D.E. Shaw & Co. had a strong 2023, with its two largest funds, the D.E. Shaw Composite Fund and the Oculus Fund, delivering industry-beating returns. With some $60 billion in assets under management, the New York based hedge fund is one of the most influential hedge funds in the world and its performance is closely watched by analysts in the global financial industry.

The D.E. Shaw Composite Fund, the firm’s largest multi-strategy fund, recorded a gain of 9.6% after fees last year, according to a Reuters report. The Oculus Fund, which focuses on macroeconomic trends, ended 2023 with a 7.8% net gain. The source disclosed that both funds are closed to new capital and that D.E. Shaw expects to return full 2023 profits to outside investors in the two funds.

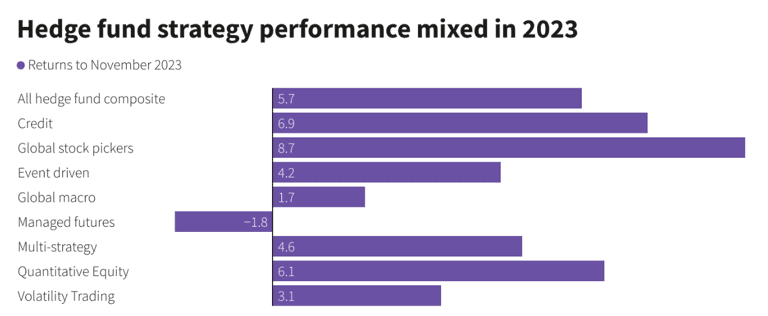

Although both funds posted lower returns when compared with the previous year — D.E Shaw Composite Fund delivered 25% in 2022 and the Oculus Fund netted 20% — they still outperformed a benchmark of similar funds tracked by Hedge Fund Research (HFR). HFR’s Global Hedge Fund Index tracks hedge funds globally and was up marginally by 2.5% for the year as of Dec. 15. D.E Shaw’s two key funds also outperformed a range of different hedge fund strategies:

Source: Reuters

A History Of Outperformance

In comparison to the broader indices such as the S&P 500 or the Nasdaq 100, D.E. Shaw’s main funds lagged the market in 2023. The S&P returned 23% while the Nasdaq 100 delivered a mouth-watering 53% last year. However, if you zoom out and look at longer-term returns, D.E. Shaw is a remarkable investment that has helped investors to cope with the market fluctuations. Its flagship funds delivered positive returns in 2022, when the major market indices suffered huge losses, with the S&P 500 plunging 19% and the Nasdaq 100 plummeting 32%. Moreover, both funds have maintained consistently delivered double-digit returns since they were launched.

Since inception in 2001, the D.E Shaw Composite Fund has returned 12.5% and has only had one down year, according to a report by the Institutional Investor. The Oculus Fund, which was launched in 2004, has returned 12.8% since inception, and has not had a single negative year, the report notes.

D.E. Shaw will be keen to sustain this outperformance in 2024 amid higher pressure on hedge funds to deliver superior results after sustained outflows in both 2023 and 2022. Investors yanked about $75 billion from hedge funds in 2023, data from Nasdaq eVestment showed. The outflows come on the heels of some $112 billion that left hedge funds in 2022.

“Some strategies that historically have been very conservative, yielding 5%-6%, are less attractive now because investors can get similar returns in cash,” said Fredrik Langenskiold, senior investment specialist, alternatives at UBP in comments carried by Reuters about his outlook for hedge funds in 2024.

According to Rebecca Adel, who works in the capital introduction team for EMEA at Societe Generale, investors are looking for double digit returns of at least 10% in 2024. She said that they are interested in various strategies, such as credit, global macro, commodity, and equity long/short.

A blistering rally in stocks and elevated bond yields are pressuring global hedge funds to boost returns as they fight to staunch investor outflows, industry insiders told @Reuters https://t.co/eDSJWkvm2x

— Reuters (@Reuters) December 22, 2023

Betting Big On Private Equity

D.E. Shaw is mostly known for its quant trading strategies and was one of the pioneering investment firms to use computer-based quantitative investment strategies. However, in recent years it has been steadily increasing its exposure to private equity in a bid to enhance returns through investments in pre-IPO companies.

In Q1 2023, it raised more than $450 million for the D.E. Shaw Voltaic Fund, its first dedicated private equity fund. While Voltaic is D.E. Shaw’s first standalone private equity investment vehicle, the firm has been making investments in the equity of private companies through its main hedge funds for an extended period. The firm has a long history of backing private companies in the tech and renewable energy sectors, dating back to the 1990s and 2000s respectively. In addition, it has been active in the private credit market since 2012, raising $3.5 billion for this strategy, Bloomberg reported.

D.E. Shaw’s decision to increase its exposure to the private equity sector through a standalone investment vehicle represents renewed optimism in the sector, which has gotten attractive in the past few years amid a sustained decline in valuation of pre-IPO companies.

The Voltaic Fund started deploying capital in 2023 and will do so through 2024. While the fund will back businesses in a variety of industries, those that D.E. Shaw sees as particularly promising are “largely in the enterprise space, software security, AI and consumer internet,” according to Portfolio Manager Edwin Jager.

D.E. Shaw’s timing is ideal. Valuations in the private equity and venture capital markets are yet to fully recover after interest rate hikes in 2022 led to a drying up of new deals. Moreover, 2024 is expected to be a challenging year for venture capital as financial conditions remain relatively tight. This will give D.E Shaw greater bargaining power in deals, allowing it to build larger positions at lower costs and maximising its potential returns.

An EY analysis noted that in 2023, venture firms invested $140 billion in portfolio companies. In every year since 2018, venture-backed portfolio companies have raised more than $100 billion. However, this is expected to drop in 2024. “I’ve put a prediction out there that we won’t hit $100 billion,” said Jeff Grabow, U.S. venture capital leader for EY, in his outlook for 2024.

Venture funding started to slide in 2022, along with the rest of the economy. That trend continued in 2023. Only $23 billion was deployed in the fourth quarter of 2023, which was a 23% decline from the third quarter, according to EY. “There was a deceleration of capital throughout the year, and companies were trying to stay out of a tough fundraising environment,” Grabow said.

Brace Yourself, Start-ups: VC Investments May Hit a 5-Year Low in 2024https://t.co/DFfnSTbwmJ pic.twitter.com/GNz38mtUez

— Institutional Investor (@iimag) January 8, 2024

Qualitative Factors Driving Performance

D.E. Shaw has been able to consistently outperform through the years in large part because of the quality of human capital it has been able to attract. Qualitative factors such as the quality of talent can make a big difference in an industry like investments, where ideas and not just capital are key in determining outcomes.

The firm was one of the earliest funds to focus on using complex algorithms for trading. This innovative approach has continued to evolve and adapt to market conditions, making it a dynamic and interesting place to work. One of its notable alumni is Jeff Bezos, Amazon’s founder, who worked at the firm from 1990 to 1994. He joined the firm when it was newly founded and quickly rose through the ranks to become its fourth senior vice president at the age of 30. Bezos left D. E. Shaw in 1994 to start Amazon.

The management structure of D.E. Shaw is another strength of the firm. The founder, David E. Shaw, retired from his active role in the firm in the early 2000s. He left behind a six-person executive committee that oversees the firm’s operations. This structure allows for decentralised decision making and effective risk management – two crucial factors that investors and institutions consider before allocating capital to a hedge fund manager.

Author: Acutel

We are global investors who invest in good companies at fair valuation and speculate on all else subject to the risk exposure we can afford.

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.