CEO changes at major financial firms can be a source of uncertainty and stress for shareholders and senior executives. But a well-executed leadership change can create a strong legacy for the new CEO, motivate employees, and unlock value for investors. A prime example of such a successful transition is the one that took place in recent years at Amundi, Europe’s largest asset manager.

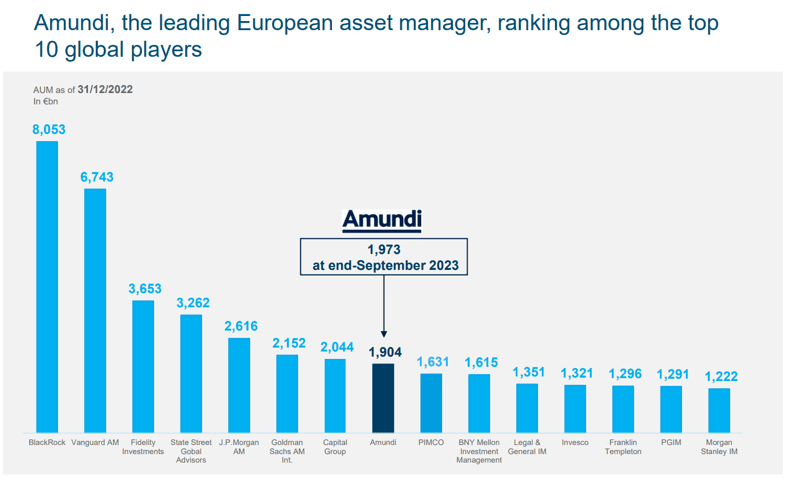

When Valérie Baudson became Amundi’s chief executive in May 2021, she faced high expectations as one of the most influential women in Europe’s asset management sector. She succeeded Yves Perrier, who transformed the French investment giant from a 985 billion euros company (in terms of assets under management) in 2015 to a 1.72 trillion euros one in 2020. Despite having big shoes to fill, Baudson has proven her mettle in leading Amundi through turbulent and unpredictable markets for the past three years.

Source: Amundi

Maintaining Cost Competitiveness

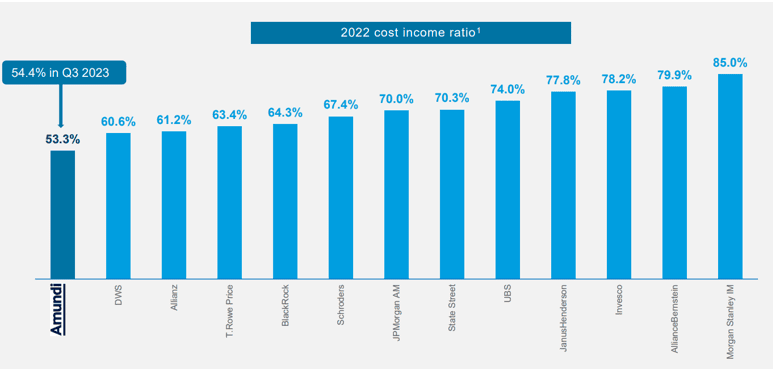

Baudson, who was Perrier’s Deputy before her promotion, has been working hard to keep the company at the top of the global cost efficiency rankings. According to its latest investor presentation, Amundi had a cost-to-income ratio of 53.3% in Q3 2023, beating its competitors like Allianz (61.2% in 2022), Blackrock (64.3%), and State Street (70.3%). The cost to income ratio provides a view of how efficiently a firm is being run. A lower ratio means a firm is more efficient and profitable, indicating that Amundi enjoys higher margins than titans like Blackrock.

Amundi has best efficiency score among global asset managers; source: Amundi

Baudson has managed to control costs and allocate capital to new growth levers such as technology. Under her leadership, the firm has been increasing its investments in technology and services, and selling these offerings to other asset managers and financial institutions, following the example of Blackrock, which started offering software as a service more than two decades ago.

Sustainable Investments Pick Up Pace

Following some updates on the EU rules for disclosing sustainability, Amundi announced in September last year that it has decided to raise the minimum share of sustainable investments in 46 of its exchange traded funds (ETFs). The asset manager said that some of its ETFs will see a significant jump in the percentage of sustainable investments, from 1% to 35%, and from 10% to 40%. For instance, the Amundi CAC 40 ESG ETF will have a minimum of 35% sustainable investments, up from 1% previously.

Amundi’s decision to align its investment strategy more closely with environmental and social goals was not only driven by regulatory changes, but also by the firm’s vision to become a leader in responsible investment for a fair transition, as part of its 2025 Strategic Plan.

The company believes that Policy packages in the US, the EU and in China will trigger huge flows of investment towards the development of green technology innovations, which will have a lasting impact on tech and their energy sources worldwide.

