The bond-market selloff, that began in 2022 when central banks around the world started hiking interest rates to combat inflation, has intensified in recent weeks. This market trend suggests that investors are coming to terms with the increased possibility of interest rates staying higher for longer as inflation stages a comeback, led by resurging energy prices.

Earlier in the year, investors, economists, and finance professionals were projecting that central banks would ease monetary policy in view of declining inflation at the time. However, officials from the US Federal Reserve and other central banks around the globe have been warning for months that rates could stay elevated amid what they view as sticky inflation. It appears that the market has started taking heed of this warning, with yields having risen dramatically in recent weeks after the release of minutes from the Fed’s September FOMC meeting.

The world’s most influential central bank indicated in its September minutes that it was prepared to adopt a more hawkish policy stance to tame inflation, which has risen moderately in the past few months after global oil prices surged following product cuts by OPEC members. The prospect of prolonged periods of tight financial conditions in the US has fuelled new bearish bets against bonds, prompting the recent selling that has sent yields higher across the global fixed income markets.

Stubborn Inflation

Bond prices and interest rates have an inverse relationship – when interest rates rise, bond prices usually fall, and vice versa. In times of high rates, as we are currently seeing, the fixed interest rate of an actively trading treasury bond or bill becomes less attractive to investors when a new security with a similar tenor is issued at a higher coupon rate. Rising rates usually prompt investors to sell their existing bonds and treasuries holdings for newer issuances, or to pull their cash out of the fixed income markets for other opportunities. This typically leads to a decline in bond prices and a corresponding surge in yields.

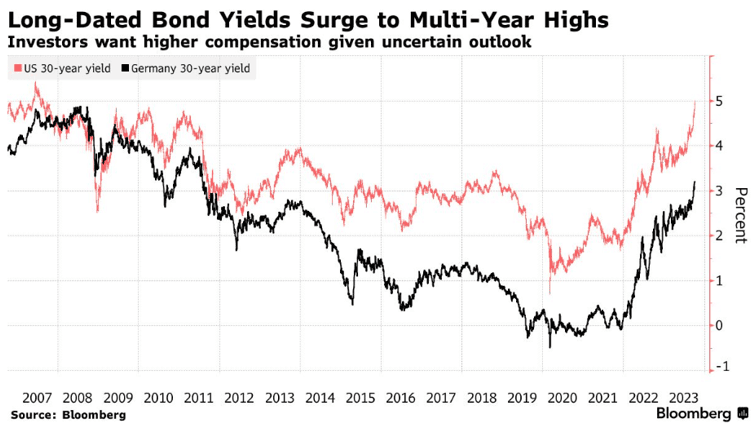

Longer-dated bonds have been the most significantly affected by rising interest rates, with yields for most long-term government bonds in the US, Europe, and Emerging Markets currently at multi-year highs. Bloomberg notes that bonds maturing in 10 years or more have slumped 46% since peaking in March 2020. That’s just shy of the 49% plunge in US stocks in the aftermath of the dot-com bust at the turn of the century, according to Bloomberg’s data.

Central bank officials are still not convinced that enough has been done to tame inflation. While inflation in major economies such as the US, the UK, and the EU has come down from peak levels in 2022, it is still higher than the 2% target that central banks in these economies believe to be the ideal inflation rate. Inflation in the US, for example, was 3.7% for the 12 months ended August, according to the U.S. Labor Department data published in September.

“Inflation continues to be too high and I suspect it will be appropriate for the Fed to raise rates further and hold them at a restrictive level for some time,” said Michelle Bowman, member of the Fed Board of Governors, in recent remarks on the economy and bank regulation. She warned that the surge in energy prices in the past few months would make the goal of bringing down inflation more difficult. “I see a continued risk that high energy prices could reverse some of the progress we have seen on inflation in recent months,” she said.

The International Monetary Fund (IMF) Managing Director Kristalina Georgieva expects inflation in some countries to remain above target until 2025, and has urged central banks to avoid prematurely easing monetary policy amid the risks of resurgent inflation.

Risks and Opportunities

Before the interest rate hiking cycle that started in 2022, markets had grown accustomed to the era of low interest rates and loose monetary policy following the 2008 Global Financial Crisis. Now things have changed and high rates look set to linger for longer than investors initially expected. This presents exciting opportunities but several significant risks as well.

