Currencies all over the world are currently in a state of flux. Inflation is causing uncertainty. However, banks with large sell-side teams have been some of the biggest winners of record profits in 2021. Technology underpins much of how this success is being achieved. Companies like Lab49 are working with both the sell-side where historically they were heavily involved in FX technology and now more and more with the buy-side.

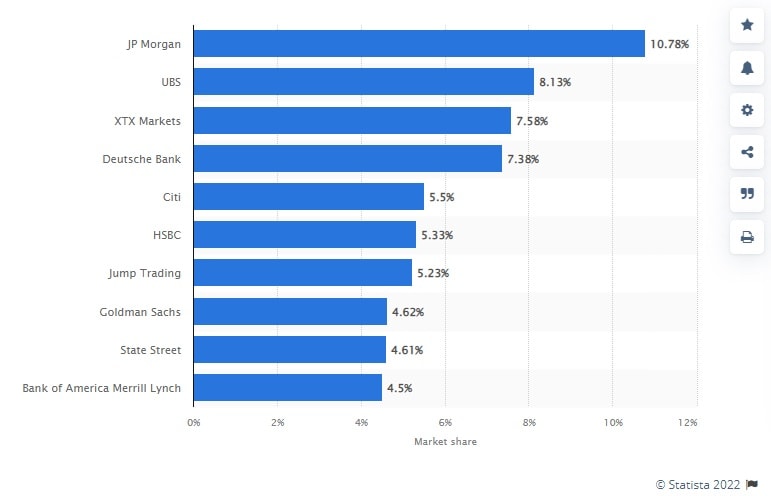

Technology that all the major banks are investing into. This technology helps them better complete their regulatory obligations. It also makes things quicker for their clients. It’s not just JP Morgan worried about new players on the market, all the banks are competing constantly to have the best technology offering for their clients. And the FX space is no exception:

DisruptionBanking met with Kenan Maciel, Director of Strategy, Lab49 to discuss FX yesterday, today, and tomorrow. The firm work with the largest global banks and have specialized in FX since the firm was established.

Sell-side FX focus at its roots

Kenan joined Lab49 in 2010. He helps customers in capital markets bring about change. And he specializes in Fixed Income, FX, Rates and Credit.

He started by explaining a little about the firm. “Lab49 was started in 2002 in New York. Initially it was a consulting company which was development-driven to tackle difficult front office problems in the risk management area,” Kenan explained.

“It grew from a small office in New York, to now, where we have further locations in Washington DC, London, Budapest, Dublin, Sydney and Delhi. Today we cover the globe.”

To understand better how Lab49 fits into the wider ION Group, Kenan shared what the firm does for clients.

“We try and tackle difficult problems end to end for our clients. We can offer product strategy and competitor analysis at the outset. Later we can go on to design and frame solutions. We also have a user experience and design team. And then we have the core development both front and back end as well as full stack integrations.”

And the firm does this across all aspects of capital markets.

The first wave of Digital Transformation in FX

After the world normalized from the ‘dotcom’ bubble, the founders of Lab49 saw an opportunity. They saw an opportunity to create a niche in the market for people that would use cutting edge technology.

“Many years ago, Deutsche Bank came out with an electronic FX Platform – AutobahnFX,” Kenan explained.

“As Deutsche Bank had a dominant market position in the forex market, the platform dominated the online trading space. They were number one in terms of average daily volume for years.” Kenan shared. “A technology war commenced. All the big banks thought that they needed a digital platform. A single dealer platform as we call it.”

Lab49 came into its own at the time with many of the top Wall Street banks looking to the technology firm to help them build platforms. Hence the word ‘Lab’, Kenan explained.

Lab49 were already working with technologies like Microsoft Silverlight and Adobe Flexin in 2009. The team helped implement technology which could be used to create rich desktop-like applications for clients through a browser which was revolutionary at the time. It was a key battleground in the electronic trading space. Sell-side banks started to offer clients Web based applications.

A host of implementations ensued. Matrix was developed by Morgan Stanley with user experience consultation from Adobe Professional Services and technical delivery by Lab49 in partnership with Adobe Professional Services and others. Interestingly many of these implementations were on the buy-side as well as the sell-side.

