“I’ve never thought about what could happen to me if this fails,” Kwon Do Hyeong (aka Do Kwon) told Coinage in 2022, a few months after his flagship project collapsed.

Since then, Do Kwon has been living the life of an exiled oligarch on the run, carrying multiple devices and passports. If he previously lived like an aristocrat in a romance novel, his life now is a bit like if Dostoevsky’s famous criminal antihero Raskolnikov was rich and subject to an international manhunt.

Most crypto outlets have been covering the saga in short posts that leave out interesting details, but local outlets have had a field day with Do Kwon’s misfortunes, tirelessly reporting every sliver of the story. Additionally, most reporters seem unable to understand or access court documents, as well. Fortunately, this weakness does not afflict Disruption Banking reporters. Our deep dive will heavily rely on local reporting and copious citations from the court record.

Mo’ Money, Mo Problems!

The smiling, carefree Do Kwon is long gone. The one who used to brag on X about Terra’s projects is now curiously silent, not tweeting since late 2022. That was a smart move, considering his legal liabilities in three separate jurisdictions.

While in a Montenegrin prison, he was separated from his wife and child. Do Kwon and his co-defendant Han Chang-joon, a former executive of Chai, a payment processor linked to Terraform Labs, told the judge they have property holdings “worth several million.” After two months behind bars, his wife posted his bail, paying 400,000 euros.

In late May 2024, an older-looking, world-wary Do Kwon with a crewcut was photographed outside a court in Podgorica, Montenegro. He was carrying a plastic bag of clothes and was surrounded by black-clad soldiers. The sobering circumstances seem to have affected his disposition, and he has been deliberate and strategic with his words and actions.

Do Kwon’s Big Spalsh in Balkan Politics

U.S. authorities were spoiling for a chance to prosecute Do Kwon, so he and Han Chang-joon holed up in Belgrade, Serbia and bought posh apartments. Things went south when they attempted to travel out of neighboring Montenegro on fake Costa Rican passports in March 2023.

Within days, both South Korea and the US sent extradition requests.

David Patton and Goran Rodic, Do Kwon’s attorneys for U.S. and Montenegro respectively, have stymied extradition and poo-pooed the SEC’s case against their client as weak.

According to Vijesti, a Montenegrin news outlet, Marko Kovač, the former Minister of Justice, made a promise to Do Kwon that Montenegro would refuse the extradition requests from both South Korea and the U.S. This promise was not publicly reported until well after the new Minister of Justice took over the case.

Publicly, Minister of Justice Kovač said in the Spring of 2023 that Do Kwon would be obliged to serve out his sentence in Montenegro for falsifying his passport before any extradition requests would be entertained.

There’s also a controversy in Montenegro over how this case was handled, which has been bouncing between high courts.

On X, Milović, the current Minister of Justice, accused his predecessor of lying to the public, writing, “They promised him that if he linked Prime Minister Spajić and himself in the disputed letter, he would receive protection, that he would not be extradited to the USA, and perhaps not even to Korea. Now they are in trouble and we understand why they are upset...”, adding that “the Ministry of Justice cannot give incorrect information, especially when everything was going through the Ministry of Foreign Affairs.”

The word “linked” is an oblique reference to a purported meeting between Do Kwon and Spaji where Do Kwon arranged for Spajic to purchase tokens at a drastic discount.

The future prime minister confirmed that he had met with Do Kwon in Belgrade, but he denied that any funds had been exchanged.

Protos reported, “Spajić may have made a deal with Do to purchase millions of dollars worth of Terra/Luna tokens for a Bulgarian-based, Singaporean-headquartered hedge fund called Das Capital,” where Spajic was a former employee.

Although a likely-sounding story, no evidence to support this claim has been forthcoming.

Montenegro’s appeals court agreed with their argument against the high court’s decision on extradition, annulling the verdict and sending it back for retrial.

Terraform Labs on Trial

The civil fraud trial in New York centered on false promises to investors and false representations about Chai. Most of the filings can be accessed here.

Jump Trading, a Chicago-based hedge fund and TFL’s silent patron and partner, was subpoenaed for documents and testimony.

In depositions, Bill Disomma, a co-founder of Jump Trading, and Kanav Kanya, the head of Jump Trading Crypto both assiduously pled the fifth amendment for every question beyond their address. And it’s not hard to see why – their behavior with regard to Do Kwon and TFL was shady, if not criminal.

