NSO Group, the Israeli cyber surveillance firm known for its controversial Pegasus spyware, has been compelled by a federal judge in California to hand over the source code for Pegasus and its other spyware products to WhatsApp. This order is part of an ongoing lawsuit initiated by WhatsApp in 2019 accusing NSO of violating 1,400 users’ privacy. The ruling by Judge Phyllis Hamilton in February is the latest episode in a string of setbacks that have bedeviled NSO Group in recent years due to its ownership of Pegasus.

Considered one of the most powerful and sophisticated tools for online surveillance, Pegasus has stoked concerns over privacy, human rights, and potential misuse. The spyware stealthily infiltrates smartphones and personal communication devices, granting the operator unhindered access to all the data on the device. This includes SMS records, contact details, call history, calendar records, emails, instant messaging and browsing history. What’s more frightening is that Pegasus can secretly take photos, record calls and surrounding audio, and even take screenshots without alerting the owner of the device.

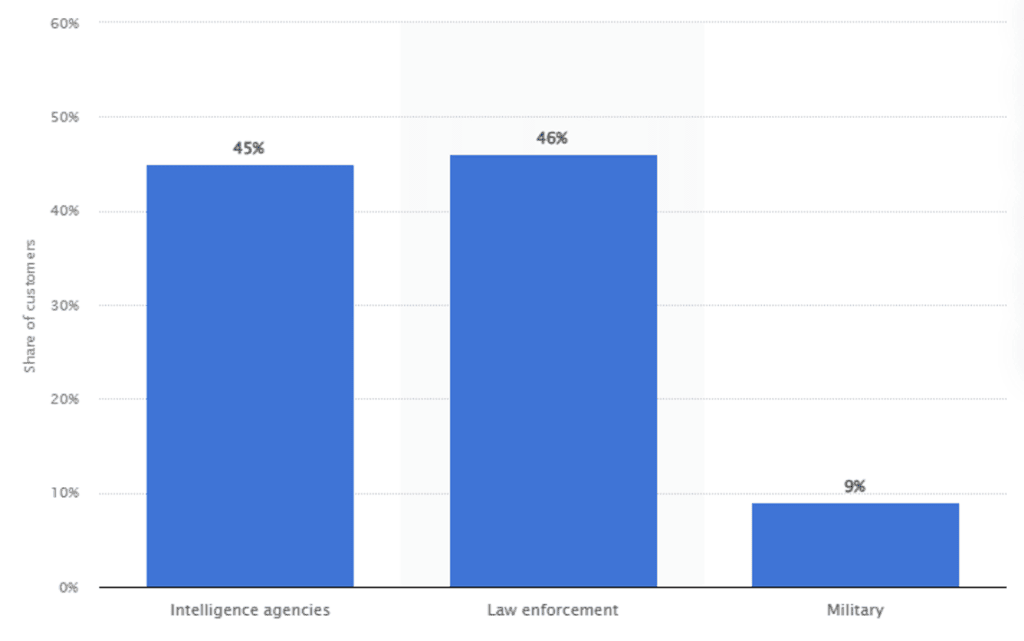

NSO Group claims to work exclusively with “authorised governments” to help them detect and prevent various local and global threats. Some of its customers have included the likes of Mexico, Panama, Hungary, and Poland. The majority of its customers are law enforcement (46%) and intelligence agencies (45%), according to a transparency report published by the company in 2023.

Pegasus customers by entity type; source: Statista

NSO licences Pegasus to sovereign states and state agencies but does not operate it directly. The company claims that it has no direct visibility into how its customers use the software and that it does not collect information about customers. However, these reassurances over its innocence have done little to deflect criticism over the licensing and sale of the controversial hacking tool to dozens of governments around the world.

A Litany Of Scandals

Allegations of misuse have swirled around NSO Group’s Pegasus tool since 2017, when credible reports first emerged of its use by governments to spy on journalists and dissidents, rather than solely targeting serious crime and terrorism. The New York Times’ investigative work brought to light the deployment of Pegasus against Mexican journalists and human rights activists, setting off a litany of scandals that have dogged NSO ever since.

In 2018, an NSO employee faced charges in Israel for attempting to illicitly sell Pegasus for $50 million in cryptocurrency. That same year, Amnesty International implicated NSO in aiding Saudi Arabian espionage efforts against one of its own staff members. The company’s ties with Saudi Arabia were suspended following allegations linking its software to the surveillance of Jamal Khashoggi in the months leading up to his gruesome murder in Turkey.

