It would be something of an understatement to brand 2022 a “difficult” year for investors. After markets were sent soaring to record highs in 2021, largely on the back of the stimulus injected into Covid-stricken economies, the fall in 2022 was equally steep. Inflation hit 7% in the States, forcing the Federal Reserve to hike interest rates at the most aggressive rate in years. An even stronger dollar was the natural consequence of these rises, sending emerging markets tumbling. Stock markets everywhere underwent “corrections,” with the tech bubble finally bursting after years of crazy valuations. Xi Jinping and zero-Covid in China kept Asian equities muted for most of the year.

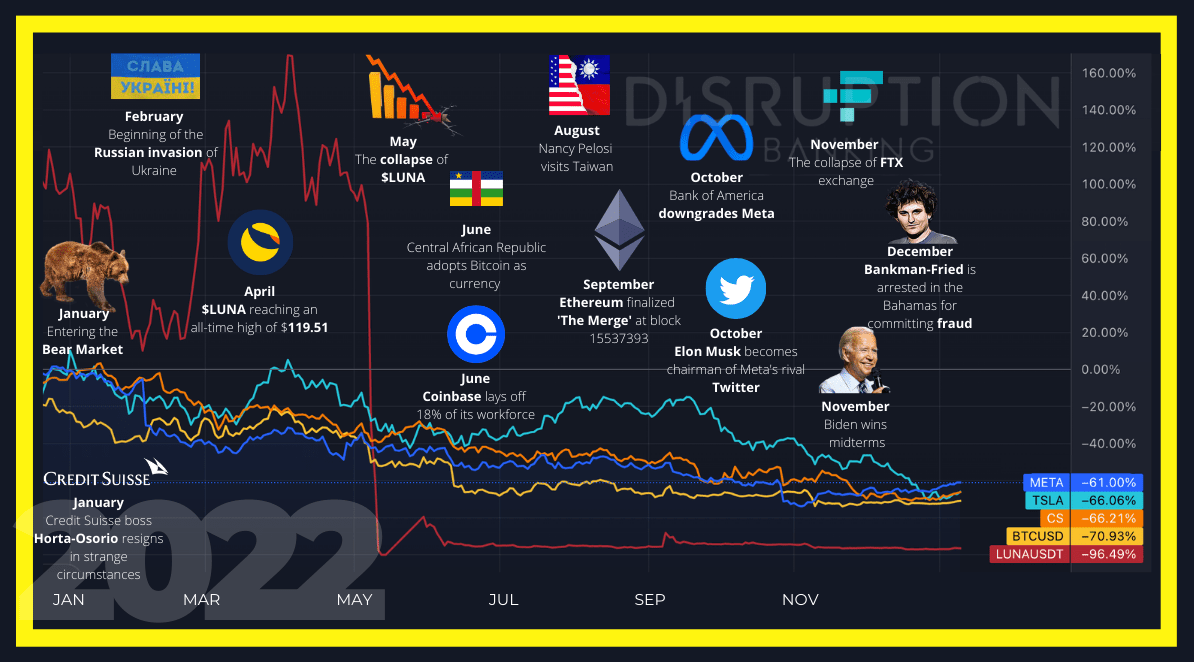

Amidst all this gloom, at least investors could put their faith in the separate world of decentralised finance though? Not quite. After a string of all-time highs in 2021, crypto markets entered a brutal bear market in 2022. Rocked by the collapse of the $LUNA stablecoin, Three Arrows Capital, and FTX, valuations plunged. The destabilisation of crypto markets raised wider fears that the traditional financial system could be affected, potentially making the situation even worse.

At times it seemed there was no asset that did perform well. Even gold trended downwards in a time of high uncertainty and elevated inflation. But in a contested field, what were five of the most notably disastrous investments of 2022?

Bitcoin

After reaching a record high of almost $70,000 in November 2021, many predicted Bitcoin would surpass $100,000 in 2022. In fact, plenty of Bitcoin enthusiasts expected the crypto to perform strongly in a high-inflation environment, like the one we have seen this year. The argument was that because supply of Bitcoin is limited, its value cannot be manipulated or undermined (either through quantitative easing or inflation) like fiat currencies. This didn’t hold up this year, with Bitcoin plunging almost 65%.