Since they were not being charged, it seems like the SEC was trying to use their non-prosecution as leverage to make the group’s top officers cough up records, emails in particular, which they provided and which were later unsealed.

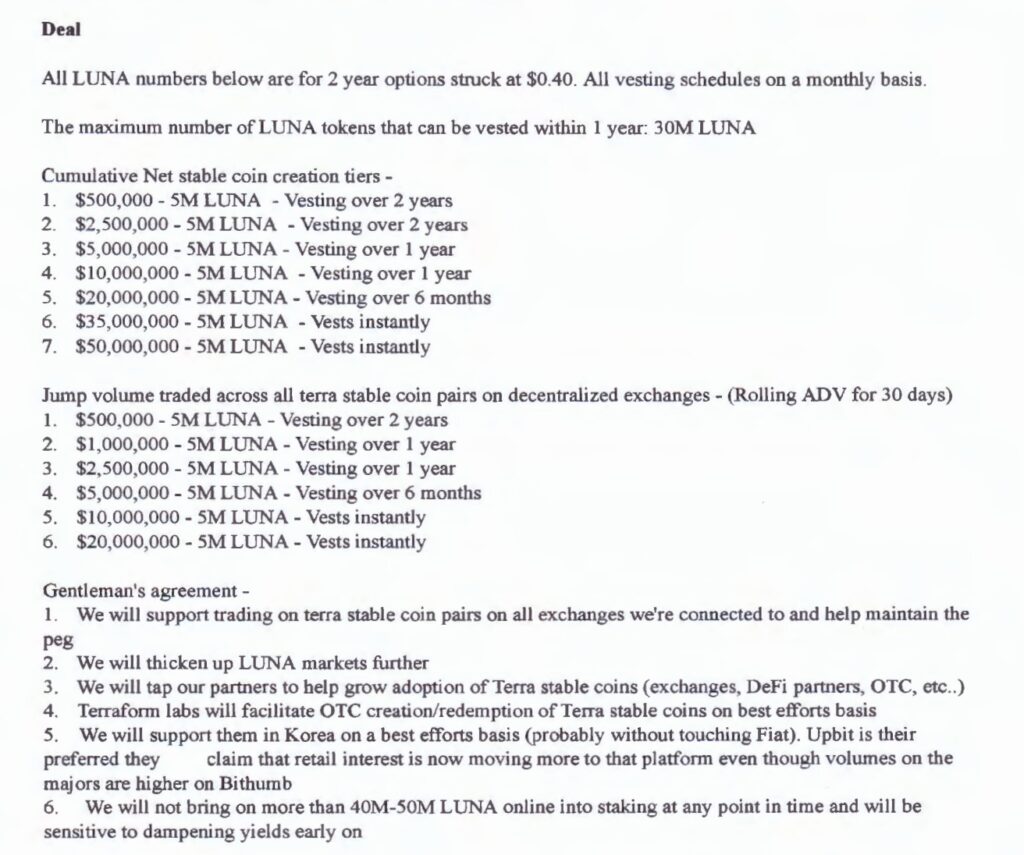

Do Kwon came to them in 2019 and made an offer of a variation of the deal the future Prime Minister Spajić was offered, but much, much sweeter. The firm was offered Luna tokens, which later traded at $116 with a market capitalization of $19 billion, for .40 cents, with a bunch of caveats about vesting and selling, so that when Jump cashed in, markets wouldn’t be impacted. In September 2020, the deal was laid out by the firm’s Kanya in a group email.

“Headline item – We have the ability to earn options on up to 65M LUNA struck at $0.4.“

In particular, Kanya was excited about Chai, as a force multiplier of Terra’s potential.

“CHAI pay is the first and largest payment provider using the Terra blockchain as it’s back end. They have 1.9M accounts ( ~40k new users every week) and raised $40M on a $220M valuation series B round (as a company independent of Terra).“

This was, perhaps, not entirely true. Terra and Chai previously shared offices and were incubated together. More on that below.

Karav went on, “Where we come in is in making Terra stablecoins feel real. Stability mechanisms and protocols are fun to debate and important to consider. But for most of crypto it’s seeing it on exchanges everyday maintain its peg and be integrated into their favorite services. If we can continue to provide thick liquid markets in terra stablecoins across crypto, we have a pretty good shot at making this happen....

