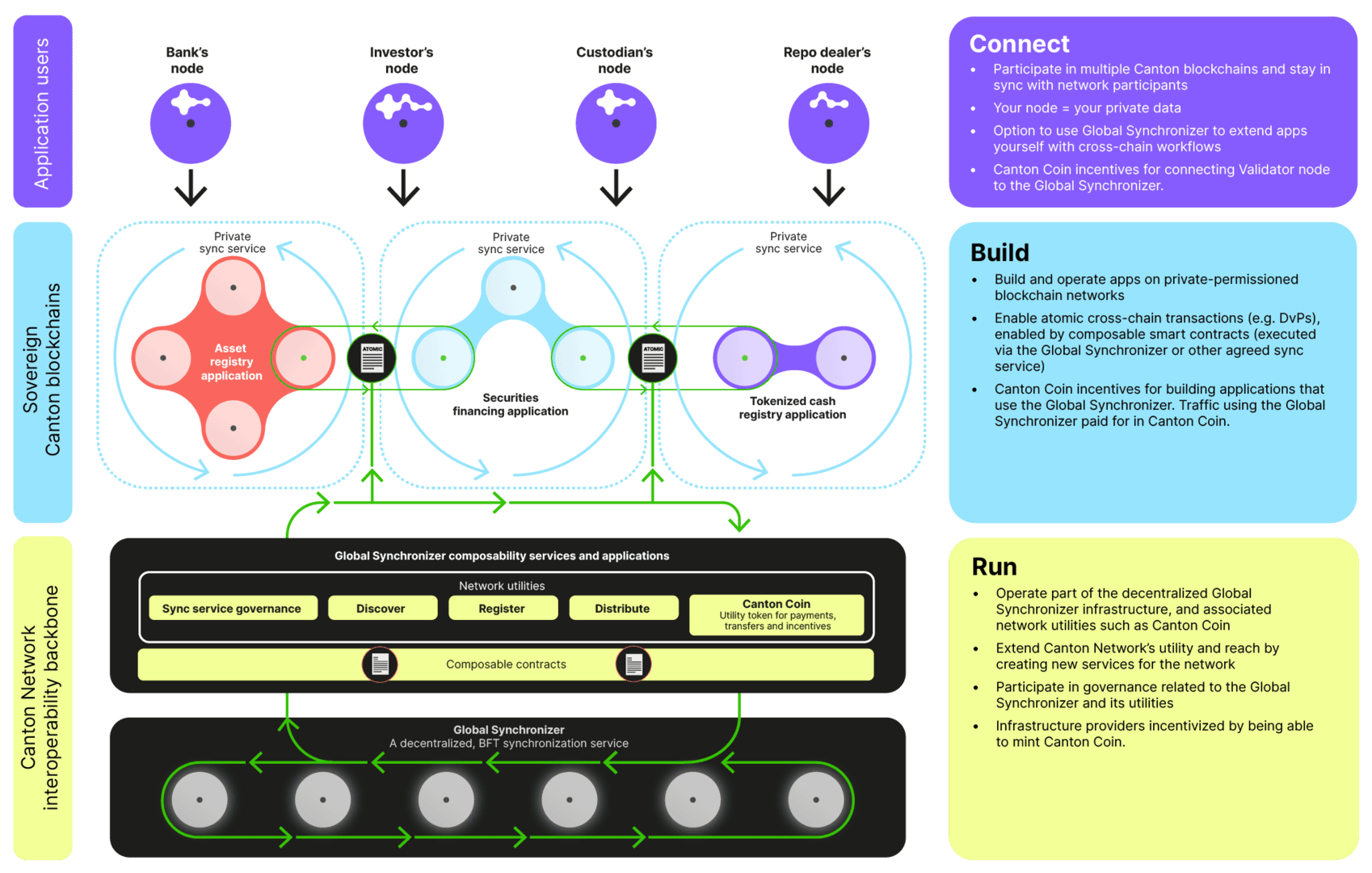

We started the discussion with Eric by deep diving into what the Canton Network is. Eric explained how the Canton Network is the collection of every single person on earth that’s running the Canton app or operating a participant Canton node. He has been involved in the project for over ten years and his grasp of both blockchain and investment banking is second to none.

Eric explained the relevance of the ‘Swiss connection’, by explaining how Swiss cantons are loosely federated. Each canton has a lot of control over its jurisdiction including setting tax regimes. All this is overseen by a light touch approach from the federal government. With the Canton Network there is also a similarity to the way the federation works in Switzerland in how every single app on the Canton Network is a different customer

“Think of each as a different web app,” Eric explained. “Goldman Sachs has its own instance of Canton. It’s running the way that they’ve configured it. They built it as a custom application. HSBC has its own application too. And the Hong Kong Monetary Authority has connected to both. We have many customers outside of those mentioned. If you circle all those customers, then that’s broadly the Canton Network as a concept.”

“What we have launched with the community is the Global Synchronizer infrastrucutre and the Global Synchronizer Foundation,” Eric continued. “The Global Synchronizer makes it possible to connect these things together without the trade-offs we’ve historically seen in blockchain.”

Eric explained how working within the Canton Network means that independent applicatons can exchange value between them without adding in additional counterparty or settlement risk. What you have instead are two or more applications that update at the exact same time.

How the Canton Network is different to other blockchains

One could be confused in thinking of the challenges of oracles or blockchain bridges when you read what Eric shared so far. Using the analogy of looking for a flight where the passenger is looking for a multi leg journey. Eric shared how this is often done by checking two different airline provider apps to get the best price. You can’t push a button today that guarantees you get both those tickets, or neither of them. You need to go to one app and book that leg. Then you need to go to the other and book the next. During that time you might have missed the deal. There’s nothing that can guarantee you get both of those legs, or nothing.