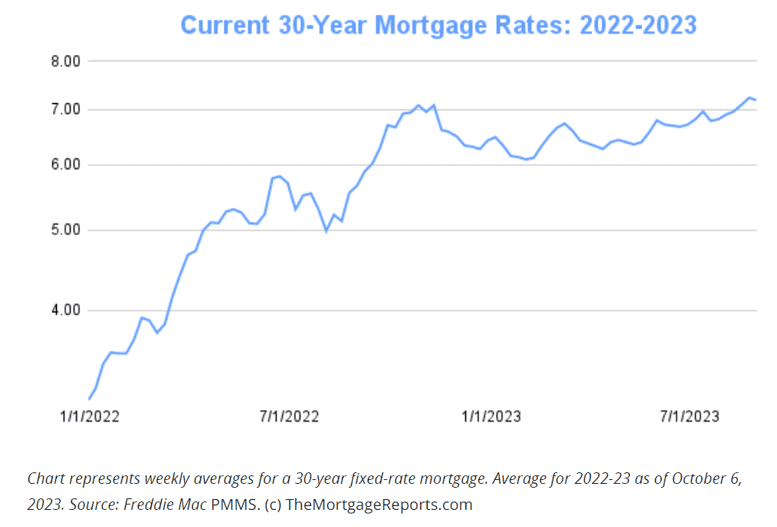

One of the main risks is that, as the cost of borrowing increases due to higher interest rates, the cost of living crisis affecting many economies will escalate. The average mortgage rate for a 30-year fixed-rate mortgage in the US reached 7.49% in October, for example. This is the highest level since December 2000, according to data from The Mortgage Reports.

A continued rise in the cost of living could have social and political implications, besides triggering an economic recession due to a fall in consumer spending. A recession poses risks for the real economy since a slowdown in business tends to lead to layoffs and lower tax collection by governments. Recessions also impact financial institutions and investment funds holding with exposure to assets in cyclical economic sectors like housing and real estate, consumer goods, auto, and retail.

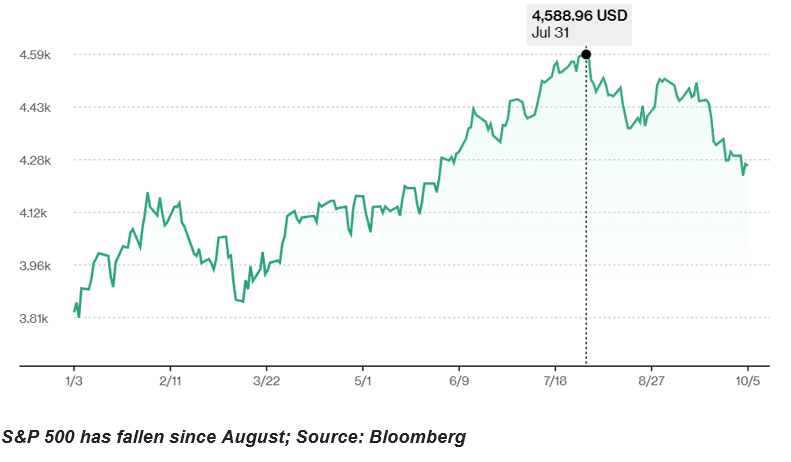

Another risk that comes with interest rates staying higher for longer is that it will likely lead to the prolonged underperformance of equities and other risk assets. Benchmarks such as the S&P 500 and the Nasdaq have given up some of their impressive year-to-date gains in recent months after higher than expected inflation data prompted central banks to adopt a more hawkish stance.

When speaking about the effect of interest rates on asset prices, legendary investor Warren Buffet has frequently likened interest rates to gravity. “Interest rates are like gravity in valuations. If interest rates are nothing, values can be almost infinite. If interest rates are extremely high, that’s a huge gravitational pull on values,” he said in a 2016 interview with CNBC.

Falling equities and falling bonds are a double whammy for investors, underlining the risk that high interest rates bring to portfolios. However, there are some opportunities in the current market environment, according to Lisa Shalett, Chief Investment Officer for Wealth Management Morgan Stanley. She writes in a recent note that higher rates call for active strategies. “Investors will have to adjust to higher rates, which may make equities less attractive compared to safer fixed-income investments. This environment favors active stock selection over passive index-level investing,” she says.

Rising interest rates could also add fuel to the dollar’s strong multi-year rally, creating opportunities in the FX markets for traders and investors who position themselves accordingly. Investors and traders who are nimble in how they allocate capital can also benefit from sticking to shorter-duration bonds and bills, as this strategy allows them to reinvest their principal investments and additional capital at higher rates of interest when their securities mature. Investors in markets where local currencies are losing ground against the stronger dollar would want to avoid or pay down dollar-denominated debt and buy and hold dollar-denominated assets.

Finally, sophisticated investors who are familiar with leveraged products, derivatives, and short selling strategies can enhance their returns during times of high interest rates by shorting equities and bonds that are likely to fall. This approach is, however, fraught with risks that come with trading marginalised products, including the anguish of losses exceeding principal. It is therefore important for investors and traders to make their independent investment decisions, regardless of the strategies that have been promoted in the article.

Author: Acutel

We are global investors who invest in good companies at fair valuation and speculate on all else subject to the risk exposure we can afford.

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organisations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.