In 2010 Lab49 became involved in the UBS Neo project. Neo went live with clients in 2013. Many banks created sophisticated multi-channel strategies as Neo did. They wanted to have more contact with clients including web and mobile. Many of these projects were completed by Lab49.

Company announcement: Lab49 and The Yield Book team in fixed-income analyti… https://t.co/Nge91X1vGe #fintech

— Finextra (@Finextra) July 18, 2016

By 2016 Lab49 were working on even more sophisticated products in the fixed income space. However, Kenan explained, once implementations are completed the banks often hire in-house teams to maintain and continue development of the product. This has meant that Lab49 have had to reinvent themselves several times over the history of the firm.

The next wave of Digital Transformation

It’s not just the pandemic that has changed the way we work. Cloud and data have emerged as dominant trends of digital transformation. Kenan shared how Lab49 have completed some proof of concepts for a clearing and settlements organization in the U.S., and how the firm have also worked on several cryptocurrency projects.

Kenan explained how, “Initially our client-base was predominantly sell-side. All the big banks, a few small banks, some exchanges, and specific broker dealers. But, in the last few years we’ve seen a move and a trend towards the buy-side.”

As Lab49 had become specialists in the capital markets domain, their new client-base of wealth management and asset management had not been big spenders when it came to Tech. Today that has changed.

“I think one of the triggers for the trend has been the COVID experience. It’s been a big trigger because people had to work from home.” Kenan shared. And it’s not just about client contact, Kenan explained, but also about “the technology they use to manage their portfolio and to execute trades.”

“At home, people have one screen, maybe two at best. Meaning that their main application, their portfolio management or order management or execution management system had to include all the market data. Because peak times can cause huge latency issues for them. If prices go out of date while you are switching systems, this can cause huge frustrations,” Kenan elaborated. He suggested that this challenge was one of the reasons that “we’ve seen more buy-side business and we’re helping these clients with new cutting-edge technology. We’re building these thin web-based clients, which allow for huge data throughput at low latencies.”

Partner Spotlight: With the speed of #tech advancement, you'll need to build new products swiftly. @lab49, one of OpenFin's global certified dev partners has been delivering on #OpenFin at speed for over 5 years. Learn more here: https://t.co/PyVjrbgxB8 pic.twitter.com/CDwA7vBmJf

— OpenFin (@openfintech) September 1, 2020

Kenan explained how Lab49 partner with firms like OpenFin and Glue42 to improve user experience. The firm are also looking at Low Code No Code, a trend that we covered in a story last year.

MiFID regulation and innovation

Regulation is one of the biggest topics we cover at DisruptionBanking. Many of our stories are on the topic of how regulation has created opportunities for many companies, including StartUps. Regulations also need interpretations. They need to create obligations that banks need to address.

The first issue of IQ magazine for 2021 is out now and it’s a must read. Our cover package dives deep into #ESG and #derivatives, with other features including benchmark reform, Basel III, the ISDA 2021 Definitions and initial margin #ISDAIQ https://t.co/Hum8ltC0QR

— ISDA (@ISDA) February 11, 2021

“Regulation can drive innovation. Because regulation poses some tricky questions that banks need to comply with and then we come up with the technology solutions to provide answers,” Kenan emphasized.

Regulatory change with Dodd-Frank in the U.S. and MiFID in Europe, has affected financial institutions across the globe. And not just these regulations. The regulations, like MiFID, require that before a deal can be executed, client checks are put in place.

Kenan brought up an example of a bank that worked with Lab49 related to MiFID.

“In fast moving markets you need to be able to do these checks [MiFID checks] very, very quickly,” explained Kenan. “So, we designed solutions to help our clients with that. For example, in derivates. Most banks would do a ‘swap’ over the phone with a client. Input into MarkitWire, which has the matching platform, meaning it’s not really their risk at this point.”

“Then, from MarkitWire, a third-party platform, the bank ingests the deal into their books and on to their records. At which point it hits their risk. Creating a bit of exposure. How do you do checks in this situation?” Kenan queried.

