Binance is the largest cryptoexchange in the world. According to its billionaire CEO Changpeng Zhao, the trading volume on the platform has recently hit 170 billion dollars in a single day. For context, this amount would be the same as more than 2.5% of the entire foreign exchange market passing through one company every day. Its average daily volumes are greater than those of its four largest competitors combined. It is also a company that never seems to be far away from controversy and, increasingly, the attention of the regulators.

In May, Bloomberg reported that Binance Holdings Ltd had come under investigation by the US Justice Department and Internal Revenue Service (IRS), with enquiries involving officials specialising in money laundering and tax offences. This followed reports from Chainalysis, a blockchain forensics firm, that more funds related to criminal activity passed through Binance than any other cryptoexchange.

In August, we reported that a group of over 700 traders, backed by Swiss law firm Liti Capital, have brought a case against Binance to the Hong Kong International Arbitration Center. According to the terms and conditions which all users agree to upon opening an account, this court – where it costs $65,000 just to raise a claim – is the only place where it is possible to pursue litigation. These traders are attempting to recoup money that was lost when Binance’s platform suffered major technical flaws during a Bitcoin crash on the 19th May last year. This meant that thousands of individuals were unable to trade or hedge their positions in any way. By the time the platform was working again, many had seen their accounts completely liquidated. We spoke to one trader who saw his balance of $6 million reduced to zero. Binance has denied any responsibility for this.

Traders have secured financial backing to pursue Binance for compensation over an outage during crypto market turmoil earlier this year https://t.co/H0IcuE8IO0

— Financial Times (@FinancialTimes) August 19, 2021

Binance is registered in the Cayman Islands but does not yet have a formal HQ anywhere in the world. It operates through a “complex global network of legal entities,” which makes pursuing recompense in the courts very difficult. The “Tai Chi” papers, leaked to Forbes, revealed what the magazine called “an elaborate corporate structure” that was designed “to deceive regulators.”

In the UK, Binance operates through two separate entities: Binance Markets Ltd and Binance Europe Ltd. According to Binance Markets’ 2020 Strategic Report, “the ultimate parent company is now Binance Capital Management Co Ltd, a BVI [British Virgin Islands] company, and the controlling party is Mr Changpeng Zhao.”

This parent company in the British Virgin Islands is currently facing a class action in the US for the alleged unlawful collection and retention of biometric data. A resident of Illinois is arguing that Binance.US and biometric firm Jumio did not obtain “proper written consent” for the collection of data, which included scans of users’ faces and a range of personal information.

Binance is facing a class action in the US, with the company alleged to have collected and stored users' biometric data unlawfully. #Binance #Regulation #Biometrics #Data #Cybersecurity #Tech #Cryptoexchangehttps://t.co/1plGriuRZF

— #DisruptionBanking (@DisruptionBank) December 1, 2021

In June 2021, the FCA banned Binance Markets Ltd from undertaking “any regulated activity in the UK.” This was partly because FCA investigations were met with “responses [that were] incomplete” and “direct refusals to provide information” regarding the company’s corporate and legal structures. Binance Europe was incorporated in the UK in March 2020 but is not registered with the FCA.

The FCA’s ban on Binance Markets’ regulated activities followed a more general ban on retail users trading in crypto derivative products. These are products that are particularly profitable for Binance. This ban was announced in October 2020 and came into effect on 6th January 2021. In announcing the move, the FCA cited the “prevalence of market abuse and financial crime in the secondary market” and the “extreme volatility in cryptoasset price movements” as two reasons for initiating the measure.

Britain’s bans the sale of cryptocurrency derivatives, saying they have no value for ordinary investors https://t.co/HI68mdgtCW

— Bloomberg Crypto (@crypto) October 6, 2020

Of course, the wider crypto industry has also had its fair share of legal controversies since its advent. The first of these was the Mt. Gox scandal in 2014. After the launch of Bitcoin in 2009, Mt. Gox emerged as the first major cryptoexchange and, at its height, handled over 70% of all Bitcoin transactions. After a number of security incidences and data breaches, the exchange was hacked in 2014, resulting in more than 850,000 Bitcoins being “lost.” Only 200,000 were eventually located, and Mt. Gox declared itself bankrupt. Because of Mt. Gox’s preeminent position, the nascent Bitcoin market was also destabilised. The cryptoexchange was criticised for a complacent approach to security and compliance and, for many, this raised wider question marks over the viability of cryptoassets themselves.

Binance is now in a similar position in being, by far, the market leader. Its robustness when it comes to compliance and regulatory affairs matters not only for the tens of millions of consumers around the world which use its platform, but for the entire market. Should the largest cryptoexchange in the world display sloppiness or amateurishness in the eyes of regulators, that is inevitably going to cause wider problems. The many controversies surrounding Binance, from many different directions, are a testament to the fact that the company is struggling to get its act together.

