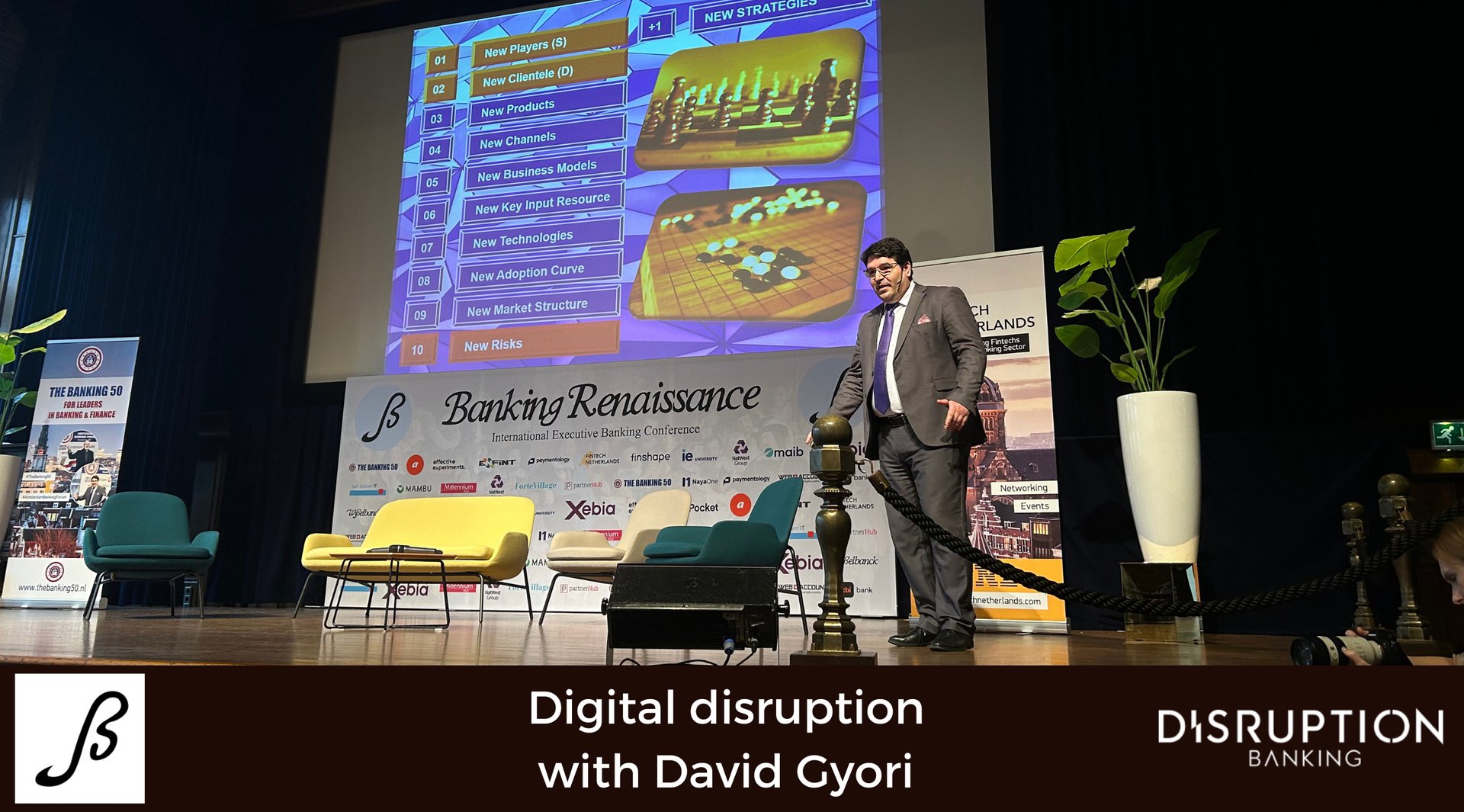

Last week we reported from Banking Renaissance in Amsterdam, where the #DisruptionTeam had the pleasure to listen to David Gyori‘s keynote speech. David is a globally renowned FinTech consultant, trainer, author, and keynote speaker. Moreover, he is a CEO of Banking Reports Ltd London, providing top quality “FinTech Training for Bankers” around the world. In Amsterdam, he spoke on “Advanced Digital Banking Strategies,” focusing on digital disruption.