There are many potential reasons for this drop. Russia’s invasion of Ukraine, and the geopolitical fallout from that, rocked markets and put an end to the myth that Bitcoin can be a hedge against volatility. The sanctioning of high-profile Russians increased scrutiny on Bitcoin activity that could be seen as sanctions evasion. The Terra stablecoin collapsed (more on that in a moment), reverberating into Bitcoin markets. Three Arrows Capital, a leading cryptocurrency hedge fund in Singapore, filed for bankruptcy. And then FTX, previously deemed one of the safest and most compliant exchanges, went bust in very dramatic fashion.

Looking at #crypto in 2022 we can ask: if all these investment veterans managed to get it so catastrophically wrong, what chance did the little retail investor actually have? #retailinvestorshttps://t.co/BpG1wbGtA7

— #DisruptionBanking (@DisruptionBank) January 3, 2023

Given all of this, it’s hardly surprising that Bitcoin had a dire year. Opening the year at $46,311.74, the crypto ended up closing at $16,603.67. Investors putting in $1000 at the start of the year would have just $358.52 left by the end.

Terra Luna

While retail investors in Bitcoin were badly stung last year, it can hardly compare to those exposed to Terra Luna ($LUNA). This is the sister coin of the stablecoin TerraUSD ($UST). Run by the South Korean entrepreneur Do Kwon – now an international fugitive – $USDT was meant to be based on an algorithm that would ensure price stability. Rather than being backed by fiat cash reserves, Do Kwon advertised the project as a “decentralised algorithmic stablecoin” that automatically created or destroyed coins in order to maintain a $1 peg. However, once investors began to dump the stablecoin in large numbers, this mechanism failed, and the value of $LUNA quickly nosedived in turn.

$LUNA started 2022 at a solid price of $91.4, before reaching an all-time high of $119.51 in April. The unravelling came only weeks after, losing over 99% of its value on a single day in May. The crypto has all but died, although is theoretically still available to purchase at a value of $0.0001668. If you’d put in $1000 into Terra Luna at the start of 2022, you would now have $0.

A few weeks ago, @neelsalami took a huge pay cut to leave his job at Citadel and join Terra. Unfortunately for him, that was just weeks before the crypto would lose over 99.9999% of its value. This morning, he speaks to @DisruptionBank:https://t.co/nKrRM1sdmW

— Harry Clynch (@clynchharry) May 17, 2022

Credit Suisse

A stock which is now a hallmark of our annual “disastrous investments” feature, Credit Suisse has had another tricky year. Credit Suisse shares declined over 30% in 2021 after a series of scandals. The first related to the failed investment fund Greensill, which collapsed after it was unable to repay a $140 million loan to Credit Suisse. It transpired that the Swiss bank had exposed itself to a huge amount of risk when dealing with the fund, offering loans to the company on the bank of expected future invoices, rather than invoices which had already been issued. Shortly after, Bill Hwang’s Archegos hedge fund also collapsed after being unable to meet margin calls to cover its exposure to swaps on tech stocks. Credit Suisse lost an almost unbelievable amount of $5.5 billion.

2022 was supposed to be the year when Credit Suisse started to move past this – but this isn’t how it played out. The year started off badly when its Chairman Antonio Horta-Osorio departed in rather strange circumstances. Unsurprisingly, the bank has been consistently losing some of its most senior bankers. Given the need to find savings and rework internal operations, Credit Suisse is looking to restructure, but the market seems unconvinced. Shares in the bank dropped by almost 70% over the course of the year, declining from $8.79 to $2.76. A $1000 investment would now be worth about $314. In other words, Credit Suisse performed worse than Bitcoin in 2022.

