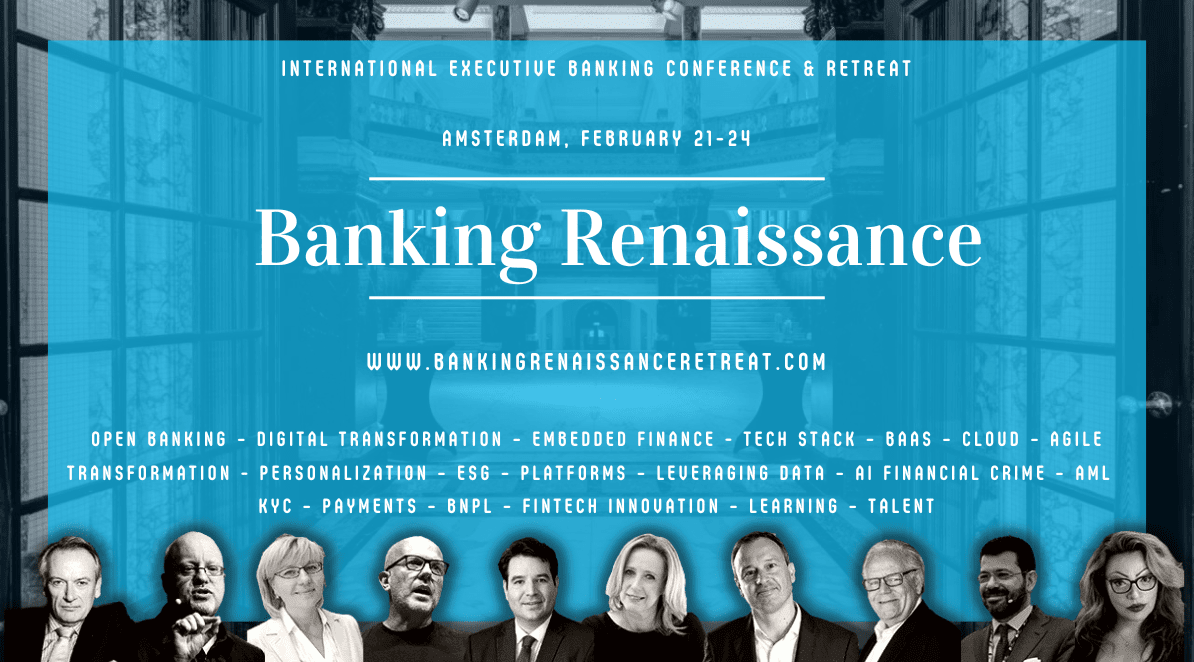

The banking industry is set to experience its renaissance with the upcoming International Executive Banking Conference & Retreat “Banking Renaissance 2023” that will be held in Amsterdam, February 21-24. During the event, 300+ people, such as bankers and fintech influencers from all over the world will gather to discuss the latest innovations and developments in the banking industry. The four-day event will include a full retreat program, a two-day conference, and a diploma for completion of the full retreat program. This diploma will be issued by the International Academy for Banking and Financial Management, with an official accreditation of Certified Digital Banker (CDB).

The two day conference, taking place on February 22-23, will bring together professionals and industry leaders to discuss and debate latest trends and developments in the banking sector, as well as how to make the most out of these changes in order to create a better, smarter banking landscape. The program will include topics such as open banking and digital transformation, leveraging data and AI, financial crime, payments and fintech, and innovation and learning.

The conference will be accompanied by a Retreat on February 21 and 24, where attendees will have the chance to gain a Digital Banker Certification. The CDB diploma will be issued by the International Academy for Banking and Financial Management, co-founded by Brett King. Brett was also the founder of Moven, the world’s first challenger bank, and a bank where our founder Morten Kriek was on the executive management team for 2 years. The diploma comes with an official accreditation of CDB, Certified Digital Banker, which can be used in a similar way to CFA behind your name if you wish to do so. In order to achieve accreditation, you need to complete the full Banking Renaissance Retreat & Conference program of 4 days. The retreat promises to be an invaluable opportunity to learn new technologies, connect with industry peers and gain knowledge and skills to advance their banking careers.