“For a large Swiss bank,” Kenan continued. “We were able to re-engineer the process. The first thing that happens is the deal goes into a sales system. We run these pre-checks quickly against a ‘rules engine’. And it comes up in no time with answers or questions.”

One of the questions the system would ask, Kenan shared, is “Are you allowed to quote or not?” On some deals, you are not allowed to trade bi-laterally, they need to trade on a venue.

“Once they have permission to quote, and they quote to the client. Then we run some algorithms again to see if we can execute.” Of course, this is dependent on whether the client still wants to. Because, Kenan pointed out, “there are other obligations after you quoted, like the pre-trade transparency checks, you’ve got to publish that price and so on.”

“We turned it around,” Kenan shared. “Instead of deals first going into MarkitWire. MarkitWire is further downstream from the process. And we built platforms for the trades to go straight into the client’s sales system. Performing all the checks before the trade is committed.”

Basel regulation and innovation

Industry bodies such as the International Swaps and Derivatives Association (ISDA) or the Fixed Income, Currencies and Commodities Markets Standards Board (FMSB) help to provide guidance when it comes to regulation. Basel is one of the regulations that we have written about in the past. Kenan explained how Lab49 help clients with these regulatory challenges.

“A very simple problem for Basel is the traders pricing, which is done on a regional basis. From a desk in Tokyo, Singapore, Sydney, somewhere in Europe, London, and New York. If you have those desks around the world the books are marked at closing prices for each region. But the risk management for the regulatory reporting of risk, is completed at the end of the U.S. day for the global book.”

The way the process looks allows for a lot of mismatches warned Kenan. He continued by explaining how “Basel says there’s going to be some capital hits. The P&L attribution test compares two measures: the hypothetical P&L generated by the desk’s front-office pricing models, and the risk-theoretical P&L generated by the bank’s enterprise risk models. The ratios generated from the two P&Ls must remain within defined thresholds. Four breaches of the thresholds within a 12-month period constitutes a failure, which could force the trading desk back on to the standardised approach, meaning higher capital requirements.” Which are exactly the kinds of problems that Lab49 likes to help clients solve.

“Those regulatory requirements help us to think of innovative solutions for our clients,” Kenan concluded.

Digital Transformation is Global

Lab49 have a very strong position in the U.S. Customers are very aware of the capabilities of the firm. However, the U.S. is not the only market where they are strong. In Australia the firm have helped the National Australia Bank (NAB) with projects too – in 2016, Lab49 helped NAB release the first e-trading platform with uniquely Australian knowledge. In Europe the firm have helped a leading European investment bank to “centralize and automate processes to simultaneously improve efficiency and achieve compliance ahead of the regulators’ deadline for MiFID II.”

Kenan shared how he has personally helped in a project with a European-based bank with their emerging markets strategy. How the firm are helping the bank build out their digital platform, to help the bank better reach their clients. Hedge funds would pass the bank by, leaving them with mainly corporate customers in their portfolio.

“Their client-base is great, but they need the depth of volume,” Kenan explained. “So, we spoke to their different client segments. Private banks, wealth management, hedge funds and large corporates who pretty much work as a hedge fund due to their size (ie. Shell and similar). Then we help them with their product strategy. In terms of what they should develop first.”

While the bank needed support with the strategy, Kenan continued, they did the building out themselves. This often happens with banks in Europe. Banks in Europe rarely outsource the building element of their digital strategy. Often financial institutions in Europe will simply go to normal software firms to help with implementation.

Could this be because consulting firms in Europe rarely do well on the Tech side? IBM is an exception to this rule, and maybe a handful of others. But Lab49 do very well too, except that their sole focus is capital markets, which is a very rare combination that perhaps more banks should take note of.

If you are interested in other stories by Kenan, he recently shared a story with Traders Magazine about “How Wall Street Can Get the Post-Pandemic Hybrid Working Model Right”.

A similar story that we covered last year highlights the depth of the problem: Trading Floor Surveillance – Can RegTech solve the Technology needs of the post-Covid Trading Floor? • Disruption Banking

Author: Andy Samu

#Lab49 #BuySide #SellSide #Innovation #Regulation #MiFID #Basel #FX #Forex #Market #Trader