The world of blockchain is complex, but for those immersed in it, blockchain bridges are a crucial concept to understand. One such bridge is the Wormhole network, maintained by 19 Guardians who act as ‘notaries.’ Like Marvel’s foremost and renowned Guardians of the Galaxy superheroes — helping to save our planet from alien invasions and doomsdays, these guardians hold equal weight in governance consensus, providing an essential service in bridging different blockchains and saving users thousands of dollars in gas fees.

5/

— Wormhole (@wormholecrypto) May 19, 2022

Guardians are a vital part of the Wormhole community.

They help the network reach consensus, and vote on governance decisions.

Each member is an asset to our cross-chain future.

Stay tuned to learn more about our individual guardians!

Defi Llama reports that as of January 26, 2024, there was $13.3 billion worth of crypto locked in bridges, with the largest blockchain bridge – wrapped Bitcoin, accounting for almost half of the bridge market, with $6.6 billion in total value locked (TVL), while Multichain trumps as the largest cross-chain bridge, with about $167.7 million in TVL.

For starters, what are Blockchain bridges? What purpose do they serve? And how are the guardians of the Wormhole Bridge connected to this?

Grasping Blockchain Bridges (Wormhole Network)

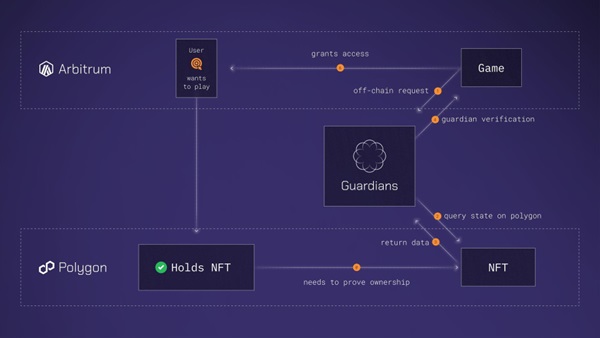

Blockchain bridges serve as conduits that facilitate the transfer of tokens and/or arbitrary data from one blockchain to another.

The Wormhole Network — a cross-chain bridge that allows users to send and receive crypto between Solana, Ethereum, Binance Smart Chain (BSC), Oasis, Polygon, Terra, and Avalanche without the use of a centralized exchange, is a typical example of a Blockchain bridge.

They essentially act as translators, converting the language of one blockchain into another, thereby enabling these disparate networks to communicate and interact with each other.

The Role of Notaries (Guardians of the Wormhole) in Blockchain Bridges

In the Wormhole network, our superheroes, the Guardians, act like referees in a football match. They observe the game (or, in this case, the transactions/messages), make sure everyone plays fair, and maintain order. Essentially, they act as notaries – they observe and sign off on transactions, ensuring the validity and security of cross-chain operations and ensuring that it complies with the established rules and protocols.

Their role is crucial in maintaining the trust and reliability of the Wormhole network.

The Who And Why?: Profile of the Guardians, Their Background and Motivation for Becoming Guardians

The Guardians of the Wormhole network are 19 established entities in the Web3 space. They’re like the school prefects of the blockchain universe. They’ve built businesses that are deeply aligned with the networks they validate and are committed to the overall health and growth of the crypto ecosystem.

1/

— Wormhole (@wormholecrypto) May 19, 2022

What are Wormhole Guardians❓

You may have heard the term Guardians before but might not be familiar with the precise role they play.

The Guardians are a key part of the Wormhole community. Read on to learn more.

Their involvement in the Wormhole network stems from their belief in the potential of blockchains and their desire to contribute to its advancement. They’re in it for the long haul, not just for a quick buck. Thus, making them ‘worthy’ Guardians of the Blockchain Galaxy.

As with the other 18 Guardians, MoonletWallet — one of the Guardians of the Wormhole Network and a key node operator covering over 30 blockchain networks, with over $50M in AUM (Assets Under Management) and 18k delegations to their nodes. MoonletWallet believes in the transformative potential of blockchains and want to contribute to its growth and development.

Meet the Guardians of the Wormhole Network

With the exception of the Wormhole Network node, below is a list of the 18 current validators of the Wormhole Bridge, each holding equal weight in governance consensus:

- 01node

- ChainLayer

- ChainodeTech

- Chorus One

- Everstake

- Figment

- Forbole

- HashKey Cloud

- Inotel

- MCF

- MoonletWallet

- P2P Validator

- Staked

- Staking Facilities

- Staking Fund

- syncnode

- Triton

- xLabs

According to a statement by Wormhole, “In the 10 months of its existence, together with Guardians like Everstake, it has successfully sent 1.2M+ messages,” and is looking forward to upping those numbers in the coming months and years.

