Leverage is a big concern amongst regulators, and traders, today. One of the regulated ways that day traders can leverage their positions today is through ‘Contract for Difference’ or CFD. Most of the leading trading platforms in Europe currently allow day traders to use leverage through CFDs.

Much like any derivative, a CFD is used to buy a future price of an equity, currency, or commodity in most instances. The future price can be higher or lower than the initial price. And many platforms offer leverage of varying amounts. The amount of leverage available is usually lower in the case of a retail investor.

CFDs were popularized in London in the 1990s and have been reviewed repeatedly by the FCA. Interestingly, though, CFDs are not legal in the U.S. And the regulation of CFDs varies by jurisdiction. Many CFD providers have a presence in jurisdictions like Cyprus, as well as in off-shore locations. However the regulation of ‘off-shore’ providers is not always as robust.

What does the FCA say about CFDs?

Historically the leverage available on CFD trading was not efficiently regulated with some traders even using up to 500 times leverage. In 2019 the FCA decided that in the case of retail investors this should be limited to between 30:1 and 2:1. This was just one of the changes that the FCA put in place. This was mainly due to the amounts of money that retail investors were losing.

More recently as part of a 3-year strategy (2022 to 2025) the FCA has “seen a rapid increase in new investors choosing high-risk investments.” Which has led the regulator to look at reducing “the gap between investors’ particularly young investors’ – risk appetite and the actual risks associated with the investments they choose.”

CFD providers affected like IG.com, Plus 500 or CMC who have had to react. And the guidelines, at least for new products or services, are to take effect on the 31st of July 2023. Next Monday.

Why are Retail Investors making so many losses using CFDs?

Wherever you look online there is a different statistic related to how many retail investors make losses using CFDs. From what one can see, it is anywhere between 75% and 82% of all retail investors who make losses trading CFDs. The FCA has suggested it is 80%.

The response to this has been varied over the years. Demo accounts with users being encouraged to trade virtual money before they use their own. More educational content online and through videos.

Those leading the market have been working in a market where 20% of investors are still making money. Yet, there are always bad players on the market, much like one sees in the digital assets space. The FCA have had to tighten regulations in order to protect retail investors from these bad players.

Watchdog warns firms over CFD mis-selling risks https://t.co/m8KeFGGNAX

— FT Europe (@ftbrussels) December 2, 2022

IG.com, Plus 500 and CMC are just some of the CFD providers that have had to implement changes.

What are the changes that need to be implemented?

In a letter from the 1st of December the FCA highlighted the changes or the ‘Final non-Handbook Guidance for firms on the Consumer Duty’ from July 2022. And some of the reasons for the changes.

“CFDs are high-risk derivative products which can pose risks to both our consumer protection and market integrity objectives. We have previously acted to mitigate these risks but have ongoing concerns.”

In a further letter from April the FCA reminded firms of the new rules and guidance that the Duty introduces:

- Products and services: Are designed to meet the needs, characteristics, and objectives of a specified target market.

- Price and value: Products and services provider fair value with a reasonable relationship between the price consumers pay and the benefit they receive.

- Consumer understanding: Firms communicate in a way that supports consumer understanding and equips consumers to make effective, timely and properly informed decisions.

- Consumer support: Firms provide support that meets consumers’ needs throughout the life of the product or service.

Of course, there may be a knock-on effect when it comes to pricing amongst the leading firms.

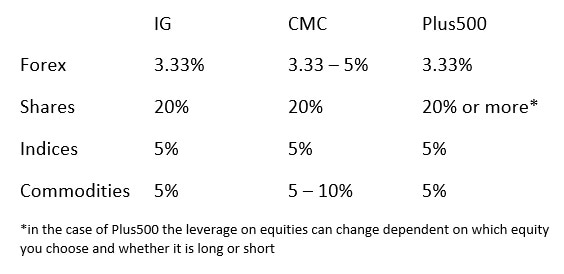

What are the retail margins available on the market today?

Margins amongst the larger regulated platforms in the UK are similar. In order to see how reponsive the platforms were to users needs, we reached out to IG.com, CMC and Plus500 for information. We wanted to understand to how they have prepared for the upcoming changes. And whether or not there would be any price changes going forward.

IG.com responded to our request:

“The Consumer Duty is a financial services-wide piece of regulation that IG is well placed and prepared for. In their reference to high risk investments, the FCA is principally (but not exclusively) concerned with unregulated firms aggressively marketing digital assets that do not come with traditional consumer protections seen with other financial products, such as CFDs.”

CMC and Plus500 did not respond. But, from Monday, the FCA have made it very clear that if it reaches out to them, then it will be looking for evidence that the firms have complied. These checks will be taking place ongoing over the next 12 months as the guidelines cover new products for now. From July 2024 every product and service will be affected.

Author: Andy Samu

See Also

Institutional Crypto with Gold-i | Disruption Banking

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.