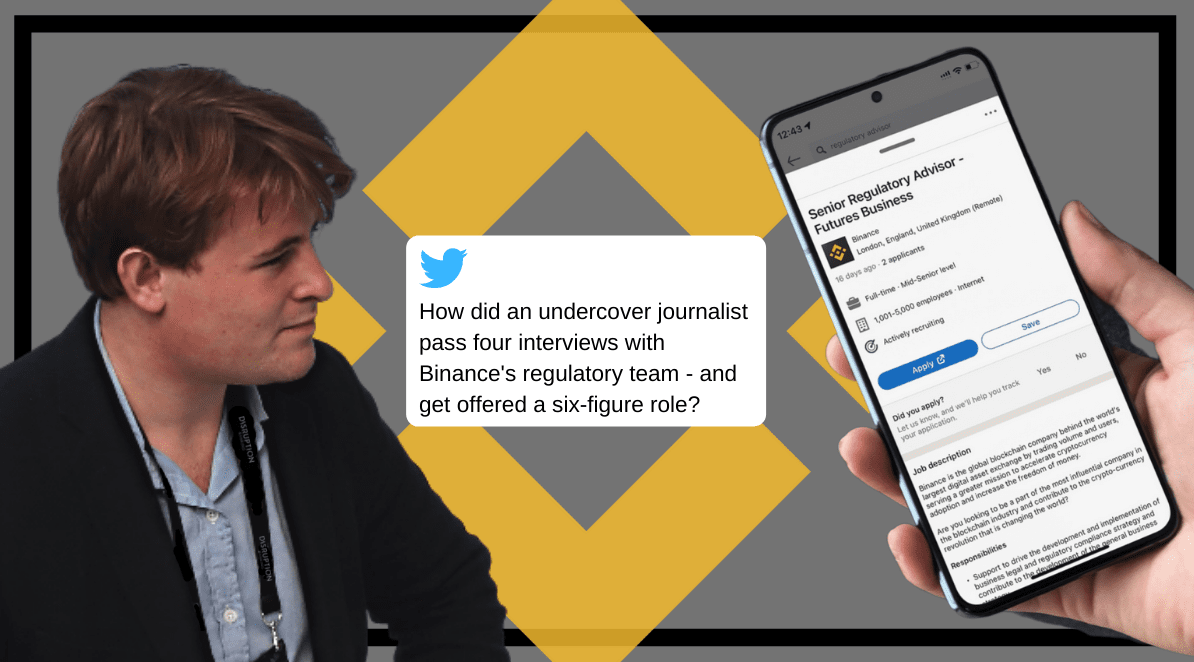

Given the pressure the company is under from regulators, Binance has recently advertised a number of positions relating to their regulatory and compliance operations. This follows media comments from Zhao indicating that hiring individuals with regulatory and compliance experience is a top priority. One job opening was for a “Senior Regulatory Advisor” in the Binance futures business based in London. The requirements for this job included “at least ten years of regulatory experience in financial institutions” and “experience applying for and acquiring EU derivatives licenses.”

.@cz_binance said the firm's new hires in compliance have brought "a level of expertise & knowledge that we didn't have before. More importantly they can communicate with regulators in a language they understand. Just having them increases credibility."https://t.co/N5Tn259GW4

— #DisruptionBanking (@DisruptionBank) November 26, 2021

I was keen to investigate how serious Binance really is about cleaning up its act, and how robust their regulatory recruitment processes are. So I decided to apply for the role under a fake name and with false credentials. Especially because of how senior the role was, and because of the attention this area of the company has been receiving, I assumed I would probably fall at (or before) the first hurdle. I envisaged crumbling when asked some complex question about derivatives licensing regulation. Nonetheless, I drew up a fake CV and LinkedIn page, assuming the identity of “Daniel Somerset” – a distinguished Cambridge Law graduate, who had risen through the ranks in the anti-money laundering departments of various leading banks before seeing the crypto-light. Currently in a senior regulatory position at Coinbase, Daniel had all of the skills and experience Binance could wish for. The only problem was it was all a lie, and, of course, I had neither the evidence nor the knowledge to back any of these claims up.

Four interviews later, I was offered the senior role in Binance’s futures business. The base salary on offer was £160,000 per year. I was also to be entitled to a sign-on bonus payment of £60,000 worth of Binance Coin (BNB) after six months’ service and was eligible for the company’s discretionary bonus scheme. The entity that formally offered the job was Binance Europe, which is not registered with the FCA unlike the vast majority of UK financial services companies.

This is the first piece in a three-part series, to be continued on Thursday 20th January.

This article was updated on 13/01/22 to include Binance’s full response to this investigation:

“All roles at Binance are offered on a conditional basis and are contingent on meeting thorough background checks to verify experience after an offer is accepted. This candidate falsified his background and work experience. While he was offered a position, like any other company, after signing he would have had to pass our background check which is conducted by an independent third-party. His fraudulent statements and falsified work history would have been easily flagged.”

Author: Harry Clynch

#Crypto #Blockchain #Cryptoexchange #Bitcoin #Binance #HongKong #CaymanIslands #BritishVirginIslands #CryptoDerivatives #MtGox #Compliance #Regulation #Futures

8 Responses