Ladies and gents, Sam Bankman-Fried (SBF) has been arrested, finally. In July, we at #DisruptionBanking called attention to the fact that Voyager Digital, a crypto lender and one of SBF’s closest partners, had defrauded investors, but we never guessed how deep the fraud went.

Nevertheless, we were pleased when at long last Bahamanian authorities detained the disgraced crypto financier at the behest of U.S. prosecutors. After being hauled out of his penthouse the night before, SBF had to ditch a scheduled testimony before Congress, although he’d been doing a free-wheeling media tour.

In the Spring, SBF, founder and 50% owner of the now-bankrupt crypto exchange FTX, as well as the almost wholly-owned hedge fund Alameda Research, was palling around with politicians and bailing out crypto companies. His dexterity with numbers and his disheveled persona comported with the image of the eccentric genius. And he was generous, spouting often about his effective altruism philosophy.

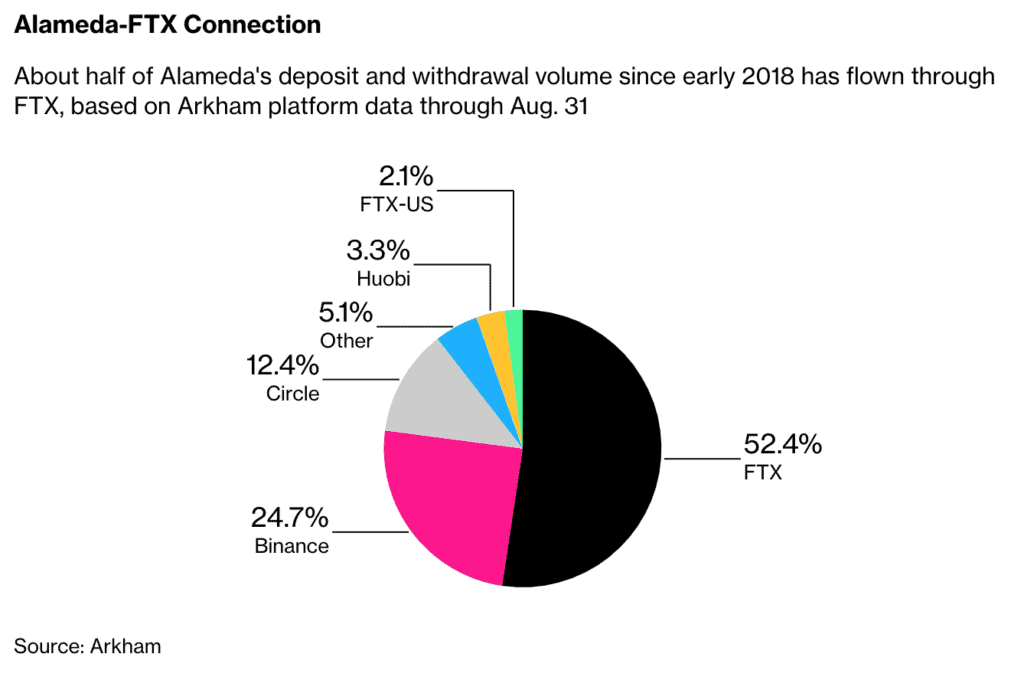

He showered mostly Democratic politicians with about $46.5 million in public donations and later admitted he gave a similar bounty to Republicans through dark money groups, which is now under investigation by the FEC. He also dumped about $256 million into luxury real estate in the Bahamas. Alameda generated a cool billion in profit last year, more than half of which was routed through FTX.

However, along the way, the numbers got away from Sam. In the space of a single day, he lost $15 billion of his own and a few more billion belonging to his customers. In his arraignment Tuesday, there was talk of upwards of $7 billion of customer funds unaccounted for, and SBF is staring down a long jail sentence for fraud.

Ponzi Scheme: Crypto Edition

SBF is by no means alone. Since the start of 2022, crypto hedge funds, lenders, exchanges, and token issuers have all been forced into acquisitions or Chapter 11 bankruptcy. Plenty of executives are on the run. Earlier this year, Voyager was one of the casualties of the massive collapse of Three Arrows Capital (3AC), a crypto hedge fund, now nearly forgotten among the wreckage of the crypto crash.