How this accrues value to LUNA – the only way to create terra stablecoins to participate in those apps or in yield farming is through converting LUNA to stablecoins on chain. This means buying LUNA on exchanges. As these stablecoins move around, LUNA staking yield rises which further increases LUNA demand. A big part of our deal is smoothly facilitating these feedback loops (feed them when their mouths are open) to enable parabolic growth when the opportunity arises. The more Terra stablecoins exist, the more valuable LUNA gets (I believe in a super linear fashion past an inflection point)…

This network has the potential to redefine FinTech . We’re sitting on an opportunity to own I 0% of the payment processor, open bank and stable asset protocol of South East Asia and beyond. Playing for anything less than $100M would be severely underplaying our hand here. There’s very real and large value being created here independently of crypto/DeFi hype and we have long-term vested interests in seeing this grow. As long as we do our job and Do and his team continue to kick major ass, there’s nothing stopping Terra from being a multi-billion dollar enterprise. I’m definitely drinking the kool aid here, but I hope you are a little too. If all goes well, we’ll be sitting on a pile of profits and money printing machine that spits out a continuous stream of widely adopted stablecoins. Like any ambitious project this may of course go to zero, but in the positive scenario it has the potential to work out in a very grand fashion.”

TFL was a money mint for Jump Trading — until it wasn’t. And the change came suddenly, catching Jump flat-footed, although they knew the risks from the beginning, as their internal emails show.

Gaza Labs CTO Grilled

The testimony of Han Ju (“Paul”) Kim, the Chief Technology Officer of Gaza Labs. He worked with Do Kwon and Daniel Shin, co-founder of Terraform Labs. Kim’s testimony, which can be found here, paints a picture of a small team of young “horizontally organized” entrepreneurs where no one reports to anyone else. They checked each other’s work.

Kim described the company culture, “Since the company had a horizontal corporate culture, people did not exactly report to other people, but by rank, Do Kwon was of a higher rank than myself at Gaza Labs, and at Chai Corporation, Daniel Shin was above me in terms of rank. It wasn’t a relationship where I had to make reports to them.”

Kim scrupulously avoided testimony that would implicate him in any knowledge of issues related to laws or regulators. A few lines of questioning shed light on the relationship between the three interlocked companies, Gaza Labs, Chai Corporation, and Terraform Labs.

Q. Did Terraform and Chai have overlapping employees and shared office space? For this one, the same office was shared until the separation, split in early 2020, and as they split, the offices were both in the same Seongsu-dong but separate with a distance of 10 to 15 minutes by foot in between, correct?

A. Yes.

Q. When Terraform and Chai split, you never consulted with or talked about the split to anyone or took part in discussions about how a split was inevitable due to certain reasons?

A. No, I did not know of the fact before the split was decided. Neither did I talk to anyone about it.

Q. Regarding the split, you never consulted with Do Kwon about technical regulations, about how there are certain regulations and difficulties due to technical matters?

A. No, I did not.

Kim argued that Chai, Gaza Labs, and Terra were separate companies when they seemed more related, or linked, in his words. Under questioning by the Plaintiff’s Counsel, Kim explained the relationship.

Q. What was the relationship between Chai and Terraform?

A. The two were in a mutually cooperative relationship as Chai mobile payment service is linked to the Terra blockchain.

Q. Chai Pay is an mobile payment service launched by Chai Corporation, and Terraform Labs

Korea is the company that does blockchain, so the two were in a cooperative relationship – is

this what you are saying?

A. Yes.

Then, later in the same interchange:

Q. The service you made and developed in connection… When you say, “you’ve linked them,” – can I take it that this conceptually means “aggregating information about payments that consumers made by topping up Chai Pay points, converting that information, and displaying it in coins”? Is this a correct understanding?

A. Yes, but that happened in real-time.

Q. Development of a program that uses that in real-time.

A. Yes, correct.

The judge and attorneys grilled him in depth about the engineering of the blockchain side of Terra’s operations and how they connected to Chai. Under questioning by the judge, Kim gave more detail.

“If the user makes the final approval, then, the Chai app sends certain approval request to the Chai API server over the Internet. Afterwards, the Chai API server receives it on its end, and after verifying everything like “the information sent by this person is correct. This person is the user,” it verifies all those information and then checks whether “there is or isn’t remaining Chai points balance,” after which, proceeds with the remaining approval process. Programmatically. Then, at that point, data in the Chai database is looked up to make sure that it’s all correct, after which, under the same function is a concept called LP, the concept of LP server. That is where this data is, there is a concept called LP queue (hereinafter “queue”), registered on the LP queue on Chai’s end. The reason for registering on the LP queue is to transmit the data in the queue layer to the LP server – the LP server managed by Gaza Labs. After doing so, the LP server receives the data, makes a wallet if it needs to, a crypto currency wallet. It makes a wallet – it makes it through the symmetric algorithm in order to quickly digest the data, uses the multisend function of the Terra blockchain to create a KRT transaction, which is uploaded on the blockchain. This is how the linkage works.“

Kim’s attempted to bolster the claim that Terra’s blockchain wasn’t just “mirroring” transactions that happened through Chai because Do Kwon had used that “real world use-case” in his pitches to investors. Judge Rakoff ultimately didn’t buy it.