According to this, MBS called Netanyahu in Sept 2020 asking to renew the license for Pegasus, which had been withheld by the Israeli defense department. Netanyahu agreed, on condition that Saudi Arabia will open its skies to Israeli flights.https://t.co/jvs0y9cYZ2

— İyad el-Baghdadi | إياد البغدادي (@iyad_elbaghdadi) January 28, 2022

The most damning scandal erupted in 2021 with Direkt36’s investigation into Hungary’s use of Pegasus, identifying over 300 potential targets for infection within the country. Amnesty International confirmed the spyware’s successful deployment on multiple occasions. This revelation was part of the Pegasus Project, an unprecedented joint effort by over 80 journalists from 17 organizations across 10 countries, spearheaded by Forbidden Stories.

“NSO Group can no longer hide behind the claim that its spyware is only used to fight crime – there is overwhelming and growing evidence that Pegasus is being systematically used for repression and abuse. We call on NSO Group to immediately stop selling its equipment to countries with a track record of putting human right defenders and journalists under unlawful surveillance,” said David Vig, Director of Amnesty Hungary.

These scandals not only shredded NSO’s reputation, but also impacted its financial performance as more governments – particularly in democratic countries – have steered clear from NSO and its products. Against this backdrop, the Biden administration in 2021 blacklisted NSO Group, stating that the company’s actions were “contrary to the foreign policy and national security interests of the US.” This cut off a major source of revenue for NSO, given the US has by far the largest defence budget in the world.

The #Pegasus scandal is Europe’s Watergate. The abuse of secret service weapons against journalists & political opponents in Hungary & Poland threatens the foundation our Union

— Katalin Cseh (@katka_cseh) January 20, 2022

My call to President Macron & the French EU Presidency #PFUE to address the case in Art7 proceedings👇 pic.twitter.com/N2XGiIr3ix

Attracting Investors An Uphill Task

NSO’s aspirations for a public offering appear to have been halted in the wake of the US blacklisting. In 2021, Reuters brought to light the company’s intentions for an IPO in Israel, with sources hinting at a potential valuation of $2 billion. However, these ambitions have not materialised, and NSO has remained silent on the reasons behind the abandonment of its IPO plans. Curiously, NSO neither confirmed nor denied that it was seeking an IPO. This silence suggests a challenging environment for investor engagement, amidst the controversies and the US’s punitive measures.

Over the last three years, NSO has engaged in discussions with multiple private investors to secure additional funding, yet an agreement remains elusive, highlighting the significant challenges it faces in drawing investment interest. In 2022, it was reported that the company’s equity was considered “valueless.” NSO struggled to obtain new contracts from 2021 to 2022 after being placed on the US blacklist, resulting in a dire liquidity shortfall and mounting debts. Furthermore, the firm encountered disapproval from investors when its CEO, Shalev Hulio, proposed resuming sales to high-risk clients as a means to compensate for the downturn in business precipitated by US sanctions.

NSO Group deemed ‘valueless’ to private equity backers https://t.co/jqqEu7dAoJ

— Financial Times (@FT) April 11, 2022

All these factors seem to have kept investors at bay, including the likes of US defence contractor L3 Harris, which abandoned negotiations for a deal mid-way. NSO is currently backed by Novalpina Capital , a London based private equity firm. It bought the stake from Francisco Partners in 2019, which had previously unsuccessfully tried to offload the stake to The Blackstone Group for around $400 million in 2017. Novalpina Capital is set to be dissolved after its partners failed to resolve a bitter dispute. While not directly connected to the NSO scandal, this development adds further complexity to the situation. The winding-up of Novalpina raises questions about the future ownership and management of NSO Group.

Future attempts to sell Novalpina’s NSO stake are likely to be extremely complicated given the recent revelations about Pegasus’s use in targeting journalists, human rights activists, and other individuals who do not fit the description of “terrorists and deadly criminals.” The fact that the company is tightly regulated by the Israeli ministry of defence, which has ultimate say over the government clients it signs up, could also make it difficult to woo new investors.

Israel has faced intense criticism in the past for agreeing to sell the surveillance technology to countries with poor human rights records, including Saudi Arabia and the United Arab Emirates. The political and diplomatic manoeuvring required to pry off such a company from Israel’s defence apparatus is simply not worth most investors’ time and money. This suggests that the firm’s financial and commercial troubles are far from over.

Author: Acutel

We are global investors who invest in good companies at fair valuation and speculate on all else subject to the risk exposure we can afford.

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.