Looking back at SBF’s tweets, a lot of questions arise. For example, SBF wanted to give customers priority in the bankruptcy process of Voyager. One wonders if customers will get the same deference in the bankruptcy of FTX.

13) Anyway: in the end, we think Voyager's customers should have the right to quickly claim their remaining assets if they want, without rent seeking in the middle.

— SBF (@SBF_FTX) July 25, 2022

They've been through enough already.

SBF has a new view of the world because he’s now in the hot seat where the Four Horsemen of the Cryptocalypse, Do Kwon, founder of Terraform Labs, Su Zhu, CEO of 3AC, Alex Mashinsky, former CEO of Celsius, and Stephen Erhlich, former CEO of Voyager, have been for months – fearing arrest, ducking court orders, and generally laying low.

SBF’s Fall from Grace

The reason for this sudden shift in FTX’s fortunes has not been fully explained. Some have blamed Changpeng Zhao, the CEO of Binance, the main competitor of FTX, since he delivered the coup de grace that sent FTX spiraling, a tweet that he would drop his enormous holdings of FTX’s crypto token, FTT.

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

Changpeng Zhao, known as “CZ,” says his tweet was not an attack against his competitor, but the tweet unleashed a run on FTX and within hours, SBF sought Chapter 11, which he later told a Vox reporter was his biggest mistake. In an interview with Forbes, SBF said it was a targeted attack.

The business relationship and feud between CZ and SBF definitely played a role in the fall of FTX, but there’s an intriguing process that is happening now as the assets of bankrupt crypto firms get sold off to the highest bidder.

CZ and SBF have both been very active in this process – it serves their interests in tamping down panic in the market. SBF posed as a savior to struggling crypto firms, but since he has been revealed as a fraud, it’s worth reconsidering all the news we previously took as normal and all the relationships SBF had with other fraudsters.

Voyager: Neither a Borrow nor a Lender Be

Stephen Ehrlich is one of them. Ehrlich owned Voyager Digital, now in bankruptcy proceedings, and fraudulently told investors that their deposits in Voyager were “insured by the U.S. Federal Deposit Insurance Corp. Ehrlich and SBF had deep business ties dating back to at least September 2021. We only know this from court filings because the relationship was initially undisclosed.

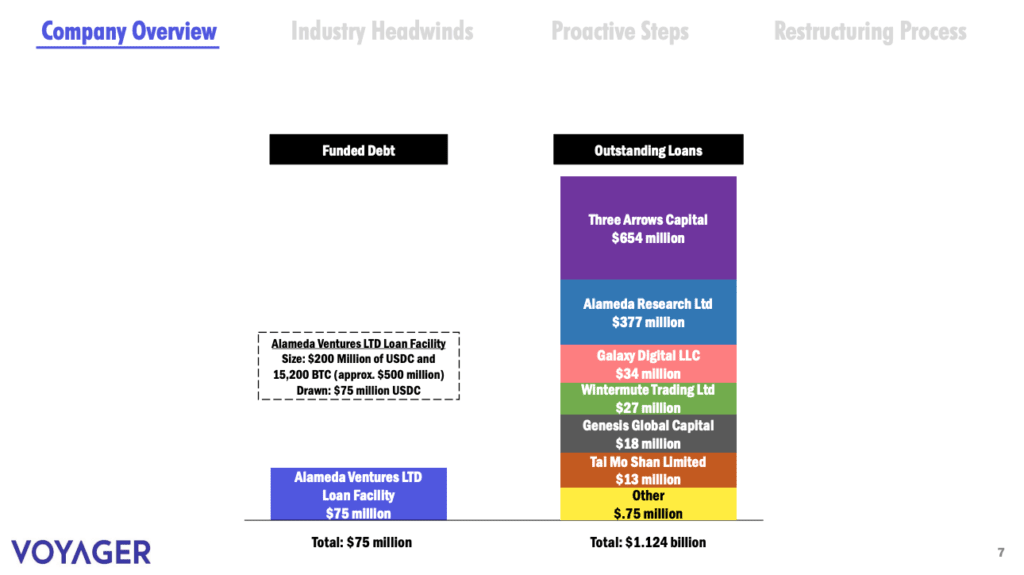

Voyager was one of the erstwhile beneficiaries of SBF’s largesse with a “revolving credit facility” announced in June. This involved $200 million US and 15,000 BTC from Alameda.