Today, we had the pleasure to attend @DavidGyori1’s presentation on #digitaldisruption. Stay tuned for the full coverage from his talk! pic.twitter.com/uLloFQ8z7u

— #DisruptionBanking (@DisruptionBank) February 23, 2023

Embracing #Disruption

Digital disruption refers to the transformative impact of emerging technologies on industries, markets, and businesses. It is a phenomenon that has been unfolding for decades, but has accelerated ecently due to the technological advancements. Today, David Gyori discussed the rapid pace of digital disruption and the importance of embracing it in the banking industry. To illuminate its force, he pointed out Metcalfe’s law, which states that the value of digital ecosystems is proportional to the number of active users. Furthermore, David mentioned Moore’s law, which states that the cost of computing, data storage, and computational power is decreasing exponentially. Drawing from that, David has argued that “when these two laws intersect, a delta of digital disruption is created.”

This is the disruption that banking is currently facing.

Driving Forces of Digital Disruption

When discussing digital disruption’s driving forces, David pointed out that general purpose technologies (GPT). Examples of GPT such as writing and electricity, are rare and very important. He also argued that ICT (information and communications technology) is the GPT of our time.

“Yes, you cannot stop general purpose technologies” Gyori said. “You can learn that you can embrace them, and you can win them.”

He argued that ICT is disrupting the banking industry through fintech (financial technology) revolution. He touched on specific areas of disruption in financial services, including the rise of mobile wallets and the potential for new channels like augmented reality and virtual reality to transform banking in the future. With that in mind, he emphasised that individuals and organisations must adapt to these changes to remain relevant and competitive.

Disrupting FinTech

David discussed five categories of fintech disruption. The first category is CBDCs (Central Bank Digital Currencies), which are compliant cryptocurrencies that can be rolled out as, for example, a digital Euro. The second category is channel tech, which includes new channels like augmented reality and virtual reality. The third category is data tech, which is like air and a valuable resource.

“Deep learning and machine learning algorithms are being used to feed data through deep neural networks. The fourth category is land tech, which includes peer-to-peer lending, crowdfunding, and credit cards for millennials and future generations. The fifth category is wealth tech, which includes robo-advisors and other tools for investing and managing wealth.”

The 40 Areas of Financial Technology EXPLAINED!

— David Gyori (@DavidGyori1) February 21, 2022

'The Galaxy of FinTech'#fintech #paytech #channeltech #banktech #lendtech #creditech #wealthtech #datatech #regtech #risktech #neobanks #QuantumComputing #CBDCs #bnpl #roboadvisors #bigdata #etoro #naga #suptech #cysec #biometrics pic.twitter.com/oVEyzzJ1As

Disruptive Innovation

Gyori discussed advanced digital banking strategies, beginning with Clayton Christensen’s concept of “disruptive innovation.” According to Christensen, there are three types of innovation: “efficiency innovation, sustaining innovation, and disruptive innovation.” David explained that efficiency and sustaining innovations are areas where established banks tend to excel, while disruptive innovation is where they tend to struggle.

“Disruptive innovation is when a new player enters the market with a simpler, cheaper, and more convenient solution that ultimately disrupts the existing market. This is where startups have an advantage over established banks. To compete in this area, banks need to adopt a strategy of disruptive innovation, which involves developing new products and services that are not just incremental improvements but fundamentally different and transformative.”

David then outlined several key strategies for achieving disruptive innovation in digital banking:

“First, banks need to embrace a culture of experimentation and risk-taking, encouraging employees to test new ideas and fail fast if necessary.

Second, they need to adopt a customer-centric approach, using customer feedback and data to drive product development.

Third, they need to leverage technology to create innovative products and services, such as using AI and blockchain to streamline processes and offer personalized experiences.“

David concluded by stressing the need for companies to adapt to disruptive innovation by creating separate organisational units that can survive the disruption. He advises companies to use their existing assets and positions in a profitable way to disrupt weaker competitors. He noted that companies must be willing to take risks and invest in disruptive innovation, even if the returns on investment are not immediate.

David concluded: “We are living in the age of banking renaissance. Strategise it, and win it!”

Author: Barbara Listek

#Banking #DigitalDisruption #Fintech #Innovation