Since the beginning of the year, Texan state politicians have been mulling what to do with a $32.7 billion budget surplus. If the surplus were divided among all 30 million Texans, everyone would get around $1,088. Of course, nobody who is anybody in Texas is seriously talking about that.

The surplus is roughly equivalent to the entire state budget of South Carolina and rivals those of New York, California, and Florida. It came about because of a rare confluence of events, not because it’s easy for a state government to save so much.

Although there were hopes that renters and teachers could get some relief, state legislators couldn’t make up their minds, so Governor Greg Abbott took control with a special session and put most of the money towards property owners and border security.

Origins of the Surplus

The surplus arose on the heels of historic tax collections by the state and economic growth at the end of the pandemic. Additionally, Texas state comptroller Glenn Hegar has blamed inflation as the driver, since people are paying more for goods and services, all of which generate sales tax.

Hegar warned back in January: “Bluntly, don’t count on me announcing another big revenue jump two years from now. The revenue increases that we’ve seen have been, in many ways, unprecedented, and we cannot reasonably expect a repeat. This budgeting session is truly a once-in-a-lifetime session.”

To be certain, current state revenues have far exceeded lawmaker’s expectations. As it stands today, the estimated general revenue for the 2022-2023 biennium is $149 billion – a $30 billion increase from what the legislature projected when the budget was passed two years ago.

What’s more, additional funds made available to the legislature in the form of General Revenue-Related (GRR) spending actually puts the “true” surplus closer to $78.4 billion, indicating a higher figure than the state has ever seen before.

Much of these funds have already been allocated to state agencies, big business, and education funding. A large swath, $13.9 billion, has been provided for the construction of electrical plants and electric grid debt relief.

Who has their hands out?

Although the legislative session in March generated support for increased funding of broadband infrastructure, healthcare, public education, and pay raises for teachers and other state employees, legislators have been at loggerheads on what to do.

Texas Attorney General Ken Paxton wanted to allocate a few million in taxpayer funds to settle one of the lawsuits he faces due to retaliating against his staff members who reported his corrupt practices. Legislators didn’t have any appetite for that, either, so the former staff members who were wrongly fired and promised a settlement from the Office of the Attorney General will end up waiting another two years until the legislature meets again.

At that point, they’ll probably earmark the funds and disburse the settlement with less fanfare. By then, everyone will probably have forgotten about Ken Paxton’s credible indiscretions.

One particularly vocal constituency in the fight is Texas educators, who are frustrated with the current political stalemate and the failure of lawmakers to approve pay increases in the midst of an ongoing teacher shortage.

The powerbrokers in the Senate and the governor’s office have never prioritized raises for teachers, partially because they are all about charter schools. Therefore, as the May legislative deadline loomed, Senate legislators intentionally weighed down proposals with amendments so that they were dead in the water once they reached the House.

As such, every amendment to boost teacher pay was shot down, and the proposals left on the table most likely to pass (S.B. 9 and H.B. 100) are underwhelming. Instead of giving teachers a $6,000 bonus, the legislature wants to dole out funds to the school districts to enable them to break even.

Cecil Lanoux, a veteran San Antonio teacher, told the Texas Tribune that the news of a historic budget surplus initially raised hopes that teachers would see big pay increases. “I’ve been in this long enough that it just gets demoralizing,” he said.

The Governor’s Special Session

With no resolution to the fate of the surplus, Governor Greg Abbott announced a special session at the end of May. Only the governor can call for a special legislative session and lawmakers are limited to the agenda the governor sets.

Unsurprisingly, the agenda was focused on potential property tax breaks and increased policing on the Southern border, while ignoring Texas teachers and the state’s 3.7 million renters. It showed the governor’s political priorities: first, his campaign donors and second, his ambitions for national office. Teachers and renters play no part in those calculations.

In any case, Republican infighting dominated the June session, so no resolutions were forthcoming. Not until early July were bills passed and sent to Abbott’s desk.

On July 22nd, Governor Abbott signed an $18 billion tax cut package for property owners. Texas has some of the nation’s highest property taxes, which offsets the absence of state income tax. It’s not surprising that property tax relief is where a good chunk of the surplus will likely go.

The bill substantially reduces school taxes for property owners, so the government is essentially stepping in to foot the bill. Additionally, the homestead exemption was increased from $40,000 to $100,000, the amount of a home’s value that cannot be taxed. $5.6 billion has been allocated for that purpose.

Abbott has pushed lawmakers to adopt the recommendations of the Texas Public Policy Foundation, a conservative think tank. The idea is that if the state chips in $7.1 billion dollars to Texas schools, they can lower the taxes the schools levy on property owners, a process known as “compression.”

The bill notably provides no additional funding to public schools, which rate near the bottom of the nation for per-student funding. That didn’t stop Governor Abbott from crowing about how he had chosen “one of the best” ways to give the surplus back to taxpayers:

Texas has an all-time record budget surplus.

— Greg Abbott (@GregAbbott_TX) August 9, 2023

That money belongs to YOU — the taxpayers.

Working with the Texas Legislature, we will deliver the largest property tax cut in Texas history — $18 BILLION. pic.twitter.com/JGnD9OzTvo

The 3.7 million renters in Texas will likely see no relief. Arguments that lower property taxes will reduce rents are hollow. Market rates historically drive rent prices, not property tax breaks.

Chandra Villanueva, director of policy and advocacy for the progressive think tank Every Texan, told the Texas Tribune, “We still see that the Legislature is prioritizing these tax cuts over actually funding our schools.”