Then, in July, it was revealed that Alameda had taken out a loan for $377 million. Huh? Never mind that most of this was in crypto, which was then tanking.

That’s where things got so murky that CZ tweeted that the relationship between Voyager and Alameda was “hard to follow.”

So, 3AC owes Voyager a few 100m, went bust. FTX/Alameda gives 3AC $100m, but didn’t save it.

— CZ 🔶 Binance (@cz_binance) July 7, 2022

Alameda invests in Voyager, then takes a $377 million loan from Voyager… ok…

V went bust. FTX didn't “bail them out” or return the money?

hard to follow?https://t.co/yx6RJjVZrB

Then, in August 2022, another head-scratcher came out of Voyager’s bankruptcy proceeding. Alameda Research had borrowed $1.6 billion in crypto, representing 61% of Voyager’s loan book, according to a court filing.

If true, this would seem to contradict the “First Day Presentation” Voyager made in the Bankruptcy Court for the Southern District of New York wherein Voyager claimed that the total of its outstanding loans was just $1.124 billion, of which Alameda Research only represented $377 million. Perhaps, Voyager was holding millions of FTT tokens or potential FTX equity as collateral. Marcum LLP, Voyager’s auditor, did not immediately respond to a request for comment.

Michael Saylor, CEO of MicroStrategy and one of the largest Bitcoin investors, spoke recently about the SBF saga in an interview. “Sam basically scraped billions from unsuspecting investors in Silicon Valley. They should have known better. He took money from crypto hedge funds and crypto banks like BlockFi and Voyager. They should have known better.”

Loan Repayment Disguised as a Bailout

Then, SBF and his people must have lost the money, which helped drive Voyager and BlockFi into bankruptcy. The next steps are indeed hard to follow, especially with regard to the motives of the parties.

Christine Mackay, a professor at the Emory School of Law, noted in an email, “What would happen if FTX did not try to stop the [bankruptcy] of Voyager – the ties between the companies would become known and the jig is up. House of cards falls, which eventually did happen. The problem (likely) is that there really isn’t the money that appears on the financial statements and so could not be paid back …the collateral was a company that they already had a loan or receivable with. If one fails, the others may also or are definitely negatively impacted. Although she noted that this is not evidence of fraud, she observed that SBF’s act is standard behavior among fraudsters who perpetrate Ponzi and pump and dump schemes.

If these loans were exposed, then it becomes SBF’s problem, so he wants to cover it up by posing his partial repayment of the loan as a bailout and completing the sale of Voyager and BlockFi with FTX equity.

Again, Michael Saylor commented further, “The reason that Sam wanted to bail them out is he didn’t want to actually have the loans called. He was actually trying to buy BlockFi and buy Voyager with FTX equity, which of course is fraudulent and worth nothing, but if I borrowed a billion dollars from a company and they want the money back and I can simply give them a billion dollars of equity, take over the company, and not pay the loan back, I can roll the entire fraud forward.”

SBF effectively bankrupted both Voyager and FTX. In the course of his attempt to cover his and his staff’s losses, SBF adversely affected the deposits of two sets of clients. Maybe, he knew he was in deep shit at that point, so he took out a massive loan using somebody else’s money (Voyager and its clients) as collateral to try and cover his own positions.

A Balance Sheet Full of Funny Money

Trying to find real assets in FTX’s balance sheet is like trying to put the wind in your pocket. Most of the big numbers they put in there are either massively deflated or utterly collapsed.

Cory Klippsten, CEO of investment platform Swan Bitcoin told Coindesk, “It’s fascinating to see that the majority of the net equity in the Alameda business is actually FTX’s own centrally controlled and printed-out-of-thin-air token.”

