“Crypto is dead in America,” said Chamath Palihapitiya, a venture capitalist, recently in the All-In podcast. He went on, “The United States authorities have firmly pointed their guns at crypto.” He cited the threat of digital assets to the establishment as the cause of Uncle Sam’s aggression.

Spooked by the relentless onslaught of the Securities & Exchange Commission (SEC), 60 firms in the crypto and Web3 world, including various new startups, opened their wallets in 2022. The sum they deposited into the coffers of lobbyists is unprecedented, and with public records, we have only a hint of the real figures.

The root of the problem for U.S. regulators is ostensibly economic instability. We’re to believe that the SEC is looking out for the little guy, although the regulators seem to care much less when it’s Wall Street that robs retail investors.

In January, an article posted by the World Economic Forum predicted, “We could now see the handover of crypto technology and blockchain infrastructure to more regulated and established institutions.”

In any case, there’s a fight for the future of digital currency, and after 2022, traditional finance (tradfi) has the upper hand as governments cast about for alternatives that won’t tank the financial system like crypto nearly did last year.

Naturally, the U.S. government prefers to run the show itself and get in on the ground floor.

With the writing on the wall, many digital currency companies are joining the policy fight by turning their wallets upside down. We’re going to look at six lobbyists chosen to wield their contacts in the political class, and where the companies are getting the best results.

Send the Lobbyists!

The private digital currencies and associated exchanges would stand to lose market share if there were a public alternative with the backing of tradfi, or a private option with the backing of the government. Predictably, Goldman Sachs, a.k.a. Government Sachs, has already thrown its digital hat in the ring.

In 2022, Coinbase, Crypto.com, Ripple Labs, Block Inc. (formerly known as Square), Binance, and groups like Blockchain Association and the Chamber of Digital Commerce have all shelled out around 1$ to 3$ million for K Street Lobbyists to lay siege to Capitol Hill.

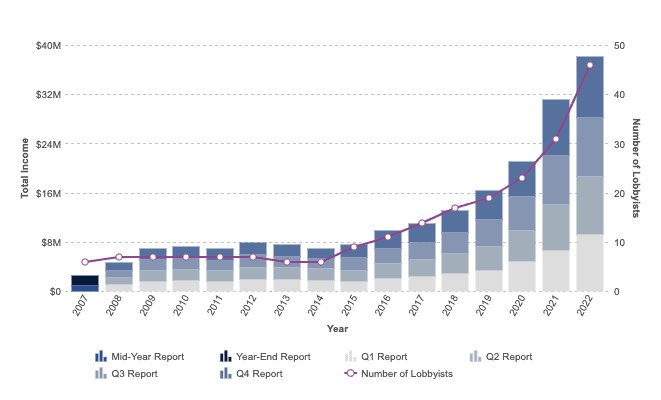

Half of the companies getting in the influence racket have never lobbied before, and the haul for 2022 at around 26$ million equaled a year-on-year increase of 121% and roughly equal to the total of the preceding five years of political contributions, which stood at 25.13, according to a new report by the Money Mongers.

All told, these companies put together 50.75$ million, trying to bend the political winds into their sails, to no avail, because the SEC, headed by Gary Gensler, is deadset on hobbling their competitiveness and eventually driving them out of the USA.

Coinbase, by far the biggest visible spender, has the most to lose from the intransigence of American policymakers because of its indelible footprint in America (think Disney in Florida), and the dawning realization of this dilemma by the company’s leaders can be measured in proportion as the Coinbase lobbyist roster has expanded.

In 2020, Coinbase had 7 lobbyists, a year in which CEO Brian Armstrong whistled as he strolled through a graveyard. In 2021, the firm’s proverbial “oh shit!” moment, the company quadrupled its bench to 28. Then, in 2022, it added another 4 for a grand total of 32.

All the lobbyists in D.C. won’t save Coinbase from the SEC’s “exchange shakedown,” which the SEC indicated is coming down the pipe with a Wells notice, the SEC’s calling card, on March 22, 2023. Hilariously, Coinbase issued a salty remonstration on its blog the same day, accusing the SEC of sitting through 30 meetings in 2022 during which SEC officials behaved like empty suits.

Disruption Banking has written about the well-known regulatory ambiguity in the U.S. and the SEC exchange shakedown racket here and here. It’s genuinely difficult to say what is happening behind the scenes or if there’s a method to the madness.

It seems as if policymakers are just confused, fearful, divided, and indecisive, so they dither, make excuses, and launch proposals without a prayer in Congress’s legislative sausage factory.

The lobbyists of Crypto

Who is channeling all this money into the pockets of our Congresspeople, paying their mortgages, and giving them the money with which to legally play the stock market with inside information during recess?

Lobbyists are notoriously quiet, and by law, lobbying disclosures are fairly easy to avoid, using dark money groups, which Sam Bankman-Fried famously used to give equally to Republicans without offending the idealists in the media who dared to make him feel bad for undermining American democracy.

