In a full Level39 on a beautiful summer’s evening we had the pleasure of hearing from PASHA Holding from Azerbaijan. The company invests in banking, insurance and many other sectors. And the leadership team of the company had been at London Tech Week (LTW) where HSBC Innovation Banking were one of the main sponsors.

There is a lot of innovation taking place in Azerbaijan today. The government has already adopted legislation relating to payment systems and services. The country is ready to embrace central bank digital currencies:

The monetary sector wants the newest applied sciences (together with #blockchain). The position of #digitalcurrencies and #cryptocurrencies is continually rising. Work is underway in Azerbaijan to develop a digital manat https://t.co/4oaBVOcMhe

— Digital Startup (@digitalstartup5) June 16, 2023

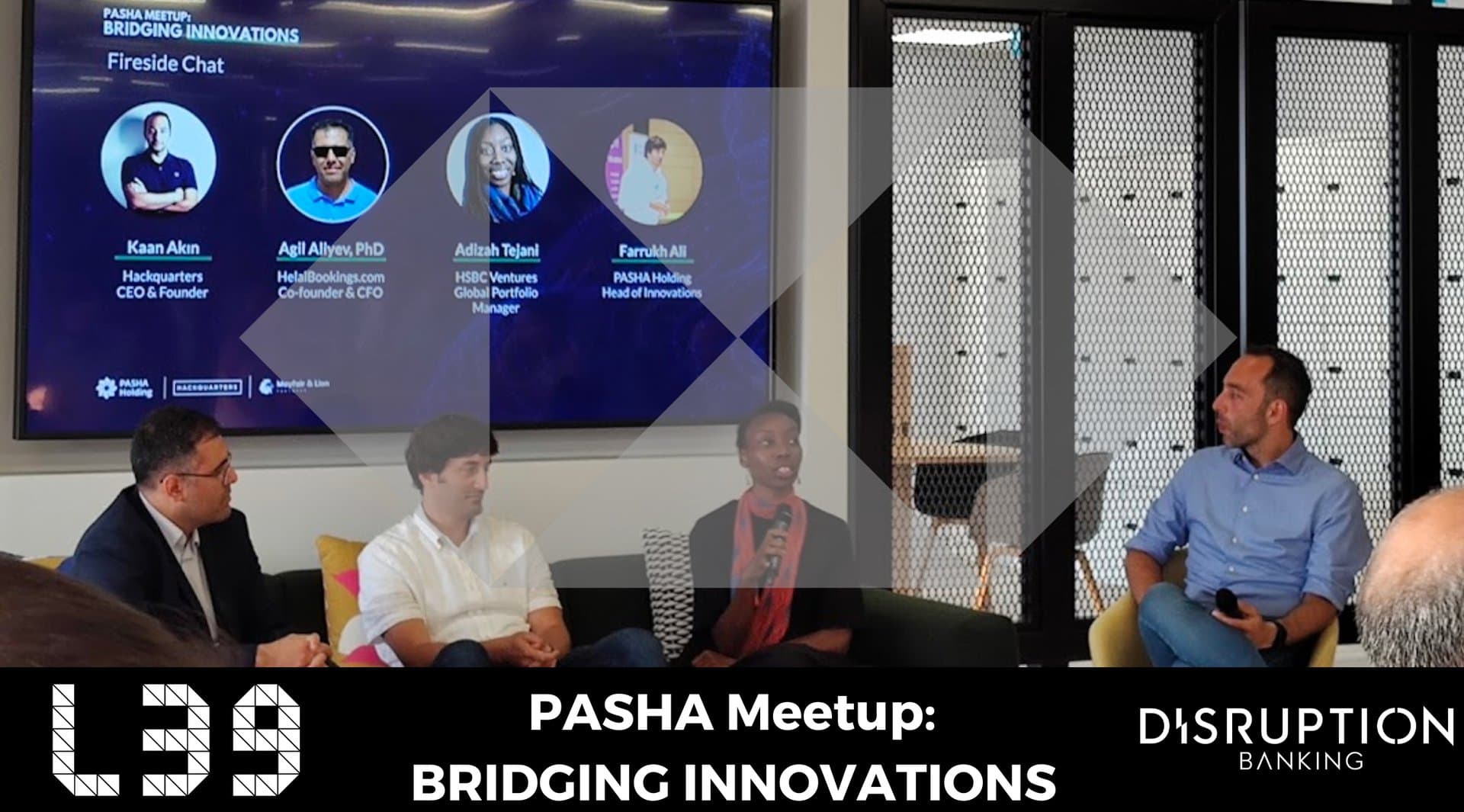

Head of Innovations at PASHA Holding, Farrukh Ali, thanked the audience at Level39 before joining Adizeh Tejani, HSBC Ventures Global Portfolio Manager, and Agil Aliyev, Co-Founder & CFO of HelalBookings.com for a Fireside Chat about ‘Bridging Innovations’. The chat was moderated by the charismatic Kaan Akin, CEO & Founder of Hackquarters.

The international nature of this week in London shouldn’t be overlooked. Our team has met with over 25 nationalities at London Tech Week so far. And one of the Fintech Fringe events attached to LTW was even held at Level39 on Monday. Adizeh herself had already appeared on stage at one of the many events going on in London this week.

Bridging Innovations with HSBC

HSBC is located adjacent to Canary Wharf One, where one can find Level39. As a tenant of Canary Wharf Group, there has been a long history of collaboration between the global systemically important bank (G-SIB) and the largest Fintech hub in Europe. Adizeh explained how she had been one of the people involved in the creation of Level39 over ten years ago.

Adizeh shared how she had joined HSBC initially as part of the retail banks’ team looking at Fintech partnerships and the procurement of Fintechs. She then joined the venture team where they make strategic equity investments and work with a portfolio of 30 companies.

“A company that you might recognize from our portfolio is Quantexa,” Adizeh explained. “They are an AI company and they are actually one of the few companies in the UK to join the billion dollar club this year. Very few companies have done that this year.”

