Boom and bust cycles in global crude oil markets have many implications for financial markets, the overall economy, and local and global geopolitics. In the financial markets, cyclical oil and gas prices not only affect the profitability of energy companies, but also the fortunes of investors with holdings in energy stocks.

Higher crude oil prices, for example, often translate to bigger returns for investors who profit from larger dividend payouts, accelerated stock buybacks, and share price appreciation. This explains why investors have been decidedly bullish on energy stocks in recent years, especially the big and stable oil majors such as Shell and BP in Europe, and ExxonMobil and Chevron in the US.

Like most of their industry peers, the four companies enjoyed supernormal profits in 2022 thanks to surging oil and gas prices. Although their earnings have moderated along with oil prices in the first three quarters of 2023, the four have continued to record strong financial performance. This is because, although overall inflation and oil prices have come down in the past few quarters, oil prices are still elevated compared to historical levels.

Crude oil prices have moderated but are still elevated; Source: Trading Economics

With crude oil prices still higher than they were before February 2022 – the period marking the Russian invasion of Ukraine – the prospect of oil majors sustaining robust performance and yielding strong shareholder returns in 2024 is plausible. Moreover, some analysts believe that crude oil prices could increase again in 2024 amid supply cuts by major producers such as Saudi Arabia.

Back in September, Goldman Sachs’ commodities strategists predicted that Brent Crude, the international benchmark, will hit $100 a barrel in 2024 due to demand for crude outweighing supply. JPMorgan strategists at the time also discussed a scenario where the price could jump as high as $120 a barrel on continued curtailments by major producers.

Similar Playbook, Different Outcomes

If crude oil prices edge higher in 2024 or remain at current levels, oil majors like Shell, BP, ExxonMobil, and Chevron could prove to be potentially good investment opportunities in light of their strong focus on returning excess cash to shareholders.

Shell, for example, announced $3.5 billion in share buybacks for the next three months at its recent third quarter results briefing. This increases total announced shareholder distributions for 2023 to approximately $23 billion, including dividends. In 2022, it distributed $26 billion to shareholders.

BP, like Shell, has also ramped up distributions to shareholders. In Q1 2023 BP announced a dividend per ordinary share of 7.27 cents, an increase of 10%, and a further $1.5 billion share buyback. In Q2 2023, the company kept its dividend per ordinary share at 7.270 cents and committed to using 60% of 2023 surplus cash flow for share buybacks.

Across the Atlantic in the US, ExxonMobil is on track to repurchase $50 billion of stock through 2024, expanding its previous plan of $30 billion through 2023. Chevron, on the other hand, announced a $75 billion buyback earlier in the year, tripling the size of its previous authorization announced in 2019.

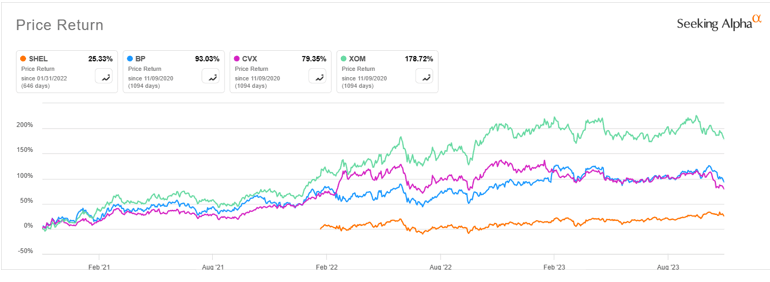

Despite all four oil majors using a similar playbook to reward shareholders, there is a clear divergence between the stock returns of US oil majors and European oil majors. It has therefore made more sense for an investor to back US oil majors in the recent past. Those who have done this are sitting on far better returns.

Taking the last three years, for example, ExxonMobil’s stock has returned 178%, Chevron’s 79%, BP’s 93%, and Shell’s just 28%, according to the chart comparison tool on Seeking Alpha. Interestingly, BP only closed the gap with Chevron in 2023, having lagged Chevron for the better part of the past few quarters.