Risks Associated With the Guardians And Blockchain Bridges

Like any technology, blockchain bridges come with their own set of risks and challenges. The security breach on the Wormhole token bridge that led to the disappearance of 120,000 Wrapped Ether (wETH) tokens, equivalent to $321 million, from the platform is a tall-standing example of the risks of bridges.

Mr. Hacker, can you, like, give those three hundred millions back? We’re really screwed here! I’ll probably lose my job. #Chainlink #Ethereum #Wormhole #Solana #BinanceSmartChain #Hackers #Terra https://t.co/6NxsI881mL

— Digital Startup (@digitalstartup5) February 15, 2022

The reliance on Guardians also introduces a potential point of failure. If the Guardians were to act maliciously or become compromised, it could disrupt the operation of the Wormhole network.

Pro-this-viewpoint, Vitalik Buterin, Ethereum co-founder, made a Reddit post in January, which he afterward shared on his X (ex-Twitter) handle, suggesting that the future may not be kind with cross-chain bridges, partly due to the security lapses surrounding backing of bridged assets in cross-chain transactions.

At No. 8:@VitalikButerin has also voiced his concerns, believing that the crypto's future will be multi-chain & not cross-chain.

— The Crypto Insider (@crypto_ins1der) August 8, 2022

There are fundamental limits to the security of cross-chain infrastructures (e.g. a bridge), which will always carry inherent vulnerability risks. pic.twitter.com/yblcNubVAc

A tweet that Wormhole didn’t take lightly, for obvious reasons, one might surmise.

Saying the world will be multichain but not crosschain is like saying there will be multiple countries but no international trade + diplomacy.

— Wormhole (@wormholecrypto) March 31, 2022

Even the neanderthals knew better.

The Upcoming Wormhole Token And Its Potential Impact on the Wormhole Network

There’s a buzz in the crypto world about a new Wormhole token. While we don’t know all the details, it’s expected to play a big role in the Wormhole network. It’s also expected to enhance the functionality of the Wormhole network and further facilitate the transfer of tokens and data across different chains. The introduction of this token represents a significant development in the Wormhole network and is eagerly awaited by the crypto community.

Tip-Off: Anomalies With Wormhole During the Terra Luna Collapse

The sudden events that led to Terra Luna collapse in early May 2022 had a significant impact on the crypto market, including the Wormhole network. The value of UST, the stablecoin of the Terra ecosystem, unexpectedly began falling from its $1 peg.

A working paper by the National Bureau of Economic Research (NBER) titled “Anatomy of a Run: The Terra Luna Crash” reports that this demise led to a massive number of LUNA, the native token of the Terra ecosystem, being minted to stabilize the UST value. The sudden influx of LUNA tokens into the market is rumored to have led to some anomalies within the Wormhole network.

Thus further highlighting the potential risks and challenges in the crypto world and equally serving as a stark reminder of the volatility and unpredictability of the crypto market and the need for robust security measures and protocols in blockchain networks.

Notwithstanding, it is unclear whether there were any known anomalies within the Wormhole bridge arising from Terra’s collapse. The last and only mention of Terra/LUNA on the official X account of Wormhole was on the 28 February 2022, over two months prior to the unfortunate crash in May of the same year.

📢 #LUNAtics

— Wormhole (@wormholecrypto) February 28, 2022

Send UST cross-chain using the Portal to earn double rewards ( $LUNA and $YUZU) on @Yuzu_Swap today! https://t.co/zXXdJZWiXo

As we move forward, it’s crucial to continue exploring and understanding these developments and their implications for the future of the blockchain universe.

All in all, Blockchain bridges – and the 19 Guardian’s Wormhole bridge validators are here to stay, in all their glory or gory — referring to the hacks and losses of crypto funds on Blockchain bridges.

The data on the dashboard of Cryptoranks, a reliable crypto research and news analytics, as fact-checked by Fortune Crypto, a similarly trusted crypto blog affiliated to Binance, Wormhole Bridge recently, as of 29 November 2023, secured more funding to the tune of $225M amidst a valuation of $2.5B.

According to Crunchbase, this was the largest fundraiser in the Web3 space last year, 2023. Alas, the 19 Guardians of the Wormhole Network get to keep their symbiotic alliances for the foreseeable future of validating transactions and for the greater good of invested crypto consumers.

Author: Ayanfe Fakunle

See Also:

‘I took a huge pay cut to join Terra – weeks before it went to zero’ | Disruption Banking