He cited evidence from Chai employee who wrote in a 2020 email that Chai would “process transaction[s] outside [the] blockchain” and then “write a record on the Terra blockchain in parallel.”

The emails from Do Kwon’s staff and Jump’s top brass were damning.

Do Kwon’s attorneys countered that most of the securities were not sold inside the U.S., but after less than three hours of deliberation, a NY jury found Do Kwon and TFL liable for fraud.

Uncle Sam Sends Emissaries

In May 2024, U.S. officials, including the heads of the SEC’s Investigations Division and Crypto Assets and Cyber Unit (CACU), conferred with their Montenegrin counterparts about Do Kwon’s continuing legal exposure in U.S. jurisdiction, pushing for extradition to the US over South Korea.

According to the press release from the Ministry of Justice of Montenegro, the SEC provided a detailed presentation about the SEC’s mission to protect crypto investors and the ongoing process to hold Do Kwon and his gang accountable.

The statement announced the meeting as “a significant step towards strengthening relations between Montenegro and the United States of America in the area of justice and investor protection, and that in the future, for the mutual benefit of the two institutions, the relationship should be stronger.” These types of statements are oftentimes protocol but it also may be a sign that the American side was leaning on Montenegro as it always does with small countries.

The heat must have convinced Do Kwon and his legal team that steps were needed to resolve ongoing litigation over the alleged fraud.

In a bold move that could set a precedent for the future of crypto regulation, Terraform Labs has thrown down the gauntlet in the face of a staggering $5.3 billion SEC fine.

— Rachel (@Rach224) May 2, 2024

💼💥 Refusing to back down, the company is challenging the punitive measure, citing a lack of concrete… pic.twitter.com/XrvTsZWwu6

Just weeks later, the SEC announced the settlement of its civil case against Do Kwon and TFL.

A Secret Deal

On June 11, the terms of the deal were made public. Although Do Kwon’s attorneys offered the $1 million against the $5.4 billion demanded the SEC, the two parties agreed on $4.5 billion in disgorgement, prejudgment interest and civil penalties. The largest settlement number in history was laconically described by SEC as “conservative.” Do Kwon is personally on the hook for $204.3 million, including an $80 million civil fine.

Before the settlement number was announced, a digital wallet associated with the Luna Foundation transferred around $23.64 million worth of BNB and $72.51 million worth of AVAX tokens, according to Arkham Intelligence.

After the settlement in principle was announced, the LUNA token surged 38%.

The SEC wants to put Do Kwon and TFL out of commission permanently, and it seems that their plan worked. The SEC asked for and was granted an injunction against either defendant from buying or selling securities or serving as an executive in any public company.

Citing the testimony of Chris Amani, TFL’s CEO, that the company is “still working to build” products, and the SEC told the court, “Defendants have not shown remorse for their conduct, nor can there be any doubt that they are in position where additional violations are not only possible but likely are already occurring.”

Given its worries about TFL, the SEC will most likely not be pleased with Amani’s recent posts on X.

4/ the community will need to take over ownership of the chain. I believe there are a couple teams and devs who want to do this and you should be seeing information in the forums soon.

— Chris Amani | Terra (@fleece_cannon) June 12, 2024

Terraform agreed to wind down its business “as soon as possible,” dispersing its assets to the harmed investors and creditors. The community is supposed to continue the mission of the platform.

As for our master of manipulation, Do Kwon is not nearly out of the woods yet. He still faces extradition, although it may not happen for some time while his extradition case is retried in Montenegro. If Do Kwon’s alleged attempt to bribe the prime minister bears fruit, expect the case may not be resolved for another year or more.

On the settlement, The Wall Street Journal mused, “The regulator may end up receiving only a fraction, if any, of the penalty.”

Author: Laird Dilorenzo

#Crypto #Blockchain #DigitalAssets #DeFi

Laird Dilorenzo is a hatchet thrower and wordsmith.

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.