As such, lobbying data and the details of how influence is applied are difficult to surmise with publicly available information, which is why Disruption Banking is going to make a special effort to learn more about how digital asset companies are leveraging influence in Washington, D.C. (stay tuned for more on this!)

Hogan Lovells

One of the biggest lobbyists is undoubtedly Hogan Lovells (HL). Changpeng Zhao (CZ) and his Emirates-based Binance and its U.S.-affiliate Binance.US retained HL as their primary lobbyists on the Hill, until recently when the group shook up their lobby shop in D.C.

Side Bar: It’s not hard to understand why. The group is facing investigations from the Commodity Futures Trading Commission (CFTC), as well as the U.S. Justice Department, which is never good, although the fines likely to be levied are often rather insignificant compared to the media hoopla surrounding the investigations.

Binance and the Chamber of Digital Commerce recently contracted HL to the tune of a few hundred Gs. It may seem like a drop in the bucket, but keep in mind, lobbying disclosure are like an iceberg; most of it is hidden from view.

Conaway Graves Group

Former Congressman Mike Conaway cut his teeth on the House Agriculture Committee (Ag Committee), after which in 2021, he and Scott Graves, his deputy chief of staff, set up this shop as the Conaway Graves Group.

A short time later, Ripple Labs hired them to leverage their relationships on Capitol Hill. In 2022, the Association for Digital Assets Markets (ADAM) and the U.S. affiliate of FTX signed on.

Interestingly, Scott Graves told The Block, “The growth in that space has been organic for us. Folks have kind of come to us. Mike and I take very seriously our reputation and who we work with.”

FTX’s collapse must have been a teachable moment for the young firm because FTX was pushing for the CFTC to regulate crypto exchanges, which is believed to be more limp-wristed than Gensler’s SEC, which is constantly flexing its muscles, and the most influential organ of Congressional oversight on the CFTC is the Ag Committee, where Conaway Graves are well-connected.

The influence operation of this small shop seems to have born fruit because the Ag Committee leadership held a hearing last Summer on the future of digital asset regulation and various representatives have advocated for the CFTC to be the prime regulator of the space, where they quizzed directors of the CFTC about whether the Commission was up to the task.

It’s a touchy subject on the Hill. Nobody wants to address the issue head-on because the SEC, like other federal agencies, is highly territorial and becomes emotional when its turf is challenged, even if the fact is plain to all observers that the SEC is doing a shoddy job.

DiRoma Eck and Co.

Another small operation formed by former officials with contacts in a top Congressional Committee is DiRoma Eck & Co., which has a small profile, like Conaway Graves, just Michael DiRoma and Andrew Eck, a duo from the Treasury Department, the former who used to work for Senator Susan Collins and the latter who was a staffer on the House Financial Services Committee.

Started in 2020, the group already boasts public mining giant Marathon Digital Holdings, Uniswap Labs, a DeFi startup associated with the eponymous decentralized exchange, as well as Chainalysis, the blockchain research firm.

With these clients, DiRoma Eck and Co. has positioned itself as a “thought leader” for Washington policymakers. In this respect, the influence of Chainalysis is particularly salient both because of the frequent appearances of its co-founder and CSO Jonathan Levin before lawmakers, as well as the firm’s numerous government contracts with the IRS, the DEA, the FBI, ICE, the SEC, TSA among other (undisclosed?) agencies.

By becoming indispensable as a financial intelligence asset, Chainalysis has become a major player in the influence game, following in big data miner Palantir’s footsteps.

Invariant LLC

A lobbying firm for crypto companies with a growing footprint is Invariant LLC. Their contributions have increased by 20-fold in the last ten years and they serve the who’s who of big tech, big oil, big pharma, big food, you name it, they got it. Payward, better known as Kraken, paid them 80,000$ last year. Circle gave 90,000$.

Sternhell Group

An OG in the D.C. lobby bench for digital asset firms is Sternhell Group. They began bending the ears of lawmakers to talk about crypto in 2014. The founder is Alex Sternhell, a former staffer for the Senate Banking Committee who became a lobbyist at Cypress Advocacy in 2008 and hung up his shingle the very next year.

Sternhell is a tradfi guy with some of the biggest names in finance on his roster, including Citadel, Fidelity, PwC, and Citigroup, so the firm got into digital assets as they started raising eyebrows and stepping on toes on Wall Street. Since then, the firm racked up a long list of digital asset, fintech and a few crypto-curious firms like Meta.

Some of the big names on the list are Silvergate Bank, Coin Center, Robinhood Markets, Dapper Labs, Gemini Trust, and the Crypto Council for Innovation.

Ice Miller Strategies

Nevertheless, Binance retained Ice Miller Strategies, which specializes in some Midwestern states and D.C. Interestingly, the company counts John Pence, the nephew of former VP Mike Pence, among its staff.

Interestingly, Binance.US is actually planning to launch a SuperPAC with the help of HL’s Michael Bell, according to a November Federal Election Commission (FEC) filing.

