The world’s biggest chipmaker, Taiwan Semiconductor Manufacturing Co (TSMC), has seen its stock price soar by about 12% in January, marking its best monthly performance in almost a year. The company, which makes chips for Apple and Nvidia among others, has also risen by nearly 29% over the past year, showing strong market momentum. What is behind this rally and can TSMC keep up this bullish trend? The main reason for this bullish run is the company’s solid business performance in recent quarters and the favorable outlook for the global chipmaking industry.

Strong Performance, Optimistic Outlook

TSMC posted a strong quarterly performance for the quarter ending Dec 31, 2023, beating analysts’ expectations and signaling a recovery in the semiconductor sector. The company reported $19.62 billion in revenue for Q4, a 13.6% increase from Q3 and $50 million above the consensus estimate.

According to the Semiconductor Industry Association, global chip sales rose in November, reversing a downward trend that lasted more than a year. This suggests that the chip industry is bouncing back from the slump caused by oversupply and weak demand in 2022 and 2023, when many companies stockpiled chips during the pandemic. TSMC is well-positioned to benefit from this rebound, as its Q4 earnings show.

The company also expressed confidence in its 2024 outlook, projecting revenue growth of over 20% year-over-year. This is encouraging for investors who are betting on TSMC’s sustained growth. Analysts expect the company to increase its earnings by 19% in 2024 and 25% in 2025.

TSMC’s profitability remains high, as evidenced by its Q4 margins. The company achieved a gross margin of 53.0%, an operating margin of 41.6%, and a net profit margin of 38.2%, reflecting its dominant position and competitive advantage in the global chip market.

TSMC beats profit and revenue expectations in the fourth quarter https://t.co/SR4EHde1eS

— CNBC (@CNBC) January 18, 2024

AI Fuels Bullish Bets

TSMC is betting big on AI as a key driver of its future growth. The company’s executives said on the Q4 earnings call on Jan 18 that AI is one of their top priorities, and that they are exploring various opportunities in this field.

According to Bloomberg, the company’s leaders also emphasized how AI will boost the demand for specialised semiconductors that can handle complex computing tasks. These chips, which TSMC produces, are essential for AI applications such as machine learning and deep learning. “Executives also spent a lot of time talking about how the advent of AI should turbocharge the industry because of its immense computing needs.” Bloomberg reported.

“We see this more bullish outlook as predicated upon some combination of optimism around a growing contribution from AI, better expectations for traditional end market trends in 2024,” Wedbush analysts noted.

"When I look at TSMC, they're going to grow faster than the total market."

— Bloomberg TV (@BloombergTV) January 19, 2024

IDC Group VP Mario Morales says after Taiwan Semiconductor Manufacturing Co.’s outlook for capital spending and revenue lifted hopes of a broad tech recovery in 2024. https://t.co/4YLcKdjpd8 pic.twitter.com/UqlcxHPBpb

Market Dominance Strengthens Appeal

TSMC’s monopolistic control over chipmaking puts it in a prime position to benefit from AI. The company enjoys a dominant position in the chip industry, with a 60% market share of the foundry business and an 85% share of the high-performance chips segment. This gives it a strong competitive advantage and a wide economic moat, which means it can easily fend off rivals and sustain its profitability and growth.

TSMC’s economic moat is also supported by its strategic partnerships with some of the biggest names in tech, such as Apple, Nvidia, and AMD. These customers rely on TSMC’s cutting-edge technology and innovation to deliver their products and services. TSMC is a rare example of a monopoly that benefits both its shareholders and its customers and its market dominance strengthens its appeal as an investment opportunity for stock-pickers.

Disciplined Capital Spending

The management of TSMC announced that the company plans to invest between $28 billion and $32 billion in 2024, a similar level to the $30 billion budgeted for 2023. This shows that TSMC is maintaining a prudent strategy for capital expenditure in 2024, which should ease the worries of investors who fear a weak recovery and possible oversupply in the next two or three years as the AI market heats up.

The company finished the quarter with $55 billion in cash & cash equivalents and $30 billion in debt. Its debt is rated AA-/stable by Standard & Poor’s and Aa3/stable by Moody’s. Its strong balance sheet and disciplined capital spending should help minimise downside risk to its stock.

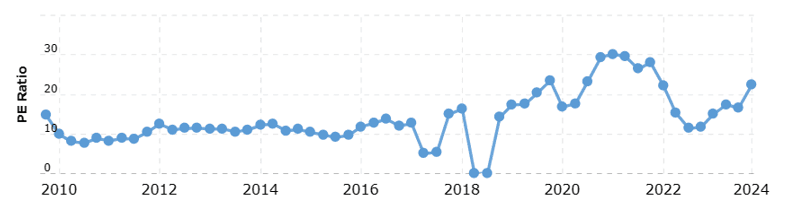

TSMC’s valuation is appealing, as its current price-to-earnings (P/E) ratio of 22.3 is much lower than its peak P/E of 30 that it reached during the pandemic when chipmakers’ revenues surged to meet the increased demand for chip-powered devices.

TSMC’s price to earnings has room to expand based on historical highs; source: Macrotrends

Geopolitical Risks Linger

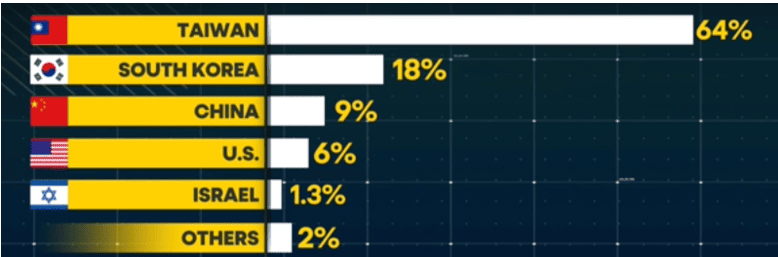

TrendForce estimates that Taiwan controls 46% of worldwide chip production, a figure rising to 68% when considering the world’s most advanced chips. However, amid heightened geopolitical tensions over the island nation’s territorial and political disputes with China, manufacturers have scrambled to produce more chips outside of the country. That includes TSMC, which has invested heavily in a facility in Arizona, US and is opening more facilities around the world.

World’s biggest semiconductor producers; source; WION

Tellingly, Warren Buffett last year reversed Berkshire Hathaway’s decision to own TSMC due to the geopolitics in that region. That is a reminder of the potential dangers the chip manufacturer faces. The geopolitical risk over Taiwan primarily stems from the ongoing tensions between China and Taiwan. China views Taiwan as a part of its territory and has not ruled out the use of force to bring it under its control. This has led to increased fears of a potential conflict in the Taiwan Strait, which would have significant implications for the global economy and TSMC.

TSMC holds a strategically important position as a gatekeeper in the global supply chain for high-performance semiconductors, making any escalations between China and Taiwan potentially disruptive for the company and the industry. However, despite such concerns, TSMC’s customers have no choice but to rely on it for the most cutting-edge chips, as it has a clear lead over its competitors. The company is likely to keep up its strong commercial performance throughout the year, allowing its attractively valued stock to continue on its upward trajectory despite the prevailing geopolitical uncertainties in Taiwan.

Author: Acutel

We are global investors who invest in good companies at fair valuation and speculate on all else subject to the risk exposure we can afford.

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.