Michael Saylor explains how SBF’s committed fraud and worked the jurisdiction of the Bahamas to his own and FTX’s benefit: “Then, he took 10 billion or more from depositors on his exchange. They have the best argument. It’s like they were staring at terms and conditions that said he’s not gonna rehypothecate or use their assets. He just lured them with the promise of cheap trading [and] high leverage. If you thought, Sam is manipulating the price of FTT, and Serum and Solana, and he was, right? That’s illegal and unethical, right? It’s a pump and dump scheme, and we talked about this before, but if you accept the idea that crypto tokens issued by some offshore dude are okay, well, then you’re thinking, I wanna get behind Sam and Alameda because they’re gonna drive the price up. Solana went up from 3 bucks to 50. FTT went to 50 a token. You could have made a lot of money trading those tokens, but you probably would have wanted to go to the FTX exchange because guess what, news flash, that’s illegal in the US.”

So perhaps Voyager thought SBF was doing them a favor. Stephen Erhlich told his stakeholders that “the people we lend to are some of the biggest names in the industry.” A real big name was enough for Erhlich, apparently, since Voyager later revealed that 3AC had provided only one single page of information about its assets in order to secure a $953 million loan.

With the benefit of hindsight, it seems like SBF was seeking to cover his losses by separating a fool (Stephen Erhlich) from the money of Voyager’s depositors.

If you have enough market influence to make your lender go insolvent and you never have to pay them back, do you do it @cz_binance ?

— Ben (@kcryptoinvest) July 7, 2022

SBF Talks Trash on Twitter

Then, when Voyager’s exposure to 3AC threatened to publicize the enormous liability Alameda had to Voyager, SBF acted aggressively to disparage Voyager in the media and on Twitter while hyping his own bid for the platform, assuring Voyager’s customers that they would be taken care of.

14 p.s. to clarify: our offer would give Voyager customers back 100% of the remaining assets that Voyager has, including claims on anything recovered in the future.

— SBF (@SBF_FTX) July 25, 2022

At the same time, Voyager received a proposal from Alameda/FTX offering to purchase its assets and loans in a way that would benefit Alameda/FTX at the expense of Voyager’s customers.

First, Alameda/FTX proposed to buy Voyager’s crypto assets at “fair market value.” The crypto would go into its own account and the cash value of the assets would be distributed to FTX’s own customers, rather than those of Voyager, despite SBF’s claims.

Voyager protested that the bidding process is supposed to be confidential, rather than public, meaning SBF was in effect undermining the competition of the bidding process.

You have all heard the terms "hero," "bailout," "rescue," and "help" in reference to FTX saving distressed companies. Voyager, one of the aforementioned companies, disagrees – they think that SBF's deal is extremely predatory and will actually hurt customers even more. https://t.co/l726t4U4RR pic.twitter.com/NeARz3lRiP

— FatMan (@FatManTerra) July 24, 2022

Now, we can understand why he would do this. He wanted to deter other bidders so that he could purchase the items on Voyager’s balance sheet, especially his own massive loan, which he could effectively settle and perhaps keep secret.

Crypto’s White Knight Unseated

Perhaps unsurprisingly, SBF’s apparent bailouts and generosity had an ulterior motive – covering his own ass. At this point, all the political donations he made on both sides of the aisle won’t save him. In fact, the politicians may be even more pissed off because SBF made them look like dupes. A few have reportedly returned SBF donations, but most of them are mum on the topic.

Since SBF’s tangled web of deception unraveled, he tried to avert disaster with excuses about supposed accounting errors, ignorance, and mismanagement, but it seems that only forestalled the imminent disaster, buying him a few more precious weeks of freedom, which further angered his many new enemies.

Voyager’s legal team was reportedly “shocked, disgruntled, dismayed” by the FTX bankruptcy. Really, guys? It’s a bummer they have to find a new buyer with enough cash to cover Voyager’s 100,000 creditors, but it could hardly have been a surprise.

As he faces a slew of indictments for wire fraud, wire fraud conspiracy, securities fraud, securities fraud conspiracy, and money laundering, we hope SBF has a good attorney. CZ may not want to bust out the champagne just yet because rumors are swirling that SBF, CZ, and other exchange kingpins were involved in a secret signal group.

SBF will be pressed to give the feds any and all information that could lead to other indictments, so whatever conspiracies he may have been involved in, including a weird investment in a tiny Washington state bank, will likely come to light.

Author: Tim Tolka, writer, journalist, and BI researcher

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

One Response

Thank you for your information about blockchain. This is very important for me and I’m very interested in your information.

Keyword