That will allow them to solicit funds from other companies and investors with minimal disclosure. As such, the amounts contributed to HL and others on this list may be only a fraction of the total expenditures made by the industry. With this money, the SuperPAC can contribute unlimited funds to state-level candidates, not federal ones, which is telling.

Uncle Sam jumps into the digital pool

However, there may be a bigger threat to the crypto industry coming from Uncle Sam. U.S. officials are, in fact, very interested in the potential of digital currencies; they just want the government to profit from them.

The Federal Reserve has been exploring the potential of a central bank digital currency (CBDC), which would provide greater security while taking away the privacy and decentralization prized by crypto enthusiasts.

The CBDC would also privilege traditional financial stakeholders (tradfi), bypassing the entire “proof of work” and “proof of stake” systems that were the chief innovation of Bitcoin and Ethereum, respectively. Without the government getting first dibs on the deal, regulators remain hostile.

Never fear! Goldman Sachs, the big money octopus, has been championing its own “stablecoin” alternative to the CBDC with the argument that the only stable and safe alternative that offers similar privacy and anonymity is their option.

The company Goldman is backing is called Circle. Its stablecoin is called USD Coin. In either case, the money backing such a digital alternative would be put up upfront, hence the need for the Fed or big Wallstreet banks.

Just can’t quit the Washington Consensus

Never mind that the whole impetus behind the invention of Bitcoin was precisely to cut the big banks out of the transaction as middlemen.

Never mind that transactions for crypto are a fraction of what the big banks charge and that they’ve had to reduce transaction costs just to compete.

Never mind that there is a certain amount of privacy and anonymity achieved by using digital assets, as long as whatever you’re doing doesn’t attract too much attention.

In fact, the danger of collapse and the problem of runs on the digital bank is real, and currencies like Tether are not invulnerable. As we saw with Terra-Luna crash last year, the impact of a stablecoin collapse is devastating.

Clearly, digital currencies must be based on something more than market sentiment and a white paper with all the right jargon. There needs to be proof-of-reserves and the government will naturally play a role in confirming that these companies have sufficient capital in their coffers to backstop their coins.

From Federal to State, the Money Moves

With banking regulators carrying out an undeclared war on crypto, the companies and their advocates have shifted their sights from D.C. to statehouses located in Red States. In Missouri, North Carolina, Montana, and New Hampshire, digital asset influence peddlers have found receptive lawmakers.

Shout out to @Dennis_Porter_ and @SatoshiActFund. pic.twitter.com/hIBSIs2C1q

— 805 (@8_O_5) April 16, 2023

Bitcoin miners have been chased around the globe, and big mining operations have also faced blowback in obscure American towns, from locals who don’t understand digital assets and are annoyed by the noise emitted by mining facilities. However, these facilities and mining activity is crucial to the infrastructure of digital currencies.

Because of this, the Satoshi Action Fund, a 501(c)3 – or nonprofit, which is not supposed to contribute to political campaigns, seeks to influence specific legislation through the “education of lawmakers” about the benefits of bitcoin mining.

Satoshi Action is a 501(c)(4) dedicated to protecting the innovation of the Proof-of-Work consensus mechanism on the #Bitcoin protocol.

— Satoshi Action Fund (@SatoshiActFund) June 3, 2022

SAF will educate lawmakers and advance pro-#Bitcoin mining policy that encourages this nascent tech infrastructure to grow here in the USA.

Apparently, they were influential in the recent Bitcoin mining bill passed in Montana this month. They were also involved in North Carolina and in New Hampshire. Another bill was passed in Missouri. And this month in Texas, they’ve announced in a grassroots campaign in league with other state groups to stop legislation restricting Bitcoin mining, which we at Disruption Banking wrote about here.

Given that no new bills to clarify or categorize digital assets at the federal level, it’s unclear what if any change lobbying has wrought in D.C. At the state level, however, direct engagement to educate policymakers has probably gone further than millions spent lobbying, although we must assume that it’s been a full-court press with local lobbyists at the state level, as well.

Put a Lobbyist in Charge

Increasingly, industry associations and exchanges are hiring lobbyists to work full-time in-house. The Blockchain Association not only employs lobbyists; they got a lobbyist in charge. Kristin McKenzie is the executive director, after spending years at D.C. lobby shops like Thompson Coburn LLP, VogelHood Group, and Alpine Group.

Although Coinbase has reportedly been preparing to set up shop in Bermuda, the firm has also recruited a small army of lobbyists to its in-house team, putting Kara Calvert from Franklin Square, a firm representing the interests of big tech, in charge.

On May 2, Calvert told American Enterprise Institute, “I really started my journey with Coinbase back in 2015, 2016 and was one of the first and really only people up here talking about the need for regulation and how crypto as a whole was going to change the policy landscape.”

That change is now way overdue.

Author: Tim Tolka, writer, journalist, and BI researcher

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.