The Southern Border Campaign

Meanwhile, the Southern border has never received so much funding, but it’s unclear what taxpayers get out of the billions being spent there. What is clear is that costly new initiatives and campaigns often emerge when the governor is gearing up for a re-election campaign or a bid for higher office.

Oddly, the governor’s office does not attempt to track the success or failure of any of these campaigns, even when billions are invested. When contacted by ProPublica, The Texas Tribune and The Marshall Project about the results of Operation Lone Star, no documents or information was provided by the state government.

Instead, Renae Eze, the governor’s spokesperson, stated that the operation kept “millions of deadly drugs and thousands of criminals and weapons” off the streets.

Operation Lone Star involved the deployment of 10,000 National Guard troops to the border, and the cost has overrun the budget by $2 billion every year, almost five times what the legislature budgeted.

Meanwhile, troops at the border have complained about poor living conditions, issues with their pay, and inadequate gear. They reported being frustrated by the length of the mandatory deployment and its hasty announcement, which left them mere days to prepare and inform their families, leading to difficulty maintaining their marriages, civilian jobs, and households.

One National Guardsman wrote in response to a survey question, “I’m wasting time watching the grass grow at my [observation] point [along the border], while my civilian job is dying on the vine. IF my job still exists when I return, I will have a giant hole to dig out of.”

Now, two years into Operation Lone Star, the state has allocated nearly $10 billion. There are walls of shipping containers on the ground near the border, barbed wire, and lines of buoys floating in the Rio Grande, with circular saw blades mounted between them.

Appalled by the ongoing cruel and inhumane tactics employed by @GovAbbott at the Texas border. The situation's reality is unsettling as these buoys' true danger and brutality come to light. We must stop this NOW! pic.twitter.com/XPc4C8Tnl0

— Rep. Sylvia Garcia (@RepSylviaGarcia) August 8, 2023

There have been documented cases of migrants and their children drowning in the river or a pregnant woman caught in the razor wire while having a miscarriage.

Texans support cruel border policies

Nevertheless, many Texans unapologetically defend the cruelty of these types of operations. They point to the crimes of human traffickers and drug dealers, saying that harsh policies and violations of international law will deter these malicious actors.

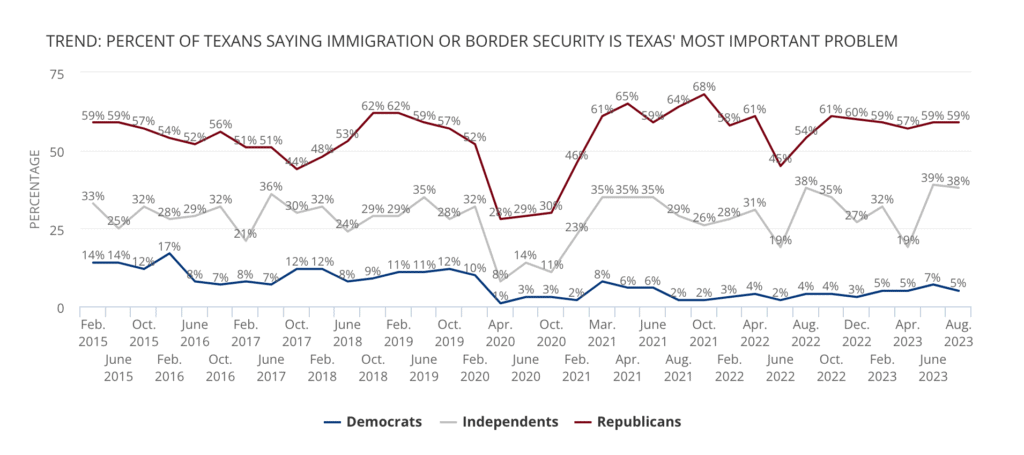

Opinion polls back up the popularity of the tactics of Operation Lone Star because a majority of Texas Republicans (between 44% and 57%) view border security as the most pressing issue facing Texas. Much smaller percentages of Independents and Democrats rate border security as the most important issue, but Republicans hold 58% of the seats in the statehouse (Texas House is 64:86 and Texas Senate is 76:105).

Abbott’s buoys have the support of 52% of Texans, while only 40% oppose it. In the end, it’s pretty clear that most Texans feel passionately about the border. They are troubled by the high numbers of migrants and asylum seekers entering the country via the southern border, and they want the government to staunch the flow. How to accomplish that is much less clear.

The Wall Street Journal, a conservative outlet owned by the Murdochs, criticized Operation Lone Star in June, stating that the effort has cost billions and fueled civil rights abuses while having little or no discernible impact on migration. The newspaper reported that Operation Lone Star personnel conducted only 1% of migrant encounters with Border Patrol, adding just 11,000 to Border Patrol’s 850,000 encounters.

What about the remaining 14.7 Billion?

A shortage of housing and pushback on new development will serve as a much stronger driver of rental prices than a decrease in their landlord’s overhead.

Given the massive uptick of institutional home ownership of U.S. real estate, where Wall Street firms snap up entire neighborhoods, there will likely only be more renters in Texas who won’t feel the benefit of a $32.7 billion surplus.

It remains to be seen what happens with the rest of the money, but if Governor Abbott’s priorities are any guide, we can expect more surplus-sponsored tax breaks for the wealthy and more hapless troops sent to the border to twiddle their thumbs.

The upshot is that Texas Republicans seem to be well aware of the challenges faced by working families, and the national party has made an effort to style itself as a populist workers’ party, although most of the policies of the Trump administration raised taxes on the working class, while cutting them for the wealthy.

Whether Republicans will do much of anything for working families is another question and one where Republicans, especially in Texas, have a bad track record.

Author: Tim Tolka, writer, journalist, and BI researcher

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.