What Is Driving Divergence?

There are several possible reasons why European majors trail behind their US counterparts in delivering strong stock returns. The two that are likely to be the most consequential in investors’ decision making are the stringent regulatory landscape faced by oil firms in Europe and the cleaner balance sheets of US oil majors, which warrants a more premium valuation.

As an example of the restrictive regulatory environment in Europe, a Hague Court asked Shell in 2019 to reduce its global net carbon emissions by 45% by 2030 compared to 2019 levels. The court asked Shell to implement the decision right away, a move that would mean divesting assets without proper planning, potentially leading to business disruption, losses and lawsuits. These kinds of issues tend to spook investors, leading to a discount in the share price. While Shell has since appealed the ruling, the case goes to show the disproportionate degree of influence that courts, regulators, and policymakers have over European oil majors in contrast to US oil majors.

Another demonstration of the stricter policies in Europe is the introduction of windfall taxes for energy companies in 2022 following recommendations by the European Commission that Member States impose temporary taxes on all energy providers. European oil companies had to basically share their record profits with the taxman – over and above normal taxes. Similar proposals in the US have failed to see the light of day, explaining why US energy companies have been more attractive to investors than their European counterparts.

Players like ExxonMobil and Chevron have also taken advantage of excess cash generation in the past few years to pay down their debt more aggressively than European peers Shell and BP. The table below – with data sourced from Macrotrends comparing the long-term debt of all four since 2021 – illustrates this.

| 2021 | 2022 | Q3 2023 | |

| ExxonMobil | $43.42 billion | $40.55billion | $36.51 billion |

| Chevron | $31.11 billion | $21.37 billion | $20.11 billion |

| Shell | $80.86 billion | $74.79 billion | $72.25 billion |

| BP | $55.61 billion | $43.74 billion | $47.4 billion |

Since 2021, US oil majors have reduced their debt loads faster than their European peers. They also have less debt in absolute terms. This potentially explains why they have outperformed. It is likely that US energy heavyweights like ExxonMobil and Chevron will maintain this lead in 2024 as their lower debt levels will free up more cash for shareholder distributions.

Playing It Safe

While US oil majors seem to be more attractive investment opportunities than their European counterparts, investors may want to play it safe in 2024 and manage their exposure to energy stocks more actively.

This is because, even though supply of crude oil is still constrained, the outlook for demand has been weakening in recent months, which is negative for crude oil prices. Tellingly, oil prices have retreated in the past few quarters. This is on the back of weaker exports data from China in October and concerns that the US and other economies could be slipping into a recession amid high borrowing rates triggered by Central banks’ interest rate hiking campaign. The Energy Information Administration (EIA) expects gasoline demand in the US to fall by 1% in 2024, which would translate to the lowest per-person gasoline consumption in two decades.

“Oil bulls are in distress,” said Ehsan Khoman, head of commodities research at MUFG. “The mood music has pivoted from pricing in geopolitics-induced supply-side risk premiums back to pricing in demand-side risk discounts.”

Central banks’ determination to keep rates high until inflation is dealt a decisive blow is progressively slowing down consumer spending as households grapple with higher loan repayments and the high cost of living. Bank of Minneapolis President, Neel Kashkari, recently noted that it’s too soon to declare victory over inflation. He said that the risk of over-tightening monetary policy is preferable to doing too little, and that he’s concerned that inflation could pick up again.

The combination of lower consumer spending, elevated borrowing costs, and a global economic slowdown – with China at the epicenter – could trigger a recession and a subsequent collapse in the price of crude oil. This would mark the end of the boom cycle that was ignited by the Russia-Ukraine war in 2022. In such a volatile environment, maintaining holdings in energy stocks could be perilous to your wealth creation goals. Hence, when considering investments in energy stocks in 2024, it’s prudent to play it safe and opt for dynamic trading strategies that incorporate hedging mechanisms to mitigate risk exposure.

Author: Acutel

We are global investors who invest in good companies at fair valuation and speculate on all else subject to the risk exposure we can afford.

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.