In relation to trading and the economy, the old adage says “what goes up must come down”. Volatility is an inherent part of trading activity, and business cycles are exactly that – cycles. Valuations of assets are in a state of near constant fluctuation for a wide variety of reasons.

Whilst conventional market wisdom has always been that traders should “buy and hold” – seeking to withstand volatility through endurance – we are now seeing the emergence of new platforms that aim to help traders navigate these cycles more actively. The recent GameStop saga significantly disrupted trading practice, by beginning a shift that means individual traders are feeling sufficiently empowered to participate collectively in the markets. Indeed, the Andreessen Horowitz blog recently pointed to the resurgence of active trading. It listed the most notable innovative platforms that enable individual traders to coordinate their market strategies so as to become collectively more sophisticated and ride out volatile cycles together. One of these platforms, Tradologics, is especially keen on empowering active traders.

So cool to see @tradologics mentioned in this excellent piece by @a16z on the shift from passive to active #trading 😎 https://t.co/s95gdHQnf2

— Ran Aroussi (@aroussi) March 31, 2021

Tradologics’ Story

Tradologics is a cloud platform for programmatic-based trading that has been in development for the last year, and that is due to be launched this autumn. We were lucky enough to talk to the company’s founder, Ran Aroussi. The story of Tradologics dates back to his first encounters with trading.

“When I first entered this space, I was shocked to see just how “low-tech” it is. Coming from the AdTech [advertising technology] industry, I was expecting everything to be super high tech. I was shocked by the fact that nearly all individual traders, as well as small trading operations, have no access to tools that allow them to focus on what’s important – which is generating alpha.

“So I created my own Python-based trading stack and released it as an open source library in 2016 – and while it was quite limited, many people started using it and building upon it. I was trying to make traders’ work easier by abstracting the technical stuff as much as possible while still retaining flexibility in strategy design.

“I was trying to remove the main barrier on most traders’ road to automation, which is the unrealistic set of skills that are required to trade programmatically. Even the more technically-capable traders have to resort to “duct-tape solutions” and use many vendors due to the market’s fragmented structure.

With that thought in mind, Ran established Tradologics last year. “We’ve set up a platform that will allow you to build your own bespoke trading platform – a platform that can trade any asset class, on any broker, using any coding language. It’s a completely agnostic approach.

“The solution I envisioned was a platform that will give its users the ability to focus on trading instead of infrastructure, broker connectivity, data handling, and server management. That’s the gospel of Tradologics and we hope that we’ll be able to deliver on it in the upcoming years.”

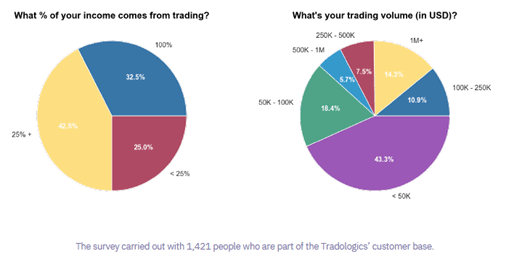

Tradologics is going to be fully launching between mid-August to early September. Until then, a small cohort of users are testing and familiarising themselves with the platform. The target market of the platform is algo-traders, quants, and prosumers, especially high-tier retail traders and lower-tier professional traders. The average monthly turnover of the traders that Ran is looking for is upwards of half a million dollars. Based on a survey conducted on 1,421 current customers, 20% of Tradologics users exceed this threshold. For more than 55% of users, the monthly trading volume exceeds $50,000. Most of the user-base trades for a living, with 32.5% of them generating 100% of their income from trading activity.

Although the platform has been tailored to more professional traders, one of Ran’s plans is to reach out to a wider customer base in the coming years by attracting smaller retail traders, too. “So far, the feedback has been great. But as part of our long-term vision, we want to build a community around the platform,” he shares.