If these booking apps were composable using Canton, you could guarantee that both issue you a ticket or neither do. At the same time, each airline would see nothing of the other’s data. It’s just two application transactions that are perfectly coordinated, and without the risks.

The key to understanding this is that although individual applications might be communicating with the Global Synchronizer, they do not know what is being coordinated. It is a clever protocol that guarantees that the process being sought only moves forward if each individual application moves forward too.

Another analogy that Eric used was how Open Banking works. He shared how if you had two different bank accounts with two separate banks and these accounts could do something at the same time, that is how you could imagine how the Canton Network works. That is where the risk can be mitigated. It is what allows DVP (delivery versus payment) without risk. It allows the movement of collateral without risk. Currently systems available in capital markets are not able to do this. They have sequential processes that are continuously reliant on steps within the process being completed one by one and often needing to be verified.

The Need for Efficiency in Capital Markets

Institutions like Euroclear, CREST, or the Depository Trust Company are all examples of organizations that address part of the problem that the Canton Network seeks to address. Eric explained how it is difficult to see how these individual organizations could operate as one. Sovereign nations and numerous financial institutions would not be keen to share governance, he explained. However, sharing a protocol appears to be more viable.

“The thing (Global Synchronizer) that we created which we gave to this decentralized group of operators, and contributed the code to Hyperledger, is the infrastructure that makes the interoperability possible. And the decentralized service has transparent governance through the Global Synchronizer Foundation, managed by Linux,” Eric added.

“Digital Asset, in an open-source way, still owns the protocol and the language. We commercialize that through our enterprise distribution. Customers like banks pay a license to put their applications into production. The infrastructure is completely decentralized and operated by completely independent parties. Digital Asset is just one of many parties. We have no controlling stake in that infrastructure.

“And now the code that the decentralized group is running for the Global Synchronizer is available open source via Splice, a Hyperledger Lab,” Eric summarized.

What all this means is that in the future customers who want to use the Canton Network can choose to do so without being reliant on Digital Asset. In fact, customers will be able to avoid working with Digital Asset altogether. All this has been put in place to ensure that there is trust and that the Canton Network can continue independently into the future.

Why the Tokenization of Money Market Funds is Important

Earlier this year we covered a story about abrdn’s tokenized money market fund. The story was important as it highlighted the amount of liquidity that can be released from the market by working towards real-time settlements. Currently the settlement period can often take one or two working days.

"The framework at Hedera looks like the things that we’re used to seeing. When there is still so much confusion surrounding crypto and blockchain, the governing council and the framework gives a lot of comfort"#Hedera #abrdn #tokenization #archax https://t.co/GSTrC4L9h2

— #DisruptionBanking (@DisruptionBank) February 9, 2024

Eric shared how if there were appropriate central banking digital currencies (CBDCs) available to asset managers, then there might not be a need to tokenize money market funds. He believes that the regulator needs to be proactive in finding ways to solve problems in capital markets. Sometimes the regulator can take too long. In those cases the market often finds its own innovation.

“A lot of the pressure that financial institutions are feeling is down to how they can get cash, or cash equivalent, on the balance sheet and then use it as collateral,” Eric explained.

A company that is trying to address this is Hashnote, Eric shared. The company has designed a money market fund specifically to be used as collateral on chain. This isn’t the only company looking at a solution to the problem, there are others, he assured me. However, in an ideal world, Eric believes that a CBDC for capital markets purposes released by central banks would address the problem. In the meantime it’s up to private companies to find a solution instead.

How does the Governance of the Canton Network Work?

The conversation up until now had focused on the use cases of the Canton Network. Importantly though, the Linux Foundation is facilitating the governance of the Global Synchronizer, via the Global Synchronizer Foundation.

Eric explained how premium members of the foundation who pay the relevant member license fees would be on the governing board, whilst normal members would have an elected representative on the board much like is the case with other Linux foundations.

“It is important to note that the Foundation does not govern the network,” Eric shared. “Not even the members do. This is because the Canton Network is an unlimited number of databases. And, like the internet, there is no need for any single entity to govern the network. Each member governs their own application instead.”

The Global Synchronizer Foundation is what is important here, Eric highlighted. This is what is going to be community owned, and it will also be community managed. Nobody must own it. The Global Synchronizer is just a piece of infrastructure that participants can rely on. It doesn’t govern the infrastructure itself, it just facilitates the governance and has a vote in the governance on behalf of the members. This is in stark contrast to other blockchains where the governance can often be very centralized.

“The network is everybody – the applications, the synchronizers, the interoperability infrastructure, and the nodes. One of those nodes is run by the Foundation and that has a membership of anybody in the community that is interested,” Eric concluded.

The Focus is Finance

Whilst the Canton network is asset agnostic, Eric highlighted how the focus remains related to financial workflows. Outside of bonds or securities other solutions include insurance.

One of the last points we discussed was related to the words public permissionless blockchain. Eric explained how many layer 1 blockchains like to translate the word public as ‘transparent’. With the Canton Network the decision to be transparent, who to be transparent to, and who to give permission to access data to is up to the individual members. With other blockchains this is not the case.

The story of Digital Asset and the Canton Network are compelling. One might even imagine that we are witnessing the growth of a new disruptor much like what we witnessed in the early days of Chainlink or Ethereum. Innovation and disruption are permeating capital markets. For now this is happening in locations like Switzerland and Hong Kong. Tomorrow it could be happening in a market much nearer to you.

Author: Andy Samu

See Also:

Why are abrdn’s money market fund investments being tokenized using Hedera? | Disruption Banking

Shaping the Future of Banking at Point Zero Forum 2024 | Disruption Banking