The way the Chairman of #CreditSuisse has departed has surely left many commentators and potential suitors scratching their heads.#DisruptionBanking explored the 'other potential reasons' for his resignation:https://t.co/S6HGNwv2ge

— #DisruptionBanking (@DisruptionBank) January 20, 2022

Meta

2022 was a torrid year for technology stocks, with the tech-heavy Nasdaq declining almost 30%. One reason for this decline is the fact that many tech stocks were vastly overvalued in the first place. 2021 and the era of cheap money saw non-profitable start-ups pushed to unsustainable valuations. Most would argue that these stocks were due a correction, and, given the macroeconomic conditions 2022 had in store, this duly happened. Hikes in interest rates cut off access to easy cash. A strong dollar drove up the cost of American tech goods in foreign markets, hurting international sales. Rampant inflation and tighter corporate budgets hurt digital advertising and e-commerce revenue.

It is estimated that the tech industry collectively lost $7.4 trillion in 2022. But one of the worst performers was Mark Zuckerburg’s Meta Platforms. While being hit by macroeconomic factors like everybody else, the market seems unconvinced that Zuckerburg’s big bet on the metaverse will pay off. Zuckerberg has committed himself and his company to investments of up to $15 billion every year in metaverse development, a move that has “terrified” shareholders. This also caused the Bank of America to downgrade Meta’s valuation, on the grounds that this commitment will be an “overhang” on the stock given the “lack of progress” the company has made. The internal situation at Meta is clearly serious, with speculation growing that Zuckerberg may step down this year.

On the first day of trading in 2022, Meta was valued at $331.79. However, the company lost over 63% of its value and closed the year at $120.34. Had you invested $1000 in Meta shares at the start of 2022, you would now be left with $362.70.

Google and Apple stock price have both dropped by over 23% this year. Facebook's Meta has collapsed by 53% this year so far though.

— #DisruptionBanking (@DisruptionBank) July 1, 2022

Will recruiting less engineers lead to a #rebound in Meta stock? Or is the #metaverse a step too far for Zuckerberg & co? https://t.co/TSiCYIgewE

Tesla

Mark Zuckerburg wasn’t the only billionaire to have a hectic year. Elon Musk was, as ever, a disruptive influence as he completed a takeover of Meta’s rival Twitter, albeit after some hesitation. In the background of all this drama, though, was a struggling Tesla. Shares in the electric vehicle manufacturer posted a loss of 64%, declining from $342.18 per share to a measly $123.18. A $1000 investment would be worth $359.99 by the year end.

Musk’s Twitter saga undoubtedly weighed on Tesla’s share price, with Musk selling billions of dollars in his own shares to help fund moves at Twitter. Vehicle sales and production are still strong, although there’s a sense that momentum is beginning to slow. For one, Tesla fell short of investors’ sales expectations in the final quarter of 2022. Other players, such as Li Auto and NIO, are set to eat into Tesla’s market share. Supply chain issues related to the lockdowns in China, and weaker consumer demand, were also a drag on Tesla’s share price. Little wonder December 2022 was the company’s worst trading month on record – and the difficulties could continue into 2023. To make matters worse for Musk, Twitter could prove equally challenging, too:

Twitter was already “seriously distressed” by the massive leveraged buyout debt it couldn’t support before Musk took over. Has he made the situation even worse?https://t.co/478bQGuXHs

— #DisruptionBanking (@DisruptionBank) November 30, 2022

Five disastrous investments for a disastrous year on global markets. By way of summary, this is what a $1000 investment in these companies or assets were worth on the last day of trading in 2022 compared to the first.

Bitcoin – $358.52

Terra Luna – $0.00

Credit Suisse – $314.00

Meta – $362.70

Tesla – $123.18

With inflation predicted to ease off, and therefore for interest rate hikes to become less aggressive, there’s optimism that macro conditions may improve in 2023. In turn, this should help stock markets at least begin to recover some of their losses. After all, it would be hard for most assets to perform any worse than they did in 2022 – apart from Terra Luna, of course.

Author: Harry Clynch

#Bitcoin #LUNA #CreditSuisse #Meta #Tesla

Revisit our review of 2021 here:

2021 was a year of disasters – #Covid19, #Greensill and the #SuezCanal are just some of the incidents to have hit #investmentbanking. But it was also a year of opportunity. Why not read our review of the year to find out 2021’s winners and losers?https://t.co/XOtSPYB52E

— #DisruptionBanking (@DisruptionBank) December 23, 2021