In a recent note on Responsible Investment, Vincent Mortier Chief Investment Officer at Amundi said, “Despite challenging market conditions, responsible investment flows keep increasing in the long run. Favorable trends should continue to support its future development as 67% of global asset owners are convinced of the materiality of ESG factors.”

According to Broadridge, a market intelligence firm, Responsible Funds have seen a fourfold growth in their assets since 2020. They now represent 17% of global assets and more than half of European ones. This is a sign of the increasing demand for sustainable investments, which is a key area for Amundi. Baudson’s performance as a CEO will naturally be judged by how effectively she positions Amundi in the competitive and fast growing ESG market. Shareholders are likely to welcome the firm’s continued efforts to expand its ESG-focused portfolio, particularly if it results in higher revenue and profits.

Amundi increases sustainable investments levels on 46 ETFs https://t.co/r4abdpQFUm

— FT World News (@ftworldnews) September 7, 2023

Asian Expansion

Baudson has set an ambitious target for Amundi’s expansion in Asia: to reach 500 billion euros in assets under management by 2025, according to Bloomberg. This is part of Amundi’s strategy to tap into the fast-growing Asian market, where it has already made a significant move in China. In December 2019, Amundi became the first foreign firm to own a majority stake in a Chinese asset management company, through a joint-venture with Bank of China. The new entity began operating in October of 2020.

China has, however, been a bitter pill to swallow for Amundi. After lifting the pandemic-era restrictions, the world’s second-biggest economy has faced difficulties ranging from a sluggish manufacturing sector to a persistent property sector crisis and a stock market collapse. It is estimated that the Chinese stock market has lost more than $6 trillion in value since 2021. This is bad news for Amundi, which increased its bets on China last year.

Vincent Mortier told the Financial Times in May that the firm was moving its assets from the US to China. “We have shifted our allocations from west to east,” he said. As China’s economy and markets struggle, investors might see Amundi’s exposure as a risk. However, the business has a wide geographic diversification and overall risk is relatively low. A rebound in China prompted by government intervention in the markets could also bode well for the firm.

Europe’s largest 2.1trn euro asset manager Amundi is moving out of US assets in favour of China, attracted by the country’s brighter economic prospects, better valuations and a more benign outlook for inflation.https://t.co/a7JXERhcAp

— Adam Tooze (@adam_tooze) May 19, 2023

Shareholders Confident

It’s not difficult to understand why Baudson is viewed as the right person for the CEO job at Amundi. Prior to her appointment, she had been the deputy of the former CEO. She was already well versed in the company’s products, goals and plans. She also had a strong track record in developing some of the firm’s key products, such as the ETFs that she launched from scratch in 2008.

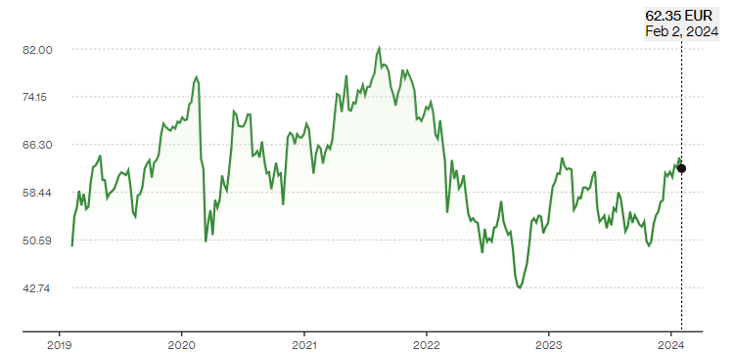

Amundi’s stock price has recovered from 2022 lows when it briefly sank below 50 euros, source: Bloomberg

It’s safe to say that Baudson has earned the confidence of Amundi’s shareholders, especially Credit Agricole, which holds a 68% stake in Amundi, according to its latest investor presentation. The stock price has been steadily recovering after briefly falling to as low as 42 euros per share in Q4 2022.

Baudson, who graduated from the prestigious HEC business school in Paris and worked as a broker before becoming an asset manager, started her career in 1995 at Banque Indosuez in the General Inspection Division. She then moved to Credit Agricole Cheuvreux, where she became Corporate Secretary, then Marketing Director Europe.

Baudsen then joined Amundi Group in 2007 to create and grow the Amundi ETF expertise. In addition to leading the ETF business, Baudson took on other senior positions, such as head of distribution and wealth segments. Her rise to the top of the organisation and strong leadership in recent years are an inspiration for women pursuing careers in finance.

Author: Acutel

We are global investors who invest in good companies at fair valuation and speculate on all else subject to the risk exposure we can afford.

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.