How community can help achieve streamlining

“When looking three years down the line, we’re seeing an entirely community-based approach. That’s our go-to market strategy. We want to really open up and try democratising this entire industry. First, by giving it the tools, obviously. This is our bread and butter. But we also want to create courses, various education materials and, ultimately, an online community similar to GitHub spaces – specifically for exchanging code snippets for trading. If you’re going to get your education from us, if you’re going to join our community, it makes sense that you’re going to wet your feet with our platform when the time comes.

“The AlgoTrading Summit is our first step towards bringing the community together. This will be followed by an online discussion platform, knowledge and code exchange, tutorials and guides on trading in general as well as on the platform – and an education program that will empower students, teachers, and schools by providing them with educational material, tools, and perks intended to shape the next generation of traders.”

Ran also shared with us what would make the Tradologics community unique in the trading world. “If you look at other platforms, such as Tradingview, and chat with traders, your chat is going to be more about the markets. What we see in our own communities, the chats are more about market mechanics. Our customers are less interested in whether the markets are going to go up or down due to some political issues, but much more interested in the microstructure of the markets. What’s the technical aspect of market mechanisms? Our customers won’t sit in front of the screen all day to trade. Their trading is completely automated, and that’s the difference.”

Algorithmic trading is the way to do it. It basically removes the human factors and instead follows predetermined, statistics-based strategies that can be run 24/7 by computers with minimal oversight.

— Tradologics (@tradologics) July 26, 2020

Furthermore, the range of financial assets that can be traded on Tradologics are fully determined by demand, Ran explains:

“Right now, we have US equities, futures, crypto, and forex. Most of the people using the platform are trading equities, ETFs and crypto; I would say probably about 70% trade equities and ETFs. The plan is to expand horizontally to European and East Asian markets with the same type of products.

“We’re buying our data from other vendors. It is not my business to be the vendor. We also offer spot FX data that come off from your brokers like CMC, Oanda, and FXCM. So we have the currency pairs and the contracts for differences (CFDs) that they’re offering. This is what the most of our target audience currently is looking for – equities, futures, crypto, forex, and within those, we have the CFDs. We don’t currently support bonds.

“Demand will determine what other products we will add. Our system is built in such a way that as long as we have a market data vendor that provides us with real time pricing information – the implementation of which could be fairly easy – we can add basically any type of asset.

“When we integrate a new broker, we don’t do any of the work manually anymore. We just map out their API against our API, and we have a software that we’ve developed that does all the translations of certain fields from scratch. We can do this pretty much with any type of broker or asset class that you want. It’s just a matter of whether or not we have the demand.”

With the democratisation of finance gaining momentum since the Robinhood affair, it is often thought that hedge funds and small investors are playing a zero-sum game. That is, only one of them can win. When asked whether hedge funds might take a hit because of platforms that democratise trading, like Tradologics, Ran gave the following answer:

“I don’t believe that we’re going to bring the fall of hedge funds. Quite the opposite. We’re planning on offering a Business Suite later next year that will provide funds with all the tools and services they need to operate more efficiently.”

Tradologics has one more game-changing aspect, Ran explains. It brings about a peace of mind. Stress is thought to be inherently present on trading floors and in trading activities in general. Ran believes that it needs not be so.

“There’s a lot of stress that comes with running and maintaining your own trading stack and making sure that everything works 24/7. Not only that, current solutions kind of force your code to be longer and more complex – which can lead to more potential issues.

“When working with Tradologics, not only is your code shorter and more maintainable, but you also get the peace of mind that things – including position monitoring, order handling, and risk management – just work. The more you use the platform, the more confident you will have in its ability to “have your back” – and that peace of mind is truly priceless.”

If trading continues to become more and more popular with a wider range of people, the future of Tradologics will no doubt be bright. We are looking forward to their official launch this autumn, and hope to be able write about their success soon.

Author: Benjamin Jenei

#Trading #ProgrammaticTrading #Technolgoy #FinTech #Automation #Democratisation #HedgeFunds

One Response