Working with Founders

Over the last few days HSBC announced that it is seeking to be a leading lender to venture capital firms. This move has been helped by the recent acquisition of Silicon Valley Bank from which 42 bankers have joined the new team in the bank.

HSBC Targets Leadership Position for VCs, Startups: Following the hire of tech and healthcare bankers earlier this year, HSBC is reportedly eyeing to be a leading lender to venture capital firms and startups. #HSBC #venturecapital https://t.co/ReP6rxpqEX

— finews_asia (@finews_asia) June 14, 2023

Adizeh explained how working with VCs is part of a wider strategy by the bank. She also shared how part of her role is to work with stakeholders and founders.

“When approaching an organization you need to make sure that you take the time to understand which stakeholder is going to be your advocate,” Adizeh shared. You also have to educate that stakeholder whilst being educated by them too, she elaborated.

Working with Later Stage Fintechs

“Stakeholders ask for many different things. Things that are important internally for the stakeholders business processes. Which means that it is important to be adaptable,” Adizeh explained. “One of the reasons we work at a later stage is because we know that really early stage firms struggle to work with us as we are so big.”

However, she continued, there is now a faster Fintech onboarding programme within the bank. This has allowed different fintechs from around the world to be onboarded. And, just like many other large institutions, there are innovation champions across the bank helping out.

If you want to know more about HSBC Ventures click here. To hear a few of the insights from Adizeh’s panel yesterday, click on the tweet below:

Impressive lineup with @PASHAHoldingLLC at #level39 tonight. Find out more with @Adizah_Tejani from #HSBC: pic.twitter.com/8jxyWZBGf7

— Andy Samu (@Andysamu) June 15, 2023

Author: Andy Samu

#HSBCVenutres #Quantexa #Level39 #PASHA #Azerbaijan #Founders #StartUps #FinTechs

See Also:

Is there a Silicon Valley Mafia? | Disruption Banking

Inside the Investment Dispute between Peter Thiel’s Block.one & EOS | Disruption Banking

Sequoia’s Saplings, Robinhood and the Crypto Hedge Fund rise (disruptionbanking.com)