To participate in the Retreat program is EUR 2,500. Other participants will be mostly board executive bankers. So far we have participants registered from top-3 banks in Netherlands, Denmark, Poland, United Kingdom, Moldova, Uzbekistan, and Qatar. Our partners for the Retreat are McKinsey & Partners, who will deliver 2 workshops from their End Game of Banking program (on the opening day, and the closing day), and IE Business School joins with a professor from New York, with a long history in financial services on Wall Street, who will deliver a workshop of strategy, innovation and leadership.

Should the full retreat program not be something you want to take part in, you can also choose to participate only in the conference, which is Wednesday 22 and Thursday 23 February. Approx. 300 attendees will participate in 6 sessions, across 2 days, full of keynotes from world famous thought leaders, presentations from market leading vendors and interactive panel discussions between the thought leaders and executive bankers from all over the world (23 countries so far). A ticket to attend only the 2-day conference is EUR 1000.

Highlights of the full Retreat agenda are:

Day 1

- Welcome at the Amsterdam Stock Exchange

- Future of Banking Presentation by McKinsey & Partners

- Trends & Opportunities in the European Banking Landscape

- Welcome Reception for all retreat participants

- Boat Dinner on Amsterdam canals

Day 2

- Keynote by Brett King – The Future of Banking | What sci-fi teaches us about the future of payments

- The Futurists Panel – Fintech Versus Banking In 10 years

- Keynote by Jim Marous – The Future of Banking | Open Banking/API

- New Value for Customers? ‘Better Together’, António Fery Antunes, Head of Direct Channels for SME and Corporates at Millennium bcp (Portugal)

- Panel Discussion: Best Practices in Personalisation

- Keynote by Chris Skinner – The Future of Banking | Digital Transformation

- The role of the branch in a digital-first strategy by Laurent Lamblin, Innovation Manager, KBC Group (Belgium)

- Panel Discussion Best Practices in Green Banking & ESG

Day 3

- Keynote by Paolo Sironi – The Future of Banking | Platform Strategies & Business Models

- Panel Discussion Best Practices in Operating Model Transformation with Cloud, Data and AI, including Zenus Bank (USA)

- Keynote by David Gyori – The Future of Banking | Financial Crime

- ISO20022 – The Key to meeting customer, and regulatory, demands by Christian Luckow, Tribe Lead – Core Payments & Payments Center of Excellence, Danske Bank

- Panel Discussion Best Practices in KYC & Onboarding, including BNP Paribas (France)

- Keynote by Matteo Rizzi – The Future of Banking | Innovation, Learning & Talent

- Panel Discussion Key Opportunities in Banking & Fintech

Day 4

- Workshop by McKinsey & Partners – The Endgame of Banking – the how (How to create an actionable strategic document from this week’s learnings)

- Workshop by zeb consulting – Branch Network Transformation

- Workshop by IE Business School – Innovation, leadership and strategy

- Roundup with Brett King and Chris Skinner

Dinner plus certificates and awards – all participants receive a diploma and become a CDB, Certified Digital Banker. Program in collaboration with IABFM (International Academy for Banking and Financial Management), signed and awarded by Brett King.

Don’t miss this amazing opportunity to be part of the Banking Renaissance. To register for the conference and retreat, click here.

About Banking Renaissance

Banking Renaissance by Wisselbanck examines the big challenges faced in the banking sector to raise awareness and prompt action. We look across industries and cultures to create new ways of experimenting to stimulate the rebirth of the banking sector worldwide. Anyone involved in solving the challenges our sector is facing, is part of the #bankingrenaissance movement.

Banking Renaissance offers opportunities for those aligned with our mission to contribute stories, essays, interviews, and other relevant content for publication on our website and via our email newsletters.

Wisselbanck is registered with the Dutch Chamber of Commerce under registration number 84440414